Origins of Money and Interest: Palatial Credit, not Barter Neolithic and Bronze Age economies operated mainly on credit. Because of the time gap between planting and harvesting, few payments were made at the time of purchase. When Babylonians went to the local alehouse, they did not pay by carrying grain around in their pockets. They ran up a tab to be settled at harvest time on the threshing floor. The ale women who ran these “pubs” would then pay most of this grain to the palace for consignments advanced to them during the crop year. These payments were financial in character, not on-the-spot barter-type exchange. As a means of payment, the early use of monetized grain and silver was mainly to settle such debts. This monetization was not physical; it was administrative

Topics:

Michael Hudson considers the following as important: History of the Near East, Monetary, Money Supply

This could be interesting, too:

Michael Hudson writes Global Economic History in 2.5 Hours

Michael Hudson writes Back from Post-Modernity: The Coming New Economic Order

Michael Hudson writes From Junk Economics to a False View of History: Where Western Civilization Took a Wrong Turn

Michael Hudson writes A debt Jubilee for America?

Origins of Money and Interest: Palatial Credit, not Barter

Neolithic and Bronze Age economies operated mainly on credit. Because of the time gap between planting and harvesting, few payments were made at the time of purchase. When Babylonians went to the local alehouse, they did not pay by carrying grain around in their pockets. They ran up a tab to be settled at harvest time on the threshing floor. The ale women who ran these “pubs” would then pay most of this grain to the palace for consignments advanced to them during the crop year. These payments were financial in character, not on-the-spot barter-type exchange.

As a means of payment, the early use of monetized grain and silver was mainly to settle such debts. This monetization was not physical; it was administrative and fiscal. The paradigmatic payments involved the palace or temples, which regulated the weights, measures and purity standards necessary for money to be accepted. Their accountants that developed money as an administrative tool for forward planning and resource allocation, and for transactions with the rest of the economy to collect land rent and assign values to trade consignments, which were paid in silver at the end of each seafaring or caravan cycle.

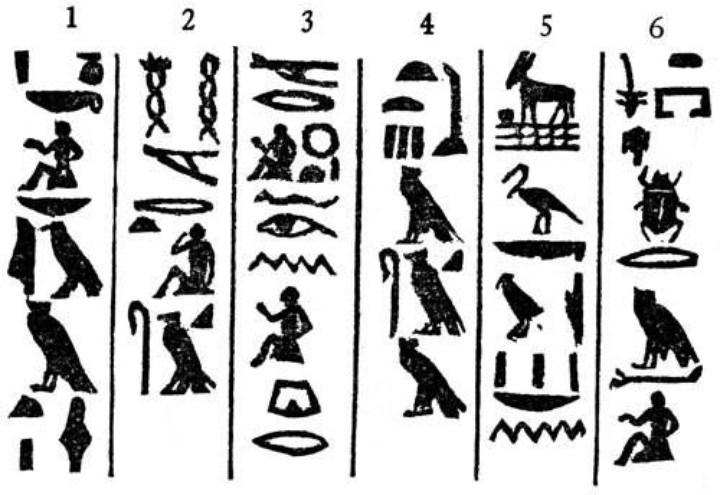

Money’s role in the palatial economies of Mesopotamia and Egypt

The origins of monetary debts and means of payment are grounded in the accounting practices innovated by Sumerian temples and palaces c. 3000 BC to manage a primarily agrarian economy that required foreign trade to obtain metal, stone and other materials not domestically available. These large institutions employed staffs of weavers and other craft personnel, who were fed by crops grown either on palace or temple land or that of sharecroppers paying grain-rent or fees to these institutions, and supplied with wool from temple and palace herds managed by entrepreneurs or owned outside of these institutions.

Building public infrastructure required feeding and supplying corvée labor and craftsmen with food, tools and beer, as well as provisioning celebratory festivals. In order to calculate budgets for forward planning and tally surpluses or shortfalls, these flows had to be measured and accounts presented to the palace for managing cropland and herds, brewing and selling beer, baking bread and producing handicrafts for use within these institutions and for local or long-distance trade.

Textiles and other products were consigned to traders to obtain silver, copper and other raw materials, while land and professional functions or enterprises were consigned to entrepreneurs to manage in exchange for a stipulated revenue, typically calculated in advance as a flat fee based on normal experience. This administrative system is described by Renger (1979 and 1984), Bongenaar (2000), and Garfinkle (2004 and 2012). The papers in Hudson and Wunsch (2004) survey account-keeping and monetization of the Mesopotamian and Egyptian economies from the inception of written accounts in the late 4th millennium BC to the Neo-Babylonian period.

The scale on which the large institutions operated required forward planning to schedule and track the flow of food and raw materials through their fields and workshops. The first need was to assign standardized values to key commodities. This problem was solved by creating a grid of administered prices, set in round numbers for ease of computation and account-keeping. Grain was designated as a unit of account to calculate values and co-measure labor time and land yields for resource allocation involving the agricultural and handicraft sphere, as well as the means of payment.

The second need of these large institutions was to organize means of payment for taxes and fees to their officials, and for financing trade ventures. Silver served as the money-of-account and also as the means of payment for trade and mercantile enterprise. A bimonetary system was created for paying the palace and temples and for valuing disparate commodities and functions, by setting the shekel-weight of silver (8 grams) as equal to a gur “quart” of grain or 300 sila. Acceptability of grain and silver for settling official debt balances catalyzed their usage as money throughout the economy.

None of this is co-mensurability is found in “primitive” money. Philip Greirson (1977:19ff., endorsed by Goodhart 1998), for instance, seeks the origins of what has come to be called “state money” in wergild payments for personal injury. Along with dowries or bride-price, such fines were denominated in customary market baskets that might include animals or slave girls, items of clothing and jewelry, not a particular commodity. They thus were pre-monetary and special-purpose.

Likewise the “spit money” and other food money cited by Laum (1924:27ff., 158f.) was pre-monetary in character, not a common denominator to value disparate commodities. Although Laum was a follower of Knapp’s State Theory of money, he saw the archaic state as a religious cult not playing a commercial or financial role. In his view the valuation of goods finds its origins in the selection of sacrificial animals “in the cult, not in commerce (which knows no basis for typology, but remains purely individualistic).” Donations of animals defined status, but did not provide a standardized economic and monetary unit. Fines and contributions were levied without reference to a standardized commodity whose price was set by palaces or temples as the basis for account-keeping, commercial exchange and credit.

That innovation occurred in Mesopotamia early in the third millennium BC.

Accounting and the origins of money

In contrast to the grain and silver that served as twin measures of value to evaluate Mesopotamian production and distribution, no monetary common denominators are found in Mycenaean Linear B accounting c. 1400-1200 BC. Tribute lists and deliveries from agricultural centers and workshops were “in kind,” with no indication of money as either a measure of value or a general means of payment. Finley (1981:198) cites Ventris and Chadwick (1956:113) to the effect that “they ‘have not been able to identify any payment in silver or gold for services rendered,’ and that there is no evidence ‘of anything approaching currency. Every commodity is listed separately, and there is never any sign of equivalence between one unit and another.’”

