IJOPEC has published the e-book ‘Globalisation and Public Policy’ edited by Kaoru Natsuda K. et al. The lin for the e-book is the following: http://www.ijopec.co.uk/wp-content/uploads/2019/10/2019_13.pdf I have contributed the first chapter with a paper titled ‘De-globalisation and the Return of the Theory of Imperialism’. The links for my chapter are the following: [embedded content] https://www.researchgate.net/publication/336252454_Globalisation_Public_Policy https://www.academia.edu/40518923/De-globalisation_and_the_Return_of_the_Theory_of_Imperialism The paper follows ‘De-globalisation and the Return of the Theory of Imperialism’ Stavros Mavroudeas Professor (Political Economy) Dept. of Social Policy Panteion University e-mail: [email protected] web:

Topics:

Stavros Mavroudeas considers the following as important: Uncategorized, Άρθρα σε επιστημονικά περιοδικά - Articles in academic journals, Εισηγήσεις σε επιστημονικά συνέδρια - Papers in academic conferences

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

IJOPEC has published the e-book ‘Globalisation and Public Policy’ edited by Kaoru Natsuda K. et al.

The lin for the e-book is the following:

http://www.ijopec.co.uk/wp-content/uploads/2019/10/2019_13.pdf

I have contributed the first chapter with a paper titled ‘De-globalisation and the Return of the Theory of Imperialism’.

The links for my chapter are the following:

https://www.researchgate.net/publication/336252454_Globalisation_Public_Policy

https://www.academia.edu/40518923/De-globalisation_and_the_Return_of_the_Theory_of_Imperialism

The paper follows

‘De-globalisation and the Return of the Theory of Imperialism’

Stavros Mavroudeas

Professor (Political Economy)

Dept. of Social Policy

Panteion University

e-mail: [email protected]

web: https://stavrosmavroudeas.wordpress.com

Abstract

The globalization hypothesis (i.e. the argument that modern capitalism has once and for all discard the nation state and modern capitalism became a truly unified ‘global village’) was overwhelmingly popular since the 1990s. This was coupled with the expansion of a multifaceted theoretical trend that rejected previous analytical tools and purported that it ushered new ones, tailor-made to the new ‘globalisation era’. Especially within Political Economy, the globalization discourse rejected the theory of Imperialism (that emphasized antagonisms and the role of the national economy) for a theory of global interconnectedness (emphasizing co-operation and deterritorialization). However, the course of events of the real world radically diverged from the stylized beliefs of the globalization discourse. Particularly, before and increasingly after the 2008 capitalist crisis, antagonisms along national lines and military conflicts proliferated. These developments signify the necessity for a return to the classical Marxist theory of Imperialism as the appropriate analytical framework to grasp the political economy of the international system.

I. Introduction

‘Globalisation’ has been a zeitgeist for at least the last thirty years. It dominated the scientific discourses and dictated political decision-making. In its pure version, ‘globalisation’ maintained that around the 1990s the contemporary world underwent an epochal transformation. The nation-state (with its national economy) ceased to be the fundamental nucleus of politico-economic affairs as both the economy and the polity were supposed to transcend – and make almost irrelevant – national borders. To put it simply, the world has become a unified global village.

The ‘globalisation’ zeitgeist affected the whole spectrum of economic and political analyses and practices, from Orthodoxy to Heterodoxy and even Marxism. Theoretical analyses were transformed in order account for this purported epochal change. Revered and long-established concepts and models were discarded as no longer applicable. Even statistical indicators changed radically to conform with the ‘globalisation’ trend (e.g. the distinction between portfolio investment and foreign direct investment [FDI] was practically blurred).

