Entretien avec l'économiste Thomas Piketty qui a publié en 2013 un essai intitulé "Le Capital au XXIe siècle". L’auteur replace l’œuvre de Karl Marx dans l’histoire longue de la réflexion sur les inégalités depuis la Révolution française. En quoi le Capital, dont on célèbre le 150ème anniversaire de la parution cette année, est-il utile pour penser la question sociale et l’économie ? Pour en savoir plus :...

Read More »Suppression of the wealth tax: an historical error

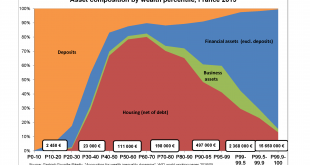

Let it be said at once: the suppression of the wealth tax (Impôt sur la Fortune or ISF) constitutes a serious moral, economic and historical mistake. This decision reveals a profound misunderstanding of the challenges to inequality posed by globalisation. Let’s go back for a moment. During the first globalisation period between 1870 and 1914, a strong international movement gradually took shape which sought to promote a new type of redistribution and taxation. Based on a progressive...

Read More »Thomas Piketty : “Karl Marx, la révolution, et après ?”

En quoi le "Capital", dont on célèbre le 150ème anniversaire de la parution cette année, est-il utile pour penser la question sociale et l’économie ? L’auteur replace l’œuvre de Karl Marx dans l’histoire longue de la réflexion sur les inégalités depuis la Révolution française. Pour savoir plus : https://www.franceculture.fr/emissions/la-fabrique-de-lhistoire/karl-marx-14-le-capital-toujours-utile-pour-penser-la-question-economique-et-sociale Inscrivez-vous à notre chaîne :...

Read More »Momento Fronteiras – Thomas Piketty

Para reduzir a desigualdade, devemos olhar mais para a política do que para a própria economia. Esta é uma das diversas conclusões do economista francês Thomas Piketty, que propôs, em sua conferência no Fronteiras, um estudo conjunto entre países como solução para a redução da desigualdade. Ou diminuímos a desigualdade pela união ou precisaremos de episódios dramáticos para fazê-lo, como guerras e revoluções. O problema da tributação, o nacionalismo, o impacto da segregação social na...

Read More »Livro #10: “Thomas Piketty e o segredo dos Ricos” –

Nesse vídeo Afonso Jr apresenta os livros "Thomas Piketty e o segredo dos Ricos" e "Os exuberantes anos 90" de Joseph E. Stiglitz. “[…] A Bélgica adotou o regime do abatimento mobiliário liberatório: as empresas ou instituições financeiras que pagam lucros ou dividendos descontam uma taxa proporcional (15% 2009) sobre os montantes pagos, a qual dispensa o contribuinte de qualquer imposto posterior.” (Panier Frédéric, “Paraísos Fiscais, o Modelo Belga”, 2014, p. 55) "A filosofia ocidental...

Read More »Re-thinking the capital code

Partager cet article What should we think of the reform of the Labour Code defended by the government? The key measure, and also the one which is most highly criticized, consists in capping the compensation payments for unfair dismissal at one month’s salary per annum per year of seniority (and half a month for each year worked beyond 10 years). In other words, an employer can freely dismiss an employee who has spent over 10 years in the firm, without having to establish the...

Read More »Lordon et Piketty débattent sur l’Europe – Part.2

extraits du discours de Bruges de Margaret Thatcher en 1988 https://www.youtube.com/watch?v=wkRwMFy0CVM https://fr.wikipedia.org/wiki/Discours_de_Bruges sous-titres perso ------------------------------ extraits du débat entre Lordon et Piketty à "Ce Soir Ou Jamais" : https://www.youtube.com/watch?v=3PHr1FEqdhw ------------------------------ "qu'est ce qu'un peuple ?" conférence de francine demichel https://www.youtube.com/watch?v=s2Pzhy2XVMw ------------------------------ Frédéric Lordon...

Read More »Thomas Piketty : “Avec les ordonnances, on va augmenter les pouvoirs du chef d’entreprise”

Thomas Piketty s'exprime pour la première fois sur la politique économique du gouvernement Macron et la réforme du code du travail.

Read More »Capital in the Twenty First Century by Thomas Piketty | Animated Book Review

Try Snapreads free for 7 days ? http://bit.ly/2vscczw - Capital in the Twenty-First Century is a 2013 book by French economist Thomas Piketty. It focuses on wealth and income inequality in Europe and the United States since the 18th century. It was initially published in French (as Le Capital au XXIe siècle) in August 2013; an English translation by Arthur Goldhammer followed in April 2014. — 5 Lessons from 'Capital in the Twenty-First Century' by Thomas Piketty 1. Western European society...

Read More » Thomas Piketty

Thomas Piketty