Michael Stephens | October 27, 2017 Today at the New School, L. Randall Wray and Stephanie Kelton take part in a public workshop organized by the National Jobs for All Coalition that is focused on developing a “A New ‘New Deal’ for NYC and the USA.” Wray and Kelton will be sharing initial findings from an upcoming Levy Institute project that proposes a universal job guarantee for the United States. The program would create...

Read More »Applications Open for the Levy Institute M.S. and New One-Year M.A.

Michael Stephens | October 17, 2017 The Levy Institute is accepting applications to the M.S. and M.A. in Economic Theory and Policy for Fall 2018. The new, one-year M.A.* joins the two-year M.S. in offering students an alternative to mainstream programs in economics and finance. Our graduate curriculum is rooted in the Institute’s distinctive research program, including macroeconomic theory and policy analysis, the development...

Read More »IMF Provides Cover for Europe’s Dysfunctional Currency Union

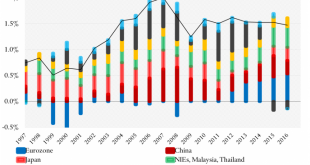

The Council on Foreign Relations’ Brad W. Setser has produced a couple of interesting blogposts on Germany’s fiscal policies of late. The first one, titled “Germany Cannot Quit Fiscal Consolidation,” was published at the end of August. On September 18th, the second one appeared, titled “The Global Cost of the Eurozone’s 2012 Fiscal Coordination Failure.” The latter is more limited in scope and draws heavily on a recent report by the Banque de France. Setser elaborates on the rather...

Read More »Event: Strategizing a New New Deal

Michael Stephens | September 8, 2017 If you’re in the vicinity of New York City at the end of October, Levy scholars Randall Wray and Stephanie Kelton are taking part in a public meeting organized by the National Jobs for All Coalition. The meeting is part of a series of public events focused on the legacy of New Deal. Wray and Kelton will be participating in a panel on the job guarantee — “Political and Economic Prospects for...

Read More »The “German Problem” Is Not a Problem for Anyone to Worry About. Or Is It?

It took a very long time. Too long. But just in time for the recent G20 meeting in Hamburg on July 7-8, The Economist’s cover page story featured Germany’s persistent current account surpluses as the world community’ new “German problem”; supposedly an issue of foremost interest to the G20. In fact, Germany has run up current account surpluses exceeding 4 percent of GDP in each and every year since 2004. For the last couple of years Germany’s surpluses even exceeded 8 percent of GDP....

Read More »Why Macron Should Not (and Cannot) Follow the German Model

Jörg Bibow | June 2, 2017 The Economist‘s analysis of Germany’s job market miracle of the past ten years offered in “What the German economic model can teach Emmanuel Macron” is more balanced than the usual accounts one hears in Germany itself. Germans are in love with the idea that structural reform of their labor market and persistent budgetary austerity were solely responsible for the German economy’s superior performance...

Read More »On the Concert of Interests and Unlearning the Lessons of the 1930s

Jan Kregel opened this year’s Minsky Conference (which just wrapped up yesterday) with a reminder that the broader public challenges we face today are still in many ways an echo of those that faced the nation in 1930s. What follows is an abridged version of those remarks: This year’s conference takes place in an increasingly charged and divisive economic and political atmosphere. Sharp differences in approach are present within the new administration, within the majority party, and even...

Read More »India’s Unexplored “Bill of Rights”: A Tool for Gender-Sensitive Public Policy

The Justice Verma Committee submitted its report on January 23, 2013. In addition to recommendations for reforming laws related to sexual violence, harassment, and trafficking, it provided a comprehensive framework for gender justice through a proposed “Bill of Rights.” The Verma Committee’s recommendations are still waiting to be transformed into public policy. We must not forget that this document represents an intense 30 days of work in response to a brutal gang rape of a young...

Read More »“America First” and Financial Stability: 26th Minsky Conference

Participants Lakshman Achuthan, Cofounder and Chief Operations Officer, Economic Cycle Research Institute Robert J. Barbera, Codirector, Center for Financial Economics, The Johns Hopkins University Fernando J. Cardim de Carvalho, Senior Scholar, Levy Institute; Emeritus Professor of Economics, Federal University of Rio de Janeiro (UFRJ) Michael E. Feroli, Chief US Economist, JPMorgan Chase & Co. Scott Fullwiler, Professor of Economics, University of Missouri–Kansas City Esther L. George,...

Read More »L. Randall Wray on MMT and Positive Money

Leave a Reply Name (required) Mail (will not be published) (required) Website You can use these XHTML tags: <a href="" title=""> <abbr title=""> <acronym title=""> <b> <blockquote cite=""> <cite> <code> <del datetime=""> <em> <i> <q cite=""> <s> <strike> <strong> Notify me of follow-up comments by email.Notify me of new posts by email.

Read More » Multiplier Effect

Multiplier Effect