In my recent piece in The Guardian, mostly about Adani, I observed The paradoxes of Adani are mirrored in the global coal market. Despite a small increase in 2017, global coal production is below its 2013 peak. Yet prices have recovered strongly, yielding big profits to existing miners and offering a seemingly tempting prospect for new mines. It turns out that this isn’t quite right. The benchmark Newcastle price, for low-ash coal with a heat content of 6000kcal/kg has risen strongly, to the great benefit of companies like Yancoal, Glencore and Whitehaven. It turns out, however, that this increase isn’t representative of the broader market. Prices for lower quality coal with lower heat content and higher ash content haven’t moved at all, with the result that the premium between

Topics:

John Quiggin considers the following as important: Economics - General, environment, Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

In my recent piece in The Guardian, mostly about Adani, I observed

The paradoxes of Adani are mirrored in the global coal market. Despite a small increase in 2017, global coal production is below its 2013 peak. Yet prices have recovered strongly, yielding big profits to existing miners and offering a seemingly tempting prospect for new mines.

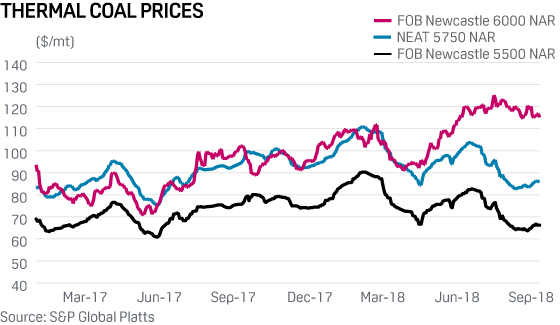

It turns out that this isn’t quite right. The benchmark Newcastle price, for low-ash coal with a heat content of 6000kcal/kg has risen strongly, to the great benefit of companies like Yancoal, Glencore and Whitehaven. It turns out, however, that this increase isn’t representative of the broader market. Prices for lower quality coal with lower heat content and higher ash content haven’t moved at all, with the result that the premium between higher and lower grades has grown dramatically.

What’s going on here? One possible explanation is that Yancoal and Glencore, who produce the majority of Australia’s high-grade coal, have engaged in successful cartel behavior. Another is that the premium reflects shifts in demand (with China and India increasingly rejecting high ash coal, while Japan continues to demand high grade coal) and supply (few new mines are opening, and this has a bigger effect on the smaller market for high grade coal).

Whatever the explanation, most analysts agree that it is more likely to be resolved by a decline in the price of high-grade coal rather than an increase in the price of low-grade coal.

Where does Adani fit into all this. Most of the discussion I’ve found focuses on the premium between 6000kcal/kg and 5500 kcal/kg. Coal extracted from the Carmichael mine would be much lower quality, below 5000 kcal/kg.