Van De Mieroop (2004:49) cites the challenge to ancient accountants: to record not merely “a single transfer, but the combination of a multitude of transfers into a summary. When information piles up and is not synthesized, it becomes useless: a good bureaucrat needs to be able to compress data. The summary account requires that the scribe combine information from various records.” Mesopotamia’s palaces and temples solved this problem by designating grain and silver as reference points to co-measure the wide range of transactions within their own institutions and with the rest of the economy for grain, textiles, beer, boat transport and the performance of ritual services.

Establishing a set of price equivalencies enabled values to be assigned and payments to be made in terms of any commodity listed on such a schedule. Englund (2004:38) cites major commodities such as copper, wool and sesame oil being assigned values in an overall price grid, mutually convertible with grain, silver or each other: “The concept of value equivalency was a secure element in Babylonian accounting by at least the time of the sales contracts of the ED IIIa (Fara) period, c. 2600 BC.”

Cripps (2017) has reviewed of prices for silver, grain and other commodities and found that administrative barley:silver price ratios among Sumerian cities “vary considerably with both the geographic origin of a text and the administrative context in which these ratios occur, whether or not we understand them as prices or equivalents.” However, these variations do not seem to reflect market supply and demand, but are administered. “The value of barley relative to silver arguably varies for quite other reasons than those of abundance or shortage due to natural events, or because of changes in the market and therefore the demand for and supply of one or the other of these commodities.” (See Englund 2012 for a general discussion.)

The 1:1 shekel/gur ratio enabled monthly and annual income and expense statistics to be expressed in terms of the most basic common denominator, and was used to denominate fees, taxes and other debts owed to the large institutions. But more steps were necessary to fill out the monetary process. To provide a standard of value and serve as the means of payment – grain and silver had to be measured or weighed in standardized units. To facilitate calculation for internal resource allocation within the large institutions, these units were based on the administrative calendar that temples created in order to allocate resources on a regular monthly basis.

That in turn required replacing lunar months of varying length with standardized 30-day months (Englund 1988). Each monthly unit of grain was measured in volumetric gur units divided into 60ths, apparently for consumption as rations to the workforce twice daily during each administrative month. Lambert (1960) describes how Babylonian accounts translated food rations into labor time for each category of labor – males, females and children. This sexagesimal system of fractional divisions enabled the large institutions to calculate the rations needed to produce textiles or bricks, build public structures or dig canals during any given period of time. Weights for silver and other metals followed suit, by dividing the mina into 60 shekels.

This silver and grain money served as the price coefficient by which the temples and palaces valued the products of their work force and the handicrafts they consigned to merchants. The rate of interest on commercial advances denominated in silver was set in the simplest sexagesimal way: 1/60th per month, doubling the principal in five years (60 months). This standardized rate was adopted by the economy at large.

Money and prices

By the end of the third millennium the large institutions were stating the value of foreign trade and other palatial enterprise in terms of silver, which emerged as the “money of the world.” Gold was used in less public contexts, such as for capital investment in Assyria’s foreign trade ventures after 2000 BC. Its price vis-à-vis silver varied from city to city and from period to period. But any attempt to link price changes to variations in the money supply would be anachronistic as far as Bronze Age Mesopotamia is concerned. That is because “money” simply took the form of commodities acceptable for payment to temples and palaces at guaranteed prices. These large institutions gave monetary value to wheat, wool and other key products by accepting them in payment for taxes and fees.

Monetary values had to be stable in order for producers to plan ahead and minimize the risk of disruptive shifts in prices, and hence the ability to pay debts. Official price equivalencies thus served as an adjunct to fiscal policy while avoiding instability. §51 and gap §t (sometimes read as §96) of Hammurabi’s laws (c. 1750 BC) specified that any citizen who owed barley or silver to a tamkarum merchant (including palace collectors) could pay in goods of equivalent value, e.g. in grain, sesame or some other basic commodity on the official price grid (Roth 1998:91 and 97).

This ruling presumably was important for agricultural entrepreneurs and herd managers who borrowed from the well to do. But most of all, along with §§48-50 of Hammurabi’s laws, rulings that stabilized the grain/silver exchange rate “are all meant to give a weak debtor (a small farmer or tenant) some legal protection and help,” and are “‘given teeth’ by stipulating that if [the creditor] takes more he will forfeit ‘everything he gave,’ that is, his original claim” (Veenhof 2010:286f.). Babylonian debtors thus were saved from being harmed at harvest time when payments were due and grain prices were at their seasonal low against silver outside the large institutions. The palace’s exchange-rate guarantee enabled cultivators who owed fees, taxes and other debts denominated in silver to pay in barley without having to sell it for silver.

What was called a “silver” debt thus did not mean that actual silver had to be paid, but simply that the interest rate was 20 percent. If creditors actually wanted silver, they would have to convert their grain at a low market price at harvest time when crops were plentiful. Deliveries to the palace’s collectors were stabilized, minimizing the effect of price fluctuations outside of the palatial sector, such as outside the city gates in the quay area along the Euphrates. The effect was much like modern farmers signing “forward” contracts so as not to get whipsawed by shifting market prices.

There was little thought of preventing prices from varying for transactions not involving the large institutions. Prices for grain rose sharply in times of crop failure, droughts or floods, as when Ur was obliged to buy grain from the upstream town of Isin at the end of the Ur III empire c. 2022 BC. But these price shifts were the result of scarcity resulting from natural causes, not a monetary phenomenon.

A monetary drain was avoided in such cases by royal “restorations of order” (Sumerian amargi, Babylonian andurarum) cancelling agrarian debts when circumstances made them unpayable. To maintain general economic balance in the face of arrears that constantly mounted up, new rulers proclaimed these clean slates upon taking the throne. No money was required from personal debtors (although commercial debts were left in place). The details are spelled out in greatest detail c. 1645 BC in Ammisaduqa’s edict §§17f. (translated in Pritchard 1985).

Despite variation in market prices for transactions outside of the large institutions, Babylonia’s bimonetary standard had no Gresham’s Law of “cheap” or “bad” money driving out good money. Grain did not drive out silver. When entrepreneurs in the agricultural sector sought to pay official debts in grain at harvest time, this was part of a structured stable relationship. There was no creation of fiat money by Bronze Age temples and palaces to spend into the economy, and no monetary inflation. Early “money” was simply the official price schedule for paying debts to the large institutions, along lines much like the American “parity pricing” policy to support farm prices after the 1930s. The fact that wool prices, for instance, varied in response to market conditions but nominally remained fixed by royal fiat for 150 years shows that this standardized price referred to debt payments owed to the palace and its collectors.

Rulers promised to promote prosperity by providing consumer goods such as vegetable oil and other commodities at relatively low prices – with what seems to have been an element of idealism. Around 1930 BC, §1 of the laws of Eshnunna (north of Ur, on the Tigris River) was typical in announcing the official rate of 300 silas of barley for 1 shekel of silver, or 3 silas of fine oil, 12 silas of regular oil, 15 silas of lard, 360 shekels (=6 minas) of wool, 2 gur of salt, 600 silas of salt, 3 minas of raw copper or 2 minas of wrought [i.e., refined] copper (Roth 1998:59).

These low prices were not to be achieved by reducing the money supply. Unlike the grain/silver ratio, such price promises were not monetary rules.

