This article is based on Chapter 1 of Cold War 2.0. The Geopolitical Economics of Finance Capitalism vs. Industrial Capitalism (Dresden, ISLET: in press; Chinese translation 2021). © 2020. All rights reserved. Marx and many of his less radical contemporary reformers saw the historical role of industrial capitalism as being to clear away the legacy of feudalism – the landlords, bankers and monopolists extracting economic rent without producing real value. But that reform movement failed. Today, the Finance, Insurance and Real Estate (FIRE) sector has regained control of government, creating neo-rentier economies. The aim of this post-industrial finance capitalism is the oppositeof that of industrial capitalism as known to 19th-century economists: It seeks wealth primarily

Topics:

Michael Hudson considers the following as important: Articles

This could be interesting, too:

Michael Hudson writes The Road to Chaos – A Global Balance of Payments War

Michael Hudson writes The Secret of the Long March

Michael Hudson writes Weaponizing the US Dollar

Michael Hudson writes Contesting the Corontation of the Rentier

This article is based on Chapter 1 of Cold War 2.0. The Geopolitical Economics of Finance Capitalism vs. Industrial Capitalism (Dresden, ISLET: in press; Chinese translation 2021). © 2020. All rights reserved.

Marx and many of his less radical contemporary reformers saw the historical role of industrial capitalism as being to clear away the legacy of feudalism – the landlords, bankers and monopolists extracting economic rent without producing real value. But that reform movement failed. Today, the Finance, Insurance and Real Estate (FIRE) sector has regained control of government, creating neo-rentier economies.

The aim of this post-industrial finance capitalism is the oppositeof that of industrial capitalism as known to 19th-century economists: It seeks wealth primarily through the extraction of economic rent, not industrial capital formation. Tax favoritism for real estate, privatization of oil and mineral extraction, banking and infrastructure monopolies add to the cost of living and doing business. Labor is being exploited increasingly by bank debt, student debt, credit-card debt, while housing and other prices are inflated on credit, leaving less income to spend on goods and services as economies suffer debt deflation.

Today’s New Cold War is a fight to internationalize this rentier capitalism by globally privatizing and financializing transportation, education, health care, prisons and policing, the post office and communications, and other sectors that formerly were kept in the public domain of European and American economies so as to keep their costs low and minimize their cost structure.

In the Western economies such privatizations have reversed the drive of industrial capitalism to minimize socially unnecessary costs of production and distribution. In addition to monopoly prices for privatized services, financial managers are cannibalizing industry by debt leveraging and high dividend payouts to increase stock prices.

* * *

Today’s neo-rentier economies obtain wealth mainly by rent seeking, while financialization capitalizes real estate and monopoly rent into bank loans, stocks and bonds. Debt leveraging to bid up prices and create capital gains on credit for this “virtual wealth” has been fueled by central bank Quantitative Easing since 2009.

Financial engineering is replacing industrial engineering. Over 90 percent of recent U.S. corporate income has been earmarked to raise the companies’ stock prices by being paid out as dividends to stockholders or spent on stock buyback programs. Many companies even borrow to buy up their own shares, raising their debt/equity ratios.

Households and industry are becoming debt-strapped, owing rent and debt service to the Finance, Insurance and Real Estate (FIRE) sector. This rentier overhead leaves less wage and profit income available to spend on goods and services, bringing to a close the 75-year U.S. and European expansion since World War II ended in 1945.

These rentier dynamics are the opposite of what Marx described as industrial capitalism’s laws of motion. German banking was indeed financing heavy industry under Bismarck, in association with the Reichsbank and military. But elsewhere, bank lending rarely has financed new tangible means of production. What promised to be a democratic and ultimately socialist dynamic has relapsed back toward feudalism and debt peonage, with the financial class today playing the role that the landlord class did in post-medieval times.

Marx’s View of the Historical Destiny of Capitalism: to Free Economies from Feudalism

The industrial capitalism that Marx described in Volume I of Capital is being dismantled. He saw the historical destiny of capitalism to be to free economies from the legacy of feudalism: a hereditary warlord class imposing tributary land rent, and usurious banking. He thought that as industrial capitalism evolved toward more enlightened management, and indeed toward socialism, it would replace predatory “usurious” finance, cutting away the economically and socially unnecessary rentier income, land rent and financial interest and related fees for unproductive credit. Adam Smith, David Ricardo, John Stuart Mill, Joseph Proudhon and their fellow classical economists had analyzed these phenomena, and Marx summarized their discussion in Volumes II and III of Capitaland his parallel Theories of Surplus Valuedealing with economic rent and the mathematics of compound interest, which causes debt to grow exponentially at a higher rate than the rest of the economy.

However, Marx devoted Volume I of Capital to industrial capitalism’s most obvious characteristic: the drive to make profits by investing in means of production to employ wage labor to produce goods and services to sell at a markup over what labor was paid. Analyzing surplus value by adjusting profit rates to take account of outlays for plant, equipment and materials (the “organic composition of capital”), Marx described a circular flow in which capitalist employers pay wages to their workers and invest their profits in plant and equipment with the surplus not paid to employees.

