The big question in the case of Argentina, as always is when it will explode. If the current developments are an indicator of anything, it should be sooner rather than later. Note that the fundamental problems regarding the possible crisis and default are associated to the external debt in dollars (one has to repeat this all the time). It does not mean that there weren't other problems with the Argentine economy, but the domestic issues do NOT lead to a default (yes, that means the fiscal problems).In spite of all the criticism of the Fernández government, and some of that is certainly correct (but not the fact that they didn't do fiscal adjustment or not enough industrial policy; it's the reserves idiot!), the increase in debt happened all during the Macri administration (2015-2019).

Topics:

Matias Vernengo considers the following as important: Argenitina, default, foreign exchange gap, IMF, inflation, Milei

This could be interesting, too:

Matias Vernengo writes Serrano, Summa and Marins on Inflation, and Monetary Policy

Angry Bear writes Voters Blame Biden and Harris for Inflation

Matias Vernengo writes Milei and real wages in Argentina

Lars Pålsson Syll writes How inequality causes financial crises

The big question in the case of Argentina, as always is when it will explode. If the current developments are an indicator of anything, it should be sooner rather than later. Note that the fundamental problems regarding the possible crisis and default are associated to the external debt in dollars (one has to repeat this all the time). It does not mean that there weren't other problems with the Argentine economy, but the domestic issues do NOT lead to a default (yes, that means the fiscal problems).

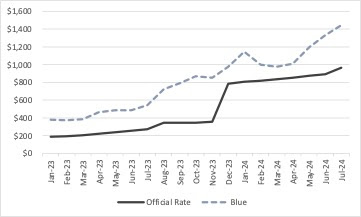

In spite of all the criticism of the Fernández government, and some of that is certainly correct (but not the fact that they didn't do fiscal adjustment or not enough industrial policy; it's the reserves idiot!), the increase in debt happened all during the Macri administration (2015-2019). Milei's 'plan' was to make a fiscal adjustment and devalue the official exchange rate to close the gap between it and the parallel exchange rate (the blue). The notion was that fiscal adjustment would solve the inflationary problem, caused in this view by monetary emissions to cover the fiscal deficits. Regarding the devaluation the logic was that the official rate was incompatible with the market determined one, and, hence, this was inevitable.

Milei depreciated the official exchange rate by more than a 100 percent, to reduce the parallel market premium, and implemented a draconian fiscal adjustment, that he claims has led to a balanced budget. In reality his adjustment is a bit of a sham, an accounting gimmick. For example, the distributor of electricity, privatized in the 1990s, has stopped payments to the producers, and the government is negotiating the bill, which will not be zero, even though that is what they show in the balances. Many other cuts are unsustainable. In this case, even the IMF has suggested that the measures have gone too far, and might have severe social consequences. Note that fiscal adjustment and depreciation are the traditional IMF policy prescriptions.

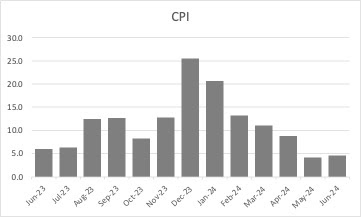

As a result of his measures, inflation accelerated to more than 25 percent per month in December right after the depreciation, and as the exchange rate depreciation moderated, inflation has decelerated, remaining for now more or less at the same level as before Milei’s inauguration, which corresponds to an annualized rate of about 180 percent. However, in the last month inflation increased again, from 4.2 percent in May to 4.6 in June.

More importantly, the exchange rate premium has started to increase again, as the parallel exchange rate depreciates more than the official one, and reaching a gap of 60 percent, before falling back to somewhere in the 40 something percent.

Of course the devaluation only managed to accelerate inflation, and reduce real wages, and the blue continued to devalue, since the expectations that the government will be able to stabilize the exchange rate are minimal, given the lack of reserves. The central bank is now intervening in the foreign exchange markets to reduce the gap. But all hinges on the ability to obtain dollars. And that's why we are on the verge of a crisis. The IMF will probably not pony up more dollars, even if Trump gets elected, which seems to be Milei's bet. And now Argentina will have to start make significant payments servicing the debt. Default is imminent, and there is an increasing need to acknowledge that the Argentine debt is unsustainable.