From Blair Fix Over the last year, I’ve watched with horror and amusement as health agencies around the world flip-flopped their advice on how to deal with COVID. My horror comes from knowing this flip-flopping breeds mistrust in science. But I am (morbidly) amused because I know that uncertainty is a basic part of real research. For the public, ‘science’ tends to mean authoritative knowledge. But for researchers, ‘science’ is an iterative process, filled with wrong turns, new evidence, and revised ideas. With COVID flip-flops in mind, I thought I’d tell you a story about science in progress. It’s a story about how we should understand the stock market. Three stories about the stock market Here are three stories about how the stock market works. The first story says that the stock

Topics:

Editor considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from Blair Fix

Over the last year, I’ve watched with horror and amusement as health agencies around the world flip-flopped their advice on how to deal with COVID.

My horror comes from knowing this flip-flopping breeds mistrust in science. But I am (morbidly) amused because I know that uncertainty is a basic part of real research. For the public, ‘science’ tends to mean authoritative knowledge. But for researchers, ‘science’ is an iterative process, filled with wrong turns, new evidence, and revised ideas.

With COVID flip-flops in mind, I thought I’d tell you a story about science in progress. It’s a story about how we should understand the stock market.

Three stories about the stock market

Here are three stories about how the stock market works.

The first story says that the stock market reflects the productivity of the underlying economy. When stocks go up, the thinking goes, everyone should celebrate because the tide of productivity is rising. This is the story that neoclassical economists believe.

The second story is that the stock market is actually disconnected from the ‘real’ economy, fluctuating in ways that have nothing to do with actual productivity. Stock prices represent ‘fictitious capital’. This is the story Marxists believe.

The third story is that stock prices are neither about productivity nor are they ‘fictitious’. They are about power. This is the hypothesis proposed by Jonathan Nitzan and Shimshon Bichler. The basic idea is that what capitalists really care about is not productivity. They care about income. Capitalists look at their income and then, through the ritual of capitalization, turn it into a lump sum — the capitalized value.

What’s important, Nitzan and Bichler argue, is that capitalist income is a function of power — the power to wield property rights. Hence patent trolls earn income not by doing anything useful, but by enforcing their intellectual property. Likewise Microsoft earns income not by creating software, but by restricting its use. Of course you can produce things if you want. But unless you enforce your property rights, you won’t earn income.

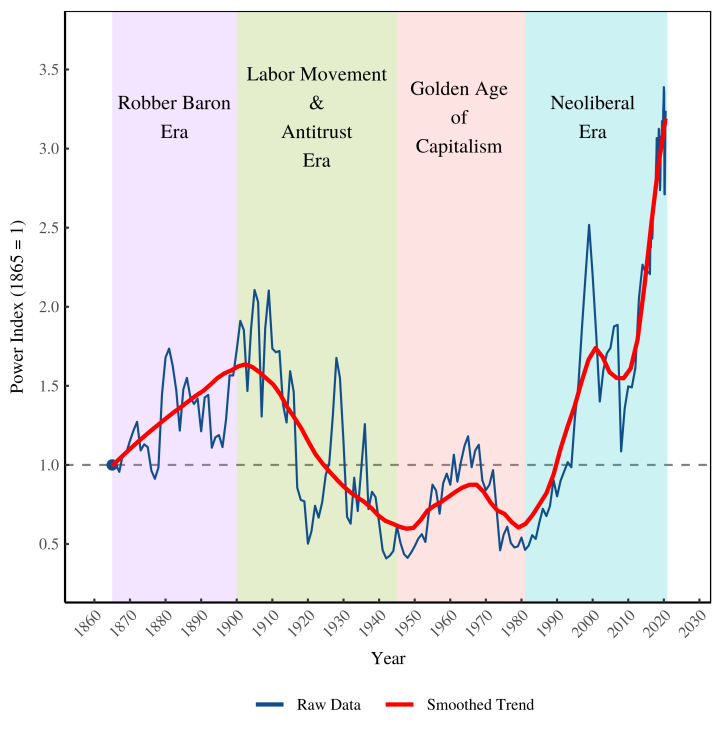

Back to the stock market. Bichler and Nitzan propose that we should understand the stock market in terms of capitalist power. When stocks go up relative to wages, that’s a sign that capitalists have grown more powerful. Conversely, when stocks fall relative to wages, that’s a sign that workers are winning the class struggle.

