Overall, the NDP leadership race has provided a lot for progressive economists to be excited about. From progressive tax reform to fair wages and worker’s rights, poverty fighting income transfers to new universal social programs, the four leadership candidates have put substantive and laudable social democratic proposals on the table. Unfortunately, the last debate waded into unhelpful – if not disingenuous – exchanges on income transfers, means testing and universality, particularly on the topic of Jagmeet Singh’s proposed senior’s guarantee. In the interest of supporting well-informed and honest debate, I want to take this opportunity to clarify what Singh has proposed, and elaborate on why I think targeted income transfers are useful and progressive tools in the fight for economic

Topics:

Angella MacEwen considers the following as important: Old Age Security, pensions, Poverty, progressive economic strategies, seniors

This could be interesting, too:

Nick Falvo writes Subsidized housing for francophone seniors in minority situations

Nick Falvo writes Homelessness among older persons

Nick Falvo writes Homelessness planning during COVID

Nick Falvo writes Demand-side housing assistance

Overall, the NDP leadership race has provided a lot for progressive economists to be excited about.

From progressive tax reform to fair wages and worker’s rights, poverty fighting income transfers to new universal social programs, the four leadership candidates have put substantive and laudable social democratic proposals on the table.

Unfortunately, the last debate waded into unhelpful – if not disingenuous – exchanges on income transfers, means testing and universality, particularly on the topic of Jagmeet Singh’s proposed senior’s guarantee. In the interest of supporting well-informed and honest debate, I want to take this opportunity to clarify what Singh has proposed, and elaborate on why I think targeted income transfers are useful and progressive tools in the fight for economic equality.

What is the Canada Seniors Guarantee?

Critiques of Singh’s income security policy have mainly focused on the Canada Seniors Guarantee, which proposes some changes to the current Old Age Security (OAS).

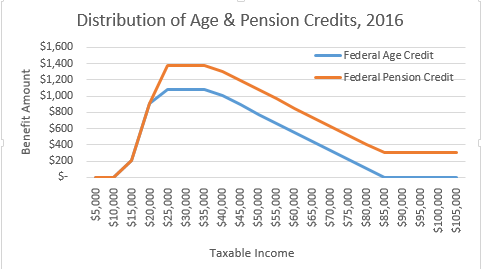

The guarantee combines a number of existing seniors’ benefits into a single income tested benefit, administered through the tax system. This includes OAS, and the Guaranteed Income Supplement (GIS), but also the regressive & non-refundable Age and Pension Income credits. By adding the Age Credit and the Pension Income Credit, Singh claims an additional $4 billion will be added to the core benefits provided by OAS / GIS. (According to federal tax expenditure data, in 2016 the Age Credit cost $3.3 billion and the Pension Income Credit cost $1.2 billion.)

(Update: this graph only shows the combined Age and Pension benefit available to a single individual, some higher income earners in a couple may have higher benefits from spousal amounts.)

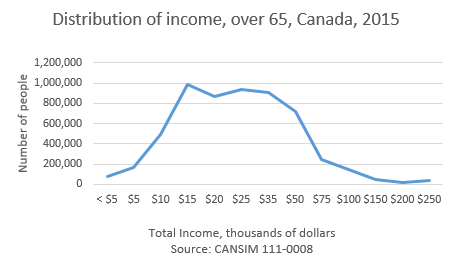

Some of the confusion results from critics who suggest that the OAS is universal. As Andrew Jackson rightly pointed out, OAS begins to be clawed back for those with incomes around $75,000 and is fully phased out for those with taxable income of $120,000. But Guy Caron was correct in pointing out that OAS is near universal, since the vast majority of seniors have taxable income below $75,000. Among those over 65 with any income, fewer than 10% have total incomes over $75,000, and about 4% have total incomes over $100,000 (See CANSIM 111-0008).

I asked Singh’s campaign for more details, and they told me that his new benefit would fully phase out by the time a senior’s individual taxable income is $100,000. Along with the $4 billion from the reallocation of the age credit and the pension credit, this allows a significant increase in benefits for seniors with low and middle incomes by redistributing income that currently goes to the top 5%-10% of income earners over 65.

Not all means-testing is the same.

It is important to note that all four candidates are proposing income tested supports in some capacity – Caron’s basic income, Ashton’s expansion of the GIS and GST tax credits, and Angus’ call for an expansion of the Working Income Tax Benefit (WITB). As they should— income transfers are a key social policy tool in the fight against poverty.

While income-testing is a form of means-testing, some have conflated Singh’s proposed targeted income transfers with other degrading means tests — the endless forms and surveillance rightly reviled for the stigma, barriers and hardship they create for many who rely on provincial social assistance programs. This is clearly an incorrect characterization of his seniors guarantee.

There are also those that suggest that by supporting income tested transfers, one leaves the door open for attacks on universal public programs and services (“the rich can pay for their healthcare”). Social democrats agree that universal social programs serve a public good in and of themselves, that there are social and economic rights that every citizen is entitled to, regardless of means. The debate surrounding targeted poverty reduction methods should not be confused with an attack on these universal programs. All of the leadership candidates, including Singh, are clearly on record supporting universal childcare, pharmacare, and homecare, as well as income tested supports.

Lost in the critiques of Singh’s proposed adjustments to OAS is the fact it is that he is increasing the progressiveness of benefits that are already delivered through the tax system, and that the vast majority of seniors would see an increase in their benefits.

Of course, as Jackson and Rozworski have argued, there is an important case to be made for solidaristic income security programs that are universal, to say nothing of universal social programs Singh clearly supports, and which can build support across social classes for economic security measures delivered as a right.

Difference is good.

While it is useful to clarify our thinking on which programs are best delivered as targeted income transfers, and which are better as delivered universal transfers or services, it is important to remember that the differences between the four candidates on this point are very small. All four candidates are putting forward exciting ideas that are clearly to the left of the debates we had in the last federal election, to say nothing of the current Liberal government.

It’s always good to remember that violent agreement does nothing to advance our thinking. Constructive and honest debate is necessary, healthy – and exciting for lefty policy wonks!

Now let’s have a debate that highlights the flaws in the federal government’s privatization / corporate welfare industrial policy.

Enjoy and share: