For decades, some of the most important data about market economies was simply unavailable: the level of private debt. You could get government debt data easily, but (with the outstanding exception of the USA—and also Australia) it was hard to come by. That has been remedied by the Bank of International Settlements, which now publishes a quarterly series on debt—government & private—for over 40 countries. This data lets me identify the seven countries that, on my analysis, are most likely to suffer a debt crisis in the next 1-3 years. They are, in order of likely severity: China, Australia, Sweden, Hong Kong (though it might deserve first billing), Korea, Canada, and Norway. Click here to read the rest of this post.

Topics:

Steve Keen considers the following as important: Debtwatch

This could be interesting, too:

Steve Keen writes Zimpler Casino Utan Svensk Licens ? Utländska Casino Mediterranean Sea Zimpler

Steve Keen writes Login Sowie Spiele Auf Der Offiziellen Seite On The Internet”

Steve Keen writes Login Bei Vulcanvegas De Ebenso Registrierung, Erfahrungen 2025

Steve Keen writes What To Be Able To Wear To The Casino? The Complete Dress Guide

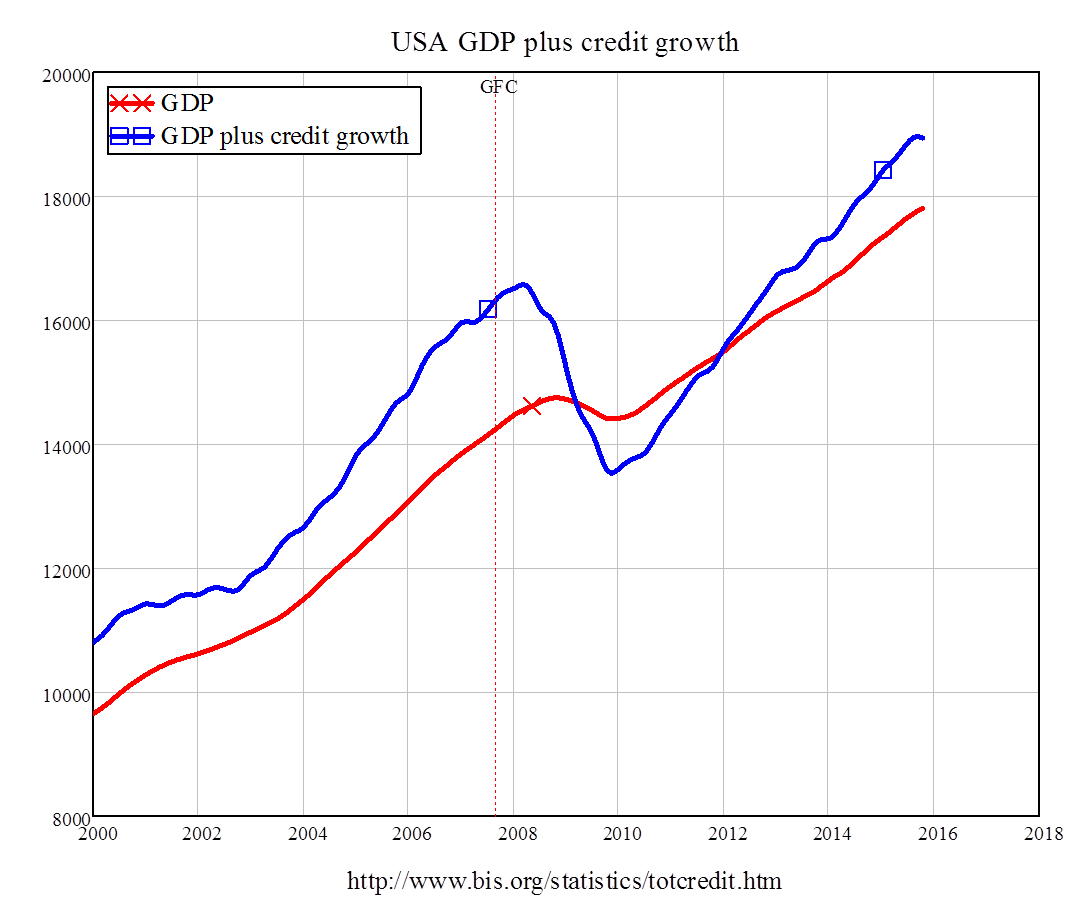

For decades, some of the most important data about market economies was simply unavailable: the level of private debt. You could get government debt data easily, but (with the outstanding exception of the USA—and also Australia) it was hard to come by.

That has been remedied by the Bank of International Settlements, which now publishes a quarterly series on debt—government & private—for over 40 countries. This data lets me identify the seven countries that, on my analysis, are most likely to suffer a debt crisis in the next 1-3 years. They are, in order of likely severity: China, Australia, Sweden, Hong Kong (though it might deserve first billing), Korea, Canada, and Norway.