However, at the end of the 20th century – and as the 2008 global capitalist crisis was approaching – cracks began to appear in the ‘globalisation’ narrative. As capitalist profitability started to falter, international politico-economic conflicts increased. In economic relations the ‘accursed’ protectionist policies started to creep in. In geopolitics military conflicts proliferated and unilateral policies by particularly dominant politico-economic powers (the US primarily) were increasingly adopted; thus tearing apart the ‘globalisationist’ narrative about a liberal democratic and free market world order. The eruption of the 2008 crisis was certainly a major turning point. All the aforementioned tendencies increased tremendously and the previously hidden behind ‘globalisationist’ narratives national interests came to the fore bluntly. This affect critically the international politico-economic discourses and the previously relegated to ‘underworlds’ discussion about ‘globalisation’ and its end came to the fore. Rather abruptly, the king was found naked and ‘de-globalisation’ or the end of ‘globalisation’ came to the centre of discussions.

This paper has a twofold aim. Firstly, it seeks to debunk the ‘globalisation’ narrative and show that it is a truthlike myth. Secondly, it argues that the classical Marxist theory of Imperialism offers a superior analytically and empirically framework in order to comprehend the political economy of capitalism’s international system. The remainder of the paper is structured as follows. In Section II the basic empirical and theoretical foundations of ‘globalisation’ are being presented and rejected as lacking a sound foundation. In Section III it is argued that the Marxist theory of Imperialism – through its understanding of the capitalist international system as a ‘battlefield’ with winners and losers – is the more fit one. Finally, Section IV proposes a redefinition of the Marxist theory of Imperialism and concludes.

II. Debunking ‘Globalization’: a truthlike myth

The thrust of the ‘globalisationist’ argument rests not in theoretical analysis but on empirical claims. Theoretical analyses, to a great extent, followed these supposedly indisputable empirical claims.

‘Globalisationist’ empirical claims

Setting aside minor differences, proponents of the ‘Globalisation’ thesis argued that the late 20th century ushered radical socio-economic transformations that produced a change of epochal dimension: economic activities burst out of national borders and organized themselves in worldwide processes and networks. More precisely, it is argued that product, capital and financial markets have become globally unified. This is supposed to be the differentiae specificae of this new era. Many theories assigned it the status of new stage, era or epoch (depending on the periodization theory adopted by them).

Different theories attribute this hypothetical historical rupture to different (seldom combined) factors. The main candidates as ‘globalisation’s’ cause are the three.

The first one, predominating mainly within Orthodox analyses, is technological change. Orthodox economics, within their a-social framework, have a tendency to attribute major epochal changes to technical factors. Thus, they usually attribute ‘globalisation’ to some form of technical revolution centered on information technologies. They argue that the development and expansion of the latter made national economic relations obsolete and facilitated the ‘globalisation’ of economic activities. This is a problematic argument for several reasons. First, the economic impact of the information technologies has been seriously disputed. As Solow (1987) with his famous paradox has pointed out, ‘you can see computers everywhere except for productivity statistics’. Second, the misnamed ‘New Economy’ of the mid-1990s (based on information technology, biotechnology and telecommunications) has long ago collapsed through the burst of its stock-exchange bubble. Last, but not the least, technologies that facilitated international economic activities have existed also in the past (e.g. telegraph, trains) and had possibly a greater impact upon the economy. So, there is nothing significantly new in information technologies.

The second candidate as cause of the ‘globalisation’ is political. It is argued that the collapse of the Eastern bloc created a ‘vacuum’ that facilitated the spread of free (capitalist) economic activities to areas governed previously by planned economy systems. This argument holds also limited water. First, it is true that the Cold War era limited economic relations between the two main blocs. However, within these blocs there were strong international activities and co-operation. Second, ‘globalisation’ spread not only to the previous Eastern bloc economies but to other areas of the world as well. Third, if there is some truth in the political cause of ‘globalisation’ this is that it was vigorously promoted by the West (and particularly the US) to the rest of the world as a means for increasing Western domination. The imposition of the Washington Consensus and its post-Washington Consensus successor upon less developed and developing economies is a typical evidence of this.

