Bank failures: The specter of crisis once again looms over capitalist economies S. Mavroudeas Department of Social Policy Panteion University THE BANKRUPCIES On 10/3, California-based Silicon Valley Bank (SVB) became the largest bank to fail since the financial crisis of 2008. It was the 16th largest US commercial bank. It specialized in transactions with technology and healthcare companies and particularly in investments in start-up companies. SVB’s bankruptcy was triggered by significant losses on corporate securities it had lent to. In order to diminish losses SVB bought US state debt titles. However, Fed’s policy of raising interest rates diminished the market value of these titles. SVB was then in a conundrum. It tried to cover losses with an equity raise, but

Topics:

Stavros Mavroudeas considers the following as important: bankruptcies, Credit Suisse, falling rate of profit, Mavroudeas, Silicon Valey Bank, Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Bank failures: The specter of crisis once again looms over capitalist economies

S. Mavroudeas

Department of Social Policy

Panteion University

THE BANKRUPCIES

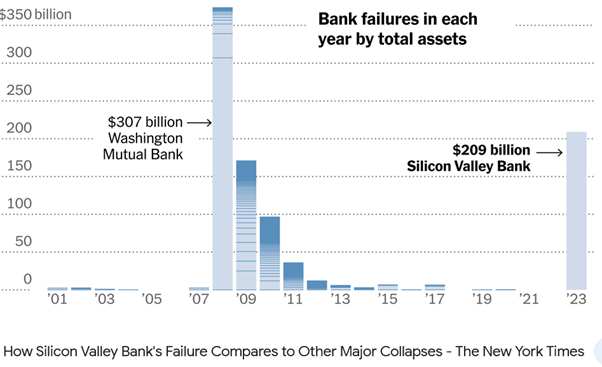

On 10/3, California-based Silicon Valley Bank (SVB) became the largest bank to fail since the financial crisis of 2008. It was the 16th largest US commercial bank. It specialized in transactions with technology and healthcare companies and particularly in investments in start-up companies.

SVB’s bankruptcy was triggered by significant losses on corporate securities it had lent to. In order to diminish losses SVB bought US state debt titles. However, Fed’s policy of raising interest rates diminished the market value of these titles. SVB was then in a conundrum. It tried to cover losses with an equity raise, but that caused panic among the major California tech companies that kept their cash in SVB. The result was that instead of raising capital, SVB faced a typical bank run. Its stock collapsed, dragging that of other banks down with it. Trading in its stock was halted and efforts to raise capital or find a buyer failed, leading to the US Federal Deposit Insurance Corporation (FDIC) taking control of it. The latter is an independent government agency that insures bank deposits and supervises financial institutions. It will liquidate the bank’s assets to repay its customers, including depositors and creditors.

The SVB bankruptcy is not an isolated incident. It was preceded by another crack in the financial system in the sinful sector of cryptocurrencies. Cryptocurrency bank Silvergate went bankrupt after prices and trading of bitcoin and other cryptocurrencies collapsed (8/3/2023). In addition, the collapse of SVB was quickly followed (12/3/2023) by the closure of Signature Bank, a lender to the cryptocurrency sector. During the following days a number of other financial institutions came to the fore as ‘toxic’ (i.e. in danger of going under); the Credit Suisse being the more prominent of them. In all cases there was concerted efforts to devise plans to solve them.The crucial point in all these cases is not that salvation plans were devised but the high frequency of bankruptcies or near-bankruptcies in a limited time-period. Another crucial point is that the specific mechanisms of each case differ: from start-up financing (in the case of the SVB) to the cryptocurrencies (in the case of Silvergate) and to the more traditional causes (in the case of Credit Suisse). All these point towards a general malaise and not to isolated specific cases (as some Mainstream commentators tried to argue initially).

FEARS OF A DOMINO EFFECT AND IMMEDIATE POLICY REACTIONS

These events have caused fears in all the main political-economic decision centers of the capitalist system about triggering a chain (domino) of bankruptcies. Their reactions, as usual, are a combination of ostrich and alertness.

The EU and the UK were quick to say they were little affected by the events. At the same time, however, the English branch of SVB is literally being sold for peanuts.

On the contrary, the USA activated a series of available tools (overt and covert) to neutralise the danger of the domino. In addition to reassuring statements and influencing public sentiment, the Treasury Department, the FDIC and the Fed announced a new Bank Financing Program (BTFP), which offers loans of up to one year to institutional institutions against bonds and certain other collateral. Collateral will be taken at face value rather than market prices, avoiding forced sales in response to the fear of bankruptcy. In addition, the deposits of the two insolvent banks (including those above the institutional limit of USD 250,000) were guaranteed. Also, regulators are mussing over the introduction of new tests and requirements for bank solvency.

These moves aim to avoid panic in the international money and capital markets in the aftermath of the bankruptcies. A general panic would cause an uncontrolled avalanche and possibly a crash. Capitalist decision-making centers have enough experience – if conditions and time permit – to avoid such avalanches. But what they fail to achieve is to resolve the deeper contradictions of the system that give birth to them.

THE LITMUS TEST OF PROFITABILITY

Within Mainstream Economics and the ruling classes’ decision centres the bankruptcies fomented already raging controversies. Two are the main focal points of these controversies. First, social-liberal views blame Trump’s deregulation of the financial system (the withdrawal of the Dodd-Frank Act in 2018), which loosened supervision over banks. They maintain that with more financial regulation bankruptcies would be avoided. Second, proponents of looser monetary policy (supported by private markets that are panicking) argue that rapid interest rate hikes stifle business and demand a pose.

