ROBERT SKIDELSKY and SIMONE GASPERIN (2021) Abstract: This paper upholds the classical Keynesian position that a laissez-faire market economy lacks a spontaneous tendency to full employment. Focusing on the UK case, it argues that monetary policy could not prevent the economic collapse of 2008-9 or achieve full recovery from the Great Recession that followed. The paper then outlines the case for fiscal policy to regain a permanent status of primacy in modern macroeconomic management, beyond the pandemic emergency. It distinguishes between public investment and automatic stabilisers, reducing discretionary actions to a minimum. It presents the case for re-empowering the State’s public investment function and for reforming the system of automatic counter-cyclical stabilisers by

Topics:

Robert Skidelsky considers the following as important: Academic papers

This could be interesting, too:

Robert Skidelsky writes Full Employment, as the Hearth of the Cultural Economics of Orban

Robert Skidelsky writes How to Achieve Shorter Working Hours

Robert Skidelsky writes Stylised Facts

Robert Skidelsky writes How would Keynes have analysed the Great Recession of 2008 and 2009?

ROBERT SKIDELSKY and SIMONE GASPERIN (2021)

Abstract:

This paper upholds the classical Keynesian position that a laissez-faire market economy lacks a spontaneous tendency to full employment. Focusing on the UK case, it argues that monetary policy could not prevent the economic collapse of 2008-9 or achieve full recovery from the Great Recession that followed. The paper then outlines the case for fiscal policy to regain a permanent status of primacy in modern macroeconomic management, beyond the pandemic emergency. It distinguishes between public investment and automatic stabilisers, reducing discretionary actions to a minimum. It presents the case for re-empowering the State’s public investment function and for reforming the system of automatic counter-cyclical stabilisers by means of public jobs programmes.

1. Introduction

Even before the advent of the pandemic crisis, economic policy had begun to inch back to the use of fiscal instruments after decades of belief in the efficacy of monetary policy to maintain the lowest possible –i.e. non-accelerating inflation –rate of unemployment (NAIRU). Already in an October 2019 speech, former ECB Chairman Mario Draghi was talking about “fiscal policy playing a more supportive role alongside monetary policy.”This reappraisal followed the failure of quantitative easing (QE) to providethe promised recovery in prices and output after the Great Recession. Conventional economic theory could not explain why trillions of QE assets remained stuck in bank deposits offering negative real rates of return. Even the very same Central Banks that have implemented unconventional monetary policy programmes have recently admitted that “important knowledge gaps remain” over the “technical understanding of QE” (Bank of England, 2021b).Disappointment over monetary policy has coincided with a much more positive reading of the global fiscal boost in 2008-9, and a much more negative interpretation of Europe’s subsequent espousal of fiscal ‘consolidation’. A notable turning point was the rehabilitation of fiscal multipliers in 2013 by the IMF Chief Economist (Blanchard and Leigh, 2013), whose findings have been recently confirmed and extended (Fatas & Summer, 2018; Brancaccio and De Cristofaro, 2020). This reflected both disappointment with the results of monetary policy and the reduced costs of fiscal policy opened up by interest rates stuck at the zero lower bound. In short, the economic crisis of 2008 exposed long-standing muddles in conventional macroeconomic theory, with vicious interrelated consequences (Gabellini and Gasperin, 2019). However, no generally agreed vision exists for future conduct of macroeconomic policy. While monetary policy is generally viewed as insufficient to safeguard macroeconomic stability, the demand for fiscal ‘help’ is still far from being a principled discussion, more in the nature of a temporary emergency response to an unexpected shock, as championed by IMF Chief Economist Gita Gopinath (2020) or by the Governor of the Bank of England Andrew Bailey (2021), who merely sees fiscal policy as “helping to spread the cost of this [Covid-19] shock over time”. During the COVID-19 lockdowns, governments have run up deficits and debts unprecedented in peacetime, without abandoning the consensual theory of what constitutes fiscal prudence in the long term.Our proposition is that fiscal policy should be reinstated as part of a coherent and permanent framework for macroeconomic policy. In fact, the economic recovery that will follow the gradual resolution of the pandemic emergency will leave economies with higher debt-to-GDP ratios.A return to fiscal consolidation, without any consideration to the actual level of activity, must be avoided.1 This paper sketches the principles of a new fiscal policy approach, which would allow the maintenance of employment and output as near as possible to their optimal levels, while minimising the scope for discretionary spending driven by special interests. The focus is on the UK case.Section 2 of the paper outlines the main features of pre-crash orthodoxy. Section 3 shows how monetary policy failed in practice to stabilise the economy, both before and after the crash. Section 4 explains the causes of this failure. Section 5 outlines the case for reinstating fiscal policy. Section 6 discusses the importance of public investments in protecting against cyclical shocks and improving the long-run performance of the economy. Section 7 proposes a strengthening of the system of automatic fiscal stabilisers, embracing the introduction of a public sector job programme. Section 8 summarises the elements of theproposed fiscal approach.

2. Pre-crash macroeconomic orthodoxy

Pre-crash macroeconomic orthodox policy was essentially underpinned by the following beliefs:

(1) The belief in optimally self-regulating markets, with the supposed existence of a ‘natural’ rate of unemployment to which the economy automatically converges.This is associated with the rational expectations revolution of the 1970s, championed by Robert Lucas and Thomas Sargent. In their models (Lucas, 1972) there is no uncertainty, only risk,and wages and prices are flexible. The ‘New Keynesians’ pointed out that the existence of sticky nominal prices and wages prevented the economy from being optimally self-adjusting (Mankiw and Romer, 1991), but mainstream policy saw this fact as an invitation to de-regulate product and labour markets. It was, therefore, the economics of Lucas and his school which provided a theoretical underpinning for the Thatcher and Reagan liberalisations and labour market reforms of the 1980s. On top of this, Eugene Fama’s (1970) ‘efficient market hypothesis’ rationalised financial de-regulation and justified the expansion of banking, as giving a promise of uninterrupted liquidity.

(2) The control of inflation is a necessary and normally sufficient condition for macroeconomic stability. This is attributed to Milton Friedman’s (1968) elegant demonstration that competitive market economies2would be stable at their ‘natural rate of unemployment’ provided the rate of inflation was kept low and constant.

(3) Monetary policy is superior to fiscal policy for stabilisation purposes. This also followed from Milton Friedman’s argument3that fiscal policy operates only with ‘long and variable lags’, so that government interventions are likely to have their impact in the wrong phase of the business cycle.

(4) Stabilisation policy should be carried out by independent central banks,4insulated from political interference and applying mechanical rules. In contrast, the vote-seeking propensity of politicians would infallibly lead them to overheat the economy by running budget deficits at full employment.

(5) The State is less efficient in allocating capital than the private sector. Although Adam Smith ([1776] 1976) recognised the State’s responsibility to provide public goods such as transport and education, this was downplayed by his successors. David Ricardo (1817) notably remarked that only ‘productive industry’ could generate useful capital. This kind of reasoning underpinned the marginalisation of the State’s investment function from the 1970s. It also fed the idea that State budgets should be balanced at the lowest feasible level of taxes and revenues to prevent them from ‘stealing’ productive resources from private industry.

In summary, orthodox theory held that fiscal policy should have little or no influence either on the economy’s level of output or upon the allocation of capital.The year 1976 represented the symbolic point of hegemonic transition from Keynesian fiscal to Friedmanite monetary policy, particularly in the UK.That year James Callaghan, Labour’s prime minister, told his party conference5 (quoted in Skidelsky, 2018, pp. 169-170):“We used to think that you could spend your way out of a recession, and increase employment by cutting taxes and boosting government spending. I tell you in all candour that that option no longer exists, and that in so far as it ever did exist, it only worked on each occasion since the war by injecting a bigger dose of inflation into the economy, followed by a higher level of unemployment as the next step. Higher inflation followed by higher unemployment…That is the history of the last twenty years.”

