Let it be said at once: the suppression of the wealth tax (Impôt sur la Fortune or ISF) constitutes a serious moral, economic and historical mistake. This decision reveals a profound misunderstanding of the challenges to inequality posed by globalisation. Let’s go back for a moment. During the first globalisation period between 1870 and 1914, a strong international movement gradually took shape which sought to promote a new type of redistribution and taxation. Based on a progressive taxation system on income, wealth and inheritance, this new model was aimed at a better distribution of productivity gains and the structural reduction of the concentration of property and economic power. It was successfully implemented in the period 1920 to 1970, partly as a result of the pressure of

Topics:

Thomas Piketty considers the following as important: in-english, Non classé

This could be interesting, too:

Thomas Piketty writes Regaining confidence in Europe

Thomas Piketty writes Trump, national-capitalism at bay

Thomas Piketty writes Democracy vs oligarchy, the fight of the century

Thomas Piketty writes For a new left-right cleavage

Let it be said at once: the suppression of the wealth tax (Impôt sur la Fortune or ISF) constitutes a serious moral, economic and historical mistake. This decision reveals a profound misunderstanding of the challenges to inequality posed by globalisation.

Let’s go back for a moment. During the first globalisation period between 1870 and 1914, a strong international movement gradually took shape which sought to promote a new type of redistribution and taxation. Based on a progressive taxation system on income, wealth and inheritance, this new model was aimed at a better distribution of productivity gains and the structural reduction of the concentration of property and economic power. It was successfully implemented in the period 1920 to 1970, partly as a result of the pressure of dramatic historical events, but equally thanks to a lengthy intellectual and political process.

We may perhaps today be witnessing the premisses of a similar movement. Confronted with the rise in inequality, awareness is gaining momentum. Those who advocate withdrawal into some form of cultural identity are, of course, attempting to exploit the feeling of abandonment experienced by the working classes, at times successfully. But concomitantly we see the rise of a new demand for democracy, equality and redistribution. The United Kingdom might swing distinctly to the left in the years to come – and perhaps also the United States if the democrat candidates who are preparing to stand are anything to judge by.

In this type of context, the abolition of the wealth tax today in France, almost 40 years after the arrival in power of Reagan and Thatcher, has totally missed the plot. There is absolutely no sense in making tax gifts to groups who are old and wealthy and have already done very well in recent decades. All the more so as the loss in revenue is anything but symbolic. If we add the gifts made to dividends and interests ( which will in future be taxed at a maximum rate of 30%, as opposed to 55% for salaries and incomes from non-waged activities), we come to a total cost of over 5 billion Euros. This is the equivalent of 40% of the total budget allocated to the universities and higher education which will remain static at 13.4 billion Euros in 2018, whereas the numbers of students rise steadily and preference should be given to investment in training. I would like to bet that the students will remind the government of this when it endeavours to add selection to austerity in the coming months.

The government’s argument is that the wealth tax would provoke a fiscal hemorrhage. The problem is that this assertion is totally false. If one examines all the data available calmly and objectively – the national accounts, declarations of income and of fortunes, surveys on wealth – then the conclusion is irrevocable. The biggest fortunes are doing very well in France and there is no hemorrhaging to be seen.

