As is well known, Marx and the classical political economists before him made a distinction between productive and unproductive labor. Marx’s distinction somewhat differed from Smith’s. For Marx, labor is productive when it is: (i) directly productive of surplus value; and (ii) exchanged directly against capital. I remain unsure how applicable the distinction is to a state money system. Some of my misgivings are explained in an earlier post. The uncertainty has held back an attempt to explore connections between Marx and Modern Monetary Theory (MMT). To get around this, here I proceed on an as if basis by assuming for the sake of argument that the distinction is meaningful. Consider a simplified economy with a productive sector (sector p) and an unproductive sector (sector u). It can

Topics:

peterc considers the following as important: Economics

This could be interesting, too:

Lars Pålsson Syll writes Schuldenbremse bye bye

Lars Pålsson Syll writes What’s wrong with economics — a primer

Lars Pålsson Syll writes Krigskeynesianismens återkomst

Lars Pålsson Syll writes Finding Eigenvalues and Eigenvectors (student stuff)

As is well known, Marx and the classical political economists before him made a distinction between productive and unproductive labor. Marx’s distinction somewhat differed from Smith’s. For Marx, labor is productive when it is: (i) directly productive of surplus value; and (ii) exchanged directly against capital. I remain unsure how applicable the distinction is to a state money system. Some of my misgivings are explained in an earlier post. The uncertainty has held back an attempt to explore connections between Marx and Modern Monetary Theory (MMT). To get around this, here I proceed on an as if basis by assuming for the sake of argument that the distinction is meaningful.

Consider a simplified economy with a productive sector (sector p) and an unproductive sector (sector u). It can be supposed, for simplicity, that all private sector activity is productive and all public sector activity unproductive.

Suppose that spending on the output of sector p is divided between private autonomous demand A, a part of government spending Gp and induced demand (1 – α)Y, where α is the fraction (positive and less than one) of an increment in income Y that drains to taxes, saving and imports.

The spending on sector u output Gu is carried out entirely by government. This spending takes the form of wage and salary payments to public sector employees.

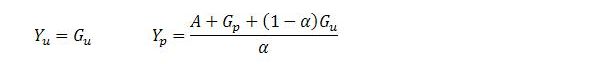

Under these assumptions, total demand is

When output is adjusted to demand (Y = Yd) the economy generates total output and income of:

For ease of correspondence with Marx’s value categories, Y can be interpreted in the present context as Net Domestic Product (meaning Gross Domestic Product minus Depreciation). It is also convenient to assume that Y and the other variables are expressed in nominal terms.

Of total income, only Gu is generated in sector u. The rest is generated in sector p.

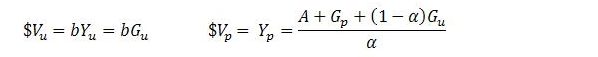

Since some income is the result of unproductive activity, the total new monetary value $V realized in the economy will be less than the level of income. Sector p will produce value equal to the income it generates while sector u will produce value (if at all) that is only a fraction of the income it generates:

For the economy as a whole:

In the above expressions b is a fraction between zero and one, and quite possibly zero. If b is taken to be zero, as a worst-case scenario for capitalists, then sector u will create no value and the total new value realized in the period will simply be due to sector p:

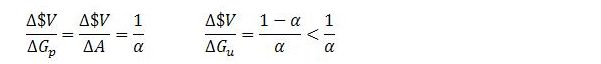

This expression is consistent with a capitalist preference for Gp rather than Gu. The multiplier impact of the latter is smaller due to a fraction of the spending being withdrawn from the circular flow of income before having a chance to be realized by domestic capitalists within the period. Some of the leakage (to saving) may enter sector p in a future period and some (to imports) will be captured by capitalists elsewhere in the global economy. The part that leaks to taxes will go unrealized by capitalists.

When government runs a deficit, capitalists enjoy a net gain from the presence of any kind of government spending, other factors remaining equal. But they do even better out of the spending that is directly on sector p output. If, instead, government runs a surplus, the net effect on capitalists is less clear and will depend on the incidence of taxation.

The reason capitalists derive some benefit as a class from government spending on unproductive output is at least twofold. First, as is obvious from (1), government spending on sector u output induces consumption expenditure on sector p output. This additional demand justifies expansion of production in sector p. For a given rate of exploitation, capitalists will realize more surplus value as a result. Second, much of the government spending on sector p output is itself only carried out for the purposes of sector u production. So although for a given level of government spending capitalists will do better when the ratio of Gp to Gu is high, the level of government spending cannot really be taken as independent of the level of Gu. The more Gu there is, the more Gp there will tend to be.

The above is on the basis of a given rate of exploitation. In reality, capitalists’ attitudes toward government spending will also be influenced by how they think policy will affect the rate of exploitation. Since unemployment will tend to depress wages, capitalists as a class will prefer a level of government spending that is well short of maintaining full employment. And for a given level of government spending, they will prefer the spending to take forms that are less empowering to workers.