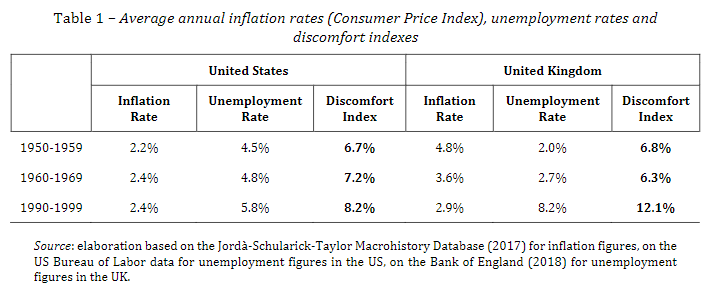

Economists will recognise this as the death sentence ofPhillips Curve Keynesianism (Phillips, 1958). Prime Minister Callaghan’s account, which echoed Friedman’s narrative of the 1960s, ignored the fact that the average inflation rate in the UK was lowerin the 1960s than it had been in the 1950s, while in the United States it was about the same (table 1). The record shows that full employment and low inflation –coinciding with a low ‘Discomfort Index’, the sum of the rates for inflation and unemployment popularised later by the McCracken Report (OECD, 1977) -were perfectly compatible with intelligent Keynesian fiscal policies. In contrast, the golden age of macroeconomic monetarist management (i.e. the 1990s) recorded higher Discomfort Indexes, due to the inability to reduce unemployment down to the levels of the 1950s and 1960s. Moreover, the relative importance of those two macroeconomic objectives shifted away from the full-employment commitment of the Keynesian era to the univocal obsession with inflationtargets, embedded in the policy approach of major central banks during the 1990s.6What these figures also show is that the so-called ‘fiscal theory of inflation’ -the theory that the government would always use inflation to meet its budget constraint -is at the very least vastly exaggerated. Although inflation was starting to rise at the end of the 1960s it really only took off in the 1970s, under the influence of a coordinated world boom (which caused a dramatic rise in commodity prices), the first oil price shock and the breakdown of the international monetary system (Skidelsky, 2018, pp. 164-167).

Friedman’s explanation of the higher rates of inflation over the 1970s is thus seriously incomplete. As confirmed by Benati (2008, p. 123): “the Great Inflation was due, to a dominant extent, to large demand non-policy shocks, and to a lower extent ―especially in 1973 and 1979 ―to supply shocks.”

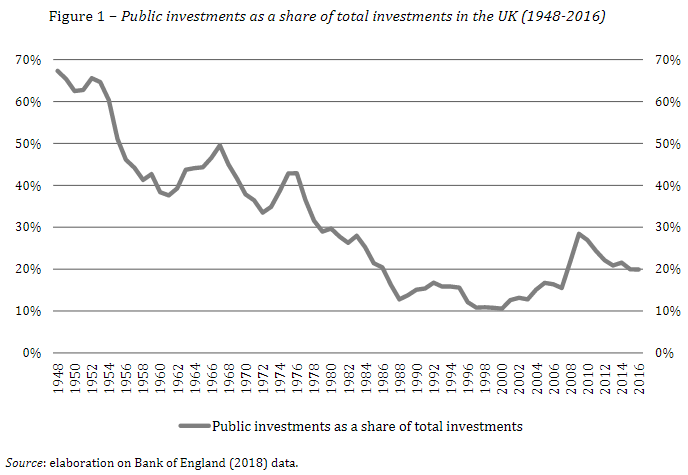

Nevertheless, the stagflation period continued to be considered as the empirical demonstration that demand-management fiscal policy was ultimately ineffective –if not deleterious –as a tool of macroeconomic stabilisation.The withdrawal of the State from stabilisation policy was matched by the shrinkage of its role in allocating capital to guide the investment decisions of private business. Since the mid-1970s, public investment as a share of total investment has steadily fallen indeveloped countries. The UK’s record is illustrative (figure 1): from an average of 47.3% in the years 1948-1976, the public investment share fell to 18.4% in the years 1977-2007. This has left total investment unduly dependent on volatile short-term expectations.

3. The weakness of monetary policy during the Great Moderation and its failure after the 2008 crisis

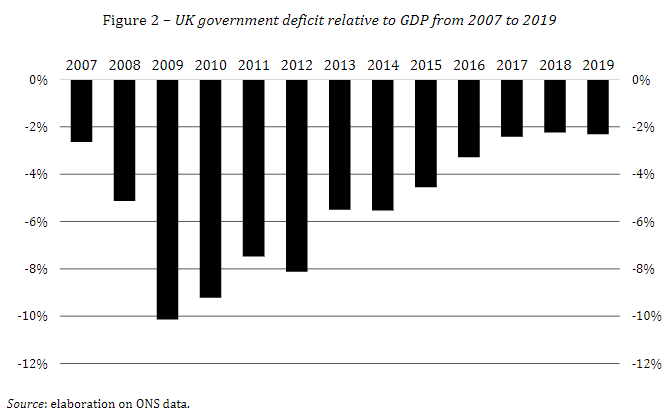

The case for reinstating fiscal policy as the main instrument for macroeconomic stabilisation rests on the limitations of monetary policy. Monetary policy has had a prolonged trial, from the 1980s to the present day. The evidence is consistent with two conclusions.First, central bankers’ achievement of their target rates of inflation during the Great Moderation, which lasted from the mid-1990s to 2008, was more the result of external factors than of good policy, as Roger Bootle argued in The Death of Inflation(1997). Likewise, Mervyn King (1998, p. 2) talked about a “benign environment” for monetary policy during the Great Moderation. Second, since the economic downturn of 2008-9, central banks have been trying in vain to restore the pre-crash trend rate of economic growth. In other words, monetary policy has had much less direct influence on the real economy than orthodox monetary theorists believe, and inflation outcomes are more the result of real-economy developments than their cause.In the immediate post-crash years (2008-2010), monetary and fiscal policy acted together to halt the downturn resulting from the 2008 financial crisis. “Deficits saved the world” declared Paul Krugman (2009). In the UK, government deficit relative to GDP increased above the 9% level in the years 2009-2010, keeping the economy afloat. Subsequent monetary expansion on its own failed to offset the effects of the fiscal consolidation started by the Chancellor of the Exchequer George Osborne in his budget of June 2010 (figure 2).

