It's been a while since I wrote about Argentina. In all fairness, because it is difficult given all the mistakes of the last few years since Macri's victory. I discussed the prospects of what to expect back then. Since then I posted here and here on the supposed improvement in 2017, and the beginning of the still unfolding crisis in 2018. And this could simply be an "I told you so post," since I did warn about most things that would happen. But there are important and interesting news about Argentina, now that there is at least some clarity about who will run against Macri this year.Cristina Kirchner finally announced she's running for the vice-presidency, and that her husband's chief of staff (when Néstor was president), Alberto Fernández, will be at the top of the ticket. Some have

Topics:

Matias Vernengo considers the following as important: Argentina, Currency Crises, default, Financial Times

This could be interesting, too:

Matias Vernengo writes Milei and real wages in Argentina

Matias Vernengo writes Are we on the verge of a debt crisis?

Joel Eissenberg writes Javier Milei: Argentina’s Trump?

Merijn T. Knibbe writes Superinflation in Milei´s Argentina

Cristina Kirchner finally announced she's running for the vice-presidency, and that her husband's chief of staff (when Néstor was president), Alberto Fernández, will be at the top of the ticket. Some have suggested that this is a great move that will allow to unify Peronism, which might lead to victory in the election later this year. As a response, the editorial board of the Financial Times (FT) published a piece in which it suggests that given the low popularity of Macri's austerity measures backed by the International Monetary Fund (IMF) policies, that a return of Peronism, would be possible, but a huge mistake for Argentina.

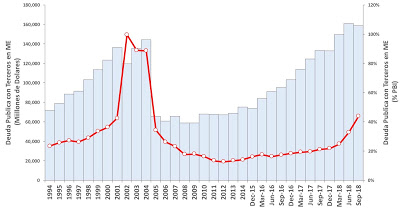

There are many problems in FT's analysis. FT's piece suggests that "Mr. Macri's austerity programme is broadly on track to deliver long term gains for Argentina." There is a fundamental misconception in their argument. Argentina's problems are not fiscal, caused by excessive government spending, but external caused by excessive borrowing in foreign currency. Mr. Macri took over in 2015 with foreign debt at around 70 billion dollars, and proceeded to more than double it to approximately 160 billion dollars, as shown in the figure below (elaborated by Juan Matías De Lucchi, for a paper we co-authored in Spanish and that should be published soon). Foreign denominated debt is now higher than it was before the 2002 default, if smaller as a share of GDP (red line).

The Macri government established those propositions. His team backed very 'serious' mainstream economists like Federico Sturzenegger, who argued that increase in the domestic energy price bills would have no inflationary impact, believed that inflation could be solved in a simple way by stopping the financing of the Treasury. Inflation was in Monetarist fashion a question of too much money. They also believed, to some extent, that a devaluation would solve external problems if it happened. But they expected a surge in foreign investment that would lead to growth and also put pressure for the appreciation of the peso. Of course, the outcome of their liberalization of the foreign exchange market, and their Monetarist experiment led to higher inflation and depreciation.* Fiscal adjustment and the firing of many government workers led to a recession, and higher unemployment. That was the macroeconomic package of the government, even before the IMF.**

Note that there was no need at that point to borrow in international markets in foreign currency. The current account deficit was manageable, foreign debt obligations were relatively low, and the capital flight caused by the liberalization of the foreign exchange market could had been stopped, to some extent, with a hike in the interest rate. Of course they should have been more careful about the liberalization of the external accounts, but that was probably too much to ask from this government of financial operators with deep ties to Wall Street and international financial markets (and a president with accounts in tax havens, documented in the Panama papers).

Macri's government renegotiated the debt with the vultures, the final step for Argentina to re-enter financial markets, under conditions that were excessively generous, one might add. And note that the external debt had already been significantly reduced by the successful renegotiation of the Kirchners with 93 percent of debt holders (and the Macristas talked about a heavy inheritance!). Minor increases in the rate of interest in the US, which in most places led to minor depreciations, coped with interest rates that at times were negative in real terms, led to massive flight. But the government continued to borrow in foreign currency, when almost every country in the periphery has been able to borrow in domestic currency.

That of course was no mistake. This government has promoted a massive increase in foreign debt to finance large amounts of capital flight. The IMF has essentially validated this model, by allowing the government to use the loan to contain the exchange rate. This government has created conditions for a huge amount of dollars to be purchased by essentially their friends in financial markets. It is a financial racket. This is obviously not sustainable, and a relative safe position has been turned into a possible default soon. Not surprisingly the specter of Peronism haunts Argentina.

* On some level the government wanted higher inflation, in order to reduce real wages, something I noted back in 2015. They also wanted a recession, to help reduce the bargaining power of workers.

** As I often say, our elites don't need the IMF, they carry the orthodox gene in their economic DNA.