Paper on Paul with Tom Palley and Jamie Galbraith published by ROKE. From the abstract:"Paul Davidson was a critical figure in the preservation of John Maynard Keynes’s ideas, sticking with them when they were out of fashion. He was also key to the survival of the Post Keynesian school. Davidson endorsed Keynes’s liquidity preference theory of interest, and he emphasized fundamental uncertainty as a central feature of economic reality, essential to making sense of a monetary economy. His...

Read More »Paul Davidson (1930-2024)

Paul (I'm next to him) and the Brazilians at the UMKC, PK Conference in 2002Paul has passed away a few days ago. He wasn't in good shape for a while, and this was expected. He lived a long and productive life. I wasn't personally close to him, even though I met him several times from the mid-1990s onward. He went to two conferences I co-organized at the Federal University in Rio, always with Louise, which was a central figure of Post Keynesian (PK) life, and basically run the Journal of Post...

Read More »Forty Years of Balance of Payments Constrained Growth and Thirlwall’s Law

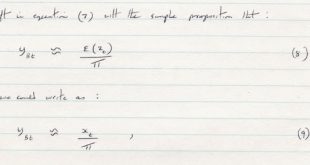

From original draft by Thirlwall Thirlwall's seminal paper on the balance of payments (BOP) constrained growth is forty years old. Paul Davidson once referred to the BOP constrained growth as a positive Post Keynesian contribution to economics. The Review of Keynesian Economics (ROKE) will publish soon a special issue with many well-known contributors to the literature, and with a paper by Thirlwall himself.The idea built on the Kaldorian supermultiplier model (Kaldor mark II), and with...

Read More »Davidson on Temin and Vines

Paul Davidson debates Peter Temin and David Vines in this INET working paper. I had criticized Temin and Vines before here and here. Although in general I agree with Paul, in my view, there is a problem with Keynes’ Bancor Plan kind of solution, that is the one that puts an emphasis on the need for surplus countries to carry the burden of external adjustment. It is really, in the world we live with a hegemonic currency, the role of the issuer of the international reserve currency to carry...

Read More »Did anyone notice the global financial crisis of 2007–2008?

By Paul DavidsonOn November 4, 2008, at the dedication of a new building, Queen Elizabeth of Great Britain visited the London School of Economics (LSE). While there she was given a briefing by academics at the LSE on the origins and effects of the global financial crisis and its resulting turmoil in international financial markets. The Queen is reported to have asked, “Why did nobody notice it developing?” The director of research at LSE told her, “At every stage someone was relying on...

Read More » Heterodox

Heterodox