Mainstream economics is a cult, not a science. It clings to outdated beliefs despite evidence to the contrary. Think of it like a stubborn old car. You know it’s broken. But instead of fixing it, you keep pouring in gas. That’s what mainstream economists do. They ignore the warning lights. Just like Marx contradicted his own Labour Theory of Value, economists ignore anomalies that disprove their models. It’s like trying to fit a square peg into a round hole....

Read More »Revolutionizing Capitalism: A New Vision.

Revolutionizing Capitalism: A New Vision.

Read More »This Matters in Economics

Mainstream economics often overlooks energy's crucial role in production. It's like trying to bake a cake without considering the oven. You can mix all the ingredients, but without heat, nothing happens. This oversight leads to models that fail to address real-world issues, like climate change. Take the Neoclassical view that production is mainly about labor and capital. It's a bit like saying a car runs on just its wheels and chassis. Without fuel, the car won't move. Energy...

Read More »Debt Crisis Hits Us Again!

Debt Crisis Hits Us Again!

Read More »How Hitler Actually Rose To Power (Top Economist Proves)

Engineers, Finance, and IT Pros: Learn 50+ years of Real Economics in only 7 Weeks. Weekly with me. Learn more: apply.stevekeenfree.com OR Join ~10,000 others in downloading my free 'Funny Money' Bundle (2 books, worth $60): new.stevekeenfree.com -- Who is Dr. Steve Keen? Dr. Steve Keen is an influential economist who has dedicated over 50 years to challenging mainstream economic theories. Since his days as a university student, he has been engaged in a David vs. Goliath battle against...

Read More »Neoclassical Economics is a Cult

Neoclassical economics is a cult, not a science. It clings to outdated models that ignore reality. We need an economics grounded in realism, not fantasy. Imagine a pilot flying a plane. He relies on a map from decades ago. That map shows mountains that no longer exist. He’s flying blind, and the passengers are terrified. This is what neoclassical economics does. It uses models that don’t reflect the world we live in. It’s like trying to navigate a city with a...

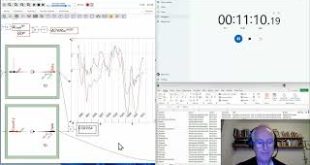

Read More »Using Ravel to show what causes House Price Bubbles in ten minutes flat

Ravel is a whole new way to analyse data. No coding needed, no obscure cell reference formulas, and no need for pivot tables. Here I show how Ravel can effortlessly analyze the relationship between household debt acceleration and house price changes, in just ten minutes! Ravel will streamline and dramatically accelerate your data analysis. It works with any type of data, from marketing sales data to scientific. Get Ravel from https://www.patreon.com/ravelation for a budget-friendly $7...

Read More »The Economics Cult Ignoring Reality.

The Economics Cult Ignoring Reality.

Read More »Money Matters

Money is often dismissed as a mere tool. People think it doesn’t matter in the grand scheme of things. This belief is a dangerous fallacy. Money creation by banks is the lifeblood of economic growth. When banks lend money, they create new deposits. This process fuels spending, investment, and ultimately, growth. Ignoring private debt in economic models is like ignoring the engine in a car. Without it, the vehicle won't move. Mainstream economists, like Ben Bernanke,...

Read More »House Price Bubble About to Burst?

House Price Bubble About to Burst?

Read More » Steve Keen’s Debt Watch

Steve Keen’s Debt Watch