The third candidate is the argument that there is an inherent tendency of capitalist accumulation towards surpassing national borders. This argument can be found mainly in Heterodox and Marxist ‘globalisationist’ theories. Immanuel Wallerstein’s (1979) World Systems theory is both a pioneer and a typical example of this perspective. There are well-known and devastating critiques of this argument. Among others, one of its main deficiencies is that it cannot account convincingly about the long non-‘globalised’ periods of the capitalist system. If the capitalist system is prone to such a tendency then why it passes through long periods during which national economies – and blocs formed around them – predominate? Furthermore, it is well-known that the capitalist system has been born through the creation of national economies (that is national centres of accumulation). Moreover, during its period of gestation capitalist economic activities resorted to strong protectionist policies as means to protect themselves particularly their periods of infancy. The era of Mercantilism is a typical example of this.

As already mentioned, the ‘globalisation’ thesis has two interrelated economic corollaries. The first one is that national economies no longer matter. The second one is that state ability to implement economic policies has been critically curtailed if not totally annuled. Both arguments are highly debatable. Even at the high point of ‘globalisation’ at least several dominant Western economies exhibited remarkable ability in pursuing national economic policies. The US is the more prominent case in point. But even less developed and influential economies exhibited similar abilities. Such an example is the introduction by Malaysia of capital controls in the 1990s.

These economic arguments were supplemented with several political claims. The most prominent among them were the following.

It was argued that ‘globalisation’ would lead to the spread of global democracy. As Held & McGrew (1998: 242) typically argue ‘through a process of progressive, incremental change geo-political forces will come to be socialized into democratic agencies and practices’.

Moreover, it was argued that in ‘globalisation’ the ‘make business not war’ motto would predominate as global entrepreneurship abhors nationalism and militarist conflicts. In fact, this is a renovated version of classical Liberalism’s belief that was utterly disproved by the 1st WW.

Unsurprisingly, both these political claims are also highly disputable. During the ‘globalisation’ era there was actually a proliferation of nation-states (not only because of the disintegration of the Eastern bloc’s states) which were seldom accompanied by bloody military conflicts. Furthermore, international agencies never ceased to be dominated by national interests and their workings remained field of power struggles rather than of democratic practices.

On the basis of the aforementioned arguments, ‘globalisationist’ theory made two bold empirical claims. First, that ‘globalisation’ is totally new phenomenon. And, second, that it is irreversible. Both claims are equally unfounded.

The initial versions considered ‘globalisation’ as a totally new phenomenon. However, critics pointed out that all its main features (rates of international trade, capital mobility, financial interconnectedness, transnational politico-economic institutions) have existed in a previous period (the so-called ‘first globalisation’ (1860-1914)). See, for example, the analysis of Baldwin & Martin (1999) for one of the first Orthodox disputes of the originality in the period 1950-2000. From a more radical point of view, the study by Hirst & Thompson (1999) is indicative.

Subsequently, ‘globalisationists’ modified their position by arguing that this time is different. Various explanations were proposed. The more prominent between them were that the second ‘globalisation’ is characterized by different technology, that FDI is more important and that financial ‘globalisation’ is stronger.

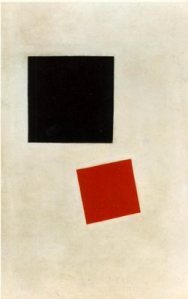

None of the ‘globalisationist’ counter-arguments is very convincing. For example, international trade to GDP and international capital flows to GDP ratios were similarly high during the era of the so-called ‘first globalisation’. This is accepted even by proponents of the ‘globalisation’ thesis as the following graph by Chandy & Seidel (2016) shows[1].

There are additional credible counter-arguments to the modified ‘globalisationist’ argument. International flows of trade and capital instead of creating unified global circuits they have formed regional blocs. And even the expansion of FDIs (from the 1980s and onwards) have not created a globalized system of production or a borderless global economy in any meaningful sense. Many studies have shown that multinational corporations of all the big capitalist economies exhibit strong ‘home country bias’ linking them to their home economy (e.g. Hirst & Thompson (1996), Tyson (1991)). Moreover, regarding financial ‘globalisation’, even Zevin (1988) – a prominent ‘globalisationist’ – accepts that during the 1850-1914 period the consolidation of the financial markets was equally significant.