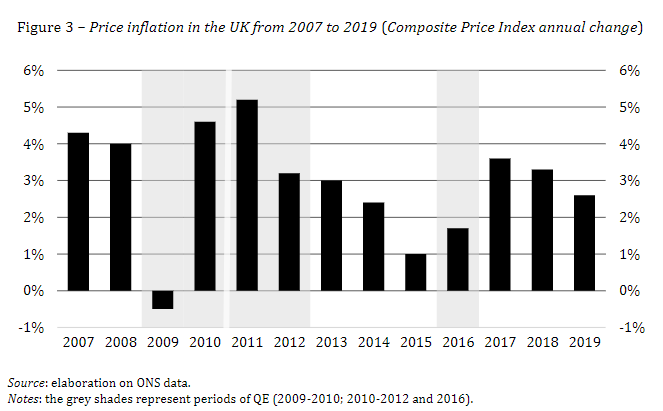

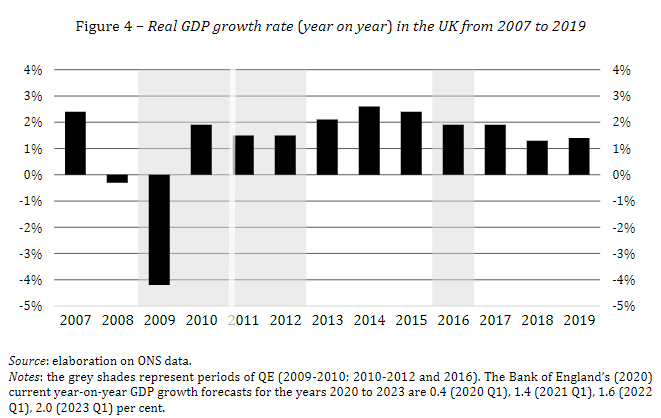

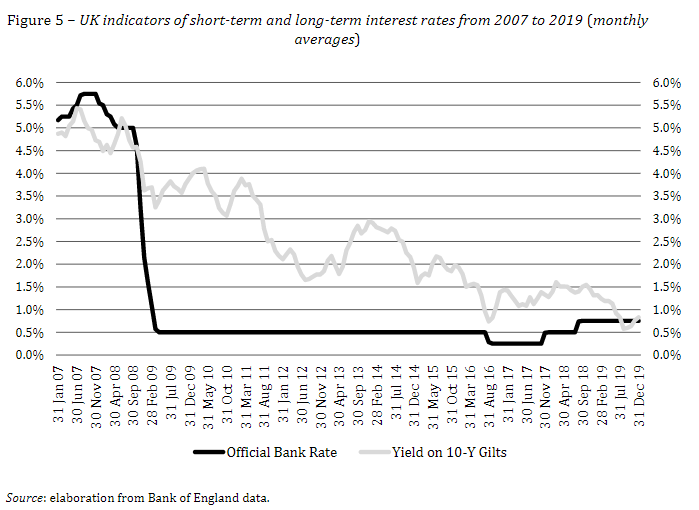

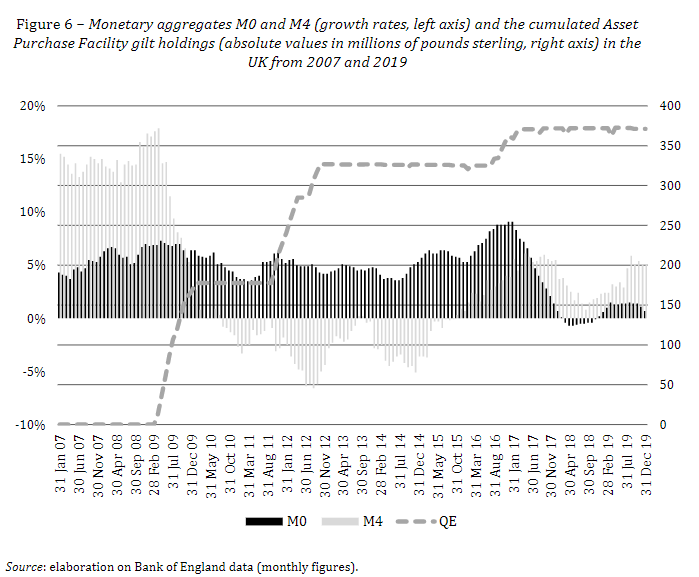

With conventional interest rate policy disabled, as official rates hit the zero lower bound, central banks resorted to ‘unconventional monetary measures’ in the form of quantitative easing, or buying government securities. In the UK, three rounds of quantitative easing (QE) in 2009-10, 2011-12, and 2016 injected into the British economy about £435 billion of ‘high-powered’ money corresponding to 21.8% of GDP in 2016. These measures did not achieve the recovery of prices one would associate with a strong upward movement of the business cycle (figure 3). Most importantly, the main failure of unconventional monetary policy was its inefficacy in revamping economic growth (figure 4). In the post-crisis years (2010-2019), real GDP growth was more than 1 percentage point lower than during the Great Moderation period (1997-2006).

QE was supposed to work through two main transmission channels. First, buying government debt held by banks would cause them to lower interest rates, making it cheaper for households and businesses to borrow money. Secondly, buying both public and commercial debts from non-financial companies, would stimulate investment “by boosting a wide range of

financial asset prices” (Bank of England, 2021a). However, this did not happen as quickly as foreseen, given that total business investment (in real terms) in 2014 was still below its pre-crisis level, with large variations among sectors: already in 2011 investment in real estate was close to its 2007 value, while it took until 2015 for the manufacturing sector to recover its pre-crisis value, confirming the relatively small impact of expansionary monetary policy outside housing (Krugman, 2014).7Slashing the official Bank Rate and implementing an unconventional programme of large-scale purchases of government bonds did lower short-term and long-term interest rates (figure 5), without spurring bank lending and business investment. The only clear impact was on government’s borrowing costs: interest rates on 10-year Gilts fell from 4.02% to 0.83% at the end of 2019, creating a fiscal bonus for extra primary spending.

The underlying expectation of monetary authorities, based on the theory of the money multiplier, was that an increase of base money M0 would lead to a multiplied expansion of broad money M4.8 In fact, as figure 6 shows, the relationship between these two variables in the period 2009-2015 was inverse.

This meant that QE failed to unblock the two expected transition channels from money to output and prices: the demand for bank loans did not respond to the lower structure of interest rates enabled by QE and asset owners (i.e. households and businesses) did not increase their spending (see Author, 2018, pp. 258-273). It was not the scarcity of liquidity that stopped businesses from investing, but rather a lack of demand, reinforced by the concurrent implementation of contractionary fiscal policy.

4. Theoretical shortcomings of monetary policy

The mediocre results achieved by monetary policy point to a key theoretical weakness: the scant attention paid to the causes and existence of what Keynes ([1936] 2018) called the “speculative-motive” or demand for money. In expecting QE to generate increased business

investment, the Bank of England ignored the possibility that the cash proceeds of the Bank’s bond sales would be ‘hoarded’, rather than spent. The United Kingdom Economic Accounts compiled by the ONS show that total currency and depositsof non-financial corporations in the UK increased from £ 428 billion in 2009 to £ 750 billion ten years later.The emergence of ‘idle balances’ was a well-established explanation of business downturns before Keynes. It was stated clearly by Hawtrey in 1925 (p. 42):

“When trade is slack, traders accumulate cash balances because the prospects for profit for any enterprise are slight, and the rate of interest from any investment is low. When trade is active, an idle balance is a more serious loss, and tradershasten to use all their resources in the business.”

Keynes took hold of the idea of ‘liquidity preference’ in the General Theoryand ran with it. First, he thought of it arising not just in moments of anxiety but as a normal condition of capitalist economies, given the inherent uncertainty about the future. It is his basic explanation of long-run underemployment equilibrium. Second, he thought of the rate of interest as the ‘price’ of dishoarding, not the reward for saving. Savings could not therefore be treated as ‘loanable funds’, whose rate of return had only to come down for investment to pick up. Third, absent official intervention, the liquidity premium attaching to money would prevent the establishment of a long-run rate of interest consistent with continuous full employment. Fourth, Keynes distinguished clearly between the cost of capital and the demand for capital. Central Bank policy can influence the financing of credit, but not the decision to invest which ultimately depends on the expected returns from the investment. QE adds to the liquid reserves of banks and corporations, it does not automatically reduce ‘risky’ lending rates or increase the marginal efficiency of capital.The Bank of England also ignored the distributional effects of its bondbuying policy. Its assumption was that, by raising asset prices, QE would automatically deliver the ‘wealth effect’ of increased consumption. Nevertheless, given the different class propensities to consume, this ‘effect’ turned out to be too small to stabilise consumption, with much of it being hoarded by wealthier individuals. Summing up this line of argument, the quantity of money is not an independent variable that affects lending and spending activities. The causality is rather the opposite: money circulation through the lending process depends on the level of economic activity (McLeay et al., 2014). How much QE-generated purchasing power is spent producing output depends on business expectations, and these ultimately depend on the state of effective demand, that is, having ‘consumers at the door’.