With this thinking in mind, Bichler and Nitzan propose a metric they call the ‘power index’ — the ratio of stock prices to the average wage:

Figure 1 shows the oscillations of the power index in the United States. (For an analysis of the trends, see ‘Stocks are up. Wages are down. What does it mean?’)

The corollary of power is fear

When Peter Parker became Spider-Man, his Uncle Ben remarked:

With great power comes great responsibility.

That may be true. But Bichler and Nitzan think that something else also comes with great power: great fear.

Bichler and Nitzan hypothesize that as capitalists grow more powerful, they become more fearful about losing their grip on power. After all, if you are at the apex of power, there is nowhere to go but down.

The idea that capitalists fear for their fortunes is nothing new. But what is new is that Bichler and Nitzan propose a specific way of quantifying this fear. The way to measure capitalist fear, they argue, is to look at how capitalists apply their ritual of capitalization.

The principle of capitalization is to put a present value on future income. To get capitalized value, we take (expected) future income and ‘discount’ it by some agreed-upon rate:

The immediate problem for capitalists is that future income is unknown. So what should they do? Their answer is to invert the capitalization formula so that it looks at the past. With this inversion, capitalists calculate present value by discounting past incomes:

Noting this inversion, Bichler and Nitzan propose that it can be used to measure capitalists’ fear. The more fearful capitalists are, the more they will cling to the past rather than look to the (increasingly uncertain) future.

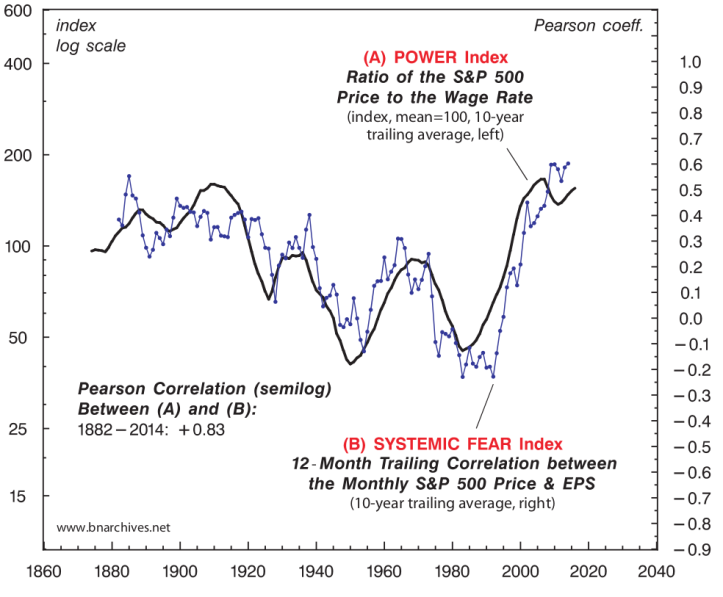

The way to measure capitalist fear, then, is to see how strongly stock prices correlate with past income. More specifically, Bichler and Nitzan correlate stock prices with earnings per share over a rolling window. They call the result the ‘systemic fear index’:

Since the resulting correlation fluctuates wildly in the short term, Bichler and Nitzan then take the rolling average to better see long-term trends.

If great (capitalist) power does bring great fear, the systemic fear index ought to rise and fall with the power index — Bichler and Nitzan’s measure of capitalist power. Looking at the United States, Bichler and Nitzan find that this is exactly what has happened.

