from Terry Hathaway Contemporary political and economic discourse sees capitalist systems characterised as market economies, and references to both The Market and markets are ubiquitous; markets are seemingly everywhere. This situation is distinctly odd, as while economic relations have been more and more characterised as “markets”, many economies have seen both the withering away of traditional marketplaces and the concurrent growth of hierarchically ordered non-market economic...

Read More »China’s Evergrande Conundrum

from C. P. Chandrasekhar China’s Evergrande group, identified as the world’s most indebted property company with accumulated liabilities in excess of $300 billion, missed an interest payment instalment due on September 23, 2021 on bonds borrowed through US dollar bond markets. Though the company enjoys a 30-day grace period to pay up and avoid being in default, the absence as yet of any clarification on the missed instalment has increased uncertainty. Markets seem sceptical that the firm...

Read More »Three conceptualisations of the market

from Terry Hathaway – http://www.paecon.net/PAEReview/issue97/Hathaway97.pdf Watson (2018) shows that within neoclassical economics the shifting definition of the market has led to three conceptualisations of the market that are rolled into one another; the descriptive concept, the analytical concept, and the formalist concept. The descriptive concept can be seen in Smith where the idea is of “the market literally as a marketplace, with all the hustle and bustle of people going about...

Read More »“What is the true value of my property?”

from Blair Fix – http://www.paecon.net/PAEReview/issue97/Fix97.pdf Putting a fence around something and calling it “property” is step one of capitalization. But property alone is not enough. Romans had property. So did most feudal kingdoms. But these societies did not have capitalization. To capitalize property, there is a second step. You must mix property with finance. The word “finance” evokes a sense of awe – a sense of other-worldly complexity. But at its heart, finance is simple. It...

Read More »The preventable horrors of the pandemic and the short case for open research

from Dean Baker and Arjun Jayadev The Covid 19 pandemic is once again at an inflection point– with cases now falling sharply in most of the world. The current pandemic may be coming under control, but after millions of preventable deaths, this is very far from a success story and it is as good a time as any to take a hard look at our failings, especially with regard to our management of knowledge Across the world, the number of Covid infections are declining: the United States numbers...

Read More »Life expectancy in the U.S.

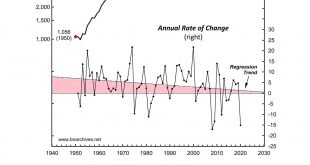

from John Komlos – http://www.paecon.net/PAEReview/issue97/Komlos97.pdf A good economy would not have 150,000 deaths of despair a year with life expectancy declining even before Covid (Figure 7) (Case and Deaton, 2020). When traditional social structures of support dissolved for working class whites there was nothing to take their place and despair accumulated. The family was gone, the unions were gone, neighborly love was gone, the churches were no longer relevant, the government looked...

Read More »Raising Keynes

from Lars Syll The defeat and suppression of the classical perspective — with its evolutionary, institutionalist, and developmental descendants — cleared the way for a dogmatic economics that exalted self-regulating competitive markets … As we have seen, this perspective soon ran into serious — but temporary — difficulties with the Great Depression, mass unemployment, and the rise of Keynes, whose theory is revived in Harvard University economist Stephen A. Marglin’s Raising Keynes …...

Read More »The decline of US power based on financialised neoliberal capitalism

from Radhika Desai and Michael Hudson As a new Cold War against China began, it was clear that the pandemic was altering the international balance of power fundamentally. For former US Treasury Secretary, Lawrence Summers, it was likely a “hinge of history”: “[i]f the 21st century turns out to be an Asian century as the 20th was an American one, the pandemic may well be remembered as the turning point”. It would erase 9/11 and 2008 from memory and rank alongside “the 1914 assassination...

Read More »Mainstream economics — the poverty of fictional story-telling

from Lars Syll One of the limitations with economics is the restricted possibility to perform experiments, forcing it to mainly rely on observational studies for knowledge of real-world economies. But still — the idea of performing laboratory experiments holds a firm grip of our wish to discover (causal) relationships between economic ‘variables.’If we only could isolate and manipulate variables in controlled environments, we would probably find ourselves in a situation where we with...

Read More »Dominant capital and the government

from Shimshon Bichler and Jonathan Nitzan This note contextualizes the ongoing U.S. policy shift toward greater ‘regulation’ of large corporations. Cory Doctorow (2021) and Blair Fix (2021) are optimistic about this shift. We doubt it. The Limits of Power Large U.S.-based corporations are extremely powerful, but the growth of their power has decelerated considerably. Figure 1, updated from our ‘Corporate Power and the Future of U.S. Capitalism’ (Bichler and Nitzan 2021), shows the...

Read More » Real-World Economics Review

Real-World Economics Review