5. The need for fiscal policy and the conditions of its reinstatement

The Keynesian case for macroeconomic policy rests on the claim that a market economy lacks any efficacious internal mechanism for reaching and maintaining full employment. Moreover, because of radical uncertainty, investment is subject to sudden collapses. Such downturns, far from triggering V-shaped recoveries via flexible wages and prices, lead to a more general decline in aggregate demand. Monetary policy on its own is relatively powerless to prevent the collapse of business expectations or to counter the ensuing fall in aggregate demand.

This leads to the case for reinstating fiscal policy as a ‘necessary’ and ‘permanent’ tool of macroeconomic management.9The prime objective of fiscal policy should be to influence the level of aggregate demand in order to eradicate involuntary unemployment, accommodating the highest growth potential of the economy. A distinction needs to be made between capital and current spending.10Although both play a part in influencing demand, their functions are partly different. The role of capital spending is to help equip the economy with the infrastructures and the capital goods it needs for achieving better productive capabilities and a superior growth rate of the economy. The role of current spending is to provide the necessary resources for the government to carry out its ordinary functions, such as the provision of goods and services to the population, especially when it comes to offsetting short-term collapses, as in the recent case of the COVID-19 crisis.Following from these distinctions, fiscal policy should be reinstated in its double aspect of steadying total investment and offsetting cyclical disturbances through more automatic mechanisms.

6. The role of public investment

The return of macroeconomic policy management in normal times requires a permanent public investment function for the State. In the final chapter of his General Theory, Keynes ([1936] 2018, p. 336) stated the logic behind it as follows: “It seems unlikelythat the influence of banking policy on the rate of interest will be sufficient by itself to determine an optimum rate of investment. I conceive, therefore, that a somewhat comprehensive socialisation of investment will prove the only means of securing anapproximation to full employment;though this need not exclude all manner of compromises and of devices by which public authority will co-operate with private initiative.” The State should therefore determine the volume, and influence the direction,of investment by its own capital spending, and not just seek to influence the price(i.e. the interest rate) of investment through monetary policy.This was fully recognised in the Keynesian era, when the large share of public investment over total investment contributed to reducing the inherent volatility of private investment (figure 1). The logic of this argument is that public investment level should be partly independent of the business cycle and based on “long views and on the basis of the general social advantage”11(Keynes, [1936] 2018, p. 143). When the economy slows down, public investment programmes should be maintained, independently from short-term public financing needs. A guaranteed flow of public projects would provide the expectational foundation of a growing economy, by reducing the scope for violent fluctuations in overall investment (Kalecki, 1971).12This is now increasingly supported by recent empirical evidence, which seems to confirm that ‘Schumpeterian’ public investments have sizeable multiplier and accelerator effects (Deleidi and Mazzucato, 2019). For a sample of eleven Eurozone countries (1970-2016), Deleidi et al. (2020, p. 354) have found that “fiscal multipliers tend to be larger than one and an increase in public investment engenders a permanent and persistent effect on the level of output”. Similar results are obtained with respect to public investment and military spending by Gechert & Rannenberg (2018), based on a collection of 98 existing studies. Estimates of this long-term ‘supermultiplier’ effects (Deleidi et al., 2019) for the US economy (1947-2017) report multiplier values on GDP to be 2.12 for direct public investment (including R&D), up to 7.76 for non-military R&D public investment. Public investment is performed by central and local governments or by government-controlled entities. In the first case, investment spending is often contracted out to the private sector, which assumes the responsibility for implementing the single investment projects. This normally increases the cost effectiveness of investment projects, while affecting the planning capacity of the State when it comes to promptly executing its investment programmes (Kattel and Mazzucato, 2018).Alternatively, public investment projects could be ‘internalised’,by making use of dedicated public agencies, which represent a more direct tool of policy intervention and state planning. In the UK, a significant share of public investments is performed by public corporations, whose investments are accounted separately from other business investments.13However, the share of public investments performed by public corporations in recent decades have been significantly lower than in the post-war years. The average share of investments made by public corporations from the early 1950s until the late 1970s was 44.5%, while it only represented 18.4% in the 1980-2016 period.14This is mostly explained by the privatisation of previous State corporations, operated throughout the 1980s, which compromised the capacity of the BritishState to directly orient public investments in a more targeted way. A more effective role for the State in planning its investment programmes does not necessary imply the re-nationalisation of large chunks of the economy. Nevertheless, the macroeconomic efficacy of public investment can be reinforced with a further internalisation of investment projects within existing public entities and with a greater involvement in the coordination of investments performed by private businesses, as notably advocated decades ago by the Nobel Laureate James Meade (1970).

7. The role of public jobs programmes

The normalisation of fiscal policy as a tool to reach and maintain full employment is complemented by the role that automatic fiscal stabilisers play in taming thebusiness cycle. These can be further strengthened by means of public sector job programmes, which would directly offset cyclical variations in employment.According to Paul Samuelson (1948, pp. 332-334): “the modern fiscal system has great inherent automatic stabilizing properties.” When the economy turns down, government tax receipts fall and spending on unemployment benefits and other transfers rise, creating an automatic deficit which offsets the fall in private spending (or in terms of the national income identity offsets the rise in private sector saving). When the economy recovers the budget automatically re-balances. Following on from Minsky’s early theorisation of the government as “an employer of last resort” (1986; 2013), and in line with the existing policy research from the Levy Institute in the US15(Wray et al., 2018), this paper advocates a Public Job Programme (PJP). This is tailored for the UK economy, but can readily be applied in other countries. It would not only restrict discretion overfiscal policy, but it would also constitute a much more powerful –and modern –counter-cyclical stabiliser than the system described by Samuelson.