The refutation of the first ‘globalisationist’ empirical claim injured critically their second empirical claim as well. If the ‘first globalisation’ was reversed and if the arguments about the distinctiveness of the ‘second globalisation’ are unfounded then there is nothing guaranteeing that the latter cannot also be reversed. Indeed, even proponents of ‘globalization’ recognized that there is nothing inevitable about it: ‘(T)here is a tendency to see globalization as irreversible. But the political forces that fragmented the world for 30 years (1914–1944) were evidently far more powerful than the accretion of technological progress in transport that went on during that period. (Frankel (2000): 6–7)).

‘Globalisationist’ analysis

Indisputably, the dominant theory behind the ‘globalisation’ thesis is the Orthodox Neoclassical analysis of international economics. This dominated the public discourse as well as the commanding heights of the world economy. Heterodoxy (traditional Keynesian, post-Keynesian, Radical Institutionalism approaches etc.) followed behind. Despite their partial analytical differences, they basically succumbed to the main Orthodox arguments. Even Marxist ‘globalisation’ theories implicitly accepted much of the Orthodox discourse. For reasons of brevity, other versions of the ‘globalisation’ theories will be left aside and the focus of this section will be on the Orthodox one.

The foundations of the Orthodox Neoclassical version rest upon its theory of international economic relations. Historically, but also analytically, the theory of international economics has been constructed and inaugurated on the basis of the theory of international trade. The founding block of Orthodox international trade theory is its dogma of the beneficial role of free international trade. This is based on the beleaguered Ricardian theory of comparative advantage. The gist of this thesis is that free trade between developed and less developed economies is beneficial to both as each one will specialise to the production of the commodity in which it is more productive even if one of them is more productive on all commodities. The comparative advantage thesis has been criticized convincingly both on analytical and empirical terms. Its main, and more realistic, alternative is the theory of absolute advantage advanced by A.Smith and K.Marx. The theory of absolute advantage argues that an economy that is more productive in internationally traded commodities will produce all of them; thus, leaving the less developed (and less productive) without production and, thus, in a trade imbalance.

Neoclassicals extended the theory of comparative advantage from international trade to international capital flows as well and argued for the beneficial impact of the combination of free trade and free capital flows. However, Ricardo was fully aware that the theory of comparative advantage will not hold if capital is mobile, because in that case specialization will be determined by absolute and not by relative costs.

Despite its ‘heroic’ assumptions and blatant problems, the Neoclassical approach dominated the area of international economics. As it will be shown in the next section, this dominance is not without problems. Particularly as historical reality systematically fails to vindicate the Neoclassical arguments and conclusions. However, the advent of ‘globalisation’ offered a golden opportunity to Neoclassical Orthodoxy. Within the ‘globalisation’ narrative, even Heterodoxy succumbed to its charm. This surrender is typically expressed by Higgot (1999: 26) when he argues that the ‘argument for liberalization and open markets as generators of wealth has been won at both intellectual and evidentiary levels’.

Based on this theory, it was pronounced that globalisation (a) enhances aggregate welfare overall and (b) leads to the convergence between more and less developed economies. Empirically, both arguments have been rejected. Globalization has not reduced inequality of income and wealth. Since the early 1980s the world economy has been characterized by rising inequality and slow growth. Despite the rise of the new emerging economies (BRICS etc.) increasing inequality characterises the world economy. On top of this and to a great extent as a result of ‘globalisationist’ policies (with the disarming of national economic policies and the deregulation of labour markets), inequality has risen especially within developed economies. The US is a typical example of this trend.