Finance capitalism has eroded this core circulation between labor and industrial capital. Much of the midwestern United States has been turning into a rust belt. Instead of the financial sector evolving to fund capital investment in manufacturing, industry is being financialized. Making economic gains financially, primarily by debt leverage, far outstrips making profits by hiring employees to produce goods and services.

Capitalism’s Alliance of Banks with Industry to Promote Democratic Political Reform

The capitalism of Marx’s day still contained many survivals from feudalism, most notably a hereditary landlord class living off the land rents, most of which were spent unproductively on servants and luxuries, not to make a profit. These rents had originated in a tax. Twenty years after the Norman Conquest, William the Conquer had ordered compilation of the Domesday Book in 1086 to calculate the yield that could be extracted as taxes from the English land that he and his companions had seized. As a result of King John’s overbearing fiscal demands, the Revolt of the Barons (1215-17) and their Magna Carta enabled the leading warlords to obtain much of this rent for themselves. Marx explained that industrial capitalism was politically radical in seeking to free itself from the burden of having to support this privileged landlord class, receiving income with no basis in cost value or enterprise of its own.

Industrialists sought to win markets by cutting costs below those of their competitors. That aim required freeing the entire economy from the “faux frais” of production, socially unnecessary charges built into the cost of living and doing business. Classical economic rent was defined as the excess of price above intrinsic cost-value, the latter being ultimately reducible to labor costs. Productive labor was defined as that employed to create a profit, in contrast to the servants and retainers (coachmen, butlers, cooks, et al.) on whom landlords spent much of their rent.

The paradigmatic form of economic rent was the ground rent paid to Europe’s hereditary aristocracy. As John Stuart Mill explained, landlords reaped rents (and rising land prices) “in their sleep.” Ricardo had pointed out (in Chapter 2 of his 1817 Principles of Political Economy and Taxation) a kindred form of differential rent in natural-resource rent stemming from the ability of mines with high-quality orebodies to sell their lower-cost mineral output at prices set by high-cost mines. Finally, there was monopoly rent paid to owners at choke points in the economy where they could extract rents without a basis in any cost outlay. Such rents logically included financial interest, fees and penalties.

Marx saw the capitalist ideal as freeing economies from the landlord class that controlled the House of Lords in Britain, and similar upper houses of government in other countries. That aim required political reform of Parliament in Britain, ultimately to replace the House of Lords with the Commons, so as to prevent the landlords from protecting their special interests at the expense of Britain’s industrial economy. The first great battle in this fight against the landed interest was won in 1846 with repeal of the Corn Laws. The fight to limit landlord power over government culminated in the constitutional crisis of 1909-10, when the Lords rejected the land tax imposed by the Commons. The crisis was resolved by a ruling that the Lords never again could reject a revenue bill passed by the House of Commons.

The Banking Sector Lobbies Against the Real Estate Sector, 1815-1846

It may seem ironic today that Britain’s banking sector was whole-heartedly behind the first great fight to minimize land-rent. That alliance occurred after the Napoleonic Wars ended in 1815, which ended the French blockage against British seaborne trade and re-opened the British market to lower-priced grain imports. British landlords demanded tariff protection under the Corn Laws – to raise the price of food, so as to increase the revenue and hence the capitalized rental value of their landholdings – but that has rendered the economy high-cost. A successful capitalist economy would have to minimize these costs in order to win foreign markets and indeed, to defend its own home market. The classical idea of a free market was one free from economic rent – from rentier income in the form of land rent.

This rent – a quasi-tax paid to the heirs of the warlord bands that had conquered Britain in 1066, and the similar Viking bands that had conquered other European realms – threatened to minimize foreign trade. That was a threat to Europe’s banking classes, whose major market was the funding of commerce by bills of exchange. The banking class arose as Europe’s economy was revived by the vast looting of monetary bullion from Constantinople by the Crusaders. Bankers were permitted a loophole to avoid Christianity’s banning of the charging of interest, by taking their return in the form of agio, a fee for transferring money from one currency to another, including from one country to another.

Even domestic credit could use the loophole of “dry exchange,” charging agio on domestic transactions cloaked as a foreign-currency transfer, much as modern corporations use “offshore banking centers” today to pretend that they earn their income in tax-avoidance countries that do not charge an income tax.

If Britain was to become the industrial workshop of the world, it would prove highly beneficial to Ricardo’s banking class. (He was its Parliamentary spokesman; today we would say lobbyist.) Britain would enjoy an international division of labor in which it exported manufactures and imported food and raw materials from other countries specializing in primary commodities and depending on Britain for their industrial products. But for this to happen, Britain needed a low price of labor. That meant low food costs, which at that time were the largest items in the family budgets of wage labor. And that in turn required ending the power of the landlord class to protect its “free lunch” of land rent, and all recipients of such “unearned income.”

It is hard today to imagine industrialists and bankers hand in hand promoting democratic reform against the aristocracy. But that alliance was needed in the early 19th century. Of course, democratic reform at that time extended only to the extent of unseating the landlord class, not protecting the interest of labor. The hollowness of the industrial and banking class’s democratic rhetoric became apparent in Europe’s 1848 revolutions, where the vested interests ganged up against extending democracy to the population at large, once the latter had helped end landlord protection of its rents.

