In my class, I try to introduce a topic and then give my students a discussion question to work through so I can make sure that everyone is catching on. This discussion question relates back to the disposition effect, or the bias towards selling winning stocks and away from losing stocks. If you need a refresher, you can see the entire behavioral economics playlist here.

Read More »Reasons to dislike DSGE models

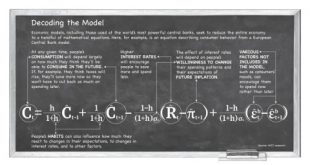

Reasons to dislike DSGE models There are many reasons to dislike current DSGE models. First: They are based on unappealing assumptions. Not just simplifying assumptions, as any model must, but assumptions profoundly at odds with what we know about consumers and firms … Second: Their standard method of estimation, which is a mix of calibration and Bayesian estimation, is unconvincing … Third: While the models can formally be used for norma- tive purposes,...

Read More »Keynesian economics in a nutshell

Keynesian economics in a nutshell

Read More »On the importance of pluralism

On the importance of pluralism [embedded content] A good illustration of what makes mainstream economics go astray — lack of pluralism (diversity) and like-minded people who are all wrong …

Read More »Noah Smith — ill-informed and misleading

Noah Smith — ill-informed and misleading Yours truly is far from being alone in criticising Noah Smith’s article on heterodox economics and mathematics (on which I commented yesterday). Tom Palley writes: (1) Pretty much everything Smith charges heterodox economics with can be said about orthodox economics. That’s OK, but in that case we should open the classroom and op-ed pages to a variety of points of view and abandon the neoclassical monopoly. (2)...

Read More »Noah Smith — confusing mathematical masturbation with intercourse between research and reality

Noah Smith — confusing mathematical masturbation with intercourse between research and reality There’s no question that mainstream academic macroeconomics failed pretty spectacularly in 2008 … Many among the heterodox would have us believe that their paradigm worked perfectly well in 2008 and after … This is dramatically overselling the product. First, heterodox models didn’t “predict” the crisis in the sense of an actual quantitative forecast. This is...

Read More »Causal Friday: Is Change Really A Good Thing, Statistically Speaking?

Steve Levitt, in addition to gaining fame (at least at an economist level, not a Justin Bieber level) for writing Freakonomics, has made a career teasing cause and effect out of (largely) observational data. (By “observational data,” I mean that he doesn’t explicitly run controlled experiments in a lot of cases and just looks at the world as it transpired naturally instead.) Observational data presents an interesting challenge because people usually make choices in life rather than being...

Read More »On the persistence of science-fiction economics

On the persistence of science-fiction economics Obscurantism is sustained by the self-interest of non-obscurantist scholars. To be effective, an attack on obscurantism has to be well documented and well argued. Mere diatribes are pointless and sometimes counterproductive. Yet scholars have a greater personal interest in achieving positive results than in exposing the flaws of others, not only because of the reward system of science, but also because...

Read More »Representative agent models and the streetlight effect

Representative agent models and the streetlight effect Attempts to rationalize representative consumer models (especially for purposes other than social welfare measurement) may seem like a quixotic endeavor. Macroeconomists (and many applied microeconomists and econometricians) routinely assume the existence of one, seeing it as a necessary (though acceptable) evil required for the sake of tractability. Many mathematical economists are unwilling to accept...

Read More »Economic modeling — nothing but obscurantist bullshit

Economic modeling — nothing but obscurantist bullshit In the present article I consider the less frequently phenomenon of “hard obscurantism”, a species of the genus scholarly obscurantism. In academic debates, a more common term for obscurantism is “bullshit” … One may perhaps, distinguish between obscure writers and obscurantist writers. The former aim at truth, but do not respect the norms for arriving at truth, such as focusing on causality, acting as...

Read More » Heterodox

Heterodox