The two ideologies of monetary origins

The root of the word numismatics (the study or collection of coins) is nomos, “law” or “custom.” Aristotle wrote (Ethics, 1133) that money “is called nomisma (customary currency), because it does not exist by nature but nomos.” It is “accepted by agreement (which is why it is called nomisma, customary currency.” Government priority in supplying money always has been primarily legal and fiscal.

The policy implication of this “state theory” for modern times is that governments do not have to borrow from private banks and bondholders when they run deficits. They can monetize their spending by fiat money – and, as Aristotle added, “it is in our power to change the value of money and make it useless,” regardless of its actual use value. (See also Aristotle, Pol. 1257b10-12.)

Georg Friedrich Knapp’s State Theory of Money (1924 [1905]) described how money was given value by its fiscal role: the state’s willingness to accept it in payment of taxes. Innes (1913 and 1914) added an important dimension by describing the origins of money in paying debts. This linked money to the credit process, not to a commodity as such. (Wray 2004 reviews the historiography of early money and reprints Innes’s articles.) Karl Polanyi (1944 and 1957) led a school emphasizing that “redistributive” economies with administered price equivalencies took precedence over market exchange setting prices by supply and demand (Hudson, in press). Renger (1979 and 1984) elaborated the administrative character of Mesopotamia’s palatial economies.

These varieties of the State Theory of money (also called Chartalism) downplayed the role of personal and purely commercial gain seeking that had dominated most earlier views of money’s origins. Elaborating what Adam Smith described as an instinct among individuals to “truck and barter,” Carl Menger (1892 [1871]) put forth the classical version of the Commodity Theory of how money originated Without making any reference to paying taxes or other debts to public authorities, he postulated that money was an outgrowth of barter among individual producers and consumers. According to this view, a preference for metal emerged as the most desirable medium for such trade, thanks to its ability to serve three major functions:

- a compact and uniform store of value in which to save purchasing power, compressing value (savings) into a relatively small space, and not spoiling (unlike grain);

- a convenient means of payment, divisible into standardized fractional weight units (assuming that their degree of purity or alloy is attested); and

- a measure of value. Because of the above functions, silver and gold have been widely acceptable commodities against which to measure prices for other products.

The Commodity or Barter Theory depicts money as emerging simply as a commodity preferred by Neolithic producers, traders and wealthy savers when bartering crops and handicrafts amongst themselves. In this origin myth bullion became the measure of value and means of payment without palace or temple oversight, thanks to the fact that individuals could save and lend out at interest. So money doubled as capital – provided by individuals, not public agencies.

Differing views regarding the origins of money have different policy implications. Viewing money as a commodity chosen by individuals for their own use and saving implies that it is natural for banks to mediate money creation. Banking interests favor this scenario of how money might have originated without governments playing any role. The political message is that they – backed by wealthy bondholders and depositors – should have monetary power to decide whether or not to fund governments, whose spending should be financed by borrowing, not by fiat money creation. As a reaction against the 19th and early 20th centuries’ rising trend of public regulation and money creation, this school describes money’s value as based on its bullion content or convertibility, or on bank deposits and other financial assets.

Governing authorities are missing from this “hard money” view, which its proponents have grounded in an aetiological scenario of prehistoric individuals bartering commodities among themselves. The policy implication is that it is irresponsible for governments to create their own money.

Both theories of money’s functions, origins source of value are rooted in the debate over whether money should be public or private, and whether it should be backed by public fiat or bullion. Charles Goodhart (1998:411) shows that the barter or “metallist” theory that money was developed to facilitate individualistic exchange does not even apply to modern times. He provides a bibliography of the long debate to highlight the politically partisan motivations behind today’s metallist bias.

Shortcomings of the Barter Theory of monetary origins

The long-dominant college textbook by Paul Samuelson (1973: 274f.) summarizes the logic of the Barter Theory taught to generations of economics students:

Inconvenient as barter obviously is, it represents a great step forward from a state of self-sufficiency in which every man had to be a jack-of-all-trades and master of none. … If we were to construct history along hypothetical, logical lines, we should naturally follow the age of barter by the age of commodity money.

Ignoring credit arrangements and excluding any reference to palaces or temples in the Near Eastern inception of monetization, Samuelson then tries to ground this speculation in ostensibly empirical evidence by turning to pseudo-anthropology:

Historically, a great variety of commodities has served at one time or another as a medium of exchange: … tobacco, leather and hides, furs, olive oil, beer or spirits, slaves or wives … huge rocks and landmarks, and cigarette butts. The age of commodity money gives way to the age of paper money … Finally, along with the age of paper money, there is the age of bank money, or bank checking deposits.

Depicting commodity money as primordial and natural, this view sees the direction of history as culminating in today’s commercial banking. It puts credit at the end of the Barter-Money-Credit sequence, not at the beginning. By the time Samuelson wrote, the prehistory of money had become an arena in which free-market economists fought with advocates of government regulation over whether the private or public sector should be dominant, and whether governments should oversee credit and create their own money or leave it in private hands. Financial interests applaud the implication that it is natural to leave credit and pro-creditor rules of debt collection to bankers, bondholders and the wealthy, minimizing government “interference.”

Neither prehistorians nor anthropologists provide supporting evidence for this Barter Theory. “No example of a barter economy, pure and simple, has ever been described, let alone the emergence from it of money,” anthropologist Caroline Humphrey (1985:48) has emphasized, stating that “all available ethnography suggests that there never has been such a thing” (cited in Graeber 2014:29; for further critiques see Wray 2004 and Ingham 2004). As for the cuneiform record, it shows that the major initial monetary activity of most Mesopotamians was to pay taxes, fees or to buy products that palaces and temples made or imported, on credit provided or regulated by these large institutions.

As far as convenience is concerned, the simplest and least costly way to conduct exchange is to circumvent direct payment in metal. Having to weigh money for retail or even larger exchanges would have maximized transaction costs. Yet when anti-government ideologues argue that commodity money and bank credit minimize transactions costs (Ober 2008:49f., echoing the ideas of North 1992), they compare coinage only to barter, not to credit, e.g., settled on the threshing floor at harvest time. The Barter Theory excludes the thought that palatial credit creation and regulation served to minimize transactions costs and indeed, to preserve economic stability.

The Barter Theory’s lack of evidence did not trouble Menger, because his logic was purely speculative: “even if money did not originate from barter, could it have?” Prehistorians and anthropologists would answer, “No, it couldn’t have happened that way.” Money always has been embedded in a public context, and hardly could have evolved without public catalysts and ongoing oversight to make it acceptable.

For starters, any practical payment system for credit and trade requires accurate weighing and measuring. This calls for public oversight as a check on fraudulent practice. Trust cannot be left to individuals engaging in barter or credit on their own. Crooked merchants historically have used light weights when selling goods or lending out money so as to give their customers less, and heavy weights when buying or collecting debts so as to gain an unduly large amount of silver or other commodities. (See Powell 1999 for discussion.)

Biblical denunciations of merchants using false weights and measures find their antecedents in Babylonia. Hammurabi’s laws (gap x [Roth 1998:98], sometimes referred to as §94 and §95) stipulates that merchants who lend grain or money by a small weight but demand payment using a larger measure should forfeit whatever they had lent. Alewomen found guilty of using crooked weights and measures in selling beer were to be cast into the water (§108 [Roth 1998:101]). Many other rulings deal with creditor abuses, which date back to the rule of Urukagina of Lagash (c. 2350 BC).