7.1 Earlier versions of public job programmes

Far from being a revolutionary innovation, the PJP idea is “plain common sense” as Keynes and Henderson (1929, p. 10) put it when backing Lloyd George’s programme of loan-financed public works to reduce the then high level of British unemployment.The Lloyd George plan did not see the light in the UK, but it would soon find its most famous realisation in the New Deal programmes under US President Franklin D. Roosevelt. Reflecting on the Works Progressive Administration (WPA), a programme that was employing 3.3 million workers in 1938, Donald S. Howard wrotein 1943 (p. 126):“An enumeration of all the projects undertaken and completed by the WPA during its lifetime would include almost every type of work imaginable […] from the construction of highways to the extermination of rats; from the building of stadiums to the stuffing of birds; from the improvement of airplane landing fields to the making of Braille books; from the building of over a million of the now famous privies to the playing of the world’s greatest symphonies.”Similarly, the Civilian Conservation Corps (CCC) was designed to provide young unemployed men (around 1 million) with work on projects that included (Merill, 1981, p. 197):“The prevention of forest fires […] plant pest and disease control, the construction, maintenance and repair of paths, trails and fire-lanes in the national parks and national forests and such other work […] as the President may determine to be desirable.”Its rationale was later succinctly stated by the US National Commission on Technology, Automation and Economic Progress in 1966 (p. 110):“With the best of fiscal and monetary policies, there will always be those handicapped in the competition for jobs by lack of education, skill, experience, or because of discrimination. The needs of our society provide ample opportunities to fulfilthe promise of the Employment Act of 1946: ‘a job for all those able, willing, and seeking to work’. We recommend a program of public service employment, providing, in effect, that the Government be an employer of last resort, providing work for the ‘hard-core unemployed’ in useful communal enterprises.”The Humphrey-Hawkins Act of 1978 authorised the US Federal government to create a ‘reservoir of public employment’ to balance fluctuations in private spending. The reservoir would automatically deplete or fill up as the economy waxed or waned, creating an ‘automatic stabiliser’. However, the Humphrey-Hawkins Act was never implemented. It represented the last gasp of New Dealism. In later decades, sporadic attempts to implement a job guarantee policy have struggled against the orthodoxy that unemployment resulted from labour market inflexibility and that reforming the labour market was key to lowering the ‘natural’ rate of unemployment. Very limited examples of public job programmes can be found in Europe. In 1997, European Prime Ministers pledged a job or training guarantee to all newly unemployed workers within one year of losing their job (Layard, 2011, p. 174). Only Denmark, The Netherlands and Hungary (Matolcsy and Palotai, 2018) have sought to implement that pledge, albeit in very limited forms. Outside Europe, India has experimented the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA) in 2005 (Gosh, 2015), while Argentina introduced its Plan Jefeemployment policy in 2002 to address the consequence of the unfolding financial crisis (Kostzer, 2008).

7.2 An outline of a modern Public Job Programme

How would a modern public work programme be conceived? In our sketch for a Public Job Programme (PJP), the government would guarantee a job to any job-seeker of working age who cannot find work in the private sector, at a fixed hourly rate which would not be lower than the national minimum wage rate. Some other elements need to be considered:1. PJP should not target aggregate output, but labour demand. This eliminates the problem of having to calculate output gaps. It is less analytically and practically complicated to target employment than output. Definition of full employment can be made quite precise and uncomplicated: it exists where all who are ready, willing, and able to work are gainfully employed at a given base wage. This corresponds to the absence of ‘involuntary’ or ‘unwanted’ unemployment.162. The PJP pool acts as a labour buffer-stock, which expands and contracts automatically with the business cycle, reducing discretionary variations in spending. It is analogous in that sense to the unemployment insurance fund, which also automatically depletes and replenishes, but is a more powerful automatic stabiliser than the latter (see below for an analytical explanation). 3. A PJP would maintain employability better –an important factor in economic recovery and growth prospects. As Pavlina Tcherneva (2018, p. 17) puts it: “it continues to stabilize economic growth and prices, using apool of employed individualsfor the purpose rather thana reserve army of the unemployed.” It is worth emphasising that maintaining ‘employability better’ is a comparative term: the comparison is not between a PJP job and a ‘good’ job, but between a PJP job and no job.4. PJP workers would be paid at a fixed rate. This can be set at any level the government wants above unemployment benefit. A fixed wage sets a floor for private firms’ wages. If the PJP wage was set at the national minimum wage, no minimum wage legislation, with all its attendant compliance costs, would be needed, since private employers would always have to pay at least the PJP wage if they were to attract workers, and in periods of strong private sector demand they would have to bid for scarce labour at above the PJP wage. The aim of paying PJP employees a fixed minimum wage is both to set a floor to the aggregate fall in income in a downturn and to prevent employers from undercutting the legislated minimum wage in ‘normal’ times.17 For many, PJP wages may be lower than those they had previously earned, but the comparison should not be between PJP and market employment, but between PJP and no employment at all.5. PJP job champions attach great importance to Keynes’s stress in 1937 ([1978], p. 385) on the “need today of a rightly distributed demand than of a greater aggregate demand”. A satisfactory average level of employment can be consistent with some parts of the economy overheating and others under-heating, as Minsky (1965) noted. The implication of this is that orders for work should be placed in areas experiencing, or most vulnerable to, high unemployment. A PJP programme can be used to influence the structure of employment as well as its level -it can thus be made consistent with advocacy for a ‘Green New Deal’.6. Consistently with the above, a PJP could be administered locally, by a variety of agencies: local governments, NGOs, and social enterprises. Their goal would be to create ‘on the spot’ employment and training opportunities where they are most needed, matching unfulfilled community needs with unemployed or underemployed people. To ensure that projects can be ‘shovel-ready’ -rolled out on demand -inventories of communal needs should be prepared and kept by ‘job banks’ and job centres. They could fall under three main heads:18 a) care for the environment; b) care for the community; c) care for people. This does not imply that ‘caring’ will only be done when unemployment is heavy. A PJP placement should not replace, it should complement, existing public sector care provision. For instance, a PJP placement could use nursing facilities and schools to create needed-on-the-job training and credentialing opportunities to facilitate transition to private sector jobs as private sector employment opportunities pick up.

7. The fiscal resource for a PJP would come initially from current taxation, just like normal unemployment benefits. In case of a recession, the extra-spending required to pay for the newly unemployed workers could come either from taxes raised progressively fromhigher incomes –exploiting the expansionary effect of the balanced-budget multiplier (Haavelmo, 1945) –or from borrowing, or by a combination of both.A first objection against PJP is based on the idea that it would lead to inflation spiralling out of control. On the contrary, the ‘automaticity’of the programme makes it less prone to be inflationary than discretionary management of the business cycle. It provides two further built-in barriers to inflation: (a) sensitivity to the regional distribution oflabour demand and (b) maintenance of employability in the downturn, which would relieve the ‘bottleneck’ of skilled labour in the upturn. To prevent the private sector rather than the public sector becoming the source of inflationary pressure, the government could be mandated to raise anti-inflation taxes automatically to prevent inflation rising above a stated rate. If counter-cyclical policy can be made sufficiently automatic, there is much less need for governments to ‘outsource’ anti-inflationary policy to central banks.A second common objection is that PJP employment is bound to be ‘pretend’ work, in the spirit of paying people to dig holes and fill them up again. This is one reason why some ofthose sympathetic to a job guarantee favour subsidising private sector employers to retain labour in a downturn. Theoretically, this would have the same effect. However, it would be extremely difficult to prevent private sector employers claiming the subsidy under false pretences (as it has happened to some extent with the Furlough schemes of 2020). The chief defect of financial incentives for people to seek work is that they may incentivise the unemployed to look for jobs but provide no assurance whatsoever that they will find them. PJP would eliminate this obvious structural flaw. 7.3 The automatic countercyclical macroeconomic impact of a PJP programmeThis section aims to provide some analytical support to the intuition that the implementation of a PJP would represent a more effective form of countercyclical fiscal policy than the traditional system of unemployment benefits (UB). In particular, the comparison is performed with respect to the mitigating element of ‘automatic stabilisation’ that the two alternatives represent, when a recession occurs. Duringthe negative phase of the business cycle, government deficit increases as a result of two factors: a fall in revenues due to the diminished level of economic activity and an increase in public expenditure in the forms of payments to the newly unemployed workers. In the PJP case, the unemployed worker, instead of receiving a monetary compensation for the loss of his/her private job, is offered a public job, and remunerated at the minimum national wage. In simple Keynesian model of a closed economy, national income equals the sum of aggregate consumption, investment and government expenditure:

?=?+?+?

The consumption equation takes this form:

?=?0+??

