[embedded content] Partial video (my fault) of the conference about the book edited by the late Jerzy Osiatynski and by Jan Toporowski published by Oxford University Press. Our chapter on Prebisch with Esteban Pérez is available in a preliminary version here.

Read More »Kalecki’s Alternative to Keynes and White’s Plans its Consequences

Webinar on Kalecki and his views on the Bretton Woods agreement. To register go here.

Read More »The End of Bretton Woods

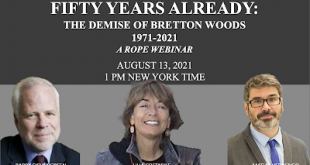

[embedded content] End of Bretton Woods with Barry Eichengreen, myself and Lilia Costabile, organized by L-P. Rochon and the Review of Political Economy.

Read More »Nixon ends dollar convertibility

50 years ago this Sunday. A debate with Barry Eichengreen on that today at 1pm NY time, and you can register here. [embedded content]My paper can be read here.

Read More »The Consolidation of Dollar Hegemony after the Collapse of Bretton Woods: Bringing power back in

Collapse, ma non troppo!New IDEAS Working Paper on the alternative views of the collapse of Bretton Woods. From the abstract:Contrary to conventional views which suggest that the collapse of Bretton Woods represented the beginning of the end of the global hegemonic position of the dollar, the collapse of the system liberated American policy from convertibility to gold, and imposed a global fiat system still dominated by the floating dollar. The end of Bretton Woods and the set of regulations...

Read More »The Demise of Bretton Woods

ROPE will be hosting a special Zoom Webinar, hosted by Lilia Costabile. The webinar is on August 13, 2021, at 1 pm, NY time (Bretton Wood collapsed on August 15, 1971) . To register, please use the following link.

Read More »Prebisch’s Critique of Bretton Woods Plans

Prebisch, Williams and KaleckiNew Working Paper with Esteban Pérez at the networkideas. From the abstract:The name and work of Raúl Prebisch are often associated with the problem of long-term economic development in Latin America. Less well known and explored is Prebisch’s contribution to the study of the monetary and financial problems of the countries of the periphery in relation to those of the center. Prebisch analyzed the post-WW-II monetary plans of John Maynard Keynes and Harry Dexter...

Read More »Keynes and the death of capitalism

In a recent article for the New Statesman, the economics commentator Grace Blakeley makes an extraordinary claim. Writing about the origins of the IMF, she says: Seventy-five years have passed since these international financial institutions were created in Bretton Woods, New Hampshire, in 1944. Back then, delegates sought to tame the power of international finance, the growth of which helped to cause the 1929 Wall Street Crash and the ensuing Great Depression. JM Keynes – who led the...

Read More »1919: Keynes’s revolutionary plan for the global economy

12 November, 2018 This year is the 150th anniversary of the TUC, and the 70th anniversary of the Trade Union Advisory Committee to the OECD. As part of the celebration of these achievements, the TUC’s Economics and Social Affairs department organised an event “Lessons from the Great Financial Crisis” – on 12th November, 2018 – the day after Armistice day, and 100 years after the ending of the First World War. Several speakers, including ex-Prime Minister Gordon Brown, were invited to...

Read More »The Crisis: causes and consequences.

The following article was written for the Progressive Economy Forum’s publication – Ten Years Since the Crash: Causes, Consequences and the Way Forward – circulated at Labour Party Conference in October, 2018. 13th September, 2018 To fix things we need to first tell ourselves the correct story about how we got here. Financialization is easily the least studied and least explored reason behind our inability to create shared prosperity – despite our being the richest and most successful...

Read More » Heterodox

Heterodox

-310x165.png)