Such abuses are timeless. The 7th century BC prophet Amos (8:5ff.) depicts the Lord as denouncing wealthy Israelites “who trample the needy and do away with the poor of the land” by scheming, “skimping the measure (making the ephah small), boosting the price (making the shekel great), and cheating with dishonest scales.” Likewise the prophet Micah (6:11) denounces merchants using “the short ephah, which is accursed? Shall I acquit a man with dishonest scales, with a bag of false weights?” (Kula 1986 reviews Biblical and Koranic examples.)

Leviticus (19:35f.) describes the Lord as directing Moses to instruct his followers not to use dishonest standards when measuring length, weight or quantity. Deuteronomy 25:1315 admonishes:

“Thou shalt not have two differing weights in your bag – one heavy, one light. Thou shalt not have two differing measures in your house – one large, one small. You must have accurate and honest weights and measures … For the Lord your God detests … anyone who deals dishonestly.”

Regulating weights and measures was a step far beyond primitive barter among individuals. It needed official organization and supervision of exchange and credit. As noted above, the sexagesimal weights to denominate minas and shekels reflect the priority of transactions within Mesopotamian palaces and temples, deriving from their grain-based accounting system to schedule and distribute food. Jewish temples likewise provided standardized measures (Exodus 30.13 and 38.2427, and Leviticus 27.25; for royal measures see 2 Samuel 14.26), as did the Athenian agoranomoi (public market regulators). Throughout antiquity markets were located in the open spaces in front of city gates or temples, providing easy access to official weights and measures to prevent fraud.

In addition to public oversight of weighing and measuring, quality standards were required for alloys of silver and gold. Sales and debt contracts from the second and first millennia BC typically specified payment in silver of 7/8 purity (.875 fine, the equivalent of 21 carats). To avoid adulteration, silver was minted in temples to guarantee specified degrees of purity. The word “money” derives from Rome’s Temple of Juno Moneta, where silver and gold coinage was struck during the Punic Wars, mainly to arm soldiers, build a navy and pay mercenaries – not for barter exchange.

Formal coinage was not required for these functions. Weighed metal was sufficient, often stamped by temples to attest to its degree of purity. Long before coins were struck in the first millennium BC, raw silver (hacksilver) and weighed jewelry served the function that coinage did in classical times. Although coinage is not attested before the seventh century BC, Balmuth (1967 and 1971) may have located second-millennium Near Eastern antecedents, citing an inscription by the Assyrian ruler Sennecherib (705-681 BC) saying that he “fashioned molds of clay and poured bronze therein, as in casting (fashioning) half-shekel pieces” (Balmuth 1971:2). The earlier Ugaritic epics of Aqht and Krt describe “flows of tears … as resembling 1/4 shekels or pieces-of-four and 1/5 shekels or pieces-of-five.” “Like markets, coinage was there before the Greeks,” summarizes Powell (1999:22); “the only significant difference that coinage makes in money transactions is the guarantee of quality; in Babylonia, as elsewhere, silver coins were cut up just like other silver and put in the balance pan.”

There were no public debts to serve as a monetary base for bank reserves as in today’s world. Throughout antiquity temples were society’s ultimate bankers and sources of money in emergencies. Sacred statues were adorned with golden ornaments that could be melted down in times of need to pay mercenaries (or perhaps pay ransom or tribute; see Oppenheim 1949), much as were the Winged Victory statues of Athens during the Peloponnesian War.

The monetary role of silver

Archaic palaces played the major role in importing silver and supplying it to the economy at large. Silver owed its status not to its technological use value in production, but to its role in settling debt balances owed to the palace, as well as the paradigmatic religious donation or commission to the temples.

Most silver was obtained by the palace mobilizing Mesopotamia’s crop surplus to supply weaving and other workshops producing handicrafts to export. Silver and also gold from Cappadocia (in Asia Minor) was sold to Elam and the Indus Valley (via the island entrepot of Dilmun/Bahrain) for tin. Late third-millennium BC records show that when merchants “receive silver and copper [from the palace] they are being paid to undertake a commission, not being issued with a commodity for disposal on the open market” (Postgate 1992:220).

Denominating prices in silver forced reliance on scales. To prevent the awkwardness of weighing relatively small pieces, silver was cast into jewelry, such as bracelets made with easily broken-off segments measured in shekels. Powell (1977) notes that the Middle Babylonian word for 1/8 shekel, bitqu (literally “cutting”), suggests silver rings and coils, and may originally have denoted “a piece of standard size cut off from such a silver coil.” Such jewelry money gave way to coinage in classical antiquity as officially stamped weights of precious metal.

Throughout the history of Sumer “the management of silver and gold, of textiles, and of other precious or ‘luxury’ goods is largely dominated by the royal palace,” notes Garfinkle (2012: 244f., 226). Even in Lagash c. 2350 BC the temples “did not actively control the politically important treasuries” but were under control of the palace. In neighboring Umma numerous branches of the economy converted their primary goods annually “into tiny sums of silver, which were collected by the province and then delivered to the state in the form of donations to a religious festival. … Luxury goods – textiles, silver and gold, meat, and special edible delicacies – are primarily found in one specific context, namely the palace.”

Silver was used primarily by the palace and the entrepreneurs managing its trade and other enterprise. The result was a bifurcated economy, in which entrepreneurial trade and management operated on a silver standard atop a rural economy on a grain standard. Grain and wool were the main means of denominating and paying agricultural fees and debts, to be paid on the threshing floor or in the shearing season.

What is not well understood is how silver got into the hands of Mesopotamia’s general population. Some would have been obtained by selling crops, textiles or other handicrafts to the palace (Sallaberger 2008, cited in Garfinkle 2012:245), or to entrepreneurs who earned silver on their trade and management of public infrastructure. The palace paid some silver to mercenaries, and there are hints of rulers handing out silver tokens to soldiers after victory and perhaps at royal festivals. But most of the influx of silver from foreign trade was re-invested in more trade ventures or lent out in rural usury for current income and, ultimately, to acquire land. Silver lying around not lent out was called “hungry” for profit-making opportunities.

There is little hint of speculative credit, and no sudden gluts of silver such as occurred in classical antiquity when Alexander the Great looted the temples and palaces of their bullion in the lands he conquered, coined the booty and put it into circulation by paying his army. There also was no monetary drain, thanks to the fact that grain could be used as a substitute for silver at a stipulated exchange rate for payments to the large institutions. Personal debts mounted up rapidly as a result of agrarian usury, and inability to pay them often resulted from crop failure, drought, or the debtor’s illness or other misfortune.

Royal proclamations cancelling agrarian debts preserved economic viability on the land. Public oversight of money thus went hand in hand with public management of debt, including the setting of interest rates and the customary royal amnesties for agrarian and personal debts. Ultimately underlying the conflict between the Barter and State theories of money is thus whether public policy should favor creditors or debtors. As creditors, banks seek “hard” debt collection rules. But governments recognize that most of their population are in debt and need to be protected from forfeiting their income and property to creditors, which would impoverish the economy at large.

