Table 1: A Common Structure Example1.0 Introduction This post presents partitions of (a part of) parameter space for two examples of models of prices of production with a choice of technique. The examples have a different structure and are parametrized differently. Yet, I want to argue, the partitions are the same, at some level of abstraction. 2.0 Thing 1 The first example is an instance of the Samuelson-Garegnani model. Table 1 presents the coefficients of production for this example....

Read More »FX Crises and the Trajectory of Interest Rates

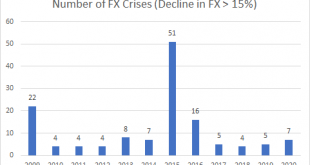

In this post, I want to get a sense of foreign exchange crises since 2008. The data that I am using is taken from the World Bank. It is not perfect. It is a bit spotty and could be improved upon. It is also annual data, so it will not pick up intrayear crises. But it is solid enough that it should give us a good first cut on the dynamics of foreign exchange crises. The first question to ask is simple enough: how many foreign exchange crises were experienced in this time period? For...

Read More »Is China Facing a Minsky Moment?

As Evergrande looks about to default on its debt many are asking whether this might be a Lehman moment for China. That is, are we about to see a wave of defaults that bring down the Chinese financial system as we did in Western countries in 2008? Much of the discussion is based on a misunderstanding. The Western financial system as it stood in 2008 was a largely laissez-faire system. There were, of course, regulations in place and there were also protections – most notably, deposit...

Read More »John Stuart Mill Illustrates Charles Mills’ Racial Contract

Here is John Stuart Mill stating a principle that sounds noble, and then immediately making a strange caveat. "The object of this Essay is to assert one very simple principle, as entitled to govern absolutely the dealings of society with the individual in the way of compulsion and control, whether the means used be physical force in the form of legal penalties, or the moral coercion of public opinion. That principle is, that the sole end for which mankind are warranted, individually or...

Read More »Inflation, the Quality Factor and Distribution

In a previous post I undertook a very simple analysis to show that factor investing during inflation helps investors to stop from simply treading water – at least, if history is any guide. An interlocutor asked if I’d looked into quality factors and I said that I would get around to it. In fact, there is something very interesting in the quality factor analysis – something that highlights an aspect of inflation that is not properly appreciated by most economists and investors....

Read More »Summary of Some Conclusions From My Research Program

This blog, over years, presents a welter of fluke cases. I created many of the numerical examples to illustrate the reswitching of techniques, capital reversing, or some such so-called 'perversity'. Fluke cases can be combined. For example, a fluke switch point at a rate of profits of zero can also be a fluke switch point at which three wage curves intersect. Or two switch points on the wage frontier can both be fluke switch points at which four wage curves, not necessarily the same,...

Read More »Mark Twain On The Wages Of Whiteness

In Mark Twain's novels, Huckleberry Finn is just a kid in what you might think is the most despised group in society. His mother ran away, and his father, who rarely is home to look after him, is the town drunk. Huck does not go to school, dresses in rags, and often sleeps outside in some barrel down by the waterfront. But Huck is quite conscious that some hard-working adults are looked down on worse than him by respectable people. 'That's all right. Now, where you going to sleep?' 'In...

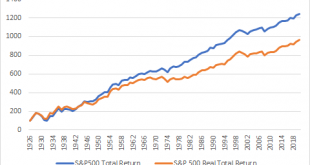

Read More »Investing During Inflation

Recently I have been looking at whether inflation might be in the pipeline. The jury is still out on that, but caution would be wise given the current situation. That leads to a rather obvious question: what should investors do during an inflation? First off, if we are to be naive stock investors, how much does inflation impact stock market returns? We can see the impact in the following chart. But this chart simply does not capture the pain investors feel during proper...

Read More »Podcast on Inflation and Labour Shortages

I appeared on the Bullhouse podcast again to discuss some of the recent work I have done on inflation. I also talk about how the impact of COVID19 and the policy responses to it risk resulting in major labour shortages and a return to a 1970s-style inflationary regime. Podcast: Inflation and Labour Shortages

Read More »The Four Circuits Of Capital

The Four Circuits of Capital Marx describes three circuits of capital in the opening chapters of Volume 2 of Capital. But when I draw a diagram, as above, a fourth circuit seems to be missing. So I have added the circuit of advanced capital. The circuit of advanced capital begins with commodities, consisting of means of production and labor power, in the hands of or under the direction of capitalists. They have purchased these commodities with monetary advances. The capitalists, at this...

Read More » Heterodox

Heterodox