Of course, it was socialists who picked up the political fight after 1848. Marx later reminded a correspondent that the first plank of the Communist Manifesto was to socialize land rent, but poked fun at the “free market” rent critics who refused to recognize that rentier-like exploitation existed in the industrial employment of wage labor. Just as landlords obtained land rent in excess of the cost of producing their crops (or renting out housing), so employers obtained profits by selling the products of wage-labor at a markup. To Marx, that made industrialists part of the rentier class in principle, although the overall economic system of industrial capitalism was much different from that of post-feudal rentiers, landlords and bankers.

The Alliance of Banking with Real Estate and Other Rent-Seeking Sectors

With this background of how industrial capitalism was evolving in Marx’s day, we can see how overly optimistic he was regarding the drive by industrialists to strip away all unnecessary costs of production – all charges that added to price without adding to value. In that sense he was fully in tune with the classical concept of free markets, as markets free from land rent and other forms of rentier income.

Today’s mainstream economics has reversed this concept. In an Orwellian doublethink twist, the vested interests today define a free market as one “free” for the proliferation of various forms of land rent, even to the point of giving special tax advantages to absentee real estate investment, the oil and mining industries (natural-resource rent), and most of all to high finance (the accounting fiction of “carried interest,” an obscure term for short-term arbitrage speculation).

Today’s world has indeed freed economies from the burden of hereditary ground rent. Almost two-thirds of American families own their own homes (although the rate of homeownership has been falling steadily since the Great Obama Evictions that were a byproduct of the junk-mortgage crisis and Obama Bank Bailouts of 2009-16, which lowered homeowner rates from over 68% to 62%). In Europe, home ownership rates have reached 80% in Scandinavia, and high rates characterize the entire continent. Home ownership – and also the opportunity to purchase commercial real estate – has indeed become democratized.

But it has been democratized on credit. That is the only way for wage-earners to obtain housing, because otherwise they would have to spend their entire working life saving enough to buy a home. After World War II ended in 1945, banks provided the credit to purchase homes (and for speculators to buy commercial properties), by providing mortgage credit to be paid off over the course of 30 years, the likely working life of the young home buyer.

Real estate is by far the banking sector’s largest market. Mortgage lending accounts for about 80 percent of U.S. and British bank credit. It played only a minor role back in 1815, when banks focused on financing commerce and international trade. Today we can speak of the Finance, Insurance and Real Estate (FIRE) sector as the economy’s dominant rentier sector. This alliance of banking with real estate has led banks to become the major lobbyists protecting real estate owners by opposing the land tax that seemed to be the wave of the future in 1848 in the face of rising advocacy to tax away the land’s entire price gains and rent, to make land the tax base as Adam Smith had urged, instead of taxing labor and consumers or profits. Indeed, when the U.S. income tax began to be levied in 1914, it fell only on the wealthiest One Percent of Americans, whose taxable income consisted almost entirely of property and financial claims.

The past century has reversed that tax philosophy. On a national level, real estate has paid almost zero income tax since World War II, thanks to two giveaways. The first is “fictitious depreciation,” sometimes called over-depreciation. Landlords can pretend that their buildings are losing value by claiming that they are wearing out at fictitiously high rates. (That is why Donald Trump has said that he loves depreciation.) But by far the largest giveaway is that interest payments are tax deductible. Real estate is taxed locally, to be sure, but typically at only 1% of assessed valuation, which is less than 7 to 10 percent of the actual land rent.[1]

The basic reason why banks support tax favoritism for landlords is that whatever the tax collector relinquishes is available to be paid as interest. Mortgage bankers end up with the vast majority of land rent in the United States. When a property is put up for sale and homeowners bid against each other to buy it, the equilibrium point is where the winner is willing to pay the full rental value to the banker to obtain a mortgage. Commercial investors also are willing to pay the entire rental income to obtain a mortgage, because they are after the “capital” gain – that is, the rise in the land’s price.

The policy position of the so-called Ricardian socialists in Britain and their counterparts in France (Proudhon, et al.) was for the state to collect the land’s economic rent as its major source of revenue. But today’s “capital” gains occur primarily in real estate and finance, and are virtually tax-free for landlords. Owners pay no capital-gains tax as real estate prices rise, or even upon sale if they use their gains to buy another property. And when landlords die, all tax liability is wiped out.

The oil and mining industries likewise are notoriously exempt from income taxation on their natural-resource rents. For a long time the depletion allowance allowed them tax credit for the oil that was sold off, enabling them to buy new oil-producing properties (or whatever they wanted) with their supposed asset loss, defined as the value to recover whatever they had emptied out. There was no real loss, of course. Oil and minerals are provided by nature.

These sectors also make themselves tax exempt on their foreign profits and rents by using “flags of convenience” registered in offshore banking centers. This ploy enables them to claim to make all their profits in Panama, Liberia or other countries that do not charge an income tax or even have a currency of their own, but use the U.S. dollar so as to save American companies from any foreign-exchange risk.

In oil and mining, as with real estate, the banking system has become symbiotic with rent recipients, including companies extracting monopoly rent. Already in the late 19thcentury the banking and insurance sector was recognized as “the mother of trusts,” financing their creation to extract monopoly rents over and above normal profit rates.