Convergence, the other ‘globalisationist’ postulate, is equally unfounded. The convergence argument is a product of the Neoclassical Growth Model. As it is well known, it is actually an assumption rather than a result of this model. To put it simply, it is an ‘article of faith’ rather than a scientific result. This Neoclassical ‘article of faith’ has an infamous empirical record. Empirical results for several historical eras and periods simply reject this argument. The same holds for the ‘globalisation’ era. Again, despite the spectacular rise of the emerging markets, divergence in relative productivity levels and living standards is the principal feature of the contemporary world economy. Some ‘sunny spells’ for the Neoclassical argument (that is periods of some convergence at least within some groups of countries) were very soon reversed or stalled. In front of this blatant failure the Neoclassical approach offered – both in general and regarding the ‘globalisation’ era – a last ditch defense. It argued that although overall convergence might not materialize, partial convergence within ‘clubs of economies’ do takes place. However, historical reality has not been kind even to this. Convergence within clubs and/or between clubs has not been verified; quite the contrary. A typical example is the European Union (EU) which was the more prominent case where the convergence hypothesis attempted to vindicate itself. After a limited period of convergence, it is divergence that characterises EU’s state of affairs. To sum up, contrary to both these two arguments, divergence rather than convergence epitomises the ‘globalization’ era.

III. The theory of Imperialism: international economy as a battlefield

The debacle of ‘globalisation’ exposes serious lacunae in the theory of international economics. The main problem is the dominance of the belief that international economic relations are a win-win game for all participants. This dogma that permeates the economic Orthodoxy serves to present the capitalist system as a benevolent and just one. As it has been shown in the case of ‘globalisation’ this is a blatantly unrealistic conception. A realistic analysis of international economic relations should be based on the exactly opposite principle: the international economy is a battlefield with winners and losers. The gains of the former are the losses of the latter. There is no win-win situation in such a battlefield. This alternative perspective is offered by the theory of Imperialism.

Interestingly, the theory of Imperialism was formed in a similar to the current historical period. It was constructed after the first global capitalist crisis of 1873-5 and while the ‘first globalization’ was disintegrating. The structural crisis was followed by a protracted period of economic malaise. The latter ignited capitalist antagonisms and led to a return of trade and currency wars seldom accompanied with military wars. During that turbulent period all the empirical beliefs of Classical Liberalism were demolished; and particularly the dogma that ‘capitalism abhors wars’. It was painfully proved that capitalism works – and seldom prospers – through wars. Additionally, it was equally painfully shown that the internationalization of capital can easily revert to protectionism and a return to the national bases.

In this politico-economic landscape the theory of Imperialism was born especially through the pioneering work of Hobson (1902). Various other bourgeois theories of imperialism followed (e.g. Schumpeter (1919)). The main feature of these theories was that they considered imperialism as a deformation of the proper functioning of capitalism that could be rectified and thus return to the mutually beneficial free operation of international markets. Hobson regarded imperialism as the product of underconsumption crisis in developed economies that could be rectified with social reforms (representative parliamentarism, trade unionism) ensuring wage growth that would provide the necessary demand. Once these reforms have been established then international economic relations would again conform to the Classical Liberal model. Schumpeter went even further by considering imperialism not as product of capitalism but as an atavism. If the pre-capitalist remnants that caused it are removed then the Classical Liberal model would operate without problems. In this sense, these theories were a true Heterodoxy; that is a heresy that shared much common ground with the Orthodoxy but disagreed in some crucial ‘articles of faith’.

However, the theory of Imperialism was spectacularly developed and shot to fame after its adoption by the Marxist tradition (R.Hilferding (1912), R.Luxemburg (1913) and especially V.I.Lenin (1917)). The Marxist theory of Imperialism departed from the previous bourgeois versions by arguing that imperialism is not a deformation but a normal part of the capitalist modus operandi. This refoundation of the theory of Imperialism produced an analysis of the international economy that is not a Heterodox appendage of the Orthodoxy but a truly alternative tradition.

