I have been criticised by among others, Professor Simon Wren-Lewis, for the earlier blog criticising the economics profession. To bolster my case, am sharing here ex-governor of the Bank of England, Mervyn King’s, views on the profession. While his is an “on-the-one-hand-but-on-the-other” approach, nevertheless it is clear on the culpability of the profession. The quotation is from page 3 of his recent book, ‘The End of Alchemy‘ published by Little, Brown in 2016. “Since the crisis, many have been tempted to play the game of deciding who was to blame for such a disastrous outcome. But blaming individuals is counter-productive – it leads you to think that if just a few, or indeed many, of those people were punished then we would never experience a crisis again. [Me: This is why I tend not to blame individual bankers, but the economics profession as a whole, even while evidencing my criticism with examples]. If only it were that simple. A generation of the brightest and best were lured into banking, and especially into trading, by the promise of immense financial rewards and by the intellectual challenge of the work that created such rich returns. They were badly misled. The crisis was a failure of a system and the ideas that underpinned it, not of individual policy-makers or bankers, incompetent and greedy though some of them undoubtedly were. . [My emphasis].

Topics:

Ann Pettifor considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

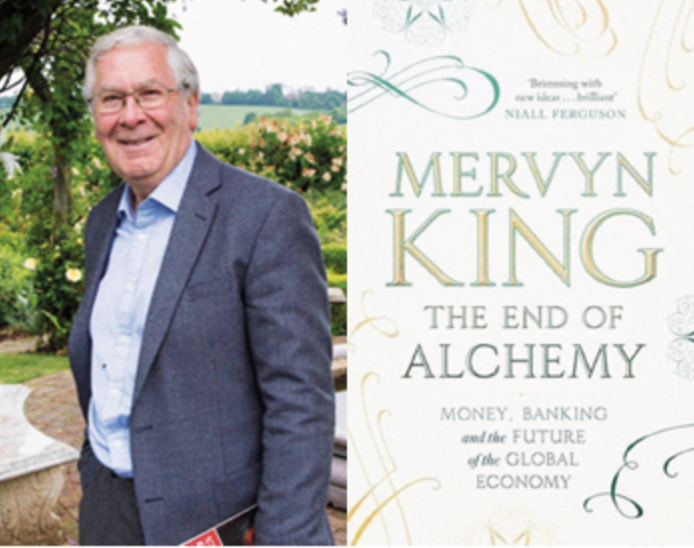

I have been criticised by among others, Professor Simon Wren-Lewis, for the earlier blog criticising the economics profession. To bolster my case, am sharing here ex-governor of the Bank of England, Mervyn King’s, views on the profession. While his is an “on-the-one-hand-but-on-the-other” approach, nevertheless it is clear on the culpability of the profession. The quotation is from page 3 of his recent book, ‘The End of Alchemy‘ published by Little, Brown in 2016.

“Since the crisis, many have been tempted to play the game of deciding who was to blame for such a disastrous outcome. But blaming individuals is counter-productive – it leads you to think that if just a few, or indeed many, of those people were punished then we would never experience a crisis again. [Me: This is why I tend not to blame individual bankers, but the economics profession as a whole, even while evidencing my criticism with examples]. If only it were that simple. A generation of the brightest and best were lured into banking, and especially into trading, by the promise of immense financial rewards and by the intellectual challenge of the work that created such rich returns. They were badly misled. The crisis was a failure of a system and the ideas that underpinned it, not of individual policy-makers or bankers, incompetent and greedy though some of them undoubtedly were. . [My emphasis]. There was a general misunderstanding of how the world economy worked…….

If we don’t blame the actors, then why not the playwright? Economists have been cast by many as the villain. An abstract and increasingly mathematical discipline, economics is seen as having failed to predict the crisis. This is rather like blaming science for the occasional occurrence of a natural disaster. Yet we would blame scientists if incorrect theories made disasters more likely or created a perception that they could never occur, and one of the arguments of this book is that economics has encouraged ways of thinking that made crises more probable…..”

My only disagreement with this excerpt from ex-Governor King’s book is that financial crises since financial liberalisation in the late 1960s and early 1970s have not been ‘occasional’. They have been a direct consequence of financial liberalisation, encouraged and cheered on by the economics profession as a whole. .