Archaic money and interest-bearing debt

Interest always has been an inherently monetary phenomenon and officially regulated. The standard Mesopotamian interest rate for commercial loans denominated in silver was set to dovetail into palatial accounting practice at the “unit fraction”: one shekel (60th) per mina per month, 12 shekels a year (the equivalent of 20 percent annual interest in decimalized terms), doubling the principal in five years. Interest rates throughout antiquity emulated this practice for ease of calculation in terms of the “unit fraction,” e.g., an ounce per pound in Rome. Rates were set simply for reasons of mathematical simplicity in Mesopotamia’s sexagesimal system of fractional weights and measures. These rates remained traditional for centuries, not being related to productivity, profit levels or risk.

The ancient words for interest – mash (goat) in Sumerian and Akkadian, and tokos and faenus (calf) in Greek and Latin are used in the metaphoric sense for “that which is born or produced.” What was “born” was not goats or calves, but interest, on the new moon each month. (Hudson 2000 discusses the semantics.)

Much as the Barter Theory of money hypothesizes trade as leading to the emergence of money without any need for a public interface, its adherents have put forth an individualistic pre-monetary productivity theory of interest. According to this origin myth, early interest was paid by individual debtors to well-to-do creditors “in kind,” out of seeds or animals. (Böhm-Bawerk’s Capital and Interest (1890 [1884]) surveyed and refuted what he called “naïve productivity” theories of interest.) This scenario depicts the origins of interest-bearing debt as being productive and hence economically justified – and occurring without silver or other official money.

The classic attempt to depict such pre-monetary interest already in the Neolithic as reflecting productivity (and implicitly, profit) rates c. 5000 BC – subject to the risk of non-payment – is Fritz Heichelheim’s Ancient Economic History, from the Palaeolithic Age to the Migrations of the Germanic, Slavic and Arabic Nations (1958:54): “Dates, olives, figs, nuts, or seeds of grain were probably lent out … to serfs, poorer farmers, and dependents, to be sown and planted, and naturally an increased portion of the harvest had to be returned in kind.” In addition to fruits and seeds, “animals could be borrowed too for a fixed time limit, the loan being repaid according to a fixed percentage from the young animals born subsequently. … So here we have the first forms of money, that man could use as a capital for investment, in the narrower sense.” Such “food-money” supposedly was lent out in the form of seeds and animals, at interest rates reflecting their reproduction rates. This scenario depicts “money” as originating not as taxes or other payments to palaces or temples, but as capital in the form of seeds and animals, capable of producing an economic surplus as interest paid in kind, at a rate reflecting physical productivity.

The problem with this mythology is that the traditional communities known to anthropologists do not lend or borrow cattle, either for calf-interest or other payment (Sundstrom 1974:34 and 38, and Hoebel 1968:230). When seeds are advanced, it typically is by absentee landowners to sharecroppers. Debtors are obliged to pledge (and forfeit) their livestock to creditors out of need to survive, and pay usury out of their own resources, not from investing the creditor’s livestock or seeds at a profit.

Like the Barter Theory of money, the Productivity Theory of interest takes interest out of its historical context, treating money simply as a commodity owned by individuals, without public oversight or regulation. This is assumed to be the “natural” condition and, as such, applicable to today’s world – with government money creation and regulation depicted as unnatural, not original.

If Heichelheim’s scenario were valid, interest rates would have varied with the productivity of the cattle, seeds or mercantile profit rates. But interest rates remained standardized over many centuries, being set independently from the production process or profit rates on trade.

Barter-based “naïve productivity” theories of interest envision transactions among individuals acting on their own account, with borrowers hoping to make a gain out of which to pay interest. This reverses the historical line of development. The paradigmatic interest-bearing debts were owed to Mesopotamia’s palaces and temples. Interest charges did not reflect physical productivity but were specifically monetary, paid in silver at a stipulated rate – for instance, for the advance of export goods to long-distance traders, paid out of their mercantile profits. Most fatal to productivity theories of interest is that the majority of Mesopotamian agrarian debts did not result from actual loans, but accrued as arrears (see Wunsch 2002). Agrarian interest often was charged only after the “due date” was missed. In such cases one could say that interest was paid for the failure of productivity to keep up with normal expectations.

Mesopotamia did not have banking in the modern sense of taking in deposits and lending them out at a profit. Even in Neo-Babylonian times “banking families” such as the Egibi were simply wealthy families. They paid depositors the same rate (equivalent to 20 percent) as they charged customers, so there was no intermediation markup as in modern banking (Bogaert 1966).

The major policy tool for rulers to stabilize the economy and save their subjects from debt bondage was to proclaim Clean Slates wiping out the overgrowth of debt in excess of the ability to pay. Productive “silver loans” to commercial traders and managers were not subject to these amnesties. The exemption of credit from such royal Clean Slate proclamations shows a policy distinction between productive and unproductive credit – the contrast that medieval Church Fathers would draw between interest and usury.

Classical antiquity’s changing context for money and credit

Interest-bearing debt is found spreading westward to the Mediterranean lands around the 8th century BC, mainly via Syrian and Phoenician traders establishing trading enclaves (Hudson 1994). They brought with them weights and measures that were adopted by Greeks and Italians. A. E. Berriman’s Historical Metrology (1953) points out that the carat originally was the weight of a carob grain, ceratonia siliqua, a tree native to the Mesopotamian meridian, weighing 1/60th of a shekel. The Greek term is keration (“small grain”).

Greek and Roman elites also adopted the Near Eastern practice of setting interest rates in accordance with the local unit-fraction, e.g., Rome’s duodecimal system dividing the pound into 12 troy ounces. One ounce per pound per year (1/12th) was the equivalent of an 8 1/3 percent rate of interest. That was much lower than Mesopotamia’s agrarian interest rate of one-third of the principal (or one-fifth for commercial loans), but debts in Rome and Greece were inexorable and hence ultimately more burdensome.

Classical Greek experience confirms a number of generalities that can be drawn from earlier Near Eastern monetary development. Describing how the commercial Isthmus city of Corinth adopted coinage c. 575-550 BC (a generation after its origins in Aegina), Salmon (1984:170f.) supports the conclusion of the numismatist C.M. Kraay (1976:317-322): “coinage cannot have been intended to facilitate trade, either at a local level or on a wider scale.” Early money was to finance credit transactions, not the exchange of goods (Salmon 1984:171f.): “From the earliest issues to the second half of the fourth century, at least in Corinth, the association between coins and trade was mainly that they offered a means of providing credit. If they had acted as an item of trade themselves we should have expected them to travel much further, and in far greater quantities, from Corinth than they in fact did. Their main function was to be lent at Corinth for purchase of items to be traded.”

Money was mainly for paying taxes and fees, Salmon continues: Corinthian “coins were first issued in order to serve the purposes of the minting authorities. Cities would find it convenient if payments made to them – taxes, fines, etc. – were in the form of coins whose purity and weight were fixed; while payments made by the state from time to time for building schemes, mercenaries, and other purposes could be much simplified if trustworthy coins were available.”

