From the March 2016 Preface to The Economic Consequences of Mr Osborne By Ann Pettifor, Professor Victoria Chick and Geoff Tily … when sustained, fiscal consolidation increases rather than reduces the public debt ratio and is in general associated with adverse macroeconomic conditions. ‘Economic Consequences of Mr Osborne’, June 2010 Having missed the genuine threat of the private debt bubble, the economics profession misread disastrously the increase in public debt. In their 2009 This Time is Different, Kenneth Rogoff and Carmen Reinhart discreetly warned: However, the surge in government debt following a crisis is an important factor to weigh when considering how far governments should be willing to go to offset the adverse consequences of the crisis on economic activity. (290) Shortly afterward their paper ‘Growth in the Time of Debt’ set an explicit threshold of 90 per cent of GDP above which adverse economic conditions became statistically significant. In the UK, academic, City and media economists warned politicians in no uncertain terms that it was imperative to reduce the public debt. On 14 February 2010, 20 of the most senior UK economists (listed below) wrote to The Sunday Times castigating the Labour government for inadequate efforts on deficit reduction and setting the tone not only for the general election of that year but seemingly ever since.

Topics:

Ann Pettifor considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

From the March 2016 Preface to The Economic Consequences of Mr Osborne

By Ann Pettifor, Professor Victoria Chick and Geoff Tily

… when sustained, fiscal consolidation increases rather than reduces the public debt ratio and is in general associated with adverse macroeconomic conditions. ‘Economic Consequences of Mr Osborne’, June 2010

Having missed the genuine threat of the private debt bubble, the economics profession misread disastrously the increase in public debt. In their 2009 This Time is Different, Kenneth Rogoff and Carmen Reinhart discreetly warned:

However, the surge in government debt following a crisis is an important factor to weigh when considering how far governments should be willing to go to offset the adverse consequences of the crisis on economic activity. (290)

Shortly afterward their paper ‘Growth in the Time of Debt’ set an explicit threshold of 90 per cent of GDP above which adverse economic conditions became statistically significant. In the UK, academic, City and media economists warned politicians in no uncertain terms that it was imperative to reduce the public debt. On 14 February 2010, 20 of the most senior UK economists (listed below) wrote to The Sunday Times castigating the Labour government for inadequate efforts on deficit reduction and setting the tone not only for the general election of that year but seemingly ever since.

Orazio Attanasio, UCL; Tim Besley, LSE; Roger Bootle, Capital Economics; Sir Howard Davies, LSE; Lord (Meghnad) Desai, House of Lords; Charles Goodhart, LSE; Albert Marcet, LSE; Costas Meghir, UCL; John Muellbauer, Nuffield College, Oxford; David Newbery, Cambridge University; Hashem Pesaran, Cambridge University; Christopher Pissarides, LSE; Danny Quah, LSE; Ken Rogoff, Harvard University; Bridget Rosewell, GLA and Volterra Consulting; Thomas Sargent, New York University; Anne Sibert, Birkbeck College, University of London; Lord Andrew Turnbull, House of Lords; Sir John Vickers, Oxford University; Michael Wickens, University of York and Cardiff Business School.Desai, House of Lords; Charles Goodhart, LSE; Albert Marcet, LSE; Costas Meghir, UCL; John Muellbauer, Nuffield College, Oxford; David Newbery, Cambridge University; Hashem Pesaran, Cambridge University; Christopher Pissarides, LSE; Danny Quah, LSE; Ken Rogoff, Harvard University; Bridget Rosewell, GLA and Volterra Consulting; Thomas Sargent, New York University; Anne Sibert, Birkbeck College, University of London; Lord (Andrew) Turnbull, House of Lords; Sir John Vickers, Oxford University; Michael Wickens, University of York and Cardiff Business School.

In June 2010, the Coalition government took office, and George Osborne announced fiscal consolidation plans to meet the concerns of Labour’s critics.

The analysis in the ‘Economic Consequences of Mr Osborne’ – published in July 2010 – was prepared as a reaction to this latest manifestation of academic influence over political consensus. We sought to learn from the record of history embodied in the National Accounts. As the quotation at the head of this paper shows, we were careful not to claim too much.