Contrary to both Orthodox and Heterodox thought, Marxism has a different conception of capitalism’s international system. The latter mirrors its national system in being also a system of exploitation: a systemic ‘battlefield’ with winners at the expense of losers. This stems from capitalism’s DNA and it is not a transient feature. Exploitation at the international level is also based on classes but it acquires additional dimensions as a capitalist economy can be exploited by another one. The latter mirrors its national system in being also a system of exploitation. Exploitation on the international level is also based on classes but it acquires additional dimensions. For example, a national bourgeoisie exploits its workers but at the same time it can be exploited by another national bourgeoisie. For Marxism this is a structural – and not a conjunctural – characteristic of the capitalist system. Therefore, capitalist international political-economic relations are antagonistic by nature and operate through war-like competition. Consequently, Marxism disagrees with the Orthodox thesis that international political-economic relations (and particularly free ones) are mutually beneficial for all their participants. It also disagrees with the Heterodoxy because it considers these relations as antagonistic by their very nature and not as specific products of special political choices.

The cornerstone of the Marxist theory of Imperialism is that capitalism’s international system is not a harmonious set but a field characterized by competition, conflicts and exploitation of groups of countries by other groups. Consequently, it does not result in mutually beneficial for all participants outcomes but instead it has winners and losers – where the gains of the former are the losses of the latter. This function is considered as a structural characteristic of capitalism and not as a conjunctural product of short-term policy choices.

It is beyond the scope of this section to review the long and winding course of the Marxist theory of imperialism. For reasons of brevity it will delineate the main pillars of a contemporary redefinition of it along the lines of the Classical Marxist Debate on Imperialism. The latter took place at the beginning of the 20th century and was the vehicle through which imperialism was adopted and re-founded by Marxism. The major currents of this debate were represented by R.Hilferding, R.Luxemburg and V.I.Lenin. Despite differences one of the main common founding blocks of this debate is that imperialism is primarily an economic mechanism and not a political mechanism. This implies that its aim is not political dominance but economic exploitation. The former is a means to achieve the latter and not a cause. This thesis is derived from capitalism’s fundamental difference from pre-capitalist exploitative systems: capitalist exploitation is not primarily based on direct (political) coercion but on indirect (economic) coercion. This economic mechanism organizes the exploitation at the international level (that is between economies). It is based on transfers of value from the exploited to the exploiting economies. This understanding does not ignore political relations – which are especially important particularly at the international level – but considers them as a corollary of economic relations.

IV. In place of conclusions: A redefinition of the Marxist theory of imperialism

A modern re-formulation of Marxist theory of imperialism is necessary after the misconceptions that prevailed after the Classical Debate and during the reign of ‘globalisationism’. As already argued, imperialism is first and foremost an economic process from which political-military processes derive. Put it simply, imperialism is primarily a mechanism of economic exploitation of one capitalist economy by another. This economic mechanism operates through the export of capital. The latter takes place in all its generic forms; that is as export of commodities, financial capital and productive investment. This export of capital is at the same time an indication of strength and weakness. An imperialist economy tends to export its economic activities both because these have developed more that its national basis can sustain and also because its capital overaccumulation threatens its viability. This economic exodus abroad leads to conflict with capitals from other countries that pursue the same course and which aim to secure wider areas of economic domination and exploitation. Sooner or later (or sometimes even preceding), the states that are the political supports of these capitals are brought in and the conflict acquires also apolitical and seldom military dimensions. As part of this process, more or less stable and permanent blocs of capitals and states are often formed.

Imperialism is not a particular stage of capitalism (although it flourishes in some of them) but the mode through which capitalism organizes its international system from its very birth. Thus, imperialism should not be associated with some form of capitalist competition (e.g. monopolies) – although some of them enhance imperialist relations more than others – but it is a general attribute of the system. Thus, its economic exploitation mechanism – i.e. international value transfers from one economy to another – works via normal capitalist competition and not only in cases of monopolist competition. In other words, imperialist surplus extraction exists irrespectively of the existence of monopolist super-profits. Marxism, contrary to the other main economic theories, has an elaborate dialectical theory of competition. Free competition, oligopoly and monopoly are not distinct cases but expressions of the same mechanism. Competition is the mechanism from which oligopoly and monopoly arise but also in which they subsequently collapse. This dialectical understanding can realistically grasp the tides and ebbs of mergers and acquisitions waves of modern capitalism.

