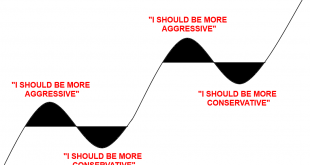

What a wild year it’s been. You could say that the pandemic was like an entire market cycle all rolled into one year. A boom, a bust and a boom. In January I wrote the following piece about how to manage a crazy booming stock market and avoid the temptation to get overly aggressive. Then just 3 months later I wrote this piece about how to manage a crazy collapse and avoid the temptation to get overly conservative. But this is the battle we constantly wage with ourselves. Successful...

Read More »The Permaeverything Approach

I’m a permaeverything. Not a permabear. Not a permabull. A permaeverything. What the hell does that mean? It means I try to always maintain a relatively balanced exposure across my financial assets. I am never too heavily leveraged to stocks. Never too heavily leveraged to bonds. Never too heavily leveraged to cash. I am balanced. I am permanently bullish AND bearish about everything to some degree. The Permaeverything mentality is essentially a type of Permanent Portfolio or All Weather...

Read More »Brad DeLong — THE MUST-READ OF MUST-READS on the links between behavioral finance and macro

THE MUST-READ OF MUST-READS on the links between behavioral finance and macro: John Maynard Keynes (1936): The State of Long-Term Expectation: The General Theory of Employment, Interest and Money: Chapter 12: "If I may be allowed to appropriate the term _speculation for the activity of forecasting the psychology of the market, and the term enterprise for the activity of forecasting the prospective yield of assets over their whole life, it is by no means always the case that speculation...

Read More »The Best Investment Strategy: DISCIPLINE

I was reading this article in the NY Times about a wide ranging diet study. They performed a meticulously controlled test to study what type of diet works best. Their conclusion: “The bottom line is that the best diet for you is still the one you will stick to. No one knows better than you what that diet might be. You’ll most likely have to figure it out for yourself.” One of my favorite things about investing is its similarities with dieting and health. Mainly, investing is really...

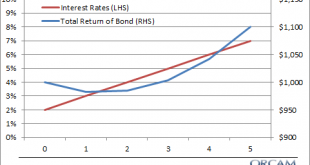

Read More »How to Overcome Your Fear of Bonds

I specialize in building relatively conservative “all weather” style indexing portfolios. They are designed for people who have a reasonably long time horizon (at least 5-10 years), don’t want to go through another 2008, but also want to generate a decent return above the rate of inflation. This means I end up managing a lot of fixed income because being a long only equity manager would expose investors to too much 2008 risk and owning cash guarantees a negative inflation adjusted return....

Read More »I forgot that I had a bunch more videos to put together and…

[unable to retrieve full-text content]I forgot that I had a bunch more videos to put together and post, so I’m trying to get that ball rolling again. (There’s a “Behavioral Economics” playlist so that you can start at the beginning if you want.)

Read More »Curating a Social Media Feed to Make Better Decisions

Share the post "Curating a Social Media Feed to Make Better Decisions"One of the most common problems in economics and finance is the fallacy of composition. The fallacy of composition occurs when you fail to understand the entirety of an argument. As an example, a common fallacy of composition in finance includes the cash on the sidelines myth. The cash on the sidelines myth is the myth often repeated on financial TV regarding the “cash” on the sidelines that will come into the market and...

Read More »Tired of the disposition effect yet? This one’s short, I…

Tired of the disposition effect yet? This one’s short, I promise- just shows how the incentives for tax-motivated selling of losing stocks change over the year and cloud the disposition effect test statistics. As usual, you can see the whole behavioral economics playlist here in case you want to catch up or need a review.

Read More »I didn’t tell you last time that the disposition effect…

I didn’t tell you last time that the disposition effect result I discussed suffered from a potential econometric problem, so I make up for that here. As usual, you can see the whole behavioral economics playlist here in case you want to catch up or need a review.

Read More »In a previous video, my class went over the empirical setup in…

In a previous video, my class went over the empirical setup in one of the main papers about the disposition effect in stock-market behavior. Now they got to talk about the results of that analysis. If you need a refresher, you can see the whole behavioral economics playlist here.

Read More » Heterodox

Heterodox