Some six years later, vast damage has been inflicted on public services and the public sector workforce. Five years of consolidation became ten years, with total spending cuts virtually doubling in size. The economy has barely expanded in per capita terms relative to the pre-crisis peak, and public sector debt as a share of GDP is still rising in spite of a vast fire sale of public assets.

Our analysis showed it would have been unwise to expect anything else.

Various authors objected to our technique as lacking in scientific or econometric rigour, or as simply self-fulfilling on account of the relation between debt and the deficit and between government expenditure and income. Given these relations between variables and their non-homogeneity over time, no technique, simple or complex, is infallible. The best technique we maintain is to study the results of economic policy as distinct episodes from history that might advise present actions, not as variables in a regression.

The acclaimed contributions to the austerity case were far more culpable of methodological error; our particular bugbear was the (still) commonplace usage of the deficit as a guide to the extent of austerity. Alesina and Ardagna’s work on which the Treasury case rested heavily, had already been dismantled (see page 33, n.29). Now Rogoff and Reinhart have been discredited in a very public way. With the evidence thin on the ground in the first place, there is very little reputable evidence left for the beneficial effects of austerity. Conversely, more and more evidence has accumulated against austerity.

International organisations have been responsible for much of this evidence. First the IMF revised their previous estimates of multipliers to substantially higher figures, which they say better reflects recent evidence. The OECD has also moved towards a more expansionary stance, culminating in their 18 February 2016 interim Economic Outlook. The press release includes this categorical re-assertion the Keynes position, no truer now than it was five or eighty-five years ago:

A commitment to raising public investment collectively would boost demand while remaining on a fiscally sustainable path. Investment spending has a high multiplier, while quality infrastructure projects would help to support future growth, making up for the shortfall in investment following the cuts imposed across advanced countries in recent years. These effects would be enhanced by, indeed need to be undertaken in conjunction with, structural reforms that would allow the private sector to benefit from the additional infrastructure; notably in the Europe Union, cross-border regulatory barriers are a significant obstacle. Collective public investment action combined with structural reforms would lead to a stronger GDP gain, thereby reducing the debt-to-GDP ratio in the near term.

Commentators in the UK press have also recanted, even The Economist. The following comes from the editorial in the issue of 20 February, 2016:

…governments can make use of a less risky tool: fiscal policy. Too many countries with room to borrow more, notably Germany, have held back. Such Swabian frugality is deeply harmful. Borrowing has never been cheaper. Yields on more than $7 trillion of government bonds worldwide are now negative. Bond markets and ratings agencies will look more kindly on the increase in public debt if there are fresh and productive assets on the other side of the balance-sheet. Above all, such assets should involve infrastructure. The case for locking in long-term funding to finance a multi-year programme to rebuild and improve tatty public roads and buildings has never been more powerful.

In 2012, when austerity in Britain was really hurting, the New Statesman, under the headline ‘Osborne’s supporters turn on him – leading economists who formerly backed Osborne urge him to change course’, reported going back to The Sunday Times’s 20 economists to ask whether they now stood by what they had written. Only one of the twenty still did so unreservedly. Extracts from specific responses are reproduced in the annex, at the end of this preface (p.11). None admit to an error of judgement; all plead changed circumstance (we return to this below).

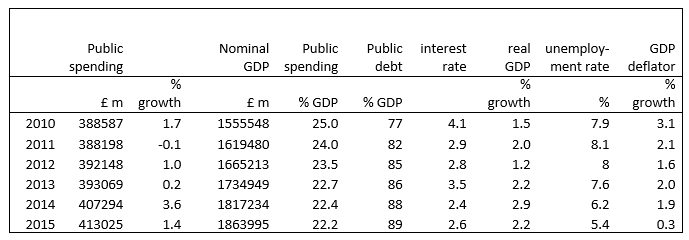

The UK was spared the worst ills of austerity when, late in 2012, policy was relaxed rather than intensified as the original doctrine of The Sunday Times’s 20 economists would have required. Moreover (without belittling the undoubted hardship caused) from a macroeconomic perspective the policy was already relatively moderate by the standards of historical experience, amounting basically to a sharp reduction in the rate of growth of nominal expenditure. (NB we used general government final consumption and investment expenditures as the indicator of discretionary contraction.) Under the original plan, government expenditure was to be virtually flat, averaging an increase of 0.075 per cent a year; after the relaxation, spending was expanded by 1.2 per cent a year (measured over 2010 to 2015; as a guide to the scale of the reduction, in the six years before the coalition spending grew by 6.5 per cent a year). The figures for these years, across the same categories as the tables in the main paper, appear below. (These are on the latest national accounts definitions and so do not continuously follow from Table 3I.1 in the main text. The main charts are updated in the annex to this preface on p.14).

