"I have invited an economist that was active in the dollarization of Ecuador to illustrate the wonders of the process." A paper with Santiago Graña on dollarization in Argentina published in the PSL Quarterly Review. From the abstract:Currency substitution defined as the use of foreign currency in the domestic economy is a relatively common phenomenon in developing countries. While mainstream economics has analyzed it in some detail, the same is not the case in heterodox economics. This...

Read More »Argentina on the verge

The big question in the case of Argentina, as always is when it will explode. If the current developments are an indicator of anything, it should be sooner rather than later. Note that the fundamental problems regarding the possible crisis and default are associated to the external debt in dollars (one has to repeat this all the time). It does not mean that there weren't other problems with the Argentine economy, but the domestic issues do NOT lead to a default (yes, that means the fiscal...

Read More »Dollars & Nonesense: Milei and the risk of hyperinflation

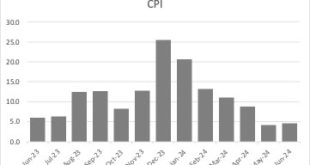

Javier Milei will be Argentina’s next president. Milei is an extreme right-wing populist, with authoritarian, some may say Fascistic, tendencies. He is an admirer of Trump and Bolsonaro. He is rumored to talk with his deceased dog, that he had cloned. His party’s proposals range from the dangerous – like dollarization, the closing of the Central Bank, the drastic reduction of social spending, the loosening gun ownership laws, and the criminalization of abortions – to the insane – like...

Read More »On the Argentinean debt renegotiation (in Spanish)

[embedded content] My interview on Led.fm with María Iglesia and Cecília Camarano for the program Reperfiladas (in Spanish, obviously) on the Argentinean debt restructuring.

Read More »Restructuring Argentina’s Private Debt is Essential

JOSEPH E. STIGLITZ, EDMUND S. PHELPS, CARMEN M. REINHARTArgentina's creditors are being asked to accept a proposal that would reduce their revenue stream but make it sustainable. A responsible resolution will set a positive precedent, not only for Argentina, but for the international financial system as a whole.Read rest and list of signatures here.

Read More »Argentina and the IMF

Alberto Fernández, who will assume as the next president in less than two weeks, has said he will not accept the next tranche of US$ 11billion that were part of the US$ 57 billion deal signed by the outgoing Macri administration. Many progressives see this as a good sign, in particular given the history of the IMF with Argentina. I've emphasized, against a lot of heterodox discussion on the subject, that the IMF remains essentially unchanged when it comes to policy prescriptions. So I...

Read More »Dollarization in Argentina?

So I have no insider knowledge on what the Argentinean government plans to do. And the White House is a mess; they don't have any knowledge on what they plan to do. But Larry Kudlow, the Director of the National Economic Council, said that the Treasury is deeply involved in a plan to dollarize the Argentinean economy (Guillermo Calvo, an influential conservative economist, has also spoken in favor of dollarization; see here in Spanish). [embedded content] He supports a Currency Board to...

Read More »Neoliberalism Resurgent: What to Expect in Argentina after Macri’s Victory*

The election of businessman Mauricio Macri to the presidency in Argentina signals a rightward turn in the country and, perhaps, in South America more generally. Macri, the candidate of the right-wing Compromiso para el cambio (Commitment to Change) party, defeated Buenos Aires province governor Daniel Scioli (the Peronist party candidate) in November’s runoff election, by less than 3% of the vote.Macri is the wealthy scion an Italian immigrant family that made its money on the basis of...

Read More » Heterodox

Heterodox