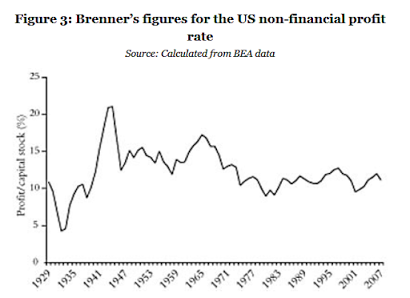

And so immediately we must ask: why do so many Marxists seem to ignore this fact and assault us with data on profit rates from c. 1945 to today, when their starting point was a period with abnormally and unusually high profit rates and this skews their data?Robert Brenner’s data for the US non-financial profit rate from 1929 to 2007 is in the graph below, as taken from this post here. I am unsure where the data actually comes from, but perhaps Brenner (2002) or (2006). Notice the spike in profit rates from 1940 until about 1946/47. During the war, wages were held down but significant price inflation did occur, and so the business profit rate rose. I suspect you would find the same phenomenon in Canada, the UK, Australia or New Zealand in these years too.So therefore a Marxist graph of profit rates from c. 1945 to 2016 – even if it did show a fall in the average rate of profit – does not prove that capitalism has a long-run tendency to a falling rate of profit, because such data would start out from a time when profit rates were abnormally high in the first place. In reality, we would need good, accurate and consistent data from the early 1800s to today in a large sample of capitalist countries to draw any legitimate conclusions about the long-run tendency of the rate of profit in real world capitalism.

Topics:

Lord Keynes considers the following as important: abnormally high in WWII, US profit rate

This could be interesting, too:

Mike Norman writes Michael Roberts — US rate of profit measures for 2018

Mike Norman writes Michael Roberts — US rate of profit update

Robert Brenner’s data for the US non-financial profit rate from 1929 to 2007 is in the graph below, as taken from this post here. I am unsure where the data actually comes from, but perhaps Brenner (2002) or (2006).

Notice the spike in profit rates from 1940 until about 1946/47. During the war, wages were held down but significant price inflation did occur, and so the business profit rate rose. I suspect you would find the same phenomenon in Canada, the UK, Australia or New Zealand in these years too.

So therefore a Marxist graph of profit rates from c. 1945 to 2016 – even if it did show a fall in the average rate of profit – does not prove that capitalism has a long-run tendency to a falling rate of profit, because such data would start out from a time when profit rates were abnormally high in the first place. In reality, we would need good, accurate and consistent data from the early 1800s to today in a large sample of capitalist countries to draw any legitimate conclusions about the long-run tendency of the rate of profit in real world capitalism.

Addendum: I’m on Twitter Now

I want to see what all the fuss is about, but I suspect I’m several years too late:

BIBLIOGRAPHY

Brenner, Robert. 2002. The Boom and the Bubble: The US in the World Economy. Verso, London.

Brenner, Robert. 2006. The Economics of Global Turbulence: The Advanced Capitalist Economies from Long Boom to Long Downturn, 1945–2005. Verso, London and New York.