By Eric Tymoigne On one side, critics argued that MMTers say nothing new when MMTers emphasize US government’s monetary sovereignty; “everybody knows this” is a common refrain. On the other side, critics argue that MMT incorrectly merges the US Treasury and Fed into a US government, which ignores the fact that the US Treasury can run out of money because it needs to tax and issue bonds first before it can spend. Something is amiss. This post shows that MMT can be understood from two...

Read More »“What You Need To Know About The $22 Trillion National Debt”: The Alternative SHORT Interview

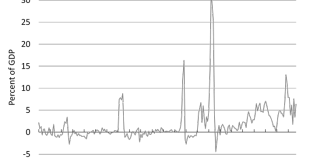

Steven Rattner’s opinion piece in the New York Times and Furman’s interview on National Public Radio are perfect examples of the ideas that MMT want to debunk. Deficits are not normal; deficits crowd out private investment; the public debt is a burden on our grandchildren; our ability to respond to societal problems is limited by the fact that the US government does not have enough money to confront them. Below is an alternative interview to the Furman’s interview that reviews these...

Read More »“What You Need To Know About The $22 Trillion National Debt”: The Alternative Interview

Steven Rattner’s opinion piece in the New York Times and Furman’s interview on National Public Radio are perfect examples of the ideas that MMT want to debunk. Deficits are not normal; deficits crowd out private investment; the public debt is a burden on our grandchildren; our ability to respond to societal problems is limited by the fact that the US government does not have enough money to confront them. Below is an alternative interview to the Furman’s interview that reviews these...

Read More »US Penny, US Nickel and Sterling Silver Penny: Similarities and Differences

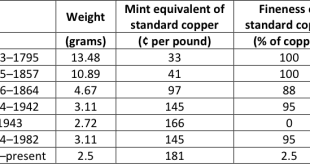

By Eric Tymoigne The history of medieval coinage is full of dramas. Debasements, changes in official value, chronic lack of coins, use of foreign coins in domestic transactions, free minting, coins with a floating denomination, clipping, metalism vs. nominalism, among others, make for a colorful and fascinating monetary history. Recent developments in metal markets have recreated one of the conditions that led to a disappearance of the coinage in the Middle Ages. The post explains the...

Read More »Money and Banking Post 21: The Interest Rate

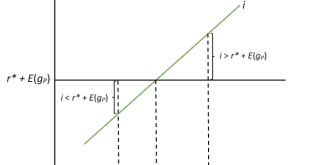

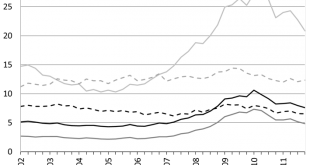

By Eric Tymoigne In Post 20, a lot is said about the role that the rate of return on financial instruments—the interest rate—plays on the pricing on securities, but little was said about what determines that rate of return. Two competing theoretical frameworks explain what influences the interest rate, one of them emphasizes the role of real factors and the other emphasizes monetary factors. Real Theory of Interest Rate: Natural Interest Rate and Expected Inflation Gross Substitution and...

Read More »Money and Banking Post 20: Pricing Securities

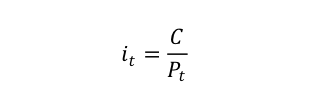

A Small Detour: Savings Account and Interest Compounding A typical way to think about interest rates is to study how a savings account works. Suppose Mr. X puts $1000 in a savings account that provides a one percent annual interest rate. In that case, X will get at the end of: Year 1: $1010 = $1000(1 + 0.01) Year 2: $1020.1 = $1010(1 + 0.01) = $1000(1.01)2 … Year 5: $1051.01 = $1000(1.01)5 Several things are worth noticing: The rate of return is fixed by the issuer of the account (1%)...

Read More »Money and Banking – Part 19 (A): Financial institutions: An overview

Part A | Part B | Part C Erratum on Post 18: Figure 18.10 has reversed proportions: about 30 percent are issued by nonfinancial corporations. Note: As I was afraid it would happen, someone emailed me to take issue with the way I use the term promissory note. “Promissory note” has a specific meaning in the law—it is a specific type of financial instruments—but Post 18 uses the term conceptually to mean any formal promise made by someone—a synonymous to financial instrument—, which may...

Read More »Money and Banking – Part 19 (B): Financial institutions: An overview

Part A | Part B | Part C Regulated Portfolio Management Companies: Mutual Funds and Others Portfolio management companies provide a wide variety of placement opportunities to economic units with spare funds who do not want to, or cannot, directly buy securities or other assets. There are three broad types of portfolio management companies: mutual funds, closed-end funds, and unit investment trusts (UITs). One of the main differences between them is the characteristics of the shares...

Read More »Money and Banking – Part 19 (C): Financial institutions: An overview

Part A | Part B | Part C Farmer Mac, Fannie Mae, Freddie Mac, and Sallie Mae This section closes the presentation of government-sponsored enterprise with a quick look at other GSEs. They work in a similar fashion to the FCS, by issuing securities and using the proceeds to buy or to back illiquid financial instruments held by financial institutions. The goal is once again to lower the level and volatility of interest rates on specific financial instruments and to encourage credit for...

Read More »Money and Banking—Part 18 (B): Overview of the Financial System: A World of Promises

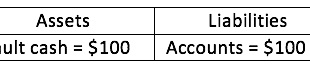

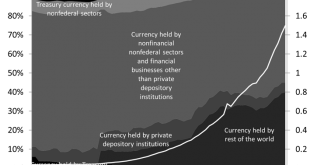

Due to the size of this post, it has been split into 2. You can find part A here. Monetary instruments Monetary instruments are the last type of marketable promissory notes. Post 15 and Post 16 are devoted to their analysis. One of the main characteristics of monetary instruments is that their term to maturity is instantaneous, that is, they can be returned to the issuer at the will of the bearer. In terms of cash, that is physical monetary instruments, the Financial Accounts of the...

Read More » Heterodox

Heterodox