Figure 1: National Income and Product Accounts1.0 Introduction This post contains some speculation about technical progress. 2.0 Non-Random Innovations and Almost Straight Wage Curves The theory of the production of commodities by means of commodities imposes one restriction on wage-rate of profits curves: They should be downward-sloping. They can be of any convexity. They are high-order polynomials, where the order depends on the number of produced commodities. So no reason exists why they should not change convexity many times in the first quadrant, where the the rate of profits is positive and below the maximum range of profits. The theory of the choice of technique suggests that, if multiple processes are available for producing many commodities, many techniques will contribute

Topics:

Robert Vienneau considers the following as important:

This could be interesting, too:

Robert Vienneau writes Austrian Capital Theory And Triple-Switching In The Corn-Tractor Model

Mike Norman writes The Accursed Tariffs — NeilW

Mike Norman writes IRS has agreed to share migrants’ tax information with ICE

Mike Norman writes Trump’s “Liberation Day”: Another PR Gag, or Global Reorientation Turning Point? — Simplicius

|

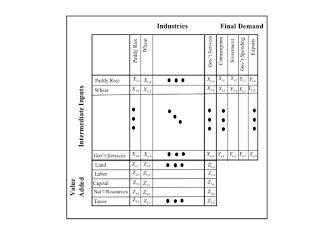

| Figure 1: National Income and Product Accounts |

This post contains some speculation about technical progress.

2.0 Non-Random Innovations and Almost Straight Wage CurvesThe theory of the production of commodities by means of commodities imposes one restriction on wage-rate of profits curves: They should be downward-sloping. They can be of any convexity. They are high-order polynomials, where the order depends on the number of produced commodities. So no reason exists why they should not change convexity many times in the first quadrant, where the the rate of profits is positive and below the maximum range of profits. The theory of the choice of technique suggests that, if multiple processes are available for producing many commodities, many techniques will contribute to part of the wage-rate of profits frontier.

The empirical research does not show this. When I looked at all countries or regions in the world, I found very little visual deviation from straight lines for most wage curves, for the ruling technique1. The exceptions tended to be undeveloped countries. Han and Schefold, in their empirical search for capital-theoretic paradoxes in OECD countries, also found mostly straight curves. And only a few techniques appeared on the frontier.

I have a qualitative explanation of this discrepancy between expectations from theory and empirical results. The theory I draw on above takes technology as given. It is as if economies are analyzed based on an instantaneous snapshot. But technology evolves as a dynamic process. The flows among industries and final demands have been built up over decades, if not centuries.

In advanced economies, technology does not change randomly. Large corporations have Research and Development departments, universities form extensive networks, and the government sponsors efforts to advance Technology Readiness Levels2. Sponsored research is not directed randomly. Technical feasibility is an issue, albeit that changes over time. Another concern is what is costly at the moment, with cost being defined widely. I suggest a constant effort to lower a reliance on high cost inputs in production process, over time, results in coefficients of production being lowered such that wage curves become more straight3.

The above story suggests that one should develop some mathematical theorems. I am aware of two areas of research in Sraffian economics that seem promising for further inquiry along these lines. First, consider Luigi Pasinetti's structural economic dynamics. I have an analysis of hardware and software costs in computer systems, which might be suggestive. Second, Bertram Schefold has been analyzing the relationship between the shape of wage curves; random matrices; and eigenvalues, including eigenvalues other than the Perron-Frobenius root.

3.0 Innovations Dividing Columns in Input-Output Table, Not Adjoining Completely New OnesI have been moping during my day job how I cannot keep up with some of my fellow software developers. I return to, say, Java programming after a few years, and there is a whole new set of tools. And yet, much of what I have learned did not even exist when I received either of my college degrees. For example, creating an Android app in Android Studio or IntelliJ involves, minimally, XML, Java, and Virtual Machines for testing. Back in the 1980s, I saw some presentations from Marvin Zelkowitz for what might be described as an Integrated Development Environment (IDE). He had an editor that understood Pascal syntax, suggested statement completions, and, if I recall correctly, could be used to set breakpoints and examine states for executing code. I do not know how this work fed, for example, Eclipse.

Nowadays, you can specialize in developing web apps4. Some of my co-workers are Certified Information Systems Security Professionals (CISSPs). They know a lot of concepts that are sort of orthogonal to programming5. I also know people that work at Security Operations Centers (SOCs)6. And there are many other software specialities.

In short, software should no longer be considered a single industry. Glancing quickly at the web site for the Bureau of Economic Analysis, I note the following industries in the 2007 benchmark input-output tables:

- Software publishers (511200)

- Data processing, hosting, and related services (518200)

- Internet publishing and broadcasting and Web search portals (518200)

- Custom computer programming services (541511)

- Computer systems design services (541512)

- Other computer related services, including facilities management (54151A)

Coders, programmers, and software engineers definitely provide labor inputs in many other industries. Cybersecurity does not even appear above.

What would input-tables looked like, for software, in the 1970s? I speculate you might find industries for the manufacture of computers, telecommunication equipment, and satellites & space vehicles. And data processing would probably be an industry.

I am thinking that new industries come about, in modern economies, more by division and greater articulation of existing industries, not by suddenly creating completely new products. And this can be seen in divisions and movements in industries in National Income and Product Accounts (NIPA). One might explore innovation over the last half-century or so by looking at the evolution of industry taxonomies in the NIPA.7.

4.0 ConclusionThis post suggests some research directions8. At this point, I do not intend to pursue either.

Footnotes- Reviewers, several years ago, had three major objections to this paper. One was that I had to offer some suggestion why wage curves should be so straight. The other two were that I needed to offer a more comprehensive explanation of how to map from the raw data to the input-output tables I used and that I had to account for fixed capital and depreciation.

- John Kenneth Galbraith's The New Industrial State is a somewhat dated analysis of these themes.

- They also move outward.

- The web is not old. Tools like Glassfish, Tomcat, and JBoss, and their commercial competitors are neat.

- Such as Confidentiality, Integrity, and Availability; two-factor identification; Role-Based Access Control; taxonomies for vulnerabilities and intrusions; Public Key Infrastructure; symmetric and non-symmetric encryption; the Risk Management Framework (RMF) for Information Assurance (IA) Certification and Accreditation; and on and on.

- A SOC differs from a Network Operations Center. Operators of a SOC have to know about host-based and network-based Intrusion Detection, Security Incident and Event Management (SIEM) systems, Situation Awareness, forensics, and so on.

- One should be aware that part of the growth on the tracking of industries might be because computer technology has evolved. Von Neumann worried about numerical methods for calculating matrix inverses. Much bigger matrices are practical now.

- I do not think my ideas in Section 3 are expressed well.

Heterodox

Heterodox