The Envelope Theorem (student stuff) .[embedded content]

Read More »Karush-Kuhn-Tucker (student stuff)

.[embedded content]

Read More »The elites’ big lie on inequality

from Dean Baker (I saw that Jeff Bezos wants the Washington Post’s editorial page to run pieces touting the merits of free markets. Here’s my submission.) There are not many issues on which there is largely bipartisan agreement, so the story we tell about the origin of economic inequality stands out. Both sides agree that the increase in inequality of income and wealth is driven by an unfettered market. The difference is that conservatives say it is wise to accept the outcomes of the...

Read More »Best advice to an aspiring economist — don’t be an economist!

from Lars Syll A science that fails to reflect on its own history and neglects critical methodological and theoretical questions about its practice is a science in crisis. As early as 1991, a commission led by Anne Krueger—featuring esteemed economists such as Kenneth Arrow, Edward Leamer, and Joseph Stiglitz—highlighted a fundamental weakness in graduate economics education. Drawing from their own experiences, they observed an alarming disconnect between theoretical and econometric...

Read More »Models and evidence in economics

Models and evidence in economics Analogue-economy models may picture Galilean thought experiments or they may describe credible worlds. In either case we have a problem in taking lessons from the model to the world. The problem is the venerable one of unrealistic assumptions, exacerbated in economics by the fact that the paucity of economic principles with serious empirical content makes it difficult to do without detailed structural assumptions. But the...

Read More »Keynes and Knight on uncertainty

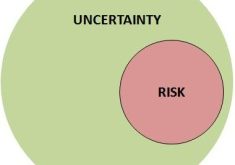

Keynes and Knight on uncertainty First, Knight and Keynes derive from their different philosophical worldviews distinct definitions of uncertainty. Keynes’s is a wholly epistemic uncertainty concept (see Packard and Clark, 2020), the ignorance of an actor regarding the objective and knowable (a priori) probabilities of future outcomes. Such probabilities are discoverable by learning the underlying ‘probability-relations’ between causes and effects....

Read More »Businesses and DEI: Corporations don’t maximize shareholder value

from Dean Baker CEOs and other top management in the U.S. are far more highly paid than their counterparts in Europe and Asia. NYT columnist Jeff Sommer had an entertaining piece on how many of the business leaders who eagerly embraced DEI a few years back are now being very quick to abandon it. This is not terribly surprising to those of us who never took the commitment to DEI very seriously, but there is an important aspect to his discussion that he leaves out. Sommer spends much of the...

Read More »Solving a simple DP problem (student stuff)

Solving a simple DP problem (student stuff) .[embedded content] In case you want to solve the problem yourself, here’s a Python script yours truly made (assuming the utility function is of the natural log kind and with some explicit numerical parameterization): import numpy as np import matplotlib.pyplot as plt # Parameters beta = 0.9 # Discount factor r = 0.1 # Depreciation rate T = 3 # Time horizon k0 = 4.0 # Initial capital # Production function:...

Read More »Best advice to an aspiring economist — don’t be an economist!

Best advice to an aspiring economist — don’t be an economist! A science that fails to reflect on its own history and neglects critical methodological and theoretical questions about its practice is a science in crisis. As early as 1991, a commission led by Anne Krueger—featuring esteemed economists such as Kenneth Arrow, Edward Leamer, and Joseph Stiglitz—highlighted a fundamental weakness in graduate economics education. Drawing from their own experiences,...

Read More »Models of uncertainty

Post Keynesian authors have offered various classifications of uncertainty … A common distinction is that of epistemological versus ontological uncertainty, with the former depending on the limitations of human reasoning and the latter on the actual nature of social systems … Models of ontological uncertainty tend to hinge on the existence of information that is critical to the decision-making task. Fundamental uncertainty occurs in “situations in which at least some essential...

Read More » Heterodox

Heterodox