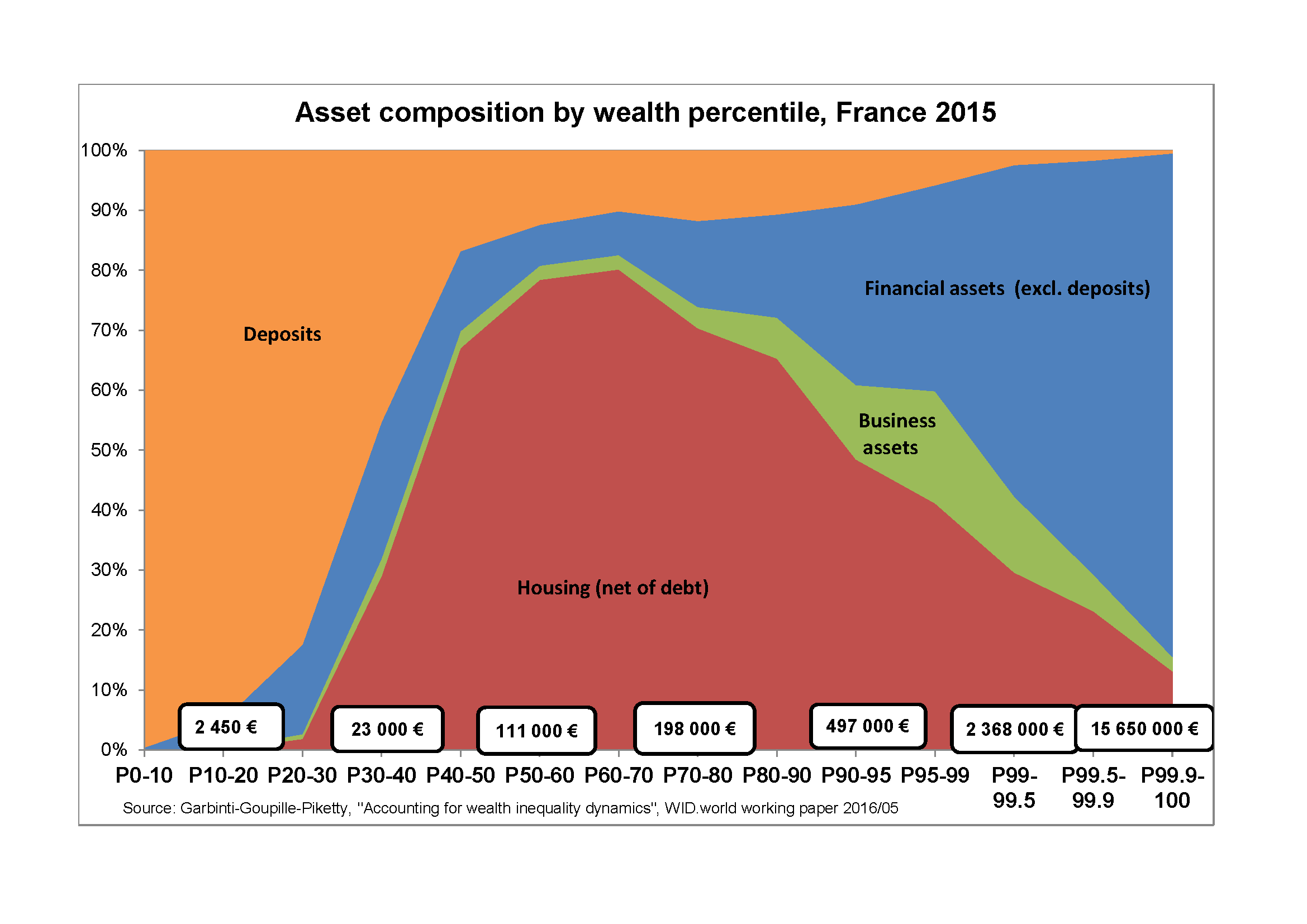

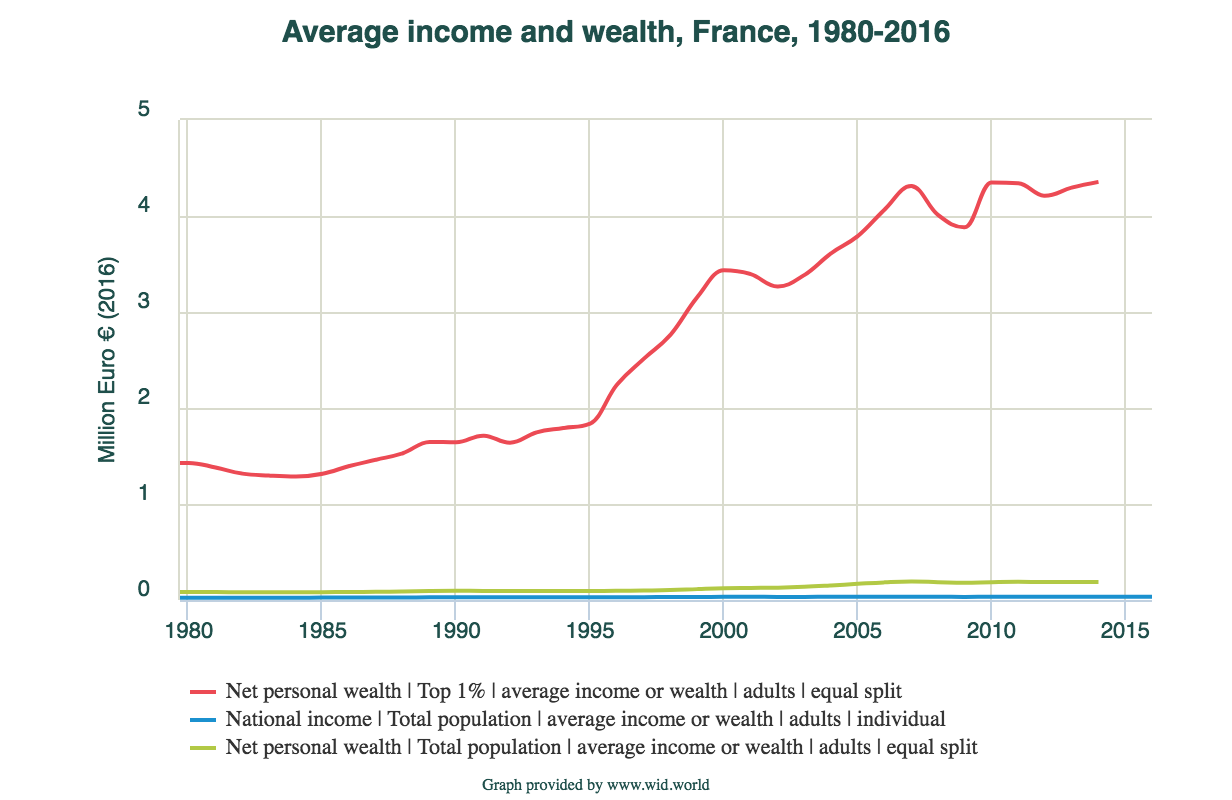

Here are the main facts (all the details are on WID.world). Between 1980 and 2016, average national income per adult, expressed in 2016 Euros, rose from 25,000 Euros to just over 33,000 Euros, or a rise of approximately 30%. At the same time, the average wealth held derived from property per adult, multiplied two-fold, rising from 90,000 to 190,000 Euros. Yet more striking: the wealth of the richest 1%, 70% of which is in financial assets, rose from 1.4 to 4.5 million Euros, or increased more than threefold. As to the 0.1% of the wealthiest, 90% of whose wealth is held in financial assets, and who will be the main beneficiaries of the abolition of the wealth tax, their fortunes rose from 4 to 20 million Euros, that is they increased five-fold. In other words, the biggest fortunes in financial assets rose even more rapidly than property assets, whereas the opposite should have been the case if the hypothesis of a fiscal flight was true.

(link to graph and data series WID.world) (with top 0,1%, 0,01%, 0,001%)

(link to the study Garbinti-Goupille-Lebret-Piketty, « Accounting for Inequality Dynamics: Methods, Estimations and Simulations for France, 1800-2014 », WID.world working paper 2006/05, from which these series are extracted)

