From original draft by Thirlwall Thirlwall's seminal paper on the balance of payments (BOP) constrained growth is forty years old. Paul Davidson once referred to the BOP constrained growth as a positive Post Keynesian contribution to economics. The Review of Keynesian Economics (ROKE) will publish soon a special issue with many well-known contributors to the literature, and with a paper by Thirlwall himself.The idea built on the Kaldorian supermultiplier model (Kaldor mark II), and with a few simplifying assumptions, it showed that economic growth depends on the rate of growth of exports divided by the the income elasticity of demand for imports. A very similar idea, as Thirlwall knew, was developed by Raúl Prebisch and Latin American Structuralists. The model, contrary to the

Topics:

Matias Vernengo considers the following as important: Davidson, Prebisch, ROKE, Ros, Thirlwall, Thirlwall's Law

This could be interesting, too:

Matias Vernengo writes Paul Davidson (1930-2024) and Post Keynesian Economics

Matias Vernengo writes Paul Davidson (1930-2024)

Matias Vernengo writes My short piece on Solow and his relation to the Review of Keynesian Economics

Matias Vernengo writes Esteban Pérez Caldentey on the Ideas of Raúl Prebisch

Thirlwall's seminal paper on the balance of payments (BOP) constrained growth is forty years old. Paul Davidson once referred to the BOP constrained growth as a positive Post Keynesian contribution to economics. The Review of Keynesian Economics (ROKE) will publish soon a special issue with many well-known contributors to the literature, and with a paper by Thirlwall himself.

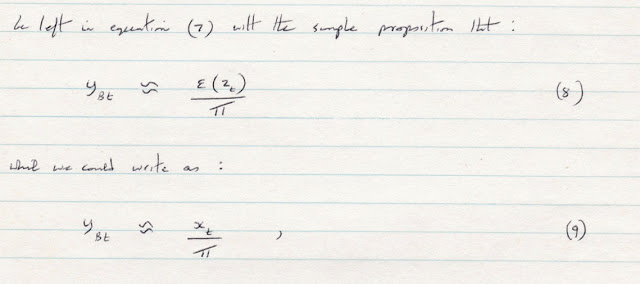

The idea built on the Kaldorian supermultiplier model (Kaldor mark II), and with a few simplifying assumptions, it showed that economic growth depends on the rate of growth of exports divided by the the income elasticity of demand for imports. A very similar idea, as Thirlwall knew, was developed by Raúl Prebisch and Latin American Structuralists. The model, contrary to the dominant mainstream growth model at the time (the Solow model), was demand-led, and allowed for significant divergence between center and periphery.

The 1970s were a period in which both macroeconomic research was biased towards short-term issues, with stabilization after the oil shocks and inflation acceleration becoming central, and also it was the decade in which heterodox groups were effectively segregated from the profession, publishing in alternative journals. These factors certainly affected the popularity of the model.

The most remarkable thing about the model, beyond its simplicity, is its incredible empirical relevance. So much so that is one of the few regularities that has been called a Law (like Okun's, for example). Financial flows might reduce under certain circumstances, the BOP constraint, but at the end of the day, capital flows must be paid with exports, and that implies that the constraint for developing countries is a strong limit to expansion. In advanced economies, income distribution and class conflict might play a more relevant role.

At any rate, it seems that under different circumstances, particularly regarding the sociology of the economics profession, this would have been a contribution meriting the Sveriges Riksbank Economics Prize in Memory of Alfred Nobel.

Will post more, with links to free papers soon.

PS: I haven't written much on Thirlwall's law, but here is a paper in response to a critique by Jaime Ros and a co-author, published by Investigación Económica, in Spanish.