In my class, I try to introduce a topic and then give my students a discussion question to work through so I can make sure that everyone is catching on. This discussion question relates back to the disposition effect, or the bias towards selling winning stocks and away from losing stocks. If you need a refresher, you can see the entire behavioral economics playlist here.

Read More »Let’s Talk About the Bubble in Catastrophizing

Share the post "Let’s Talk About the Bubble in Catastrophizing" There’s a bubble in catastrophizing. This is the tendency to always assume the worst. Which is weird because the worst rarely plays out. In fact, even in worst case scenarios the financial markets have tended to stabilize fairly fast. Larry Swedroe had a good piece today on the trend in catastrophizing everything noting 3 particularly scary instances: From 1973 through 1974, the S&P 500 Index lost a total of 37%. Over...

Read More »The Confirmation Bias of the Anti-Forecasters

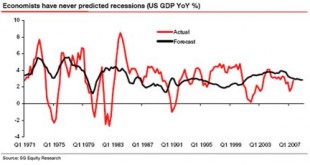

Share the post "The Confirmation Bias of the Anti-Forecasters" It’s become fashionable in recent years to shun all types of forecasting about the future. This narrative usually involves the cherry picking of bad forecasts to prove the point. For instance, we often hear about how economists have never predicted recessions or how Wall Street strategists never predict bear markets. Something like this might be presented as evidence of how bad these people are at forecasting the future:...

Read More »The Relative Thinking Trap

Share the post "The Relative Thinking Trap" Humans have an easier time understanding the world by thinking about things in relative terms. These comparisons help us better compartmentalize our thoughts and benchmark our performance. Relative thinking creates order in a seemingly orderless world. But it can be both productive and highly unproductive since, in addition to thinking in relative terms, we also tend to overestimate how good we are at certain things. The better than average...

Read More »ETFs Don’t Kill Investors, Investors Kill Investors

Share the post "ETFs Don’t Kill Investors, Investors Kill Investors" There was a good piece in the WSJ today discussing potential “flaws” in Exchange Traded Funds (ETFs). ETFs are a relatively new product that have amassed huge quantities of assets in the last few decades but are still dwarfed by the mutual fund space (roughly 2.1 trillion in assets vs 12.6 trillion in mutual funds). The SEC recently said “It may be time to re-examine the entire ETF ecosystem.” That sounds a bit...

Read More »Covariation Bias and the Bear Market “Genius”

Share the post "Covariation Bias and the Bear Market “Genius”" Covariation bias is the tendency for people to overestimate the relationship between fearful stimuli and negative outcomes. The classic example in scientific studies is people’s reactions to spiders. Death from spider bites are extremely rare and there hasn’t been a recorded spider death in Australia (where spiders are most common) since 1979 (see here and here). But you’d be hard pressed to find someone who doesn’t think...

Read More » Heterodox

Heterodox