These changes have made rent extraction much more remunerative than industrial profit-seeking – just the opposite of what classical economists urged and expected to be the most likely trajectory of capitalism. Marx expected the logic of industrial capitalism to free society from its rentier legacy and to create public infrastructure investment to lower the economy-wide cost of production. By minimizing labor’s expenses that employers had to cover, this public investment would put in place the organizational network that in due course (sometimes needing a revolution, to be sure) would become a socialist economy.

Although banking developed ostensibly to serve foreign trade by the industrial nations, it became a force-in-itself undermining industrial capitalism. In Marxist terms, instead of financing the M-C-M’ circulation (money invested in capital to produce a profit and hence yet more money), high finance has abbreviated the process to M-M’, making money purely from money and credit, without tangible capital investment.

The Rentier Squeeze on Budgets: Debt Deflation as a Byproduct of Asset-Price Inflation

Democratization of home ownership meant that housing no longer was owned primarily by absentee owners extracting rent, but by owner-occupants. As home ownership spread, new buyers came to support the rentier drives to block land taxation – not realizing that rent that was not taxed would be paid to the banks as interest to absorb the rent-of-location hitherto paid to absentee landlords.

Real estate has risen in price as a result of debt leveraging. The process makes investors, speculators and their bankers wealthy, but raises the cost of housing (and commercial property) for new buyers, who are obliged to take on more debt in order to obtain secure housing. That cost is also passed on to renters. And employers ultimately are obliged to pay their labor force enough to pay these financialized housing costs.

Debt deflation has become the distinguishing feature of today’s economies from North America to Europe, imposing austerity as debt service absorbs a rising share of personal and corporate income, leaving less to spend on goods and services. The economy’s indebted 90 percent find themselves obliged to pay more and more interest and financial fees. The corporate sector, and now also the state and local government sector, likewise are obliged to pay a rising share of their revenue to creditors.

Investors are willing to pay most of their rental income as interest to the banking sector because they hope to sell their property at some point for a “capital” gain. Modern finance capitalism focuses on “total returns,” defined as current income plus asset-price gains, above all for land and real estate. Inasmuch as a home or other property is worth however much banks will lend against it, wealth is created primarily by financial means, by banks lending a rising proportion of the value of assets pledged as collateral.

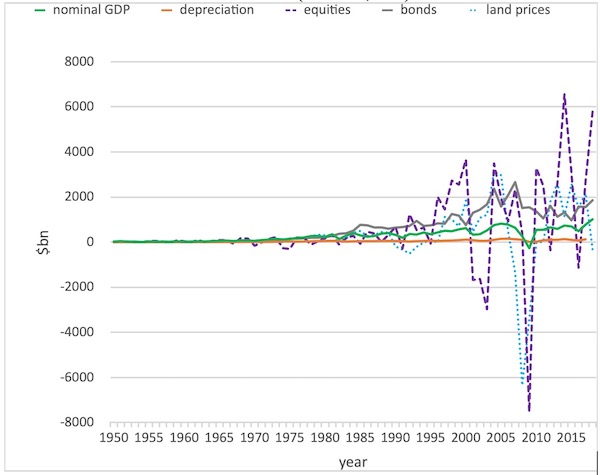

Chart 10.4: annual changes in GDP and the major components of asset price gains

(nominal, $bn)

The fact that asset-price gains are largely debt-financed explains why economic growth is slowing in the United States and Europe, even as stock market and real estate prices are inflated on credit. The result is a debt-leveraged economy.

Changes in the value of the economy’s land from year to year far exceeds the change in GDP. Wealth is obtained primarily by asset-price (“capital”) gains in the valuation of land and real estate, stocks, bonds and creditor loans (“virtual wealth”), not so much by saving income (wages, profits and rents). The magnitude of these asset-price gains tends to dwarf profits, rental income and wages.

The tendency has been to imagine that rising prices for real estate, stocks and bonds has been making homeowners richer. But this price rise is fueled by bank credit. A home or other property is worth however much a bank will lend against it – and banks have lent a larger and larger proportion of the home’s value since 1945. For U.S. real estate as a whole, debt has come to exceed equity for more than a decade now. Rising real estate prices have made banks and speculators rich, but have left homeowners and commercial real estate debt strapped.

The economy as a whole has suffered. Debt-fueled housing costs in the United States are so high that if all Americans were given their physical consumer goods for free – their food, clothing and so forth – they still could not compete with workers in China or most other countries. That is a major reason why the U.S. economy is de-industrializing. So this policy of “creating wealth” by financialization undercuts the logic of industrial capitalism.

Finance Capital’s Fight to Privatize and Monopolize Public Infrastructure

Another reason for deindustrialization is the rising cost of living stemming from conversion of public infrastructure into privatized monopolies. As the United States and Germany overtook British industrial capitalism, a major key to industrial advantage was recognized to be public investment in roads, railroads and other transportation, education, public health, communications and other basic infrastructure. Simon Patten, the first professor of economics at America’s first business school, the Wharton School at the University of Pennsylvania, defined public infrastructure as a “fourth factor of production,” in addition to labor, capital and land. But unlike capital, Patten explained, its aim was not to make a profit. It was to minimize the cost of living and doing business by providing low-price basic services to make the private sector more competitive.

