From Peter Radford Taxes. What a problem. I was going to start by saying something about our current national debate about taxes, but that would have been an untruth. We are not having a debate. Instead we are all sitting on the sidelines whilst the Republican Party desperately tries to cobble together a tax plan in order to fulfill one of the promises it made during last year’s election. That this would be the only major promise thus fulfilled we can ignore for now. Instead, I think I will start with an observation I have made many times before: the American tax code is ridiculously complex and inefficient. It is also rigged, although the real extent of the rigging only comes into focus when we take a look at the budget that the tax code nestles within. One of the sneaky ways that

Topics:

Peter Radford considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from Peter Radford

Taxes. What a problem.

I was going to start by saying something about our current national debate about taxes, but that would have been an untruth. We are not having a debate. Instead we are all sitting on the sidelines whilst the Republican Party desperately tries to cobble together a tax plan in order to fulfill one of the promises it made during last year’s election. That this would be the only major promise thus fulfilled we can ignore for now.

Instead, I think I will start with an observation I have made many times before: the American tax code is ridiculously complex and inefficient. It is also rigged, although the real extent of the rigging only comes into focus when we take a look at the budget that the tax code nestles within.

One of the sneaky ways that politicians of both parties communicate about government spending is to talk only in terms of programs funded out of revenues. That’s obviously a sensible thing to do. So we hear all about such-and-such a program costing $xx billion or trillion dollars which is invariably then presented as YY% of the total budget.

This is sneaky because it immediately creates a framework for conversation about programs and policies. In particular it opens up programs to easy public scrutiny and criticism of their expense. The most oft attacked programs — things like welfare and poverty amelioration activities — are easy targets when their cost is presented in clear dollar amounts or as shares of total revenues.

Indeed anything that is a line item in the budget becomes an easily understood and vulnerable target.

But here’s the really sneaky part:

There’s a distinct bias in the type of policies or programs that become separate line items in the budget. They tend to be things associates with low income voters, the young, the sick, and so on. Other policies get their funding in more roundabout ways so their cost is hidden from view and the public has a hard time focusing on them.

Here’s what I mean:

Tax expenditures are the big game in town.

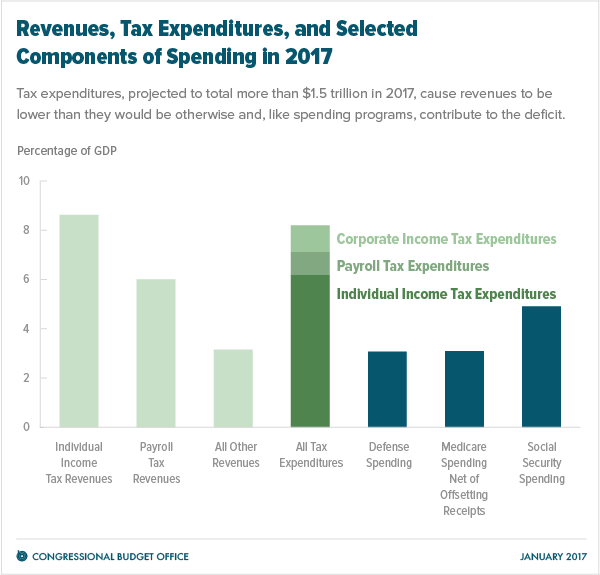

The green bars on the left of the chart are revenues actually collected by the government. That’s the cash used to fund programs like defense spending which is shown as one of the blue bars on the right. It’s the central bar where the real action takes place.

Tax expenditures are the cost of loopholes in the tax code. They are a measure of the cash the government didn’t collect because of some program or policy that ended up being paid for by rigging taxes.

And they add up to an enormous amount of money each year. Just a quick look at the chart above shows that the loopholes in the tax code leak away enough cash to pay for both defense and Social Security with change left over.

Here’s a list of the biggest tax expenditures:

The biggest loopholes benefit the middle class and business. They are huge costs to the budget. And they are very difficult to locate in the budget because they don’t exist as cash expenditure.

Middle class critics can thus attack welfare spending because it’s explicit whilst remaining blissfully ignorant about how much they, themselves, also benefit from government largesse.

Which gets me to one more thing:

There’s a strangeness to the current tax conversation. It all seems so dated.

We are being told that we need a massive reduction in corporate tax burdens in order to boost profitability and encourage investment. But American businesses are already highly profitable: profits as a percentage of the total economy are high and have been rising. There is no evidence of a profitability problem. Plus, corporations are sitting on piles of cash. They are not so cash strapped that they are forgoing oodles of great investment opportunities. On the contrary, they seem to have no idea what to do with their cash. So they are reduced to shoveling it back to shareholders rather than investing in expansion.

The economy doesn’t look very supply side constrained when you take current profitability and cash hoarding into account. The problem seems much more acute on the demand side. Were there more demand all that cash could be invested in expansion.

And yet: employment is also doing well. Unemployment is fairly low, even given the very slow recovery from 2007/2008, and the tepid policy response since.

Inflation is also low. So too are interest rates.

So why the sudden urgent need to “reform” taxes to free up the economy and get it going again?

Ideology, naturally, plays a part. Republicans always want to reduce taxes for the rich. It’s what they do. And, yes, there is merit in true tax reform to simplify the tax code and get rid of those loopholes. A lower tax burden is always an attractive policy for anyone concerned with winning the popular vote. The problem is that the current Republican tax plan seems designed to solve problems that existed in the 1970’s, not those of today.

Ideology also plays its part in framing the discussion around corporate goals. The drumbeat for short term increases in profits is so loud that it drowns out any sensible discussion about wider issues of corporate governance and financing. The shareholder value mantra long ago destroyed any alternative conception of corporate purpose and has contributed mightily to a sense of malaise in the workplace that then engenders urgency to do something. Yet that something ought not to be to pour more cash down the maw of managerial capitalism. It is not money well spent, and it encourages corruption within business and, by extension, in politics as lobbyists crawl all over Washington and subvert our democracy.

So here’s the thing:

If we have decent levels of employment; high profits; low inflation; low interest rates; and tons of investable cash, why are we discussing a tax plan that will do nothing for employment; might increase inflation; might raise interest rates; and will add to the tons of investable cash?

Why are we partying like it’s the 1970’s.

Why aren’t we simplifying the tax code, getting rid of the loopholes, and moving the tax burden upwards so that the folks who have the income to be taxed pay the taxes?

Ideology.

It is the 1970’s after all. Isn’t it?