from Ken Zimmerman Most cultures in human history have failed. The consequences of cultural collapse are almost always catastrophic. Culture defines our existence and makes us who we are. Without culture we have no past and no future. As all the products of the people of a society–material and non-material, culture is a complement to society, interacting people living in the same territory who share a common culture. Impossible to have one without the other (unless you want to call...

Read More »Economics is an ideology

from Ikonoclast Economics is not a science and it cannot be a science. It is an ideology. The policy applications of an ideology may be “science-informed”, or not, as the cases might be, but the discipline itself, economics of any ideological persuasion, is not a science. Economics properly considered is really political economy. The term “political economy” carries two connotations: one meaning “national economy” and the other literally meaning economics is always political. The attempt...

Read More »User guides to models

from Lars Syll In Dani Rodrik’s Economics Rules it is argud that ‘the multiplicity of models is economics’ strength,’ and that a science that has a different model for everything is non-problematic, since economic models are cases that come with explicit user’s guides — teaching notes on how to apply them. That’s because they are transparent about their critical assumptions and behavioral mechanisms. Hmm … That really is at odds with yours truly’s experience from studying and teaching...

Read More »D-Econ: Diversifying and decolonising economics

Our Mission “Just wander into any economics or finance conference and the anecdotal evidence is overwhelming — women and minorities are few and far between.” – Business Insider, September 13th, 2017 We are a network of economists that aim to promote inclusiveness in economics, both in terms of academic content and in its institutional structures. We are working to promote an economics field free of discrimination, including sexism, racism, and discrimination based on approach and...

Read More »Necessary changes in economic theory

from Neva Goodwin Ecology teaches that everything is connected to everything else. Economics teaches that the market is a – some say the – great connector. Its specialty is to connect demand (what people want) to supply (what people produce), via prices. There are, of course, known problems in the use of prices as a society’s key connector. For one thing, those with more money have more of what is sometimes called “effective demand”; they can send louder, more effective signals to...

Read More »A fine line – descriptive or normative science?

from Joachim H. Spangenberg and Lia Polotzek Next to the inability to describe long-term developments and to take into account the structural uncertainty of complex systems, there is a more fundamental problem regarding current economic modelling manifesting itself in IAM/DSGE models. It consists of the fact that economic models are presented as being purely descriptive, while they actually carry quite some normative baggage. This becomes particularly relevant as the function of...

Read More »My philosophy of economics

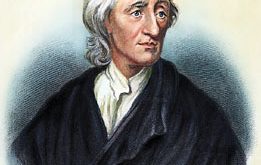

from Lars Syll A critique yours truly sometimes encounters is that as long as I cannot come up with some own alternative to the failing mainstream theory, I shouldn’t expect people to pay attention. This is, however, to totally and utterly misunderstand the role of philosophy and methodology of economics! As John Locke wrote in An Essay Concerning Human Understanding: The Commonwealth of Learning is not at this time without Master-Builders, whose mighty Designs, in advancing the Sciences,...

Read More »Two stories: household income in the US and the UK

https://ourworldindata.org/incomes-across-the-distribution

Read More »Mainstream economics — a case of explanatory disaster

from Lars Syll To achieve explanatory success, a theory should, minimally, satisfy two criteria: it should have determinate implications for behavior, and the implied behavior should be what we actually observe. These are necessary conditions, not sufficient ones. Rational-choice theory often fails on both counts. The theory may be indeterminate, and people may be irrational. In what was perhaps the first sustained criticism of the theory, Keynes emphasized indeterminacy, notably because...

Read More »Human work

from Ken Zimmerman Human work/employment/work relations are complex. In terms of muscular or nervous effort there is no distinction between agreeable and irksome activities, or between those undertaken for pleasure and those undertaken for pay. In many instances severe physical labor, combined with hardship and exposure are undertaken for pleasure by tourists, who even hire and pay guides, for example mountain climbing. Similarly, athletic sports, though often arduous are both professions...

Read More » Real-World Economics Review

Real-World Economics Review