The global system of imperialism is a complex structure comprised not by two groups (imperialist and not imperialist economies) but by more. Particularly since the middle 20th century we have witnessed the emergence of several economies that can be at the same time victims of imperialist exploitation by some economies and agents of imperialist exploitation for others. Thus, the global imperialist system is a pyramid-like structure comprising of several levels. Those middle-level economies fall in the category of sub-imperialism.

Imperialism is not identical with the notion of finance capital (i.e. Hilefrding’s influential thesis about the merge between banking and productive capital under the dominance of the former). It has been adequately proved that this fusion was not dominant neither during the early 1900s nor today (Bond 2010). On the contrary other forms of money capital (e.g. those in capital markets) can play a more influential role.

Finally, contrary to ‘globalisationism’, the basic unit of the global system of imperialism remains the national economy. Bukharin (1917) had accurately pointed out that capitalism is characterized by a permanent contradiction between nationalization and internationalization. Nationalisation denotes capitalism’s foundational unit. Internationalisation expresses capital’s inherent tendency to expand its accumulation. This permanent and unresolvable contradiction is expressed in tidal waves of internationalization and re-nationalisation (i.e. return to the foundational basis). On the basis of this contradiction antagonistic blocs of capitalist economies are being formed.

Following from the above-mentioned considerations, the primary task for a modern redefinition of the Marxist theory of imperialism is to designate the economic mechanism of imperialist exploitation. More specifically, it must specify how more developed capitalist economies can obtain transfers of value form less developed economies in all three main forms of international economic activities: (a) trade, (b) direct investments and (c) portfolio investments.

a) International Transfers of Value due to Trade

The fundamental mechanism of value transfers in international trade is this described by the absolute advantage theory as presented by A.Smith and K.Marx. According to this, any individual country that holds advantages in production costs at the beginning of the trade transactions will seek to maintain them in the same way as an individual capital struggles to prevail over its competitors in the domestic market (Shaikh 1980a, 1980b, 2016). This is a realistic conception of international economic relations that grasps accurately the existence of persistent disequilibria in international trade, uneven development and geopolitical antagonisms in stark contrast to the fictional world of free trade liberalism.

For Marxism, the absolute advantage thesis implies the existence of a mechanism of unequal exchange that results in value transfers from some countries to others. Needless to say, this hemorrhage impedes the formers’ economic development. Beginning with Emmanuel’s (1972) seminal contribution there is a heated debate within Marxist Political Economy on the form of this unequal exchange mechanism. Setting aside Emmanuel’s problematic ‘strict unequal exchange’ (i.e. unequal exchange due to differences in wage rates and consequently to rates of surplus-value) we will argue that the proper mechanism is that of ‘broad unequal exchange’ (i.e. unequal exchange due to different organic compositions of capital, that is levels of development).

The gist of the ‘broad unequal exchange’ argument lays in a basic tenet of Marx’s transformation process of labour values to prices: the equalization of the rates of profit transfers surplus value produced from capitalists with lower organic composition of capital (OCC) to those with higher OCC. This holds both within a national economy and within a multi-national common market like the EU). The conclusion is that when developed economies compete with less developed economies a transfer of value would occur from the latter to the former; thus, constituting a mechanism of international economic exploitation.

b) International Transfers of Value due to Foreign Direct Investments

Foreign Direct Investment (FDI) is a different case. Although existing from the very beginning of capitalism, it increased significantly from the middle 20th century and onwards. Contrary to Dependency Theory’s empirical flawed empirical belief, FDI does not flow only from developed to less developed economies but also within these two broad categories. FDI means that a national capital makes a productive investment in another economy in order to extract surplus value. The predominant form of such investment is through multinational corporations (MNCs) which however has distinct national bases (metropole). The profits from an FDI can either be re-invested in the recipient economy or repatriated to the metropole. Only in the latter case they do constitute an international transfer of value. Both practices are common although there are characterized by significant historical variations. As Mandel (1978) accurately points out, there are various ways and accounting devices through which MNCs realise such international value transfers (e.g. transfer pricing).