Unlike the military levies that burdened taxpayers in pre-modern economies, “in an industrial society the object of taxation is to increase industrial prosperity”by creating infrastructure in the form of canals and railroads, a postal service and public education. This infrastructure was a “fourth” factor of production.Taxes would be “burdenless,” Patten explained, to the extent that they were invested in public internal improvements, headed by transportation such as the Erie Canal.[2]

The advantage of this public investment is to lower costs instead of letting privatizers impose monopoly rents in the form of access charges to basic infrastructure. Governments can price the services of these natural monopolies (including credit creation, as we are seeing today) at cost or offer them freely, helping labor and its employers undersell industrialists in countries lacking such public enterprise.

In the cities, Patten explained, public transport raises property prices (and hence economic rent) in the outlying periphery, as the Erie Canal had benefited western farms competing with upstate New York farmers.That principle is evident in today’s suburban neighborhoods relative to city centers. London’s Tube extension along the Jubilee Line, and New York City’s Second Avenue Subway, showed that underground and bus transport can be financed publicly by taxing the higher rental value created for sites along such routes. Paying for capital investment out of such tax levies can provide transportation at subsidized prices, minimizing the economy’s cost structure accordingly. What Joseph Stiglitz popularized as the “Henry George Law” thus more correctly should be known as “Patten’s Law” of burdenless taxation.[3]

Under a regime of “burdenless taxation” the return on public investment does not take the form of profit but aims at lowering the economy’s overall price structure to “promote general prosperity.” This means that governments should operate natural monopolies directly, or at least regulate them. “Parks, sewers and schools improve the health and intelligence of all classes of producers, and thus enable them to produce more cheaply, and to compete more successfully in other markets.” Patten concluded: “If the courts, post office, parks, gas and water works, street, river and harbor improvements, and other public works do not increase the prosperity of society they should not be conducted by the State.” But this prosperity for the overall economy was not obtained by treating public enterprises as what today is called a profit center.[4]

In one sense, this can be called “privatizing the profits and socializing the losses.” Advocating a mixed economy along these lines is part of the logic of industrial capitalism seeking to minimize private-sector production and employment costs in order to maximize profits. Basic social infrastructure is a subsidy to be supplied by the state.

Britain’s Conservative Prime Minister Benjamin Disraeli (1874-80) reflected this principle: “The health of the people is really the foundation upon which all their happiness and all their powers as a state depend.”[5] He sponsored the Public Health Act of 1875, followed by the Sale of Food and Drugs Act and, the next year, the Education Act. The government would provide these services, not private employers or private monopoly-seekers.

For a century, public investment helped the United States pursue an Economy of High Wages policy, providing education, food and health standards to make its labor more productive and thus able to undersell low-wage “pauper” labor. The aim was to create a positive feedback between rising wages and increasing labor productivity.

That is in sharp contrast to today’s business plan of finance capitalism – to cut wages, and also cut back long-term capital investment, research and development while privatizing public infrastructure. The neoliberal onslaught by Ronald Reagan in the United States and Margaret Thatcher in Britain in the 1980s was backed by IMF demands that debtor economies balance their budgets by selling off such public enterprises and cutting back social spending. Infrastructure services were privatized as natural monopolies, sharply raising the cost structure of such economies, but creating enormous financial underwriting commissions and stock-market gains for Wall Street and London.

Privatizing hitherto public monopolies has become one of the most lucrative ways to gain wealth financially. But privatized health care and medical insurance is paid for by labor and its employers, not by the government as in industrial capitalism. And in the face of the privatized educational system’s rising cost, access to middle-class employment has been financed by student debt. These privatizations have not helped economies become more affluent or competitive. On an economy-wide level this business plan is a race to the bottom, but one that benefits financial wealth at the top.

Finance Capitalism Impoverishes Economies While Increasing Their Cost Structure

Classical economic rent is defined as the excess of price over intrinsic cost-value. Capitalizing this rent – whether land rent or monopoly rent from the privatization described above – into bonds, stocks and bank loans creates “virtual wealth.” Finance capitalism’s exponential credit creation increases “virtual” wealth – financial securities and property claims – by managing these securities and claims in a way that has made them worth more than tangible real wealth.

The major way to gain fortunes is to get asset-price gains (“capital gains”) on stocks, bonds and real estate. However, this exponentially growing debt-leveraged financial overhead polarizes the economy in ways that concentrates ownership of wealth in the hands of creditors, and owners of rental real estate, stocks and bonds – draining the “real” economy to pay the FIRE sector.

Post-classical economics depicts privatized infrastructure, natural resource development and banking as being part of the industrial economy, not superimposed on it by a rent-seeking class. But the dynamic of finance-capitalist economies is not for wealth to be gained mainly by investing in industrial means of production and saving up profits or wages, but by capital gains made primarily from rent-seeking. These gains are not “capital” as classically understood. They are “finance-capital gains,” because they result from asset-price inflation fueled by debt leveraging.

By inflating its housing prices and a stock market bubble on credit, America’s debt leveraging, along with its financializing and privatizing of basic infrastructure, has priced it out of world markets. China and other non-financialized countries have avoided high health insurance costs, education costs and other services freely or at a low cost by viewing them as a public utility. Public health and medical care costs much less abroad, but is attacked in the United States by neoliberals as “socialized medicine,” as if financialized health care would make the U.S. economy more efficient and competitive. Transportation likewise has been financialized and run for profit, not to lower the cost of living and doing business.

