from Lars Syll Paul Krugman has repeatedly over the years argued that we should continue to use maistream economics hobby horses like IS-LM and AS-AD models. Here’s one example: So why do AS-AD? … We do want, somewhere along the way, to get across the notion of the self-correcting economy, the notion that in the long run, we may all be dead, but that we also have a tendency to return to full employment via price flexibility. Or to put it differently, you do want somehow to make clear the...

Read More »Restore higher tax rates for corporations that can’t contain CEO pay

from Dean Baker There is an argument that carries considerable currency on the right about the need to force the poor to do things that are actually good for them. This comes up frequently in the context of work requirements for people receiving benefits like Medicaid or food stamps (the Supplemental Nutrition Assistance Program). The claim is that people will be made better off by working, since that will give them a foot into the labor market. They can eventually move up and earn enough...

Read More »Bakers – JACK & DEAN

Season 1 - Episode 1 Support us on Patreon: https://www.patreon.com/JackAndDean Follow us on Twatter: http://twitter.com/JackHoward http://twitter.com/DeanDobbs Follow us for ugly selfies: https://www.instagram.com/jackhoward https://www.instagram.com/deandobbs Buy our merch if you’re cold: http://jackanddean.livenationmerch.com/

Read More »new issue of Economic Thought

Economic Thought History, Philosophy and MethodologyVol. 7, No. 2 download issue in full A Common Misunderstanding about Capitalism and Communism Through the Eyes of InnovationDirk-Hinnerk Fischer, Hovhannes Yeritsyan Cherchez la Firme: Redressing the Missing – Meso – Middle in Mainstream EconomicsStuart Holland, Andrew Black The Lucas Critique: A Lucas CritiqueChristian Müller-Kademann Quantum EconomicsDavid Orrell Computational Agents, Design and Innovative Behaviour: Hetero...

Read More »Demystifying economics

from Lars Syll The first thing to understand about macroeconomic theory is that it is weirder than you think. The heart of it is the idea that the economy can be thought of as a single infinite-lived individual trading off leisure and consumption over all future time … This approach is formalized in something called the Euler equation … Some version of this equation is the basis of most articles on macroeconomic theory published in a mainstream journal in the past 30 years … The models...

Read More »Left behind

from David Ruccio The historically low black unemployment rate is one of Donald Trump’s favorite applause lines. Even Reuters [ht: ja] declares that Trump is right. It doesn’t seem to matter that most of the decline in the unemployment rate for African American workers (from a high of 16.5 percent in the beginning of 2010 to a low of 6.3 percent today) occurred before Trump was ever elected. What does matter is that, even as the rate has dropped (the purple line in the chart above),...

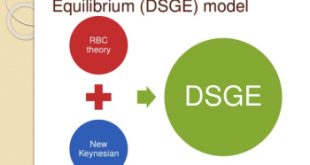

Read More »DSGE — a scientific illusion

from Lars Syll Dynamic stochastic general equilibrium (DSGE) models remain the work-horse models employed by many academics and research departments at central banks … Prior to the Global Financial Crisis the financial sector played no role in these DSGE models. That limitation is now widely acknowledged and numerous aspects of the financial sector have been incorporated into second and later generation DSGE models … Unfortunately, these efforts are misguided because they do not address...

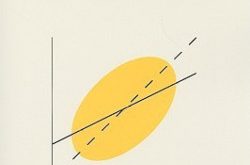

Read More »We all use glasses to see the world.

from Asad Zaman and the current issue of RWER The outcome of all this discussion can be summarized metaphorically by saying that we all use glasses to see the world. The direct world out there is a jumble of sensations – a matrix of points – which makes no sense by itself, and must be interpreted using our own frameworks, represented by the glasses. This means that ALL observations are tinged with subjectivity, and interpreted within the frameworks created by our past experiences,...

Read More »Productive versus financial uses of credit

from John Balder and the current issue of RWER In addition to the explosive growth in credit, the manner in which credit was deployed also shifted toward financing transaction in housing and other assets (e.g., equities, bonds, et al). As noted above, up until the early 1980s, credit was used mostly to finance production of goods and services. Growth in credit from 1945 to 1980 was closely linked with growth in incomes. The incomes that were generated were then used to amortize and...

Read More »P-values are no substitute for thinking

from Lars Syll [embedded content] A non-trivial part of statistics education is made up of teaching students to perform significance testing. A problem I have noticed repeatedly over the years, however, is that no matter how careful you try to be in explicating what the probabilities generated by these statistical tests really are, still most students misinterpret them. This is not to blame on students’ ignorance, but rather on significance testing not being particularly transparent...

Read More » Real-World Economics Review

Real-World Economics Review