from Lars Syll That logic should have been thus successful is an advantage which it owes entirely to its limitations, whereby it is justified in abstracting — indeed, it is under obligation to do so — from all objects of knowledge and their differences, leaving the understanding nothing to deal with save itself and its form. But for reason to enter on the sure path of science is, of course, much more difficult, since it has to deal not with itself alone but also with objects. Logic,...

Read More »Market-value in the news

from Edward Fullbrook Over the weekend I read two articles (1, 2) in The Guardian about market-value. One concerned the painter Bansky, the other a truffle hunter in Croatia. I’ve been fan of Bansky for twenty years, beginning when he was a local graffiti artist in my part of town. A couple of years ago one of his paintings, Girl With Balloon, was auctioned at Sotheby’s in London for £1.1m. As soon as the auctioneer’s hammer fell, Bansky’s canvass “passed through a secret shredder...

Read More »Weekend read – With great power comes great fear

from Blair Fix Over the last year, I’ve watched with horror and amusement as health agencies around the world flip-flopped their advice on how to deal with COVID. My horror comes from knowing this flip-flopping breeds mistrust in science. But I am (morbidly) amused because I know that uncertainty is a basic part of real research. For the public, ‘science’ tends to mean authoritative knowledge. But for researchers, ‘science’ is an iterative process, filled with wrong turns, new evidence,...

Read More »Labor Day: US labor’s future may depend on monetary and fiscal policy

from Mark Weisbrot Labor Day is a good time to reflect upon how American workers have been doing — especially the majority who have been left behind for most of the past 40 years. From 1979 to 2018, the median wage has grown by just 11.6 percent. If we compare this to prior decades, e.g., 1948 to 1979, that increase was 93.2 percent. These two facts tell a big part of the story of a social transformation that is both inexcusable and historically unusual: a high-income country becoming...

Read More »Donda Listening & Reaction

I DO NOT OWN THE RIGHTS TO THE MUSIC YOU HEAR IN THIS VIDEO Starting with Praise God due to some copyright issues on the first couple songs!

Read More »How the past allows us to imagine – and see the future

from Richard Parker and current issue of RWER Let me now try to connect this little synoptic “longue duree” to the present and to the matter before us: neoliberalism and what might succeed it. We live in the early 21st century and the conventional economics we’ve inherited has now arrived at a moment when once-novel Victorian-era ideas seem not just inadequate but irrelevant. A similar moment seemed, to many, to have arrived before, back in the 1930s. But apostles of marginalism such as...

Read More »Levels of aspiration among economists

from Lars Syll Submission to observed or experimental data is the golden rule which dominates any scientific discipline. Any theory whatever, if it is not verified by empirical evidence, has no scientific value and should be rejected. Maurice Allais Formalistic deductive ‘Glasperlenspiel’ can be very impressive and seductive. But in the realm of science it ought to be considered of little or no value to simply make claims about models and lose sight of reality. Mainstream economics has...

Read More »Defense contractor Thales calls digital vaccination passes “precursor” to universal digital identification

from Norbert Häring Thales, one of the largest international defense contractors, calls the digital vaccination passport a precursor to universal mobile-digital identity credentials. Thales thus confirms my analysis and my worst fears. Under the headline “How digital ID can help citizens access government services from anywhere,” Kristel Teyras, in charge of the defense contractor Thales’ Digital Identity Services portfolio, writes: “So-called digital ‘vaccination passports’ will play a...

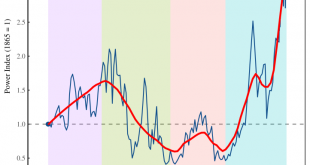

Read More »The power of dominant capital continues to rise

from Jonathan Nitzan and Shimshon Bichler Here we show the after-tax profit and market capitalization of the top 0.01% of U.S.-based corporations, expressed as a % of U.S. GDP. Updated from ‘The Asymtptoes of Power‘.

Read More »Probability and rationality — trickier than most people think

from Lars Syll The Coin-tossing Problem My friend Ben says that on the first day he got the following sequence of Heads and Tails when tossing a coin: H H H H H H H H H H And on the second day he says that he got the following sequence: H T T H H T T H T H Which report makes you suspicious? Most people yours truly asks this question says the first report looks suspicious. But actually both reports are equally probable! Every time you toss a (fair) coin there is the same probability (50 %)...

Read More » Real-World Economics Review

Real-World Economics Review