Where ?0 is autonomous consumption and ?? is the part of consumption which is explained by the level of national income. ? represents the marginal propensity to consume, and it assumes any value between 1 (all national income is consumed) and 0 (all national income is saved).Investments are supposed to be dependent on exogenous factors (i.e. expected profitability or ‘animal spirits’):

?=?0

Government spending is autonomous:

?=?0

Inserting the functional forms of ?,? and ? in the expenditure identity, and rearranging, gives the typical Keynesian dynamic income equation:

?=11−?(?0+?0+?0)

Every variable within parenthesis represents an autonomous component of aggregate demand. Therefore, with a variation in one of these (e.g. fiscal expansion +∆?0), the expression 1/(1−?) captures the value of its multiplier effect on ?. What could happen in the case of a downturn, driven for instance by a sudden fall in investment ?0? While the income component of consumption ??reacts immediately and proportionally to a recession (i.e. a fall in aggregate national income ?), the autonomous consumption component ?0 relates to other psychological conditions. It seems reasonable to assume that, during a recession, ?0 falls because people will expect to earn less in the future and they would reduce extra expenditures in favour of more precautionary savings. However, under the PJP scenario, not only would the wage compensation be immediately higher, but it would remain permanent as long as the worker is employed under the PJP. Moreover, the employability of the worker under a PJP scheme would be higher than the medium to long-term unemployed worker under UB, thus increasing the prospect of a better-paid private sector job in the future. This would positively influence the aggregate autonomous component of consumption during a recession: under a PJP scenario it would nonetheless fall, but by a lower amount than in the UB case:

↓∆?0???<↓∆?0??

Secondly, the aggregate marginal propensity to consume ?(i.e. the sum of all individual marginal propensities to consume, ∑????=1) would differ under the two different scenarios. The expansion of spending on PJP during a recession could also imply a redistribution of income from higher to lower earners (or not at all earners, as the unemployed worker would be), if the first were to be taxed more in order to finance extra public jobs.19 Two forces would then be at play.

First, the redistribution of income itself would have a positive impact on the aggregate propensity to consume. At the same time, the relatively higher stability of earnings and job prospects in a PJP scenario would reduce the incentive to save a higher rate of nationalincome, therefore increasing the marginal propensity to consume. It is reasonable to conclude that these parallel dynamics would have a more positive impact on the aggregate marginal propensity to consume in the PJP case than they would have under a simple UB system of less-than-compensating income transfers:

????>???

The crucial result arising from the distinction between the two systems is that, when considering an identical expansion in public expenditure following a recession, recovery under the PJP would be stronger. Finally, both the UB and PJP approaches should be conceived on a per capita basis. They would apply to the same number of newly unemployed. Given that PJP would amount to a full and permanent minimum wage, while the UB would represent a lower and progressively reducing disbursement, the overall increasein public expenditures relative to this automatic stabilisation mechanism would be higher in the case of the PJP. Per capita expenditure under a PJP scenario would always be higher, because providing a permanent UB at the minimum wage level (or close to) would be unfeasible, as it would generate perverse incentives for low-skilled job seekers. In order to address the same number of unemployed people, the PJP will initially imply a higher deficit but one which will rapidly fall in response to the higher boost to demand, which will increase the tax revenues (via the enlargement of the tax base) and reduce expenditures on unemployment.

8. Concluding remarks

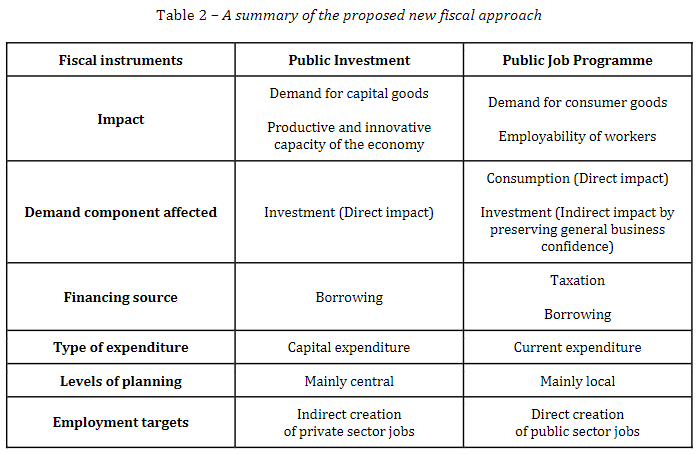

This paper has attempted to discuss the following propositions: first, a laissez-fairemarket economy is cyclically unstable and liable to settle down to a long-term underemployment equilibrium. Second, macroeconomic policy management is required to reach and maintain continuous full employment. Third, fiscal policy is a much more effective tool to achieve this than monetary policy by itself. Fourth, an effective approach to fiscal policy would separate and reinforce the practical use of capital and current expenditure, while limiting the discretionary element in old-style Keynesian demand management. Anew fiscal policy approach can be outlined, based on a combination of long-run public investment and short-run public job programmes (table 2).

Public investment –investments in general, as noted by Sylos Labini(1964) -directly impacts on the demand for capital goods (macroeconomic impact), while increasing the productive and innovative capacity of the economy (microeconomic impact). Similarly, public job programmes impact on the demand for consumer goods via workers’ wages (macroeconomic impact), while increasing their employability (microeconomic impact).The investment component of demand is affected directly by public investments acting as a catalyser of private investment, and indirectly by public job programmes because they better preserve the income expectations of workers. Higher nationalincomes coming from PJP wages positively impact on consumption.The two pillars jointly support a full employment level of economic activity, the public investment programme by protecting total investment against the fluctuations of private investment, and the PJP by strengthening the automatic stabilisers.Leaving to one side the important issue of coordination of fiscal and monetary policy, the financing source of public investment should be based on borrowing, while PJP can be financed by a combination of both borrowing and taxation, with a progressive taxation system that, by redistributing income, maximises the multiplier effect via a higher aggregate marginal propensity to consume. The priorities for public investment, classified as capital expenditure, would be centrally planned, in order to reduce coordination problems, but their implementation should take into account the role of local business and public authorities. By contrast, public job programmes can be planned and implemented locally, with precise attention to the needs of local communities.

The employment target of public investment lies in the creation of jobs via the multiplier effect of public investments on private business, while public job programmes address the reduction of unemployment through the direct creation of work.In conclusion, the two pillars of the proposed fiscal policy constitute the sketch for a modern Keynesian demand management policy based on the primacy of fiscal policy. Moreover, far from resuscitating fiscal policy as a mere emergency measure for extraordinary times –e.g. financial crises, natural disasters, pandemic events, etc. –they promote its continuing validity as the most effective and reliable instrument for reaching and maintaining a full-employment level of economic activity. This will becomeparticularly important when the COVID-19 crisis is over, leaving the scars of higher unemployment levels, business insolvencies and losses in industrial production. The trauma of the ongoing crisis will not be overcome if fiscal policy is set to turn ‘orthodox’ –that is, cease to exist as a macroeconomic tool. It is important for governments to understand that fiscal policy is for ‘normal’ times.

References

Annali Fondazione Di Vittorio (2014), Il Piano del lavoro del 1949. Contesto storico internazionale e problemi interpretativi, Rome: Ediesse.

Bailey A. (2021), “Modern challenges for the modern central bank -perspectives from the Bank of England”, LSE German Symposium virtual event, February 5.

Bank of England (2018), “A millennium of macroeconomic data for the UK”. Available at: https://www.bankofengland.co.uk/statistics/research-datasets(6 May 2021).

Bank of England (2020), “Monetary Policy Report”, January. Available at: https://www.bankofengland.co.uk/-/media/boe/files/monetary-policy-report/2020/january/monetary-policy-report-january-2020.pdf(6 May 2021).

Bank of England (2021a), “What is quantitative easing?”, Available at: https://www.bankofengland.co.uk /monetary-policy/quantitative-easing.(6 May 2021).

