from Asad Zaman My article with the title above is due to be published in the next issue of the American Journal of Economics and Sociology (2019). This was written at the invitation of the editor Clifford Cobb, as an introduction to Islamic Economics for a secular audience. The Paper explains how modern economics is deeply flawed because it ignores the heart and soul of man, and assumes that the best behavior for humans is aligned with short-sighted greed. Islam provides a radically...

Read More »Dean Baker Live Stream

Gary Becker — making nonsense out of economic science

from Lars Syll The econometrician Henri Theil once said “models are to be used but not to be believed.” I use the rational actor model for thinking about marginal changes but Gary Becker really believed the model. Once, at a dinner with Becker, I remarked that extreme punishment could lead to so much poverty and hatred that it could create blowback. Becker was having none of it. For every example that I raised of blowback, he responded with a demand for yet more punishment … Alex...

Read More »Dean Baker Live Stream

Dean Baker Live Stream

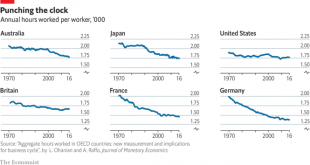

Punching the clock

Economics and reality

from Lars Syll ‘Modern’ economics has become increasingly irrelevant to the understanding of the real world. In his seminal book Economics and Reality(1997), Tony Lawson traced this irrelevance to the failure of economists to match their deductive-axiomatic methods with their subject It is — sad to say — as relevant today as it was twenty years ago. It is still a fact that within mainstream economics internal validity is everything and external validity nothing. Why anyone should be...

Read More »Most read RWER papers

Most downloaded RWER papers from current issue Who is behind the campaign to rid the world of cash?, Norbert HaeringThe trouble with human capital theory, Blair FixA progressive trade policy, Dean BakerThe enigmatization of economic growth, Bernard C. Beaudreau Most downloaded RWER papers from last 4 years Trump is Obama’s legacy. Will this break up the Democratic Party?, Michael HudsonChina’s communist-capitalist ecological apocalypse, Richard SmithInequality, the financial crisis and...

Read More »Ultra White Collar Boxing | Crawley | Jordan Prior VS Dean Baker

Crawley Ultra White Collar Boxing 24th November 2018 8 Weeks FREE training / Get in the best shape of your life/ Raise money for Cancer Research UK /Aimed at male & female beginners / Box at a glamorous event FOLLOW THIS LINK & SIGN UP NOW. www.uwcb.co.uk

Read More »Ultra White Collar Boxing | Crawley | Jordan Prior VS Dean Baker

Crawley Ultra White Collar Boxing 24th November 2018 8 Weeks FREE training / Get in the best shape of your life/ Raise money for Cancer Research UK /Aimed at male & female beginners / Box at a glamorous event FOLLOW THIS LINK & SIGN UP NOW. www.uwcb.co.uk

Read More » Real-World Economics Review

Real-World Economics Review