from Dean Baker Like most economists, I have always been a Bitcoin skeptic. The question has always been what purpose does it serve? The idea that it would be a useful alternative currency is laughable on its face. How can you have a currency that wildly fluctuates year to year and even hour to hour? Imagine if you had a wage or rent contract written in Bitcoin. Both your pay and your rent would have more than tripled over the last year, likely leaving you unemployed and unable to pay...

Read More »Ideological engineering for the 1%

from Finance as warfare by Michael Hudson The economy is polarizing because of how the 1% use their wealth. If they invested their fortunes productively as “job creators” – as mainstream textbooks describe them as doing – there would be some logic in today’s tax favoritism and financial bailouts. Rentier elites would be doing what governments are supposed to do. Instead, today’s financial oligarchy lends out its savings to indebt the economy at large, and uses its gains to buy control...

Read More »Why the idea of causation cannot be a purely statistical one

from Lars Syll If contributions made by statisticians to the understanding of causation are to be taken over with advantage in any specific field of inquiry, then what is crucial is that the right relationship should exist between statistical and subject-matter concerns … Where the ultimate aim of research is not prediction per se but rather causal explanation, an idea of causation that is expressed in terms of predictive power — as, for example, ‘Granger’ causation — is likely to be...

Read More »Effort to save humankind from impending catastrophe

from Asad Zaman and RWER issue 85 The methodology and ideology of modern economics are built into the frameworks of educational methods, and absorbed by students without any explicit discussion. In particular, the logical positivist philosophy is a deadly poison which I ingested during my Ph.D. training at the Economics Department in Stanford in the late 1970s. It took me years and years to undo these effects. Positivism uses clever arguments to make you deny what you feel in your bones...

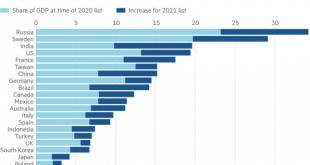

Read More »Total wealth by country in 2019

No way out

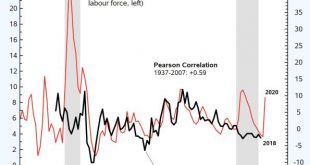

from Shimshon Bichler & Jonathan Nitzan For much of the 20th and early 21st centuries, U.S. unemployment and incarceration went hand in hand. This is how the rulers disciplined their subjects. But during the Great Depression and Great Recession, the link broke, if only temporarily. The following figure shows these patterns. Part of the rational for this two-pronged discipline is illustrated in the next figure: since the Second World War, the income share of the top 10% of the U.S....

Read More »Billionaires’ wealth as a % of GDP

Source: https://www.ft.com/content/747a76dd-f018-4d0d-a9f3-4069bf2f5a93

Read More »The current state of game theory

from Bernard Guerrien and RWER no. 83 One of the most widespread myths in economics, but also in sociology and political science, is that game theory provides “tools” that can help solve concrete problems in these branches – especially in economics. Introductory and advanced textbooks thus often speak of the “applications” of game theory that are being made, giving the impression that they are revolutionizing the social sciences. But, looking more closely, we see that the few...

Read More »The epistemic fallacy

from Lars Syll it is not the fact that science occurs that gives the world a structure such that it can be known by men. Rather, it is the fact that the world has such a structure that makes science, whether or not it actually occurs, possible. That is to say, it is not the character of science that imposes a determinate pattern or order on the world; but the order of the world that, under certain determinate conditions, makes possible the cluster of activities we call ‘science’. It does...

Read More »Back to the bank?

from Peter Radford Following on from the revelation that our impoverished banks are thinking off penalizing their staff for the rather obvious and rational decision to re-locate, along with their big city wages, to a low cost place to live, we discover that most are now trying to force those recalcitrant workers back to the big city offices. My head is still spinning from the absurdity of the threat to cut the wages of enterprising workers. Just how stupid, mean-spirited, and unnecessary...

Read More » Real-World Economics Review

Real-World Economics Review