The Lucas Critique has ruled economics for the last 40 years, and led it into a dead-end as well. In this talk to the Economics for Everyone conference run by the Post Crash Economics Society in Manchester, I argue that micro-founded models fail because of the emergent properties that characterise complex systems. An alternative approach that transcends Lucas’s well-founded objection to ad-hoc model-building is to build models from strictly true macroeconomic identities. I show that three...

Read More »Are we facing a global “Lost Decade”?

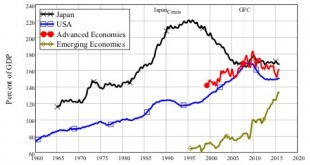

This is an invited paper by the Private Debt Project, an initiative of the philanthropic organization the Governor’s Woods Foundation to raise awareness about the economic importance and dangers of private debt. The era of low growth known as Japan’s “Lost Decade” commenced in 1990, and persists to this day. While most authors acknowledge that the seeds for the Lost Decade were sown by excessive credit growth in the preceding Bubble Economy years, only Richard Koo (Koo, 2009, Koo, 2011,...

Read More »The Seven Countries Most Vulnerable To A Debt Crisis

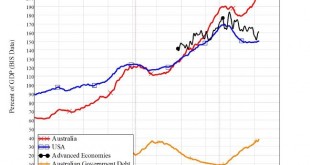

For decades, some of the most important data about market economies was simply unavailable: the level of private debt. You could get government debt data easily, but (with the outstanding exception of the USA—and also Australia) it was hard to come by. That has been remedied by the Bank of International Settlements, which now publishes a quarterly series on debt—government & private—for over 40 countries. This data lets me identify the seven countries that, on my analysis, are most...

Read More »Central Banking, Climate Change and Environmental Sustainability

The Council on Economic Policies and the Bank of England are organising a workshop on this topic to be held at the Bank on November 14-15 2016. A call for papers has just been put out, with a deadline of June 30th. Background Climate change and other environmental challenges are moving up policy agendas worldwide. Nonetheless, the potential implications of environmental risks and scarcities for central banking as well as the linkages between financial regulation, monetary policy and...

Read More »Get ready for an Australian recession by 2017

For the last 25 years, Australian politicians of both Liberal and Labor hue have been able to brag that, under their stewardship, Australia has avoided a recession. Those bragging rights are about to come to an end. During the life of the next Parliament — and probably by 2017 — Australia will fall into a prolonged recession. Click here to read the rest of this post, and here to download the Excel file showing the link between a slowdown in the rate of growth of debt and a recession....

Read More »Spanish translation of Debunking Economics

I was recently informed that a Spanish translation of Debunking Economics is now available via Amazon Spain, under the title “La Economía Desenmascarada“ There’s one review so far: Hay que agradecer que se haya traducido al español, dicho sea en primer lugar. Podría considerarse este libro como un ‘antimanual’ de los textos que se enseñan en la mayor parte de las facultades del mundo; es, por tanto, atendiendo a las patrañas con las que se ‘intoxica’ las mentes de los estudiantes, un...

Read More »Macroeconomics of Loanable Funds & Endogenous Money compared using Minsky

The mainstream economic idea that banks are just intermediaries between savers and investors is a fantasy, but given that fantasy, their argument that the level and rate of change of private debt are not macroeconomically significant (except at the “Zero Lower Bound”) is correct. But in the real world, the role of the level and rate of change of private debt is crucial. I illustrate this by building a Minsky model of Loanable Funds and converting it to the real world of Endogenous Money....

Read More »Laughter–the Worst Medicine

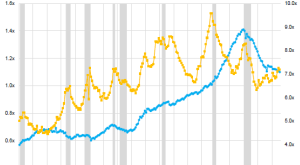

Like many commentators, I regard August 9 2007 as the start of the “Global Financial Crisis“. On that day, BNP Paribas declared that several of its funds were being closed because liquidity in those markets had completely evaporated: So I was particularly amused–in a sick sort of way–to see this brilliant info-graphic on The Fed on Twitter today: it plots the amount of laughter in FOMC meetings between 2000 and 2012. “Peak Laughter” occurred literally days before the crisis began:...

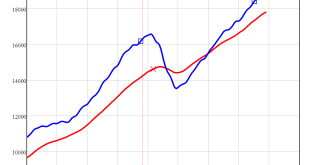

Read More »Kingston Uni releases monetarily sound forecast model of US Economy

PERG economists are developing a macroeconometric model to track the evolution of the US economy over the medium term, which is 3-5 years: KFBM Macroeconomic Outlook Issue 1 February 2016 The model belongs to the family of “financial balances models”, an approach pioneered by Wynne Godley and collaborators at Cambridge University (UK) and then successfully developed by the macroeconomics team of the Levy Institute – led by Godley himself. At its heart, the KFBM (Kingston Financial Balances...

Read More »Tilting At Windmills: The Faustian Folly Of Quantitative Easing

As I explained in my last post, banks can’t “lend out reserves” under any circumstances, which undermines a major rationale that Central Bank economists gave for undertaking Quantitative Easing in the first place. Consequently, the hope that Bernanke expressed in 2009 is “To Dream The Impossible Dream”: To dream the impossible dream To fight the unbeatable foe To bear with unbearable sorrow To run where the brave dare not go Former Chair of the Federal Reserve Ben Bernanke listens while...

Read More » Heterodox

Heterodox