Bank of England (2021b), “IEO evaluation of the Bank of England’s approach to quantitative easing”, 13 January. Available at: https://www.bankofengland.co.uk/independent-evaluation-office/ieo-report-january-2021 /ieo-evaluation-of-the-bank-of-englands-approach-to-quantitative-easing(6May 2021).

Benati L. (2008), “The ‘great moderation’ in the United Kingdom”, Journal of Monetary Credit and Banking, 40 (1), pp. 121-147.

Blanchard O.J and Leigh D. (2013), “Growth forecast errors and fiscal multipliers”, American Economic Review, 103 (3), pp. 117-120.

Blanchard O.J., Leandro, A. and Zettelmeyer J. (2020), “Revisiting the EU fiscal framework in an era of low interest rates”, Mimeo for the European Commission. Bootle R. (1997), “The death of inflation”, World Economic Affairs, 1 (2), pp. 11-15.

Brancaccio E. and De Cristofaro F. (2020), “Inside the IMF ‘mea culpa’: A panel analysis on growth forecast errors and Keynesian multipliers in Europe”, PSL Quarterly Review, 73 (294), pp. 225-239.

Deleidi M. and Mazzucato M. (2019), “Putting austerity to bed: Technical progress, aggregate demand and the supermultiplier”, Review of Political Economy, pp. 1-21.

Deleidi M., De Lipsis V., Mazzucato M., Ryan-Collins J. and Agnolucci P., (2019), “The macroeconomic impact of government innovation policies”, UCLInstitute for Innovation and Public Purpose Working Papers, IIPP WP 2019-06.

Deleidi M., Iafrate F. and Levrero E. S. (2020), “Public investment fiscal multipliers: An empirical assessment for European countries”, Structural Change and Economic Dynamics, 52, pp. 354-365.

Draghi M. (2019), “Stabilisation policies in a monetary union”, Academy of Athens, October 1. Fama E. F. (1970), “Efficient capital markets: A review of theory and empirical work”, The Journal of Finance, 25 (2),pp. 383-417.

Fátas A. and Summers L. (2018), “The permanent effects of fiscal consolidations”, Journal of International Economics, 112, pp. 238-250.

Friedman M. (1960), A program for monetary stability, New York: Fordham University Press.

Friedman M. (1968), “The role of monetary policy”, American Economic Review, 58 (1), March, pp. 1-17.

Furman J. and Summers L. (2020), “A reconsideration of fiscal policy in the era of low interest rates”, Brookings Institution.

Gabellini T. and GasperinS. (2019), “Introduction: Escaping from the economics cave”, in Gabellini T.,

Gasperin S., and Moneta A. (eds.) (2019), Economic Crisis and Economic Thought: Alternative Theoretical Perspectives on the Economic Crisis, Abingdon: Routledge.

Gechert S. and Rannenberg A. (2018), “Which fiscal multipliers are regime‐dependent? A meta‐regression analysis”, Journal of Economic Surveys, 32 (4), pp. 1160-1182.

Gopinath G. (2020), “Global liquidity trap requires a big fiscal response”, Financial Times, November 2. Available at: https://www.ft.com/content/2e1c0555-d65b-48d1-9af3-825d187eec58(6 May 2021).

Gosh J. (2015), “India’s rural employment programme is dying a death of funding cuts”, The Guardian, February 5. Available at: https://www.theguardian.com/global-development/2015/feb/05/india-rural-employment-funding-cuts-mgnrega

Haavelmo T. (1945), “Multiplier effects of a balanced budget”, Econometrica: Journal of the Econometric Society, 13 (4), pp. 311-318.

Hawtrey R.G. (1925), “Public expenditure and the demand for labour”, Economica(13), pp. 38-48.

Hicks J. (1969), A theory of economic history, Oxford: Oxford University Press.

Howard D.S. (1943), The WPA and federal relief policy, New York: Russell Sage Foundation.

Jordà Ò., Schularick M. and Taylor A. M. (2017), “Macrofinancial history and the new business cycle facts”,NBER macroeconomics annual,31(1), pp. 213-263.

Kattel R. and Mazzucato M. (2018), “Mission-oriented innovation policy and dynamic capabilities in the public sector”, Industrial and Corporate Change, 27 (5), pp. 787-801.

Kalecki M. (1971), Selected essays on the dynamics of the capitalist economy 1933-1970, Cambridge: Cambridge University Press.

Keynes J. M. (1926), The End of laissez-faire, London: L & V Woolf.Keynes J. M. ([1936] 2018), The general theory of employment, interest, and money, New York: Springer.

Keynes J.M. ([1937] 1978),Volume 21: Activities 1931–1939: World Crises and Policies in Britain and America, in Johnson E. and Moggridge D. (eds.), The Collected Writings of John Maynard Keynes, Cambridge: Cambridge University Press.

Keynes J.M. and Henderson H.D. (1929), Can Lloyd George do it?, London: The Nation and Athenaeum.

King M. (1998), “The UK economy and monetary policy-Looking ahead”, Bank of England Speech, May 27.

Kostzer D. (2008), “Argentina: A case study on the plan jefes y jefas de hogar desocupados, or the employment road to economic recovery”, Levy Economics Institute Working Paper, n. 534, Annadale-on-Hudson: Bard College.

Krugman P. (2009), “Deficits saved the world”, New York Times, July 15. Available at: https://krugman.blogs.nytimes.com/2009/07/15/deficits-saved-the-world/(6 May 2021)

Krugman P. (2014), “Notes on easy money and inequality”, New York Times, October 25. Available at: https://krugman.blogs.nytimes.com/2014/10/25/notes-on-easy-money-and-inequality/(6 May 2021)La Pira G. (1951), L’attesa della povera gente, Florence: Libreria Editrice Fiorentina.

Layard R. (2011), Happiness: Lessons from a new science, London: Penguin UK.

Lucas Jr. R. E. (1972), “Expectations and the neutrality of money”,Journal of economic theory,4(2), pp. 103-124.

Mankiw N.G. and Romer D. (1991),New Keynesian economics: imperfect competition and sticky prices, vol. 1, Cambridge (MA): The MIT Press.

Matolcsy G. and Palotai D. (2018), “The Hungarian model: Hungarian crisis management in view of the Mediterranean way”, Financial and Economic Review, 17 (2), pp. 5-42.

Mazzucato M. (2013), The entrepreneurial state, London: Anthem Press.

McLeay M., Radia A. and Thomas R. (2014), “Money creation in the modern economy”, Bank of England Quarterly Bulletin, Q1.

Meade J. (1970), Theory of indicative planning, Manchester: Manchester University Press.

Merill P.H. (1981), Roosevelt’s forest army: A history of the civilian conservation corps, 1933-1942, Montpelier (VT): Perry H. Merrill.

Ministero dell’Economia e delle Finanze (2020), “Nota di aggiornamento del documento di economia e finanza”, DEF 2020, October 5.

Minsky H.P. (1965), “The role of employment policy” in Gordon M. S. (ed.), Poverty in America, San Francisco: Chandler Publishing Company.

Minsky H.P. (1986),Stabilizing an unstableeconomy, New York: McGraw-Hill.

Minsky H. P. (2013), Ending poverty: Jobs, not welfare, Annandale (NY): Levy Economics Institute of Bard College.

OECD (1977), Towards full employment and price stability, Paris: OECD.

Phillips A. W. (1958), “The relation between unemployment and the Rate of change of money wage rates in the United Kingdom, 1861–1957”,Economica,25 (100), pp. 283-299.

Ricardo D. (1817), On the principles of political economy and taxation, London: John Murray-Albemarle Street.