However, taxation developed only slowly in Greek cities. Greece and Rome obtained bullion not from tax revenue or public enterprise but from war booty, by levying tribute or, in Athens, from local silver mines. Spending was the key, mainly to pay soldiers and hire mercenaries. In the Ionian cities of Asia Minor, money’s primary role was to pay “allowances to the sailors manning the huge fleet being prepared by the rebels” (Figuera 1981:157). “Hectataeus of Miletus did not propose a large capital levy or other forms of taxation to build up the allied fleet, but a confiscation of the treasures at Branchidae (Hdt. 5.36.3-4). This may suggest that taxation was primitive in early 5th-century Ionia.”

Military conquest remained the major source of monetary metal from Alexander the Great’s looting of temples and palaces down through the end of antiquity in Rome. Armies brought minters along to melt down the booty and distribute it to their commanders and troops, with a tithe to the city-temple. When there were no more realms for imperial Rome to conquer and extract tribute, the inability to tax the oligarchic economy led to debasement of the coinage. Replacing the State Theory of money by treating money simply as a commodity led to a monetary drain – ultimately forcing resort to barter.

The main difference between Greek and Roman economies and those of the Ancient Near East was the absence of debt relief, resulting in a long series of political crises extending from the 7th-century BC “tyrants” (populist reformers) from classical Sparta and Corinth down to Rome in the 1st century BC. Mid-19th-century historians attributed these debt crises to the introduction of coinage around the 7th and 6th centuries BC, when Greek city-states issued coins imprinted with their city-images, such as the owls of Athens. But moneychangers still weighed coins from the various cities, in keeping with the use of weighed bullion that predated coinage by about two thousand years.

The economic impact of coinage thus did not differ much from that of hacksilver. So it was not money, coinage or even interest-bearing debt by themselves that caused the polarization under antiquity’s creditor oligarchies. The problem was the way in which society handled the proliferation of interest-bearing debt.

As credit was increasingly privatized, debt became a dynamic powerful enough to dissolve the checks and balances that had shaped the social context in which money first developed. Mesopotamia had usury and debt bondage, but its rulers managed to avoid the irreversible disenfranchisement and ultimate serfdom that plagued the Mediterranean lands. The Near Eastern aim was to preserve a land-tenured citizenry supplying the palace with corvée labor and military service. Despite the palace’s role as the major creditor, it protected debtors by debt amnesties that undid the polarizing effect of interest-bearing debt. Most debts in early Mesopotamia were owed to the palace, so rulers basically were cancelling debts owed to themselves and their collectors when they proclaimed Clean Slates that saved their economies from widespread debt bondage that would have diverted labor to work for creditors at the expense of the palace.

But as debts came to be owed mainly to Greek and Roman oligarchies, debts no longer were canceled except in military or social emergencies to maintain the demos-army’s loyalty. What came to be “sanctified” was the right of creditors to foreclose, not cancelling debts to restore economic balance.

Money and debt in Greece and Rome thus followed a different trajectory from its origins in Mesopotamia. Oligarchies gained sufficient power to stop civic debt cancellations. Rural usury in Greece and Rome expropriated indebted citizens from their land irreversibly, typically to become mercenaries in armies formerly manned by self-supporting citizens. Land ownership was much more concentrated than in Bronze Age Mesopotamia or even in the contemporary Neo-Babylonian economy.

Today’s mainstream ideology maintains this shift to hard pro-creditor law, and depicts non-payment of debts as leading to chaos. Yet Clean Slates are what saved Near Eastern economies from the chaos of economic polarization and widespread bondage. Mesopotamia’s economic takeoff could not have been sustained if rulers had adopted modern creditor-oriented rules.

Nor was classical antiquity’s takeoff sustained. By the closing centuries of the Roman Empire, wealthy elites had monopolized the land and stripped the economy of money, spending most of what they had on imports that drained monetary silver and gold to the East – leaving a barter economy in its wake as the “final” or “third” stage of monetization: impoverishment and polarization in which money was stripped away.

This post-Roman oligarchic collapse into local self-sufficiency and barter reverses the once-held idea that exchange evolved from barter via monetization to credit economies. Yet textbooks still repeat that sequence without recognizing the early role of credit, without mentioning the palaces and temples where monetization first evolved, or citing the tendency of debts to be mathematically self-expanding when not overridden by debt writedowns and clean slates. If such economic theorizing really were universal, history simply could not have occurred in the way it did.

Also reversed today is understanding of how the charging of interest originated. Instead of reflecting productivity, profitability or risk, interest rates were officially administered and remained remarkably stable in each region throughout antiquity. Today’s governments continue to regulate interest rates. Yet mainstream economic theory continues to propose interest-rate models based not Treasury fiscal and monetary policy, but on profit rates, “risk” and consumer “choice.”

Summary: The shifting historiography of money’s origins

Origin myths at odds with the historical record are the result of the conflict between vested interests and reformers over whether the monetary and credit system should be controlled by banks or by governments. Are credit and debt to be administered by laws favoring creditors, or should the prosperity of the indebted population at large be protected? The way in which economic writers answer this question turns out to be the key to their preference regarding the Barter or State Theories of the origins and character of money, credit and interest.

Assyriological and anthropological research confirms that money and monetary interest were not created by individuals trucking and bartering crops and handicrafts or lending crops and animals with each other. Archaic economies operated on credit, creating money as means of paying debts, mainly to Mesopotamia’s palaces and temples. Interest emerged as the means of financing long-distance trade and advancing land to its cultivators or managers, administered mainly by palace officials.

Recognition of this palatial origin of money and interest is at odds with the drive by commercial bankers to depict their own control of money and credit as being natural and primordial. Ever since Roman law was written to favor creditors, history has been written to defend the view that private credit and the “sanctity” of debts being paid is natural. The resulting mythology to explain the origins of money and interest reflects public relations lobbying by bankers and other creditors.

Goodhart (1998) highlights the relevance to modern times of misinterpreting the history of money: It underlies creation of the euro. The eurozone was created without a central bank to monetize budget deficits for EU member governments. The anti-state ideology underlying the euro thus stands in opposition to the State Theory of money. Central bank credit is to be created only to bail out commercial banks for losses on their own credit creation and bad investments, not for governments to spend directly into the economy.

What makes today’s monetary system opposite from that of Bronze Age Mesopotamia is an ideology that recognizes no role for money and credit creation except to benefit creditors. Understanding how the origins of money went hand in hand with checks and balances to protect economies from being polarized and impoverished by debt would call for treating money and credit as part of the overall economic system, not merely a matter of “individual choice.” To view contractual monetary and debt arrangements between individual lenders and borrowers without regard for how the overgrowth of debt may disrupt the economy is not only a travesty of economic history, but is largely responsible for today’s short-termism in re-enacting the debt crises that plagued classical antiquity.

Bibliography

Balmuth. Miriam (1967), “Monetary Forerunners of Coinage in Phoenicia and Palestine in Antiquity,” in A. Kindler, ed., The Patterns of Monetary Development in Phoenicia and Palestine in Antiquity (Jerusalem).

“ (1971), “Remarks on the Appearance of the Earliest Coins,” in David Gordon Mitten, John Griffiths Pedley, and Jane Ayer Scott, eds., Studies Presented to George M. A. Hanfmann (Cambridge, Mass.:):17.

Bell, Stephanie A. and Edward J. Nell, eds., The State, the Market and the Euro: Chartalism versus Metallism in the Theory of Money (Cheltanham:1-25).