Moreover this type of finding is a characteristic in the ranking of fortunes, in France as in all countries. According to Forbes, the top world fortunes, which are almost exclusively held in financial assets – have risen at a rate of 6% to 7% per year (on top of inflation) since the 1980s, or 3-4 times more rapidly than growth in GDP and of world per capita wealth. Some see therein an almost messianic sign of the benefits of entrepreneurial dynamics. In truth, we see the same rise in numerous inherited fortunes (like that of the late L’Oréal fortune). This evolution is also in large part due to commercially avantageous privatisations, and particularly profitable monopolies, in particular in energy, telecommunications and new technologies in Europe and the United States, as in Russia, Mexico, India or China. In any event, whatever our individual opinion may be as to the importance of these various factors, we should be able to agree on the fact that a wealth tax at a rate of over 1.5% or 2% (or even more) is not a serious threat to a fiscal base which rises at a similar rate, and that there are other priorities without making presents to those who are doing best.

The political strategy which consists in transforming the wealth tax into a property tax (impôt sur la fortune immobilière), to avoid a complete suppression of the wealth tax, quite frankly leaves me speechless. There is no logical reason to levy a higher tax on a person who invests their fortune in a house or a property rather than in a financial portfolio, a yacht or any other type of good. We can only hope that elected members remember that they were not elected to be part of this kind of farce.