from Lars Syll Income inequality as measured by the Gini coefficient rose by about 36% in the 1980s under Thatcher, but the real story is the share of income that goes to people at the very top: According to Greg Mankiw … in the United States the 1%’s share of total income, excluding capital gains, rose from about 8 percent in 1973 to 17 percent in 2010. Between 2010 and 2015 it’s risen from 17% to 22%!! It’s incredibly concentrated even among the super-rich. The top 0.01%’s share of...

Read More »Economics and ideology

from Lars Syll Mainstream (neoclassical) economics has always put a strong emphasis on the positivist conception of the discipline, characterizing economists and their views as objective, unbiased, and non-ideological … Acknowledging that ideology resides quite comfortably in our economics departments would have huge intellectual implications, both theoretical and practical. In spite (or because?) of that, the matter has never been directly subjected to empirical scrutiny. In a recent...

Read More »What the German government must do now to turn around an unsustainable economy

from Norbert Häring Germany’s economic output contracted in the second quarter and most indications point to a worsening in the third quarter, which is just halfway through. The culprit is only superficially Donald Trump with his trade wars. The German economy has been on an unsustainable path in several respects. Now the government is called upon to act courageously and intelligently to ensure that a deep restructuring crisis is avoided. The German success model was not sustainable...

Read More »Good news: The stock market is plunging

from Dean Baker The stock market enjoys a mythological place not only among mainstream media types, but also among many progressives. For some reason this measure of expected future corporate profits is taken as a measure of economic well-being. The fact that the media obsesses over the stock market hardly needs to be mentioned. If there is one item about the economy that we can be sure will be repeated every day, it is the movement in the Dow or the S&P 500. And, needless to say, an...

Read More »Statistics and mathematics — not very helpful for understanding economies

from Lars Syll Statistical science is not really very helpful for understanding or forecasting complex evolving self-healing organic ambiguous social systems – economies, in other words. A statistician may have done the programming, but when you press a button on a computer keyboard and ask the computer to find some good patterns, better get clear a sad fact: computers do not think. They do exactly what the programmer told them to do and nothing more. They look for the patterns that we...

Read More »Progressive policies may hurt the stock market. that’s not a bad thing.

from Dean Baker Last week, we saw the media terrified over a plunge in the stock market following an escalation of Donald Trump’s trade war with China. There are good reasons to be concerned about Trump’s ill-defined trade war and reality TV tactics, but the plunge in the stock market is not one of them. While the idea that the stock market is a measure of the health of the economy permeates news reporting and popular understanding, it has no basis in economics. The stock market is a...

Read More »No reality, please. We’re economists!

from Lars Syll Mathematics, especially through the work of David Hilbert, became increasingly viewed as a discipline properly concerned with providing a pool of frameworks for possible realities. No longer was mathematics seen as the language of (non-social) nature, abstracted from the study of the latter. Rather, it was conceived as a practice concerned with formulating systems comprising sets of axioms and their deductive consequences, with these systems in effect taking on a life of...

Read More »Time is running out

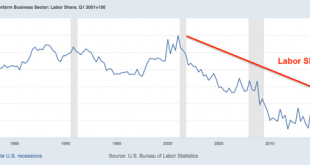

from David Ruccio Richard Reeves is right about one thing: time is crucial to capitalism’s legitimacy. The premise and promise of capitalism are that the future will be better than the present. And “if capitalism loses its lease on the future, it is in trouble.” The fact is, things are not getting better for the vast majority of American workers. They’re falling behind. For example, as is clear in the chart above, the labor share in the U.S. nonfarm business sector has fallen more than...

Read More »Yet another New York Times column gets the story on automation and inequality completely wrong

from Dean Baker I am a big fan of expanding the welfare state but I am also a big fan of reality-based analysis. For this reason, it’s hard not to be upset over yet another column telling us that the robots are taking all the jobs and that this will lead to massive inequality. The first part is more than a little annoying just because it is so completely and unambiguously at odds with reality. Productivity growth, which is the measure of the rate at which robots and other technologies are...

Read More »On the applicability of statistics in social sciences

from Lars Syll Eminent statistician David Salsburg is rightfully very critical of the way social scientists — including economists and econometricians — uncritically and without arguments have come to simply assume that they can apply probability distributions from statistical theory on their own area of research: We assume there is an abstract space of elementary things called ‘events’ … If a measure on the abstract space of events fulfills certain axioms, then it is a probability. To...

Read More » Real-World Economics Review

Real-World Economics Review