Böhm-Bawerk, Eugen von (1890), Capital and Interest [1884].

Bogaert, Raymond (1966), Les Origines Antiques de la Banque de Depôt (Leiden)

Bongenaar, A. C. V. M., ed. (2000), Interdependency of Institutions and Private Entrepreneurs (Istanbul = MOS Studies 2).

Charpin, Dominique (1987), “Les Decréts Royaux a l’Epoque Paleo-babylonienne, à Propos d’un Ouvrage Recent,” AfO 34:36‑44.

” (1990b), “Les Edits de ‘Restauration’ des Rois Babyloniens et leur Application,” in Claude Nicolet, ed., Du Pouvoir dans L’Antiquite: Mots et Realities (Geneva):13-24.

(1998) “Les prêteurs et la palais: Les édits de mîšharum des rois de Babylone et leurs traces dans les archives privées,” in Bongenaar, A C.V.M., ed., Interdependency of Institutions and Private Entrepreneurs (= Proceedings of the Second MOS Symposium, Leiden 1998), Nederlands Historisch-Archaeologisch Institute, Te Istanbul 2000):185-211.

Cripps, Eric L. (2017), “The Structure of Prices in the neo-Sumerian Economy (I); Barley:Silver Price Ratios.”

Dalton, G. (1965), “Primitive Money,” American Anthropologist 67: 44–65.

Dercksen, J. G. (1999), ed., Trade and Finance in Ancient Mesopotamia (=MOS Studies 1) [Leiden 1997], Istanbul 1999.

Dercksen, J.G., J. Eidem, K. van der Toor Nen and K.R. Veenhof, eds. (2016),

Silver, Money and Credit: A Tribute to Robartus J. van der Spek on the Occasion of his 65th Birthday on 18th September 2014 (Nederlands Instituut voor het Nabije Oosten, Leiden).

Englund, Robert (1988), “Administrative Timekeeping in Ancient Mesopotamia,” Journal of the Economic and Social History of the Orient 31:121-85.

“ (2004), “Proto-Cuneiform Account-Books and Journals,” in Hudson and Wunsch 2004:23-46.

“ (2012), “Equivalency Values and the Command Economy of the Ur III Period in Mesopotamia,” in Gary Urton and John Papadopoulos, eds., The Construction of Value in the Ancient World, ch. 21 (Los Angeles: Cotsen Institute of Archaeology Press):427-595).

Figueira, Thomas J. (l981), Aegina: Society and Politics (New York: Arno Press).

Finkelstein, Jack J. (1961), “Ammisaduqa’s Edict and the Babylonian ‘Law Codes,’” JCS 15:91‑104.

” (1965), “Some New misharum Material and its Implications,” in AS 16 (Studies in Honor of Benno Landsberger on his Seventy‑Fifth Birthday):233‑246.

” (1969), “The Edict of Ammisaduqa: A New Text,” RA 63: 45‑64.

Finley, Moses (1981), Economy and Society in Ancient Greece (London).

Garfinkle, Steven J. (2004), “Shepherds, Merchants, and Credit: Some Observations On Lending Practices in Ur III Mesopotamia,” Journal of the Economic and Social History of the Orient 47:1-30.

“ (2012), “ Entrepreneurs and Enterprise in Early Mesopotamia: A Study of Three Archives from the Third Dynasty of Ur (2112–2004 BC) (CDL Press, Bethesda, Maryland).

Gelb, Ignace J. (1965), “The Ancient Mesopotamian Ration System,” Journal of Near Eastern Studies 24:230‑43.

Goodhart, Charles (1998) “The two concepts of money: implications for the analysis of optimal currency areas,” European Journal of Political Economy 14: 407-432.

Graeber, David (2014), Debt: The First 5000 Years (Brooklyn: Melville Press).

Grierson, Philip (1977), The Origins of Money (London).

Hartman, L. F., and Leo Oppenheim, “On Beer and Brewing Techniques in Ancient Mesopotamia,” Supplement to the Journal of the American Oriental Society 10 (1950).

Hawkins, J. D. (1988), “Royal Statements of ideal prices: Assyrian, Babylonian, and Hittite,” in J. V. Canby et al. (eds.), Ancient Anatolia: Aspects of Change and Cultural Development (Essays in Honor of Machteld J. Mellink) (Madison):93-102.

Heichelheim, Fritz M. (1958), An Ancient Economic History, from the Palaeolithic Age to the Migrations of the Germanic, Slavic and Arabic Nations, I. (Rev. ed., Leiden, 1958).

Hoebel, Edward Adamson (1968), The Law of Primitive Man: A Study in Comparative Legal Dynamics (New York [1964]).

Hudson, Michael (1992), “Did the Phoenicians Introduce the Idea of Interest to Greece and Italy — And If So, When?” in Günter Kopcke and Isabelle Tokumaru, Greece Between East and West: 10th-8th Centuries BC (Mainz):128-143.

” (1996), “Privatization in History and Today: A Survey of the Unresolved Controversies,” and “The Dynamics of Privatization, from the Bronze Age to the Present,” in Privatization.

“ (2000) “How Interest Rates Were Set, 2500 BC – 1000 AD: Máš, tokos and fænus as metaphors for interest accruals,” Journal of the Economic and Social History of the Orient 43:132-161.

“ (2002) “Reconstructing the Origins of Interest-Bearing Debt and the Logic of Clean Slates,” in Michael Hudson and Marc Van De Mieroop Debt and Economic Renewal in the Ancient Near East: 7-58.

“(2003), “The Cartalist/Monetarist Debate in Historical Perspective,” in Stephanie Bell and Edward Nell eds., The State, The Market and The Euro (Edward Elgar).

“ (2004), “The Archaeology of Money in Light of Mesopotamian Records,” in Randall Wray, ed., Credit and State Theories of Money: The Contributions of A. Mitchell Innes (Cheltenham: Edward Elgar).

“ (2004), “The Development of Money-of-Account in Sumer’s Temples,” in Michael Hudson and Cornelia Wunsch, eds., Creating Economic Order: Record-Keeping, Standardization and the Development of Accounting in the Ancient Near East (CDL Press, Bethesda, 2004):303-29.

“ (in press), “From Polanyi to the New Economic Anthropology,” in Radhika Desai and Kari Polanyi Levitt, eds., The Enduring Legacy of Karl Polanyi (Montreal).

Humphrey, Caroline (1985), “Barter and Economic Disintegration.” Man, New Series 20

Ingham, Geoffrey (2004), The Nature of Money (Cambridge, Polity Press).

Innes, Alfred Mitchell (1913), “What is money?” Banking Law Journal, May:377-408, reprinted in L. Randall Wary (ed), Credit and State Theory of Money. The Contributions of A. Mitchell Innes (Cheltenham: Edward Elgar).

“ (1914), “The credit theory of money,” Banking Law Journal (Dec./Jan.):151-68, reprinted in L. Randall Wary (ed), Credit and State Theory of Money. The Contributions of A. Mitchell Innes (Cheltenham: Edward Elgar).

Jursa, Michael (2002), “Debts and Indebtedness in the Neo-Babylonian Period: Evidence from Institutional Archives,” in Hudson and Van De Mieroop, eds., Debt and Economic Renewal (2002):197-220.

