Robert P. Murphy recently gave a talk on fractional reserve banking and free banking:[embedded content]Listening to this video really brings home what a lame cult of losers American libertarians actually are.Murphy repeats the same tired lies about fractional reserve banking we have all heard before: e.g., that a demand deposit involves two entities (the bank and depositor) owning the same money (when this is a blatant falsehood), and the fake legal history of fractional reserve banking peddled by Rothbard and Huerta de Soto.A bank is, by nature, an institution that borrows money from “depositors” (a misleading word) by means of the mutuum contract, so that the bank becomes the legal owner of all money “deposited.” The bank client legally forfeits all property rights in the money. In

Topics:

Lord Keynes considers the following as important: Robert P. Murphy on Rothbardians versus Free Bankers

This could be interesting, too:

Listening to this video really brings home what a lame cult of losers American libertarians actually are.

Murphy repeats the same tired lies about fractional reserve banking we have all heard before: e.g., that a demand deposit involves two entities (the bank and depositor) owning the same money (when this is a blatant falsehood), and the fake legal history of fractional reserve banking peddled by Rothbard and Huerta de Soto.

A bank is, by nature, an institution that borrows money from “depositors” (a misleading word) by means of the mutuum contract, so that the bank becomes the legal owner of all money “deposited.” The bank client legally forfeits all property rights in the money. In return, the bank customer becomes a creditor to the bank and receives a promise to repay the debt on demand (or whatever specific terms are used): in other words, the bank client simply receives an IOU from the bank. There is nothing fraudulent about this relationship.

The mutuum contract goes back to the ancient Roman law and banking practice, and was the basis of Western banking.

The Rothbardian charlatans failed to understand the nature of the mutuum contract and have falsified the history of fractional reserve banking (see here, here, here, here, here, here).

By creating 100% reserve banks or warehouses, Austrians like Murphy would create an inherently deflationary economy that would tank private sector investment, and cripple the endogenous money system on which capitalism relies.

On the economic consequences of fractional reserve banking, the real problem is poorly regulated financial systems that can blow asset bubbles and create excessive private debt used for speculative purposes. The solution to this is rigorous financial regulation, not abolishing fractional reserve banking.

The few decent points Murphy makes come at the end, when he points out that the claim of free bankers that Canada and Scotland had stable free banking systems is not credible. Worse still, free bankers fail to look at Australia, where free banking was a disaster.

As for free banking in Canada, this was the reality of Canada’s pre-1935 bank system:

(1) the “Canadian Bank Act of 1871” regulated banks and prohibited banks from lending on real estate, a sensible regulatory measure that is hardly in line with free banking;One can hardly speak of a free banking system when Canada had a de facto government lender of last resort from 1914.(2) in 1907, the Canadian government lent $5 million in Dominion notes to the private sector banks to end a credit squeeze that threatened the agricultural sector and wider economy;

(3) the Finance Act of 1914 permitted Dominion banks to borrow notes directly from the Canadian Department of Finance with no gold-reserve requirement;

(4) the consequences of (3) were that from 1914 onwards Canada had a lender of last resort in the form of government-issued money;

(5) in 1924, the Dominion and Imperial Banks experienced runs and turned not just to other banks, but to the Department of Finance for liquidity to avert a crisis.

Addendum

In response to George Selgin’s comment below, there is a straightforward response: in order to test whether any particular pre-1933 – or relatively free market – banking system was better than the system I advocate, you need to compare the latter with the period from c. 1945 to the early 1970s, when the finance sector in the Western world was (generally) subject to effective financial regulation. In this period, there were hardly any financial crises, serious asset bubbles largely absent, and the banking sector much more stable than the more laissez-faire periods that preceded it and the Neoliberal era that followed.

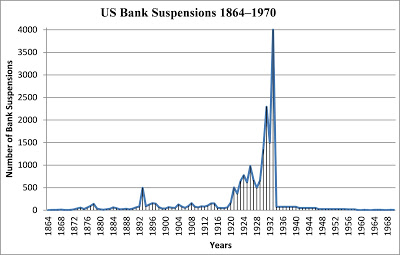

I could post all sorts of data here, but let us just look at this graph:

This speaks for itself.

Further Reading

Here are my posts on fractional reserve banking refuting the Rothbardian nonsense below:

“Hayek’s Original View of Fractional Reserve Banking,” February 29, 2012.“Fractional Reserve Banking, Option Clauses, and Government,” January 31, 2012.

“Are the Public Ignorant of the Nature of Fractional Reserve Banking?,” December 17, 2011.

“Why is the Fractional Reserve Account a Mutuum, not a Bailment?,” December 17, 2011.

“Callable Option Loans and Fractional Reserve Accounts,” December 16, 2011.

“Future Goods and Fractional Reserve Banking,” December 15, 2011.

“Rothbard on the Bill of Exchange,” December 11, 2011.

“Hoppe on Fractional Reserve Banking: A Critique,” December 11, 2011.

“The Monetary Production Economy and Fiduciary Media,” December 11, 2011

“Fractional Reserve Banking: An Evil?,” June 26, 2010.

“The Romans and Fractional Reserve Banking,” February 23, 2011.

“Gene Callahan on Fractional Reserve Banking,” February 18, 2011.

“Lawrence H. White refutes Huerta de Soto on Fractional Reserve Banking,” February 22, 2011.

“Selgin on Fractional Reserve Banking,” June 1, 2011.

“Schumpeter on Fractional Reserve Banking,” June 12, 2011.

“The Mutuum Contract in Anglo-American Law,” September 30, 2011.

“Rothbard Mangles the Legal History of Fractional Reserve Banking,” October 1, 2011.

“More Historical Evidence on the Mutuum Contract,” October 1, 2011.

“What British Law Says about the Mutuum Contract,” October 2, 2011.

“If Fractional Reserve Banking is Voluntary, Where is the Fraud?,” October 3, 2011.

“Huerta de Soto on the Mutuum Contract: A Critique,” August 11, 2012.

“A Simple Question for Opponents of Fractional Reserve Banking,” August 17, 2012.

“Chapter 1 of Huerta de Soto’s Money, Bank Credit and Economic Cycles: A Critique,” August 31, 2012.

“Huerta de Soto on Justinian’s Digest 16.3.25.1,” September 1, 2012.

“Huerta de Soto on Banking in Ancient Rome: A Critique,” September 2, 2012.

“Bibliography on the Irregular Deposit (depositum irregulare) in Roman Law,” September 6, 2012.

“Rothbard on ‘Deposit’ Banking: A Critique,” July 22, 2014.

“Carr versus Carr (1811) and the History of Fractional Reserve Banking,” July 23, 2014.

“Mutuum versus Bailment in Banking,” July 24, 2014.

“Foley versus Hill and the History of Fractional Reserve Banking,” July 29, 2014.

“Coggs v. Bernard and the History of English Bailment Law,” July 31, 2014.

“The Mutuum Contract in Henry de Bracton and English Law,” August 1, 2014.

“Fractional Reserve Banking is a Fundamental Part of Capitalism,” August 8, 2014.

“A Critique of Rothbard on the History of English Bailment Law,” August 11, 2014.

“The Banking Contract in 19th Century US Law,” August 16, 2014.

“Rothbard on how Fractional Reserve Banking would be illegal in Anarcho-Capitalism,” March 2, 2016.

“The Filthy Anti-Capitalist Mentality – of Austrian Economics,” October 17, 2015.