These are myopic quarrels that turn a blind eye to the insurmountable fundamental contradictions of capitalism. Marxist Political Economy aptly places at the core of these capitalist problems the long-term falling profitability trend that haunts the very DNA of capitalism. This position is again confirmed in today’s bankruptcies. Contrary to the frivolous financialization theories, the financial system has never cut its umbilical cord with capitalist profitability. Interest (financial sector’s revenues) are part of surplus-value (and hence a deduction from enterprises’ profit). Hence, once again – contrary to the ‘financialisationist’ naïvetés – the falling profitability causes financial bankruptcies. Interestingly, in the current situation takes the form of a very dangerous duo: falling profits and falling business asset prices due to rising interest rates. This configuration increases vertically the danger of an impending recession.

The beginning of the 21st century is already marred by the increasing occurrence of capitalist crises. After the 2008 crisis (with its double dip), the COVID-19 health-cum-economic crisis followed. Both were associated with a serious decline of capitalist profitability. After the pandemic crisis, profitability recovered quickly once the economy restarted. But the recovery did not fully cover the losses of the crisis. Moreover, it quickly stumbled again upon the overaccumulation of capital (i.e. the existence of a big proportion of non-viable under current conditions capitalist firms). This was aggravated by the specific contours of the contemporary eruption of inflation that increased production costs. Thus, even Mainstream entities (e.g. JP Morgan) estimate that profitability is back on the decline.

As mentioned above, inflation further complicates the situation. Anemic capitalist growth produced real (and not merely monetary) causes for price increases. These were exacerbated by the systematic increase in corporate profit margins through mild price increases (i.e. profit inflation). But this trick quickly became uncontrollable, due to the intensifying imperialist conflicts and the inability to further increase the exploitation of labor. The former fragment production chains and increase costs.

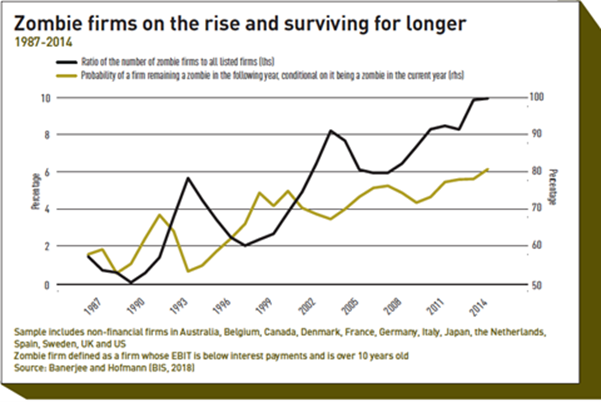

The increase of the ‘zombie companies’ (firms which cannot cover debt servicing costs from current profits over an extended period) is an indicative sign of this situation. Contrary to previous Mainstream assertions (e.g. https://www.federalreserve.gov/econres/notes/feds-notes/us-zombie-firms-how-many-and-how-consequential-20210730.html ) this cohort is on the rise. What is also worrying is the fact that – contrary to Mainstream beliefs – these ‘zombie companies’ do not disappear quickly but rather manage to survive despite their precarious condition. The prevalence of ‘zombie companies’ has ratcheted up after the 1974-5 global crisis. What made them more long-lived during the last years is the persistence on low interest rates. The unconventional monetary policy (i.e., quantitative easing (QE)), gave further lease of life to these companies which would otherwise have been long buried. The current bout of inflation puts their existence at risk as central banks raise interest rates.

Capital faces further complications in the current situation. The emergence of a tight labour market (at least for several sectors of the economy) implies that capital cannot easily reinvigorate the increase of labour exploitation (the rate of surplus-value) as a counter-acting force in the decline of the profit rate. The ‘great resignation’ (fewer people working, that is a smaller workforce) and the ‘quiet quitting’ (meaning workers seeking fewer hours of work) means that – under the current conditions of work and pay – capital cannot easily employ methods of relative and absolute surplus-value extraction. This condition is expressed in the chronically low productivity.

CAPITAL’S POLICY CONUNDRUM

Thus, the system faces the duet of low profitability and high inflation.

It seems that – at least currently – the main capitalist political-economic decision centres prioritise the fight against inflation. Hence, they increase interest rates. But this further worsens the profitability of enterprises. In such a situation the financial sector is much more vulnerable. It depends on the profitability of productive enterprises, which is falling. It is over-extended due to years of expansive fictitious capital operations (which depend upon credit expansion). At the same time, its assets are depreciated due to rising interest rates. Additionally, perverse phenomena appear; like the inverted yield curve (an unusual state in which longer-term debt instruments have a lower yield than short-term ones). This combination leads the most exposed banks to bankruptcy.

Probably capitalist political-economic decision centres expect that the rhythm of bankruptcies will be low and spread over time. Hence, they could face each one separately and without them resulting in a domino.

However, history has shown that capitalism is not an easily controlled system even by its most experienced managers. The current bout of financial bankruptcies is only the tip of the iceberg. The deep structural contradictions of the capitalist system – expressed fundamentally in the falling profitability – lay beneath the surface. And the capitalist system seems increasingly incapable of resolving them.