The increasing ascendancy of real business cycle theories of various stripes, with their common view that the economy is best modeled as a floating Walrasian equilibrium, buffeted by productivity shocks, is indicative of the depths of the divisions separating academic macroeconomists … If these theories are correct, they imply that the macroeconomics developed in the wake of the Keynesian Revolution is well confined to the ashbin of history. And they suggest that most of the...

Read More »IPA’s weekly links

Guest post by Jeff Mosenkis of Innovations for Poverty Action. A slight, shy, balding, 49-year-old when the 1980 Nobel was announced, Cronin was relieved when the university sent Larry Arbeiter to his home at 7 a.m. to help him handle the deluge of requests for press interviews. Arbeiter, a writer in the university’s press office, suggested that Cronin satisfy all the interview requests at once by holding a 10 a.m. news conference. ”Oh,” Cronin insisted, ”I can’t do it then. I’ve got a 10...

Read More »Does using models really make economics a science?

Does using models really make economics a science? The model has more and more become the message in modern mainstream economics. Formal models are said to help achieve ‘clarity’ and ‘consistency.’ Dani Rodrik — just to take one prominent example — even says, in his Economics Rules, that “models make economics a science.” Economics is more than any other social science model-oriented. There are many reasons for this — the history of the discipline, having...

Read More »Paul Romer — a flamboyant and hot-headed economist

Paul Romer — a flamboyant and hot-headed economist L’Américain Paul Romer, qui s’est vu décerner lundi le prestigieux prix Nobel d’économie aux côtés d’un de ses compatriotes William Nordhaus, est un économiste flamboyant à la carrière mouvementée, connu pour ses travaux mesurant la part de l’innovation dans la croissance. A 62 ans, il est actuellement professeur à l’Université de New York … Il avait quitté en octobre 2016 le monde universitaire pour...

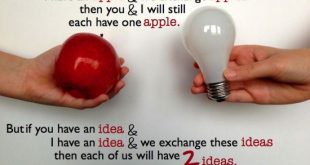

Read More »Paul Romer’s endogenous growth theory — a very short introduction

Paul Romer’s endogenous growth theory — a very short introduction Advertisements

Read More »Paul Romer’s critique of ‘post-real’ economics

In practice, what math does is let macro-economists locate the FWUTVs [facts with unknown truth values] farther away from the discussion of identification … Relying on a micro-foundation lets an author say, “Assume A, assume B, … blah blah blah … And so we have proven that P is true. Then the model is identified.” … Distributional assumptions about error terms are a good place to bury things because hardly anyone pays attention to them. Moreover, if a critic does see that...

Read More »At last — Paul Romer got his ‘Nobel prize’

At last — Paul Romer got his ‘Nobel prize’ Among Swedish economists, Paul Romer has for many years been the favourite candidate for receiving the ‘Nobel Prize’ in economics. This year the prediction turned out right. Romer got the prize (together with William Nordhaus). The ‘Nobel prize’ in economics has almost exclusively gone to mainstream economists, and most often to Chicago economists. So how refreshing it is that we for once have a winner who has...

Read More »IPA’s weekly links

Guest post by Jeff Mosenkis of Innovations for Poverty Action This weekend I’m planning on reading this crazy-looking story about the Ocean’s 11 team that tricked the government of Angola into sending $500 Million to an accountant’s front office in London and how they were caught (h/t Ken Opalo)

Read More »Krugman and ‘neutral money’

Krugman and ‘neutral money’ Paul Krugman has repeatedly over the years argued that we should continue to use mainstream hobby horses like IS-LM and AS-AD models. Here’s one example: So why do AS-AD? … We do want, somewhere along the way, to get across the notion of the self-correcting economy, the notion that in the long run, we may all be dead, but that we also have a tendency to return to full employment via price flexibility. Or to put it differently,...

Read More »Give the public debt some respect and end austerity!

Give the public debt some respect and end austerity! The claim that our public debt is excessive has been used as a major justification for austerity – cuts in spending. That massive debt, we are told, 1) must be repaid, 2) threatens our country with bankruptcy, and 3) is a burden on future generations. All these are wrong. Let me explain why … Britain’s national currency is managed by our central bank, the Bank of England, owned by the citizens of the...

Read More » Heterodox

Heterodox