Perhaps capitalist fear is not systemic

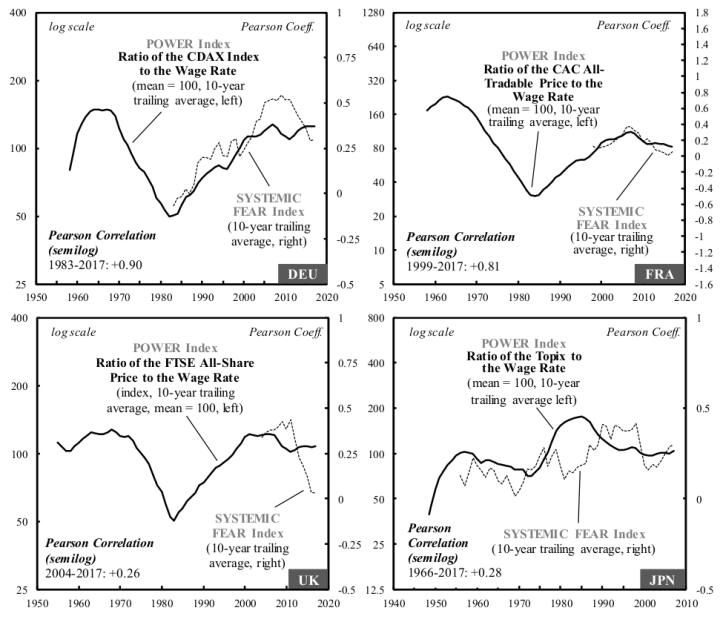

Impressed by Bichler and Nitzan’s findings, political economists Joseph Baines and Sandy Hager wanted to know if the results generalized beyond the United States. They assembled data to calculate both the power index and the index of systemic fear in France, Germany, Great Britain and Japan. Their results poured cold water on the concept of ‘systemic fear’.

Baines and Hager found that in the countries they studied, the link between capitalist power and systemic fear was not nearly as strong as in the US. Figure 2 shows their data. Baines and Hager conclude that ‘systemic fear’ may not actually be ‘systemic’, meaning the concept may be less useful than Bichler and Nitzan claimed.

Systemic fear gets another look

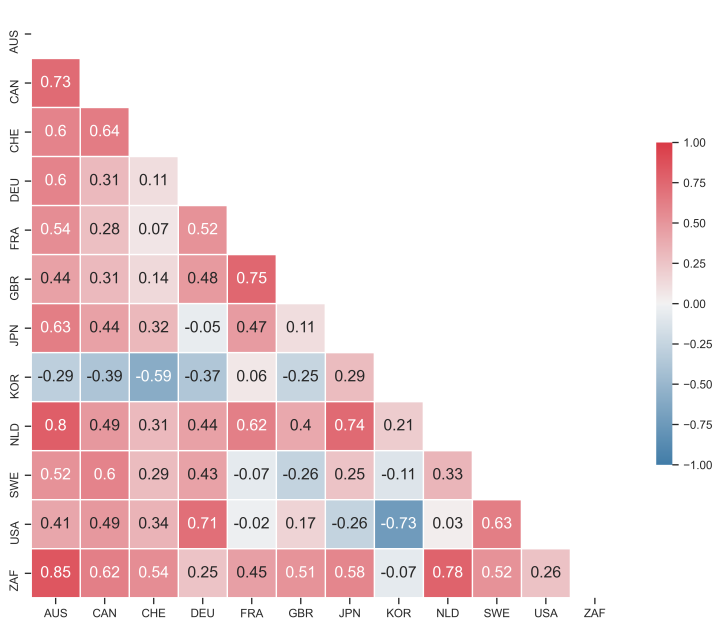

Intrigued by Baines and Hager’s results, James McMahon (who cut his empirical teeth researching Hollywood) recently took another look at the idea of ‘systemic fear’. He was able to assemble a dataset that was both wider in scope (including 12 countries) and had greater historical depth than anything used before. With this more expansive dataset, McMahon subjected the idea of systemic fear to a bevy of tests.

First up was the idea that systemic fear might not be ‘systemic’. To test this possibility, McMahon looked at how systemic fear correlated across countries. Figure 4 shows his resulting ‘correlation matrix’. Each box shows the systemic-fear correlation between the respective countries on the x–y axes. Dark red indicates that the two countries ‘co-experience’ systemic fear. Dark blue indicates that they do not. Despite a few blue squares, what’s clear is that systemic fear seems to be correlated across countries. In other words, it does appear to be ‘systemic’.

