This was my presentation at the Political Economy Research Institute (PERI) last summer. I was supposed to revise it, but never found the time. So it is now available on Substack. Fundamentally says that the current situation is very different than the debt crisis of the 1980s, and the period between the Tequila, in 94/95 and the Argentine Convertibility default in 2001/02.

Read More »Debt cycles and the long term crisis of neoliberalism

[embedded content] My talk at the IDEAS/PERI conference a few weeks ago. As I said there, I hate to be the optimist in the room, but I'm a bit more skeptical about the risks of a generalized sovereign debt crisis in the Global South. The two papers I cite are these (in their PERI Working Paper versions) two (one and two).

Read More »Argentina, Financial Times and the next default

It's been a while since I wrote about Argentina. In all fairness, because it is difficult given all the mistakes of the last few years since Macri's victory. I discussed the prospects of what to expect back then. Since then I posted here and here on the supposed improvement in 2017, and the beginning of the still unfolding crisis in 2018. And this could simply be an "I told you so post," since I did warn about most things that would happen. But there are important and interesting news about...

Read More »A Tale of Two Currency Crises: A Short Comment

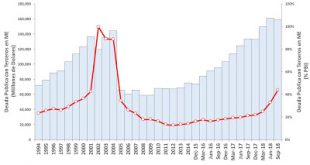

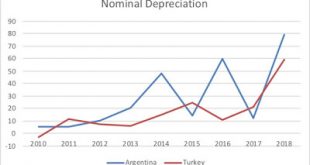

So the Turkish foreign exchange crisis is all over the news. But the Argentine one is less conspicuous in the international media. Turkey's economy has had many similarities with Latin American economies over the years, in terms of the incomplete process of industrialization, and the types of crises associated with neoliberal reforms over the last three decades. Note, however, that the Argentine nominal depreciation has been larger than the Turkish (the same is true if you go back to the...

Read More »Are we on the verge of a new crisis in the periphery?

New paper co-authored with Nate Cline published by the Political Economy Research Institute (PERI). Abstract says:In this paper we develop a simple model of currency crises, which emphasizes the role of currency mismatches and the balance of payments constraint. In our model, crises are driven by external shocks, particularly foreign interest rate and terms of trade shocks, which drive payments imbalances. In a reversal of conventional causality, we show how a currency crisis can then produce...

Read More »More on currency crises and the euro crisis

I wrote a while ago about currency crises (see here). There I suggested that classical-Keynesian or post-Keynesian views on currency crises invert the causality between fiscal and balance of payments problems in a currency crisis. Currency crises are not caused by excessive fiscal spending financed by monetary emissions, which would lead to inflation, and eventually after a run on the currency and depletion of reserves to a devaluation, but on current account problems.There two key problems...

Read More » Heterodox

Heterodox