The theory of value and distribution is at the heart of economics. To be clear, when I say that it is at the center, it means that discussions of almost any topic in economics, in one way or another, depend on a certain theoretical position about the theory of value and distribution. However, most economists have no clue about it, about the centrality of value. Not only they don't understand the original and now infamous labor theory of value (LTV), that dominated between Petty and Ricardo...

Read More »Forty Years of Balance of Payments Constrained Growth and Thirlwall’s Law

From original draft by Thirlwall Thirlwall's seminal paper on the balance of payments (BOP) constrained growth is forty years old. Paul Davidson once referred to the BOP constrained growth as a positive Post Keynesian contribution to economics. The Review of Keynesian Economics (ROKE) will publish soon a special issue with many well-known contributors to the literature, and with a paper by Thirlwall himself.The idea built on the Kaldorian supermultiplier model (Kaldor mark II), and with...

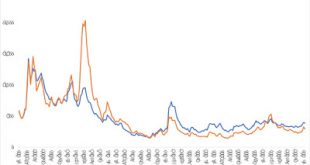

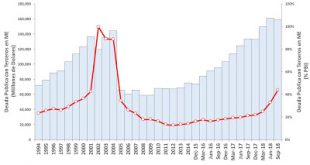

Read More »Capital Flows to the Periphery: Still ‘push’, but with significantly lower risk spreads

Gabriel Aidar and Julia Braga (Guest Bloggers) We have, in our new paper, gone back to the old pull-push debate on determinants of capital inflows to emerging markets, to look at the behavior of country risk premium spreads. Our Principal Component Analysis of the country-risk spread series of ten emerging economies from 1999 to 2019 revealed that 86% of the total volatility of the original series can be represented by only two components, suggesting the prevalence of common factors in...

Read More »Handbook of the History of Money and Currency

The Handbook (subscription required) has been edited by Stefano Battilossi, Youssef Cassis and Kazuhiko Yago. It has many interesting chapters. Barry Eichengreen writes on what determines that a currency is used as an international currency (or even as the predominant currency). While he follows conventional views in suggesting that role of money as a means of exchange and the importance of the country in international transactions, he does also explore the role of power (military power)...

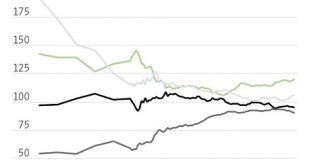

Read More »Catching up and falling behind in historical perspective

The figure below, from a recent piece in the Wall Street Journal, shows the catching up of the South. Note that most occurs after the New Deal, and up to the 1980s. The piece emphasizes the reversal, with divergence since the last recession. This suggests that the New Deal and the period in which the segregationist policies were eliminated were a period of prosperity for the South. The catching up story is one associated mostly to State action, since the New Deal in many ways was a sort...

Read More »Argentina, Financial Times and the next default

It's been a while since I wrote about Argentina. In all fairness, because it is difficult given all the mistakes of the last few years since Macri's victory. I discussed the prospects of what to expect back then. Since then I posted here and here on the supposed improvement in 2017, and the beginning of the still unfolding crisis in 2018. And this could simply be an "I told you so post," since I did warn about most things that would happen. But there are important and interesting news about...

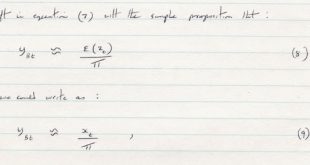

Read More »Exchange rates and income distribution in a surplus approach perspective

Old paper, presented two years ago in México, and to be published soon by the university press there. In Spanish. For those interested. The model is the same (with minor changes) one used to discuss inflation, in an old paper, eventually published here in a book on Post Keynesian economics edited by Forstater and Wray. Link here.

Read More »Forget the Natural Rate, says the Head of the Minneapolis Fed

Low rates are here to stay The head of the Minneapolis Fed agrees with something that I discussed several times here (or here for the use of alternative unemployment measures like U6) in the blog, that the unemployment level (U3) is not a good measure of the slack in the labor market. Neel Kashkari says: No one knows how many more Americans want to work. But if the job market continues to improve with only modest wage growth and below-target inflation, it can be safely assumed that...

Read More »On Karl Polanyi and the labor theory of value

The other great transformation I have discussed Polanyi on the blog before, but not in great detail (see this video posted a few years back from Fred Block for a more in depth discussion). However, writing about Bob Heilbroner's views of economics, and in particular the labor theory of value, reminded me why I have reservations about Polanyi, something that often surprises my friends, since I often cite some of his ideas, and I did put his book on the Top 10 list.Polanyi has been,...

Read More »The New School for Social Research at 100: A view from the Econ. Dept.

From a late 1990s catalogue; Lance Taylor (center), and also in no particular order and from what I can remember (Ellen Houston, Adalmir Marquetti, myself (with goaty on the left side), Margaret Duncan, Josh Bivens and Carlos Pinkusfeld (Orozco Room) The New School for Social Research was founded 100 years ago by a group of academics dissatisfied with the direction of American high education. Economics was central to the early history of the New School, and my brief, very incomplete,...

Read More » Naked Keynesianism

Naked Keynesianism