Rossi E. (1977), Abolire la miseria, Bari: Laterza.

Samuelson P.A. (1948), Economics, New York: McGraw-Hill.

Samuelson P. A. and Nordhaus W. D. (2009), Economics, 19th international edition, New York: McGraw-Hill.

Sargent T. (1981), “Stopping moderate inflations: the methods of Poincare and Thatcher”, Federal Reserve Bank of Minneapolis Research Department Working Papers, n. 173, Minneapolis: Federal Reserve Bank of Minneapolis.

Skidelsky, R. (2018), Money and Government: A Challenge to Mainstream Economics, New York: Penguin.

Smith A. ([1776] 1976), An inquiry into the nature and causes of the wealth of nations, Oxford: Oxford University Press.

Sylos Labini P. (1964), Oligopolio e progresso tecnico, Torino: Einaudi.

Taylor, J.B. (1993), “Discretion versus policy rules in practice”,Carnegie-Rochester conference series on public policy,vol. 39, pp. 195-214, New York: North-Holland.

Tcherneva P.R. (2018), “The job guarantee: Design, jobs, and implementation”, Levy Economics Institute Working Paper,n. 902, Annandale-on-Hudson (NY): Bard College

Tcherneva P. (2020), The case for a job guarantee policy, Cambridge: Polity.

Tucker P. (2018), Unelected power: The quest for legitimacy in central banking and the regulatory state, Princeton: Princeton University Press.

United Nations (2009), System of National Accounts, 2008, New York: UNO.

US National Commission on Technology, Automation, and Economic Progress (1966), Technology and the American economy, volume I,Washington (DC): Government Printing Office.

Wray L.R., Dantas F., Fullwiler S., Tcherneva P.R. and Kelton S.A. (2018), “Public service employment: A path to full employment”, Research Project Report, April, Annandale-on-Hudson (NY): Levy Economics Institute of Bard College.

1 For instance, the Italian Treasury in October 2020 was already outlining its long-term budgetary programme with the aim to set a reduction trajectory for the debt-to-GDP ratio to the pre-pandemic levels by 2031. Its ‘Budget Note’ does not include a single mention of any employment target (Ministero dell’Economia e delle Finanze, 2020).

2 This belief in the inherent stability of product markets anchored in stable inflationary expectations underpinned the succinct policy pronouncement of Nigel Lawson, then Chancellor of the Exchequer (quoted in Skidelsky, 2018, p. 192): “It is the conquest of inflation, and not the pursuit of growth and employment which […] should be the objective of macro-economic policy. And it is the creation of conditions conducive to growth and employment, and not the suppression of [inflation] which […] should be the objective of macroeconomic policy.” Such conditions typically included de-regulating labour and product markets, nationally and globally.

3 Friedman (1960) believed that a monetary policy that targeted interest rates was equally unreliable. That is why he favoured a money growth rule: the monetary authority should increase the money supply by a fixed percentage each year. Post-Friedman’s monetary policy approach rejected Friedman’s rule, but substituted a different rule –the Taylor (1993) rule –whereby central banks raise or lower their lending rates by a certain percentage in response to deviations from their inflation targets.

4 In his book Unelected Power(2019), Paul Tucker endorses the case for delegation of macroeconomic policy to central bank technicians, given the lack of ‘credible commitment’ by politicians to govern in the public interest. He does though raise the issue of the legitimacy of the decisions of banking technocrats.

5 The famous passage was written by his then Friedmanite son-in-law Peter Jay.

6 Notably, Article 2 of the European Central Bank’s Statute claims “the primary objective of the ESCB shall be to maintain price stability”.

7 ONS Data.

8 Broad money aggregate M4 is a measure of money supply in the UK. According to the classification made by the Bank of England, M4 comprises: holdings of sterling notes and coin by the private sector (other than monetary and financial institutions); sterling deposits (including certificates of deposit); commercial paper, bonds, floating rate notes and other instruments of up to and including five years’ original maturity issued by UK monetary and financial institutions; claims on UK monetary and financial institutions from repos; estimated holdings of sterling bank bills; 35% of the sterling inter-MFI difference.

9 It is important to emphasise this necessity, as recent academic literature has implied that were monetary policy not ‘constrained’ by the zero lower bound, it would be superior to fiscal policy. See Blanchard et al. (2020), Furman & Summers (2020).

10 The theoretical distinction between capital investment and current expenditure is well recognised in public finance theory (Sargent, 1981, pp. 23-24): “A pure current account expenditure is for a service or perfectly perishable goods that gives rise to no government-owned asset that will produce things of value in the future. A pure capital account expenditure is a purchase of a durable asset that gives the government command of a prospective future stream of returns, collected for example through user charges, whose present value is greater than or equal to the present cost of acquiring the asset. A pure capital account budget would count as revenues the interest and other user charges collected on government-owned assets, while expenditure would be purchases of capital assets. On these definitions, government debt issued on capital account is self-liquidating […]. Government debt issued to finance a pure capital account deficit is thus not a claim on the general tax revenues that the government collects through sales and income taxation. The principles of classical economic theory condone government deficits on capital account.”

11 For instance, public investment should be financed at the central government level and directed to the long-term objective of securing an adequate supply of public goods. The concept of public goods can be considered in a rather extensive way, ranging from the very restrictive textbook definition of a good “which can be enjoyed by everyone and from which no one can be excluded” (Samuelson & Nordhaus, 2009, p. 36) such as basic infrastructures to the more comprehensive aim “to do those things which at present are not done at all” (Keynes, 1926, p. 46), like investment in projects developing new technologies.

12 In our presentation, we deliberately abstract from additional reasons for public investment deriving from the existence of public goods or the possibility of enhancing the productive capacity of the economy. For instance, Mazzucato (2013) has shown that public investment in R&D has had an instrumental role in the development of new technologies in consumer electronics, renewable energies and pharmaceutical products.

13 A notable difference with respect to other countries, in which investments performed by State-owned enterprises are not distinguished from ‘private business investments’ even if these entities are classified as ‘public corporations’ (See United Nations’ System of National Accounts, 2008).

14 Author’s elaboration on ONS data

15 The idea of job programmes became also quite popular in Europe in the immediate post-war period, as a very direct way to eradicate the conditions of poverty that wereafflicting several European economies. In Italy, for instance, the consensus around this proposal stretched across thinkers with very different ideological orientations: from the proposal of the social-liberal Ernesto Rossi (1977), to the 1949 ‘Piano del Lavoro’ of the communist trade union CGIL (Annali Fondazione Di Vittorio, 2014), to the Catholic social teaching of Giorgio La Pira (1951), who would later put into practice a scheme of public works during his years as Mayor of Florence (1951-1957).

16 In our definition, involuntary unemployment includes forced underemployment: those in work for less hours than they would wish.

17 A PJP wage set at above the minimum wage, as recommended by American advocates (see Minsky, 2013 and Tcherneva, 2020), would also have a beneficial distributional effect, by substituting an upward for a downward pressure on wages. It would thus bring a single instrument to bear on the interrelated problems of unemployment and poverty. A public sector job guarantee might be built round the aim of reducing poverty. However, this is not its main macroeconomic objective.

18 Key areas of activity in the Hungarian programme are: use of organic and renewable energy; repair of public road networks inside rural settlements; elimination of illegal waste dumps; increase of local food sufficiency.

19 The redistribution of income happens if higher income earners are taxed more to finance more PJP workers, but the overall distribution of income become less unequal as more people retain a higher income flow compared to the UB case. In fact, the distributional comparison has to be made between the two different scenarios: in the UB case, incomes end up being less equally distributed than in the PJP case.