One must conclude that America has chosen to no longer industrialize, but to finance its economy by economic rent – monopoly rent, from information technology, banking and speculation, whilst leaving industry, research and development to other countries. Even if China and other Asian countries didn’t exist, there is no way that America can regain its export markets or even its internal market with its current debt overhead and its privatized and financialized education, health care, transportation and other basic infrastructure sectors.

The underlying problem is not competition from China, but neoliberal financialization. Finance-capitalism is not industrial capitalism. It is a lapse back into debt peonage and a rentier neo-feudalism. Bankers play the role today that landlords played up through the 19th century, making fortunes without corresponding value, by capital gains for real estate, stocks and bonds on credit, by debt leveraging whose carrying charges increase the economy’s cost of living and doing business.

Today’s New Cold War is a Fight by Finance Capitalism Against Industrial Capitalism

Today’s world is being fractured by an economic warfare over what kind of economic system it will have. Industrial capitalism is losing the fight to finance capitalism, which is turning out to be its antithesis – just as industrial capitalism was the antithesis to post-feudal landlordship and predatory banking houses.

In this respect, today’s New Cold War is a conflict of economic systems. As such, it is being fought against the dynamic of U.S. industrial capitalism as well as that of China and other economies. Hence, the struggle also is domestic within the United States and Europe, as well as confrontational against China and Russia, Iran, Cuba, Venezuela and their moves to de-dollarize their economies and reject the Washington Consensus and its Dollar Diplomacy. It is a fight by U.S.-centered finance capital to promote the neoliberal doctrine giving special tax privileges to rentier income, untaxing land rent, natural resource rent, monopoly rent and the financial sector. This aim includes privatizing and financializing basic infrastructure, maximizing its extraction of economic rent instead of minimizing the cost of living and doing business.

The result is a war to change the character of capitalism as well as that of social democracy. The British Labour Party, European Social Democrats and the U.S. Democratic Party all have jumped on the neoliberal bandwagon. They are all complicit in the austerity that has spread from the Mediterranean to America’s Midwestern rust belt.

Finance capitalism exploits labor, but via a rentier sector, which also ends up cannibalizing industrial capital. This drive has become internationalized into a fight against nations that restrict the predatory dynamics of finance capital seeking to privatize and dismantle government regulatory power. The New Cold War is not merely a war being waged by finance capitalism against socialism and public ownership of the means of production. In view of the inherent dynamics of industrial capitalism requiring strong state regulatory and taxing power to check the intrusiveness of finance capital, this post-industrial global conflict is between socialism evolving out of industrial capitalism, and fascism, defined as a rentier reaction to mobilize government to roll back social democracy and restore control to the rentier financial and monopoly classes.

The old Cold War was a fight against “Communism.” In addition to freeing itself from land rent, interest charges and privately appropriated industrial profits, socialism favors labor’s fight for better wages and working conditions, better public investment in schools, health care and other social welfare support, better job security, and unemployment insurance. All these reforms would cut into the profits of employers. Lower profits mean lower stock-market prices, and hence fewer finance-capital gains.

The aim of finance capitalism is not to become a more productive economy by producing goods and selling them at a lower cost than competitors. What might appear at first sight to be international economic rivalry and jealousy between the United States and China is thus best seen as a fight between economic systems: that of finance capitalism and that of civilization trying to free itself from rentier privileges and submission to creditors, with a more social philosophy of government empowered to check private interests when they act selfishly and injure society at large.

The enemy in this New Cold War is not merely socialist government but government itself, except to the extent that it can be brought under the control of high finance to promote the neoliberal rentier agenda. This reverses the democratic political revolution of the 19th century that replaced the House of Lords and other upper houses controlled by the hereditary aristocracy with more representative legislators. The aim is to create a corporate state, replacing elected houses of government by central banks – the U.S. Federal Reserve and the European Central Bank, along with external pressure from the International Monetary Fund and World Bank.

The result is a “deep state” supporting a cosmopolitan financial oligarchy. That is the definition of fascism, reversing democratic government to restore control to the rentier financial and monopoly classes. The beneficiary is the corporate sector, not labor, whose resentment is turned against foreigners and against designated enemies within.

Lacking foreign affluence, the U.S. corporate state promotes employment by a military buildup and public infrastructure spending, most of which is turned over to insiders to privatize into rent-seeking monopolies and sinecures. In the United States, the military is being privatized for fighting abroad (e.g., Blackwater USA/Academi), and jails are being turned into profit centers using inexpensive convict labor.

What is ironic is that although China is seeking to decouple from Western finance capitalism, it actually has been doing what the United States did in its industrial takeoff in the late 19th and early 20th century. As a socialist economy, China has aimed at what industrial capitalism was expected to achieve: freeing its economy from rentier income (landlordship and usurious banking), largely by a progressive income tax policy falling mainly on rentier income.

Above all, China has kept banking in the public domain. Keeping money and credit creation public instead of privatizing it is the most important step to keep down the cost of living and business. China has been able to avoid a debt crisis by forgiving debts instead of closing down indebted enterprises deemed to be in the public interest. In these respects it is socialist China that is achieving the fate that industrial capitalism initially was expected to achieve in the West.

