On 28 February 2023, the Danielle Smith government tabled Alberta’s 2023-2024 budget. Projecting a $2.4 billion surplus for the coming fiscal year, the budget announced some spending increases; but many are effectively cuts when one accounts for both inflation and population growth. Here are 10 things to know: The budget itself contains projections pertaining to inflation and population change. In the upcoming fiscal year, the budget projects 3.3% inflation (using...

Read More »Low taxes are nothing to brag about

I’ve written an opinion piece that appears in today’s Regina Leader-Post. The piece argues that the Saskatchewan government shouldn’t brag about the province’s low-tax climate (which it recently did). Rather, I argue that taxes serve important functions. The link to the opinion piece is here. Enjoy and share:

Read More »Low taxes are nothing to brag about

I’ve written an opinion piece that appears in today’s Regina Leader-Post. The piece argues that the Saskatchewan government shouldn’t brag about the province’s low-tax climate (which it recently did). Rather, I argue that taxes serve important functions. The link to the opinion piece is here. Nick Falvo is a Calgary-based research consultant with a PhD in Public Policy. He has academic affiliation at both Carleton University and Case Western Reserve University, and is...

Read More »Ten considerations for the next Alberta budget

Over at the Behind The Numbers website, I’ve written a blog post titled “Ten considerations for the next Alberta budget.” The blog post is a summary of a recent workshop organized by the Alberta Alternative Budget Working Group. The link to the blog post is here. Enjoy and share:

Read More »An Analysis of Financial Flows in the Canadian Economy

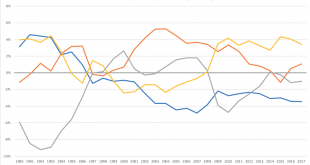

An essential but perhaps overlooked way of looking at the economy is a sector financial balance approach. Pioneered by the late UK economist Wynne Godley, this approach starts with National Accounts data (called Financial Flow Accounts) for four broad sectors of the economy: households, corporations, government and non-residents. Here’s how it works: in any given quarter or year each sector can be a net borrower or lender, but the sum of the four sectors’ borrowing/lending must equal to...

Read More »Fiscal situation of Canada’s ‘oil rich’ provinces

I’ve just written a blog post about the fiscal situation of Canada’s ‘oil rich’ provinces (i.e., Alberta, Saskatchewan and Newfoundland and Labrador). It consists of a summary of key points raised at a PEF-sponsored panel at this year’s Annual Conference of the Canadian Economics Association. Points raised in the blog post include the following: -The price of oil is impossible to accurately predict, and there’s no guarantee it will rise to past levels. -Each of Canada’s ‘oil rich’ provinces...

Read More »The Federal Role in Poverty Reduction

Your access to this site has been limited Your access to this service has been temporarily limited. Please try again in a few minutes. (HTTP response code 503) Reason: Exceeded the maximum number of page requests per minute for humans. Important note for site admins: If you are the administrator of this website note that your access has been limited because you broke one of the Wordfence blocking rules. The reason your access was limited is: "Exceeded the maximum number of page requests per...

Read More » Heterodox

Heterodox