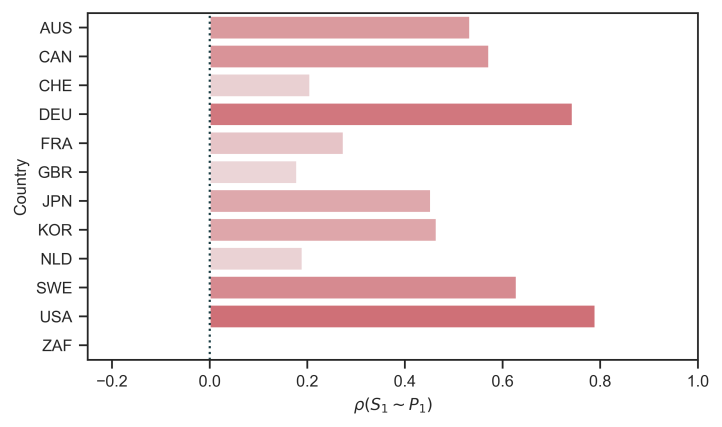

Next, McMahon looked at the correlation between systemic fear and the power index. As with Baines and Hager, he confirmed that the correlation varies across countries. Still, all countries (for which data was available) had a positive correlation. In other words, as capitalists become more powerful, they seem to become more fearful.

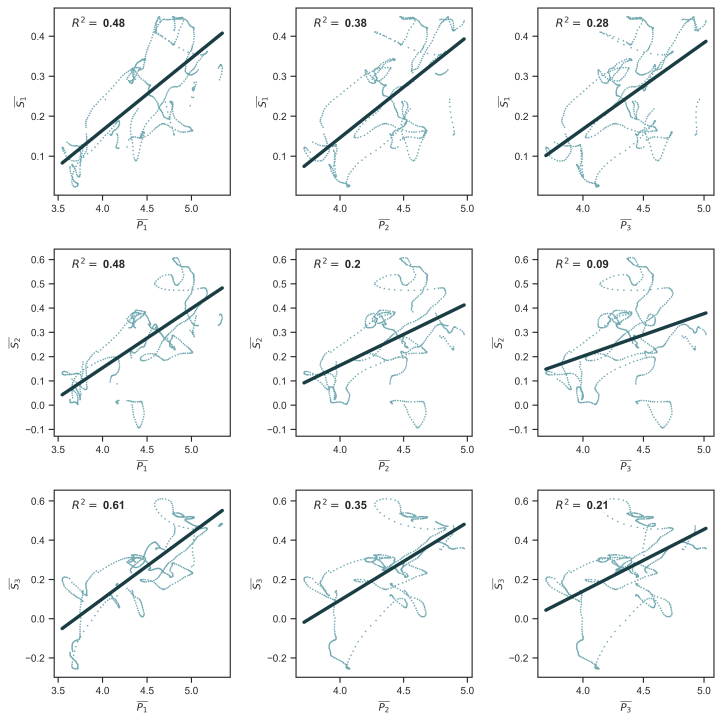

McMahon’s last step was to see how the average trend in capitalist power (across countries) related to the average trend in systemic fear (again, across countries). Here he found a strong correlation, shown below. Interestingly, the correlation remained (albeit at lower levels) when he experimented with different ways of measuring systemic fear and capitalist power.

Science in progress

Back to COVID shenanigans. Public health scientists are in the unenviable position of having their research subjected to intense public scrutiny. As the evidence changes, officials revamp their story, and the public balks. But unbeknownst to most people, this flip-flopping is how science always works. It’s messy. It’s uncertain. It’s a work in progress.

Unlike COVID research, the study of how capitalist power relates to systemic fear is conducted largely in obscurity. In a sense, that’s good, because it means that when the facts change, researchers can alter their opinions without facing public ridicule. The downside is that this research cuts to the heart of our understanding of capitalism. And that ought to interest everyone.

Whether the corollary of capitalist power is systemic fear (and whether this fear is actual ‘systemic’) is an open question. Maybe you’ll be the next one to roll up your sleeves and see what you find.

(And if you do roll up your sleeves, consider submitting your findings to the Review of Capital as Power (RECASP), a non-disciplinary journal committed to fostering debate about these types of ideas.)