c) International Transfers of Value due to Portfolio Investment

International Portfolio Investment involves financial transactions through banks (international loans) and capital markets (playing in foreign stock exchanges). In the case of international loans, the international value transfer from the debtor to the lender is obvious: loans are repaid plus interest. In the case of stock exchange gains the case is less obvious (as they can be ‘played’ again in the same capital market), but a usual practice – particularly since global financial deregulation – is to move them around the world.

REFERENCES

Baldwin, R. & Martin P, (1999), ‘Two Waves of Globalization: Superficial Similarities, Fundamental Differences’, NBER Working Paper 6904 (January).

Bond, P. (2010), ‘A Century since Hilferding’s ‘Finanz Kapital’: Again, Apparently, a Banker’s World?’, Links International Journal of Socialist Renewal, November 19.

Bukharin, N. ([originally 1917] 1976), Imperialism and World Economy, London: Merlin Press.

Chandy L. & B.Seidel (2016), ‘Is Globalization’s Second Wave about to Break?’, Brookings Institute Global Views no.4.

Frankel J. (2000), ‘Globalization of the Economy’, NBER Working Paper No. 7858.

Held, D. & McGrew, A. (1998), ‘The End of the Old Order? Globalization and the Prospects for World Order’, Review of International Studies 24 (Special Issue no.5), pp. 219-245.

Higgott, R. (1999) ‘Economics, politics and (international) political economy: the need for a balanced diet in an era of globalization’, New Political Economy, 4(1), pp.23-36.

Hilferding, R. ([originally 1912]1981), Finance Capital, London: Routledge.

Hirst, P. & Thompson, G. (1999), Globalization in Question: The International Economy and the Possibilities of Governance, Cambridge: Polity Press.

Hobson, J. (1902), Imperialism, London: Allen & Unwin.

Lenin V.I. ([originally 1917] 1948), Imperialism, the Highest Stage of Capitalism, London: Lawrence and Wishart.

Luxemburg, R. ([originally 1913]1951), The Accumulation of Capital, London: Routledge and Kegan Paul.

Mandel E. (1978), The Second Slump: A Marxist Analysis of Recession in the Seventies, London: New Left Books.

Mavroudeas S. & Seretis S. (2018), ‘Imperialist exploitation and the Greek crisis’, East-West Journal of Economics and Business, Vol. XXI – 2018, Nos 1-2, pp.43-64.

Schumpeter, J. (1919), The Sociology of Imperialism, Wien: Archiv fur Sozialwissenschaft und Sozialpolitik.

Shaikh, A. (1980a), ‘Foreign Trade and the Law of Value’ Part I and II, Science and Society 43(3), pp. 281-302 and 44(1), pp. 27-57.

Shaikh, A. (1980b), ‘On the Laws of International Exchange’ in Nell E. (ed.) Growth, Profits and Property, Cambridge: Cambridge University Press.

Shaikh, A. (2016), Capitalism: Competition, Conflict, Crises, Oxford: Oxford University Press.

Solow R. (1987), We’d Better Watch out, New York Times Book Review.

Tyson L. (1991), ‘They Are Not Us: Why American Ownership Still Matters’, The American Prospect, Winter.

Wallerstein I. (1979), The Capitalist World Economy, Cambridge: Cambridge University Press.

Zevin, R. (1988), ‘Are world financial markets more open? If so, why and with what effect?’, paper delivered at WIDER Conference on Financial Openness, Helsinki.

[1] Various indices have been proposed in order to measure globalization. Setting aside multi-measures (encompassing economic, social and political factors), the predominant economic measures focus on the proportions of foreign investment, international trade to GDP and the proportion of migration to population. This graph shows these trends.