The latest massive .1bn profit reported by Coles will doubtless produce a new round of hand-wringing about the “cost of living”. Governments will produce initiatives aimed at capping or reducing prices. Pundits will use a variety of measures to argue as to whether such measures are inflationary. Then there will be debates about whether splitting up Coles and Woolworths into smaller chains would enhance competition. And the Reserve Bank will be encouraged to push even harder to return inflation to its target range. But these responses, focused on the cost of goods, miss the point. Coles and Woolworths have increased their margins, yes – but prices for groceries have increased broadly in line with other goods. The real driver of supermarket profits is their ability to drive down

Topics:

John Quiggin considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

The latest massive $1.1bn profit reported by Coles will doubtless produce a new round of hand-wringing about the “cost of living”. Governments will produce initiatives aimed at capping or reducing prices. Pundits will use a variety of measures to argue as to whether such measures are inflationary. Then there will be debates about whether splitting up Coles and Woolworths into smaller chains would enhance competition. And the Reserve Bank will be encouraged to push even harder to return inflation to its target range.

But these responses, focused on the cost of goods, miss the point. Coles and Woolworths have increased their margins, yes – but prices for groceries have increased broadly in line with other goods. The real driver of supermarket profits is their ability to drive down the prices they pay to suppliers.

But the input that matters here is labour and it is here that the supermarkets are making big gains at the expense of their workers. Across the board, wages have failed to keep pace with prices over the last five years or more.

At least for the supermarkets, this won’t change any time soon.

In its annual wage review in June, the Fair Work Commission announced a 3.75% increase to the minimum wage and minimum award wages. But the increase barely offsets the almost identical 3.8% increase in consumer prices since the last review, leaving real wages unchanged.

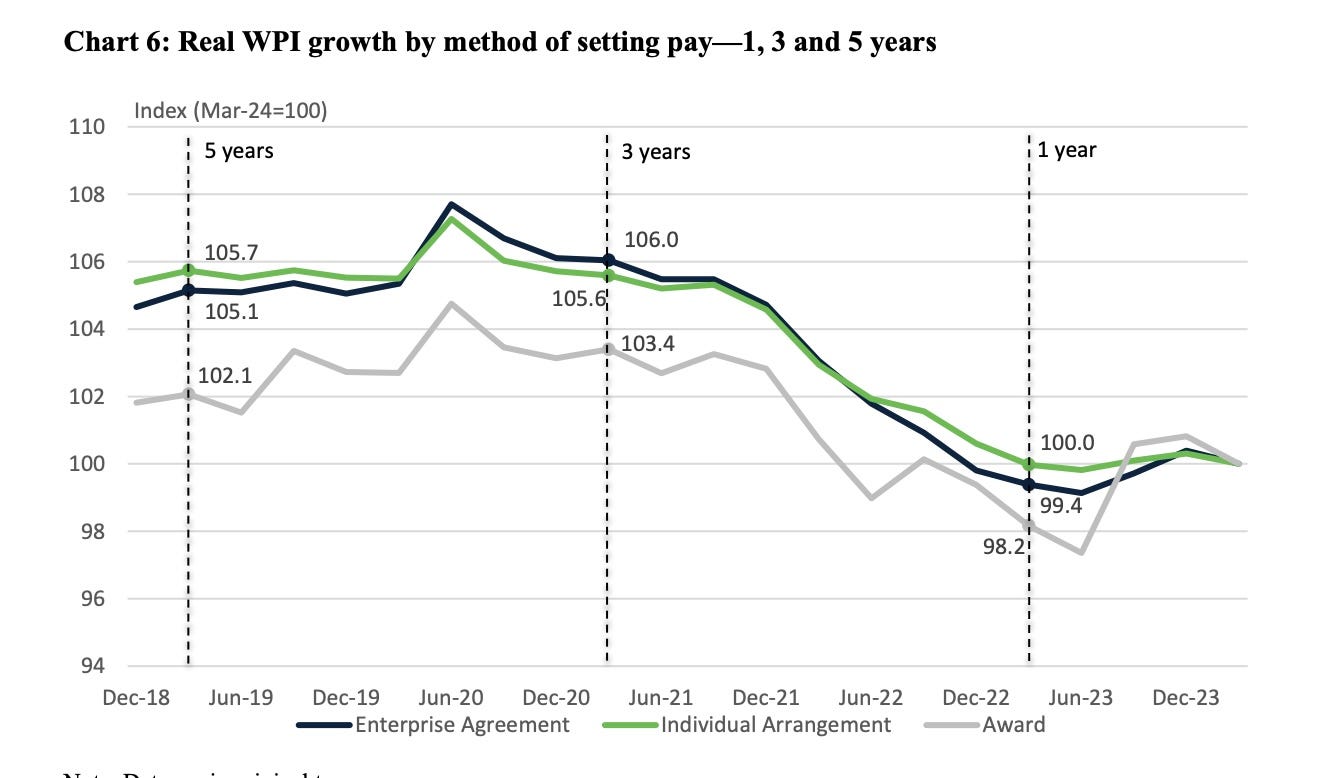

Yet again, the FWC declined to do anything about the fall in real wages that has taken place since the arrival of the pandemic, compounding a long period of stagnation before that. As it noted: “Despite the increase of 5.75 per cent to modern award minimum wage rates in the AWR 2023 decision, the position remains that real wages for modern award-reliant employees are lower than they were five years ago.”

Real WPI growth by method of setting pay – 1, 3 and 5 years. Photograph: FairWork Commission

There is no cost of living crisis for those whose income derives from profits. Those at the top end of town have seen their incomes soar. But even more modestly wealthy recipients of capital income are doing well, a fact reflected in their spending patterns.

This divergence is almost invariably framed using lazy generational cliches, comparing the expenditure of older and younger generations.

To be sure, old people, such as self-funded retirees, are more likely to be receiving capital income and less likely to be reliant on wages to pay mortgage interest. But this is by no means universal. Plenty of baby boomers are still in the workforce, while some of our most prominent property owners (such as Tim “avocado toast” Gurner) are much younger. Focusing on age merely confuses a debate that is already complicated enough.

The policies of the Reserve Bank make matters even more thorny. The problems here start with a dogmatic adherence to a 2% to 3% inflation target. The rationale for inflation targeting is thin, and the choice of target range is entirely arbitrary, arising from an ad hoc decision by a right-wing New Zealand finance minister in the early 1990s, one which was followed by a long period of economic decline in that country.

The dangers of using high interest rates to achieve rapid reductions in inflation, evident from the “credit squeezes” of the 1970s and 1980s, are now becoming apparent, as the drive to reduce inflation is reflected in a push to squeeze demand and prevent any recovery in real wages.

There is little hope that all of this will change any time soon. The concept of “cost of living” is simple and intuitive, even if it is highly misleading. What really matters is the purchasing power of people’s disposable incomes. But that’s a bit too hard for our political class to think about, let alone explain to the public.

Follow me on Mastodon or Bluesky

Share John Quiggin’s Blogstack

Read my newsletter