Summary: Finance Capital as Rent-Seeking

The transformation of academic economic theory under today’s finance capitalism has reversed the progressive and indeed radical thrust of the classical political economy that evolved into Marxism. Post-classical theory depicts the financial and other rentier sectors as an intrinsic part of the industrial economy. Today’s national income and GDP accounting formats are compiled in keeping with this anti-classical reaction depicting the FIRE sector and its allied rent-seeking sectors as an addition to national income, not a subtrahend. Interest, rents and monopoly prices all are counted as “earnings” – as if all income is earned as intrinsic parts of industrial capitalism, not predatory extraction as overhead property and financial claims.

This is the opposite of classical economics. Finance capitalism is a drive to avoid what Marx and indeed the majority of his contemporaries expected: that industrial capitalism would evolve toward socialism, peacefully or otherwise.

Some Final Observations: Financial Takeover of Industry, Government and Ideology

Almost every economy is a mixed economy – public and private, financial, industrial and rent-seeking. Within these mixed economies the financial dynamics – debt growing by compound interest, attaching itself primarily to rent-extracting privileges, and therefore protecting them ideologically, politically and academically. These dynamics are different from those of industrial capitalism, and indeed undercut the industrial economy by diverting income from it to pay the financial sector and its rentier clients.

One expression of this inherent antagonism is the time frame. Industrial capitalism requires long-term planning to develop a product, make a marketing plan, and undertake research and development to keep undercutting competitors. The basic dynamic is M-C-M’: capital (money, M) is invested in building factories and other means of production, and employing labor to sell its products (commodities, C) at a profit (M’).

Finance capitalism abbreviates this to a M-M’, making money purely financially, by charging interest and making capital gains. The financial mode of “wealth creation” is measured by the valuations of real estate, stocks and bonds. This valuation was long based on capitalizing their flow of revenue (rents or profits) at the going rate of interest, but is now based almost entirely on capital gains as the major source of “total returns.”

In taking over industrial companies, financial managers focus on the short run, because their salary and bonuses are based on the current year’s performance. The “performance” in question is stock market performance. Stock prices have largely become independent from sales volume and profits, now that they are enhanced by corporations typically paying out some 92 percent of their revenue in dividends and stock buybacks.[6]

Even more destructively, private capital has created a new process: M-debt-M’. One recent paper calculates that: “Over 40% of firms that make payouts also raise capital during the same year, resulting in 31% of aggregate share repurchases and dividends being externally financed, primarily with debt.”[7] This has made the corporate sector financially fragile, particularly the airline industry in the wake of the COVID-19 crises.

The essence of private equity, Matt Stoller explains, is for “financial engineers [to] raise large amounts of money and borrow even more to buy firms and loot them. These kinds of private equity barons aren’t specialists who help finance useful products and services, they do cookie cutter deals targeting firms they believe have market power to raise prices, who can lay off workers or sell assets, and/or have some sort of legal loophole advantage. Often they will destroy the underlying business. The giants of the industry, from Blackstone to Apollo, are the children of 1980s junk bond king and fraudster Michael Milken. They are essentially are super-sized mobsters.”[8]

Private equity has played a big role in increasing corporate leverage, both through their own actions and by disinhibiting large public companies in the use of debt. As Eileen Appelbaum and Rosemary Batt explained, the large buyout firms, following the playbook developed in the 1980s, produce their returns from financial engineering and cost cutting (smaller size deals target “growthier” companies, but while those private equity firms assert that they add value, it may just be that they are skilled at identifying promising companies and riding a performance wave).

Contrary to their marketing, private equity fee structures mean they make money even when they bankrupt firms. And they have become so powerful that it’s hard to get political support to stop them when they hurt large numbers of citizens though exploitative practices like balance (“surprise”) billing.[9]

The classic description of this looting-for-profit practice process is the 1993 paper by George Akerloff and Paul Romer describing how “firms have an incentive to go broke for profit at society’s expense (to loot) instead of to go for broke (to gamble on success). Bankruptcy for profit will occur if poor accounting, lax regulation, or low penalties for abuse give owners an incentive to pay themselves more than their firms are worth and then default on their debt obligations.” [10]

The fact that “paper gains” from stock prices can be wiped out when financial storms occur, makes financial capitalism less resilient than the industrial base of tangible capital investment that remains in place. The United States has painted its economy into a corner by de-industrializing, replacing tangible capital formation with “virtual wealth,” that is, financial claims on income and tangible assets. Since 2009, and especially since the Covid crisis of 2020, its economy has been suffering through what is called a K-shaped “recovery.” The stock and bond markets have reached all-time highs to benefit the wealthiest families, but the “real” economy of production and consumption, GDP and employment, has declined for the non-rentier sector, that is, the economy at large.

How do we explain this disparity, if not by recognizing that different dynamics and laws of motion are at work? Gains in wealth increasingly take the form of a rising valuation of rentier financial and property claims on the real economy’s assets and income, headed by rent-extraction rights, not means of production.

Finance capitalism of this sort can survive only by drawing in exponentially increasing gains from outside the system, either by central bank money creation (Quantitative Easing) or by financializing foreign economies, privatizing them to replace low-priced public infrastructure services with rent-seeking monopolies issuing bonds and stocks, largely financed by dollar-based credit seeking capital gains. The problem with this financial imperialism is that it makes client host economies as high-cost as their U.S. and other sponsors in the world’s financial centers.