As expected, economic growth was reduced significantly, averaging 2.0 per cent a year over 2010 to 2015 compared with 2.6 per cent a year over 1948 to 2007. (In fact, the recovery was the slowest over the whole period for which UK figures are readily available, even slower when measured per head and even more abrupt in nominal terms). Slower economic growth meant lower growth in labour income and profits and therefore lower than expected government revenues and increased welfare expenditure. Like everybody else we missed the strength of the employment response, but the parallel unprecedented reduction in earnings growth amounted to the same thing in terms of tax revenues, and welfare payments were higher because of in-work benefits (housing benefit and tax credits).

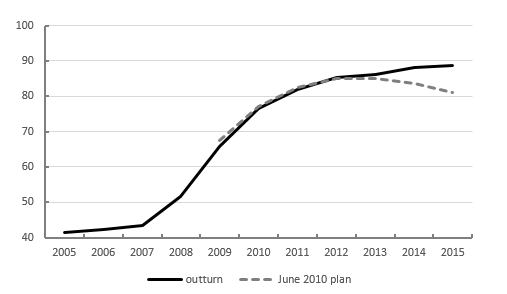

As a result of this shortfall in net receipts, the deficit was reduced by much less than expected by the coalition. On the basis of what happened to the public debt ratio, our conclusions have been wholly vindicated. While stock/flow debt/deficit relations mean debt would inevitably rise relative to 2010, according to the original plans it should by now have been on an improving trajectory. Figure A shows outturn against plan on the basis of the Maastricht definition that was used in the original work. Rather than improving, the debt ratio has not stopped rising and in 2015 was within a whisker of 90 per cent of GDP. The difference between the plan and outturn is 7.5 percentage points of GDP, i.e. £140 billion.

Figure A: Public debt as a percentage share of GDP

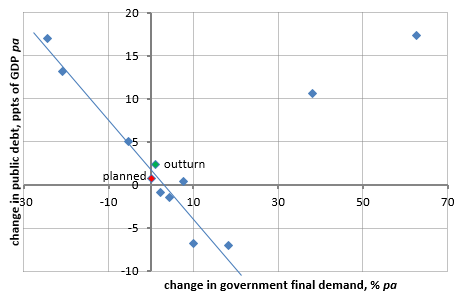

For completeness on Figure B the plans and outcome for government spending and public debt are set against the original regression (Figure 2.2 on p.17). The high level of the deficit at the start of the consolidation means that debt gains would be slower than other historical episodes; nonetheless the spending policies were set at a level not historically associated with a reduced debt ratio. Even given slightly higher spending in practice, the average annual rise in the debt ratio is still in very bad company – the only worse performances are the two world wars, associated demobilisations (including the Geddes Axe of the 1920s) and the great depression. The implication is still that higher expenditure would have been more effective at reducing the debt ratio.

Figure B: Changes in government spending and debt

Plainly one of the big fears of excessive debt is a sharp rise in interest rates, a key argument deployed by government in support of its approach. The historical evidence in our 2010 paper showed that no such relation between debt and interest rates exists; as Keynes came to understand, long-term interest rates are ultimately contingent on government debt management and monetary policies, not the public debt ratio. In a similar way, in spite of rising public debt, interest rates are presently at record lows. In 2014 the interest rate on 20-year government bonds was 2.4 per cent, the lowest on record; the previous record was 2.6 per cent in 1946, the year Keynes died. A central goal of Keynes’s policy initiatives from 1931 was this reduction in long rates. In part the present low rate is attributable to quantitative easing, the central bank now holds £375bn of the £1.3tn stock of UK government debt (gilts).

Moreover the actions of central banks across the world have undoubtedly created the impression that holding government debt is almost riskless, given their willingness to intervene when things get really sticky (witness, for example, recent exceptionally low interest rates on Spanish debt). The pressure of the consolidation was also eased when interest payments on the debt held by the Bank were returned to the Treasury from 2013. (Public sector finance figures show government receipts totalling £38bn from the asset purchase facility.)

