Brazil has an enormous past ahead As I suggested last month the coup had succeeded. Today Dilma Rousseff was effectively removed from the presidency. No real news here. I just want to correct, to some extent, the huge misinformation campaign in course in the US. Monica de Bolle was saying many incorrect things on NPR this week (for example, that "the origins of the program called Bolsa Familia came from actually Cardoso's government, so the previous government, the PSDB government that...

Read More »Some thoughts on the impeachment and the right wing turn in Brazil

Riding the coup bike without the military Brazilian President Dilma Rousseff has been impeached. The vice-president, Michel Temer, will assume the presidency temporarily while she is judged by the Senate. While the final outcome is still uncertain, it is very unlikely that she will return to office. This closes the long cycle of the left in Brazil, which started with the election of Luiz Inácio Lula da Silva to the presidency in 2002, and that led to the election and re-election of the...

Read More »New York Times on the Brazilian coup… I mean impeachment

So for the correct view (yes, it was a coup) see Laura Carvalho here. As she says: The impeachment process of President Dilma Rousseff started as a retaliation by the speaker of Brazil’s lower house of Congress, Eduardo Cunha, indicted for taking as much as $40 million in a kickback scheme at the state-owned oil company Petrobras. Cunha, whose name is also tied to the Panama Papers, initiated the impeachment process shortly after a public announcement by government allies that they would...

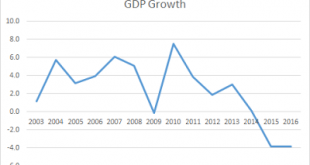

Read More »Brazilian growth during the Workers’ Party adminstration

Overall from 2003 to 2016 about 2.4%. If the last two years (2016 being an estimate are not counted) it's 3.5%. The collapse does not explain the impeachment (on this more later). It's more the result of the Workers' Party administration already caving and accepting the austerity policies promoted by the opposition.

Read More »Is there a solution to Brazil’s crises?

By Felipe Rezende This is the first of a series of posts on the Brazilian crises. There are two major crises Brazil’s president Dilma Rousseff is facing: one is a political crisis and the other is Brazil’s sharpest recession in 25 years. Brazil’s Political Crisis The political crisis has two main pillars: a) a vast corruption scandal (with evidence of a kickback scheme funneling billions of dollars from state-run firms and, more recently, in a massive data leak over possible tax evasion,...

Read More »Latin America turn to the right and American policy

Tom Jobim said that Brazil was not for beginners, and he was right. The Brazilian economy is in free fall. As I noted before the causes are strictly internal, and not related to any fiscal problem. Inflation was low, even if closer to the top margin of the inflation target. Devaluation of the currency has led to higher inflation, on the low two digit level, just slightly above 10%. At the same time, fiscal contraction has led to a collapse of about 3.5% of GDP last year. There is little need...

Read More »Political Aspects of Unemployment: Brazil’s Neoliberal U-Turn

New paper by Franklin Serrano and Luiz Eduardo Melin. From the abstract: Throughout the world, the reversion of fortune suffered by the Brazilian economy since reaching its zenith as recently as 2010 has confounded shrewd commentators, seasoned analysts and market players alike. As 2015 unfolded, ominous projections (“An Economy on the Brink”, “Brazil’s Economy Falters” “Worse May Be To Come”) were no less widespread than expressions of bewilderment (“Whatever Happened to Brazil”, “Brazilian...

Read More »The strange and misunderstood reasons for the Brazilian crisis

Almost done for the year. So do not expect many posts before the end of the ASSA conference (January 5). But as I promised, here are some brief thoughts on the Brazilian crisis.Brazil is a mess. The economy is collapsing, with an estimated decline of about 3.5% in GDP this year (perhaps worse), and inflation has accelerated, to two digit levels, way above what used to be the upper limit of the inflation target band. Worse, politically the country is paralyzed, with an impeachment process in...

Read More »Brazil´s Sudden Neoliberal U-Turn

By Franklin SerranoA sharp slowdown in the Brazilian economy presents a critical challenge for the Workers’ Party (PT) government led by Dilma Rousseff. Between 2011 and 2014, economic growth averaged only 2.1 percent annually, compared with 4.4 percent in the 2004-2010 period.The recent downturn can be squarely blamed on economic policies implemented by Rousseff’s first administration (2010-14). This policy change sought to reduce the state’s role of directly promoting the expansion of...

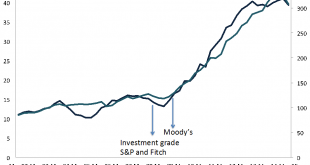

Read More »Endogenous financial fragility in Brazil: Does Brazil’s National Development Bank reduce external fragility?

By Felipe Rezende Introduction The creation of new sources of financing and funding are at the center of discussions to promote real capital development in Brazil. It has been suggested that access to capital markets and long-term investors are a possible solution to the dilemma faced by Brazil’s increasing financing requirements (such as infrastructure investment and mortgage lending needs) and the limited access to long-term funding in the country. Policy initiatives were implemented...

Read More » Heterodox

Heterodox