Read More »

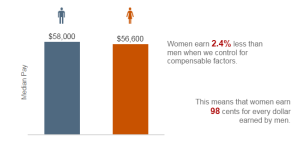

Discrimination and the use of ‘statistical controls’

from Lars Syll The gender pay gap is a fact that, sad to say, to a non-negligible extent is the result of discrimination. And even though many women are not deliberately discriminated against, but rather self-select into lower-wage jobs, this in no way magically explains away the discrimination gap. As decades of socialization research has shown, women may be ‘structural’ victims of impersonal social mechanisms that in different ways aggrieve them. Wage discrimination is unacceptable....

Read More »What’s the difference between a waitress and a private equity partner? (their tax ate)

from Dean Baker If the waitress works in an upscale restaurant and earns a decent living, there is a good chance that she is paying a higher tax rate than a private equity partner. The reason is that private equity (PE) partners get most of their pay in the form of “carried interest.” This is money that is paid to them as a share of the returns on the money they manage. Since private equity partners are rich and powerful, their carried interest payments are taxed at the capital gains tax...

Read More »How does bloated CEO pay maximize shareholder value? One of the great mysteries of the world

from Dean Baker There is plenty of evidence at this point that CEO pay bears little relationship to returns to shareholders. Yet, it is an article of faith in policy circles, especially progressive policy circles, that companies are being run to maximize returns to shareholders. This is why I loved this story. According to the NYT, Chad Richison, the CEO of Paycom, had a pay package that was worth $211 million. When it came up for vote of shareholders in a say-on-pay ballot, it was voted...

Read More »If history follows the path Thomas Piketty noted, it will . . .

from Ikonoclast (originally a comment) If history follows the path Thomas PIketty noted, it will take a major war or revolution to change matters. Each time profit rises faster than the overall rate of growth we get a war, like WW1 or WW2 or a great depression like most of the 1930s. Sometimes we get the depression, then the war. Piketty noted that under capitalism’s axioms: If R (rate of return on capital) is Greater Than G (growth in inflation adjusted dollars) then inequality...

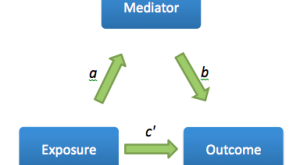

Read More »On the limits of ‘mediation analysis’ and ‘statistical causality’

from Lars Syll “Mediation analysis” is this thing where you have a treatment and an outcome and you’re trying to model how the treatment works: how much does it directly affect the outcome, and how much is the effect “mediated” through intermediate variables … In the real world, it’s my impression that almost all the mediation analyses that people actually fit in the social and medical sciences are misguided: lots of examples where the assumptions aren’t clear and where, in any case,...

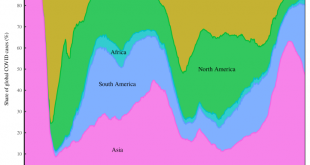

Read More »The quant case for open-access COVID vaccines

from Blair Fix Around the world, rich countries are celebrating as their COVID numbers fall. Their success is no mystery — it’s because of a massive rollout of COVID vaccines. While we should celebrate the development of these vaccines, their deployment highlights the tyrannies of capitalism. Most of the basic research for COVID vaccines was funded by the public. Yet their manufacture is controlled by Big Pharma. The predictable result is that vaccines flow to the highest bidder and Big...

Read More »Power shifts, or not?

from Peter Radford “Even someone as smart as Larry Summers.” Power can flummox even the best economist. A typical explanation of events in an economy makes scant reference to the way in which power distorts the wondrous smooth motions that so obsess the discipline. It’s almost as if human relationships don’t exist in those wonderful models they are all so proud of. For the rest of us, power is central. It takes little time to realize that establishing an imbalance can have all sorts...

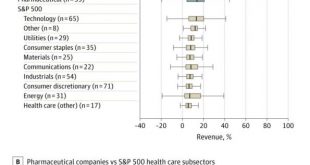

Read More »Pharmaceuticals: Beating the hell out of the average

from Shimshon Bichler and Jonathan Nitzan A lot has been written on the imminent decline of pharmaceuticals: their falling production, reduced R&D, declining innovation, the opioid crisis, patent cliffs, biting competition from generic drugs, growing opposition to IPR. The list goes on. Top Guns Judging by the yardsticks that matter the most, though – namely, the companies’ relative profit and relative capitalization – pharmaceuticals are doing just fine. In fact, based on these...

Read More »And we are still doing nothing substantive to stop this

from Ikonoclast (originally a comment) . . . what really counts is the amount of coal, oil and gas we are burning and thus how much CO2 we are releasing into the atmosphere. The benign Holocene is ending. Scientists have declared we have already entered a new era, the Anthropocene. The climate, and thus weather patterns, of the benign (for humans at least) Holocene were a resource for human civilization. It is common mistake, and one I long made, to pay attention only to primary input...

Read More » Real-World Economics Review

Real-World Economics Review