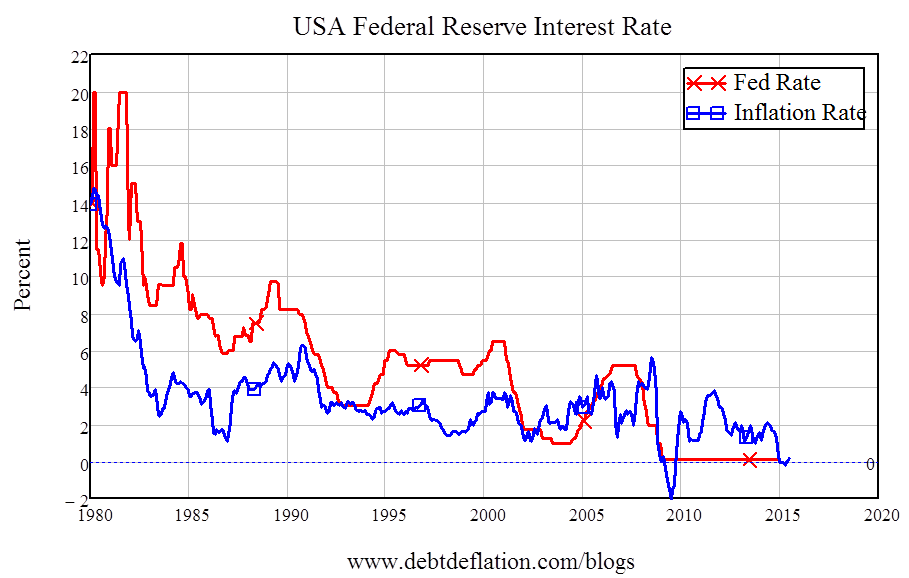

For seven years now, the rate The Fed sets to determine the price banks pay to borrow from it and from each other has been zero, or so close to zero that the difference is immaterial. This is, historically speaking, not normal, and The Fed has a desperate desire to return to what is normal, which is rate a few per cent above the rate of inflation (see Figure 1). Click here to read the rest of this post.

Topics:

Steve Keen considers the following as important: Debtwatch

This could be interesting, too:

Steve Keen writes Zimpler Casino Utan Svensk Licens ? Utländska Casino Mediterranean Sea Zimpler

Steve Keen writes Login Sowie Spiele Auf Der Offiziellen Seite On The Internet”

Steve Keen writes Login Bei Vulcanvegas De Ebenso Registrierung, Erfahrungen 2025

Steve Keen writes What To Be Able To Wear To The Casino? The Complete Dress Guide

For seven years now, the rate The Fed sets to determine the price banks pay to borrow from it and from each other has been zero, or so close to zero that the difference is immaterial. This is, historically speaking, not normal, and The Fed has a desperate desire to return to what is normal, which is rate a few per cent above the rate of inflation (see Figure 1).