All economic systems seek to internationalize themselves and extend their rule throughout the world. Today’s revived Cold War should be understood as a fight between what kind of economic system the world will have. Finance capitalism is fighting against nations that restrict its intrusive dynamics and sponsorship of privatization and dismantling of public regulatory power. Unlike industrial capitalism, the rentier aim is not to become a more productive economy by producing goods and selling them at a lower cost than competitors. Finance capitalism’s dynamics are globalist, seeking to use international organizations (the IMF, NATO, the World Bank and U.S.-designed trade and investment sanctions) to overrule national governments that are not controlled by the rentier classes. The aim is to make all economies into finance-capitalist layers of hereditary privilege, imposing anti-labor austerity policies to squeeze a dollarized surplus.

Industrial capitalism’s resistance to this international pressure is necessarily nationalist, because it needs state subsidy and laws to tax and regulate the FIRE sector. But it is losing the fight to finance capitalism, which is turning to be its nemesis just as industrial capitalism was the nemesis of post-feudal landlordship and predatory banking. Industrial capitalism requires state subsidy and infrastructure investment, along with regulatory and taxing power to check the incursion of finance capital. The resulting global conflict is between socialism (the natural evolution of industrial capitalism) and a pro-rentier fascism, a state-finance-capitalist reaction against socialism’s mobilization of state power to roll back the post-feudal rentier interests.

Underlying today’s rivalry felt by the United States against China is thus a clash of economic systems. The real conflict is not so much “America vs. China,” but finance capitalism vs. industrial “state” capitalism/socialism. At stake is whether “the state” will support financialization benefiting the rentier class or build up the industrial economy and overall prosperity.

Apart from their time frame, the other major contrast between finance capitalism and industrial capitalism is the role of government. Industrial capitalism wants government to help “socialize the costs” by subsidizing infrastructure services. By lowering the cost of living (and hence the minimum wage), this leaves more profits to be privatized. Finance capitalism wants to pry these public utilities away from the public domain and make them privatized rent-yielding assets. That raises the economy’s cost structure – and thus is self-defeating from the vantage point of international competition among industrialists.

That is why the lowest-cost and least financialized economies have overtaken the United States, headed by China. The way that Asia, Europe and the United States have reacted to the covid-19 crisis highlights the contrast. The pandemic has forced an estimated 70 percent of local neighborhood restaurants to close in the face of major rent and debt arrears. Renters, unemployed homeowners and commercial real estate investors, as well as numerous consumer sectors are also facing evictions and homelessness, insolvency and foreclosure or distress sales as economic activity plunges.

Less widely noted is how the pandemic has led the Federal Reserve to subsidize the polarization and monopolization of the U.S. economy by making credit available at only a fraction of 1 percent to banks, private equity funds and the nation’s largest corporations, helping them gobble up small and medium-sized businesses in distress.

For a decade after the Obama bank-fraud bailout in 2009, the Fed described its purpose as being to keep the banking system liquid and avoid damage to its bondholders, stockholders and large depositors. The Fed infused the commercial banking system with enough lending power to support stock and bond prices. Liquidity was injected into the banking system by buying government securities, as was normal. But after the covid virus hit in March 2020, the Fed began to buy corporate debt for the first time, including junk bonds. Former FDIC head Sheila Bair and Treasury economist Lawrence Goodman note, the Federal Reserve bought the bonds “of ‘fallen angels’ who sank to junk status during the pandemic” as a result of having indulged in over-leveraged borrowing to pay out dividends and buy their own shares.[11]

Congress considered limiting companies from using the proceeds of the bonds being bought “for outsize executive compensation or shareholder distributions” at the time it approved the facilities, but it made no attempt to deter companies from doing this. Noting that “Sysco used the money to pay dividends to its shareholders while laying off a third of its workforce … a House committee report found that companies benefiting from the facilities laid off more than one million workers from March to September.” Bair and Goodman conclude that “there’s little evidence that the Fed’s corporate debt buy-up benefited society.” Just the opposite: The Fed’s actions “created a further unfair opportunity for large corporations to get even bigger by purchasing competitors with government-subsidized credit.”

The result, they accuse, is transforming the economy’s political shape. “The serial market bailouts by monetary authorities – first the banking system in 2008, and now the entire business world amid the pandemic” has been “a greater threat [to destroy capitalism] than Bernie Sanders.” The Fed’s “super-low interest rates have favored the equity of large companies over their smaller counterparts,” concentrating control of the economy in the hands of firms with the largest access to such credit.

Smaller companies are “the primary source of job creation and innovation,” but do not have access to the almost free credit enjoyed by banks and their largest customers. As a result, the financial sector remains the mother of trusts, concentrating financial and corporate wealth by financing a gobbling-up of smaller companies as giant companies to monopolize the debt and bailout market.

The result of this financialized “big fish eat little fish” concentration is a modern-day version of fascism’s Corporate State. Radhika Desai calls it “creditocracy,” rule by the institutions in control of credit.[12] It is an economic system in which central banks take over economic policy from elected political bodies and the Treasury, thereby completing the process of privatizing economy-wide control.

Footnotes

Photo by Mike Kienle on Unsplash