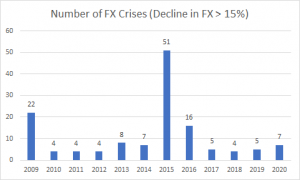

In this post, I want to get a sense of foreign exchange crises since 2008. The data that I am using is taken from the World Bank. It is not perfect. It is a bit spotty and could be improved upon. It is also annual data, so it will not pick up intrayear crises. But it is solid enough that it should give us a good first cut on the dynamics of foreign exchange crises.

The first question to ask is simple enough: how many foreign exchange crises were experienced in this time period? For our purposes, we will define a foreign exchange crisis as any time a currency fell by 15% or more in a single year. Here are the number of such crises in every year since 2008.

The next feature we want to explore is whether these crises were resolved or not. A foreign exchange crisis is – in

Read More »