Knapp, Georg Friedrich (1924), The State Theory of Money [1905].

Kraay, C.M (1976), Archaic and Classical Greek Coins (London 1976).

Kraus, Fritz R. (1958), Ein Edikt des Königs Ammi‑saduqa von Babylon, SD 5 (Leiden).

Kula, Witold (1986) Measures and Men (Princeton).

Lambert, Maurice (1960), “La naissance de la bureaucratie,” Revue Historique 224:1-26.

” (1961), “Le premier triomphe de la bureaucratie,” Revue Historique 225:21‑46.

“ (1963), “L’Usage de l’argentmetal a Lagash au temps de la IIIe Dynastie d’Ur,” Revue d’Assyriologie 57:7992.

Larsen, Mogens Trolle, (1976), The Old Assyrian City‑State and its Colonies (Copenhagen).

“ (2015), Ancient Kanesh A Merchant Colony in Bronze Age Anatolia (Cambridge University Press).

Laum, Bernard (1924), Heiliges Geld: eine historiche Untersuchung über den sakralen Ursprung

des Geldes (Tübingen 1924).

“ (1952), “Geschichte der öffentlichen Finanzwirtschaft im Altertum und Frühmittelalter,” in Wilhelm Gerloff and Fritz Neumark, eds, Handbuch der Finanzwissenschaft, 2nd ed. (Tübingen 1952):211-35.

Leemans, The Old Babylonian Merchant: His Business and Social Position (Leiden 1950).

Manning, J. G. and Ian Morris (2005), The Ancient Economy: Evidence and Models (Stanford University Press).

Menger, Carl (1892), “On the Origins of Money,” Economic Journal, 2:238-255. [Originally published in 1871.] “ (1981), Principles of Economics (New York: New York University Press).

Michel, Cécile (2013), “Economic and Social Aspects of the Old Assyrian Loan Contract.”

Ober, Josiah (2008), Democracy and Knowledge. Innovation and Learning in Classical Athens (Princeton: Princeton University Press).

Oppenheim, Leo (1949), “The Golden Garments of the Gods,” Journal of Near Eastern Studies 8:172‑93.

Polanyi, Karl (1944), The Great Transformation (Beacon Press).

Polanyi, Karl, Arensberg, Conrad M. and Pearson, Harry W., eds. (1957), Trade and Market in the Early Empires: Economies in History and Theory (New York).

J. N. Postgate, Early Mesopotamian Society and Economy at the Dawn of History (London and New York, 1992),

Powell, Marvin A. (1999), “Wir müssen alle unsere Nische nuzten: Monies, Motives, and Methods in Babylonian Economics,” in J. G. Dercksen, ed., Trade and Finance in Ancient Mesopotamia (Istanbul):5-23.

Pritchard, J. B., ed. (1955), Ancient Near Eastern Texts (Princeton; paperback,1958).

Radner, Karen (1999), “Money in the Neo-Assyrian Empire,” in J. G. Dercksen, ed., Trade and Finance in Ancient Mesopotamia (=MOS Studies 1), Proceedings of the First MOS Symposium [Leiden 1997] (Istanbul):127-157.

Renger, Johannes (1979), “Interaction of Temple, Palace, and ‘Private Enterprise’ in the Old Babylonian Economy,” in Lipinski, Eduard (ed.), State and Temple Economy in the Ancient Near East (Leuven) I, 249‑56.

” (1984), “Patterns of Non‑Institutional Trade and Non‑Commercial Exchange in Ancient Mesopotamia at the Beginning of the Second Millennium BC,” in Circulation of Goods in Non-Palatial Context in the Ancient Near East, ed. Alfonso Archi (=Incunabula Graeca, LXXII, Rome, 1984): 31‑115.

Roth, Martha T. (1997), Law Collections from Mesopotamia and Asia Minor (2nd ed., Atlanta: Scholars Press).

Sallaberger, Walter (2013), “The Management of Royal Treasure: Palace Archives and Palatial Economy in the Ancient Near East,” in Jane A. Hill, Philip Jones, and Antonio J. Morales, Experiencing Power, Generating Authority: Cosmos, Politics and the Ideology of Kingship in Ancient Egypt and Mesopotamia, (University of Pennsylvania Museum of Archaeology and Anthropology, Philadelphia): 213-55.

Salmon, J. B. (1984), Wealthy Corinth (Oxford).

Samuelson, Paul (1973), Economics, 9th ed., (New York: McGraw Hill).

Steinkeller, Piotr (1981), “The Renting of Fields in Early Mesopotamia and the Development of the Concept of ‘Interest’ in Sumerian,” JESHO 24.

“(2002) “Money Lending Practices in Ur III Babylonia: The Issue of Economic Motivation.” In M. Hudson and M. Van De Mieroop eds., Debt and Economic Renewal in the Ancient Near East. Bethesda, Md.: CDL Press: 109–37.

Lars Sundstrom, The Exchange Economy of Pre-Colonial Africa (New York: 1974 [1965]), pp. 34, 38

Van De Mieroop, Marc (1995), “ “Old Babylonian Interest Rates: Were they Annual?” in Immigration and Emigration within the Near East. Festschrift E. Lipinski (Orientalia Lovaniensia Analecta 65; Louvain: Departement Oriëntalistick), (1995), pp. 357-64.

“ (2002), “Credit as a Facilitator of Exchange in Old Babylonian Mesopotamia,” in Michael Hudson and Marc Van De Mieroop, eds., Debt and Economic Renewal in the Ancient Near East (Bethesda, Md), pp. 163-174.

“ “A History of Near Eastern Debt?” in Hudson and Van De Mieroop, eds., Debt and Economic Renewal (2002), pp. 59-94.

“(2004), “Accounting in Early Mesopotamia: Some Remarks,” in Hudson and Wunsch (2004), Creating Economic Order (ISLET, Dresden):47-64.

“ (2005) “The Invention of Interest,” in William N. Goetzmann and K Geert Rouwenhorst, eds., The Origins of Value: The Financial Innovations That Created Modern Capital Markets” (Oxford University Press), pp. 17-30.

Veenhof, Klass R. (1972), Aspects of Old Assyrian Trade and its Terminology (Leiden).

“ (2010), “The Interpretation of Paragraphs t and u of the Code of Hammurabi,” in Yayia Hazirlayan and Sevket Dönmez,, eds., DUB.SAR E.DUB.BA.A: Studies presented in honour of Veysel Donbaz (Istanbul).

Ventris, Michael, and John Chadwick (1956), Documents in Mycenaean Greek: Three Hundred Selected Tablets from Knossos, Pylos and Mycenae with Commentary and Vocabulary (Cambridge, England. Cambridge University Press).

Wray, L. Randall (ed.), (2004), Credit and State Theories of Money: The Contributions of A. Mitchell Innes (Edward Elgar).

Wunsch, Cornelia (2002), “Debt, Interest, Pledge and Forfeiture in the Neo-Babylonian and Early Achaemenid Period: The Evidence from Private Archives,” in Michael Hudson and Marc Van De Mieroop, eds., Debt and Economic Renewal in the Ancient Near East (CDL Press), pp. 221-255.