We make no appeal to disregard high public debt. We show that to attempt to lower the debt ratio by cutting spending has always been counterproductive. We appeal instead for a policy that might be successful in reducing it.

In the wake of the global financial crisis it was surprising that the opinion of economists, however distinguished, could still reach such a degree of consensus. But the call for austerity provoked widespread agreement, and once more society has been disastrously misled. Rogoff and Reinhart advised holding back on the government spending that might have “offset the adverse consequences of the crisis” in order to reduce debt; instead, the adverse consequences have been endured and the public debt has been increased, not reduced.

In the real world, there is a crisis of living standards, of the availability of decent work and, inevitably, of the provision of public services and welfare support. This crisis is seemingly endless. It is turning politics upside down and leading to the rise of populism and nationalism. Economic fragilities associated with asset and debt inflation have not diminished, and indeed the former has been exacerbated by repeated programmes of quantitative easing, extended once more last week by the European Central Bank.

And finally, as we warned, the prolonged period of low growth has meant an underutilistion of resources that is cumulative in effect and has led to price outcomes remaining on the verge of deflation. (On p. 19 of the 2010 report we wrote: “especially in the face of a slump and at a time of high indebtedness, the concern should be of consolidation leading to deflation, which most regard as far more dangerous”.) The Chancellor may have pulled back on the severity of cuts once planned for the current parliament, but annual growth in spending projected at 1.5 per cent a year will further stifle recovery and will fall far short of the needs of the economy. Mark Carney, Governor of the Bank of England, observed in January that the UK consolidation (taken as a whole) was the largest fiscal consolidation in the OECD.

The economics profession is now largely conspicuous by its absence from debate, apart from those who have been vindicated by their opposition to cuts. In media commentary a growing consensus is now emerging around the desirability of infrastructure spending, not least given the unprecedented low interest rates on government borrowing that now prevail. Given that high public debt is unresolved, there has therefore been a change in policy prescription. This is a positive development.

But there is no sense of culpability for the failure of the original policies nor any recognition of a change in course. Amartya Sen’s (somewhat belated) savaging of austerity policies after the 2015 general election, did not mention the extent of support for those policies within the profession when they were first imposed. As the remarks above and the statements in the annex indicate, the Sunday Times 20 are deploying ‘changed conditions’ to explain any failures. But conditions have changed because of their wrong policy prescription.

Changed conditions are also routinely attributed to the Eurozone crisis. Office for Budgetary Responsibility (OBR) figures show that policymakers were relying on government spending cuts ‘crowding in’ significant increases in private investment and net trade. Net trade actually performed less badly under the coalition than it did ahead of the crisis, even if it did not match the excessive expectations of the OBR. Government and consumer demand were the main drag on GDP over this period.

But whatever the importance, how was it ever sane to rely on external demand when EU policymakers were imposing even more severe austerity on their economies? The real miscalculation was overlooking the (negative) multiplier effects of spending cuts, which were effectively ignored in making a forecast for unchanged growth. As the IMF have conceded, international evidence over the course of the crisis shows these effects were material and significant. Yet as Simon Wren-Lewis has observed, there has still been no meaningful debate on these crucial factors.

In ‘The Economic Consequences of Mr. Osborne’ we provided empirical evidence that austerity policies were not successful in reducing the public debt ratio in the past and therefore that they were unlikely to do so this time. The empirical argument was reinforced by an articulation of (aspects of) Keynes’s theoretical position. Our analysis has proved better at explaining not only overall outcomes but also how they arose. While New-Keynesian economists have throughout provided a counter-narrative to the Sunday Times 20, their goal of rescheduling or reducing austerity fell short of the full Keynes account both intellectually and probably in terms of capturing the public imagination.

There are two arenas, however, where austerity has been successful. Politically, the public (for the moment) remain persuaded of the household analogies that it should be the business of an honest economics profession to dispel. And second, we should not lose sight of the original sleight of hand (evident in Rogoff and Reinhart) that turned a crisis of the financial system and associated vested interests into a failure of the public sector.

The world is now confronting another round of financial turbulence, this time under increasingly deflationary conditions. It is the legacy of the economic failures of the past five years. There is still everything to play for.

All footnotes can be found in the new preface to the Economic Consequences of Mr Osborne.