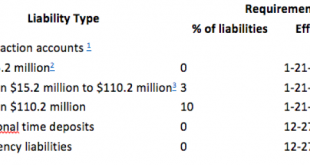

By Eric Tymoigne It may surprise you to know that the banking sector is one of the most regulated industries in the United States with a bank having to file regulatory documents with several agencies. These regulations determine how banks should and should not operate their business in terms of many aspects; from disclosure of information to potential customers, to means of determining creditworthiness of a potential client, to the amount of reserves to hold, to management issues, among...

Read More »Money and Banking-Part 8: The Private Banking Business

By Eric Tymoigne The US financial system is extremely complicated and this series shades light only on some corners of that system by focusing on the banking sector. Here is a broad picture of the US financial system (some things have changed since the time I made this). Since the beginning of this M&B series, posts have emphasized the importance of balance sheet to get a solid understanding the mechanics at play in the financial sector. This post continues that trend. The balance...

Read More »Money and Banking Part 7

By Eric Tymoigne Given that the concept of leverage will be used often in the upcoming posts, this post spends some time explaining what leverage is and some of its impacts on the balance sheet of any economic unit. What is Leverage? Leverage is the ability to acquire assets in an amount that is larger than what one’s own capital allows to buy. Say that an economic unit has a net worth of $100, that it has no debt and that the counterparty is $100 in cash. The balance sheet looks like...

Read More »Money and Banking – Part 6

Treasury and Central Bank Interactions This post concludes our study of central banking matters (there would be a lot more to cover…maybe another time). The post studies how the Fed is involved in fiscal operations and how the U.S. Treasury is involved in monetary-policy operations. The extensive interaction between these two branches of the U.S. government is necessary for fiscal and monetary policies to work properly. Once again the balance sheet of the Federal Reserve provides a simple...

Read More »Money and Banking – Part 5

By Eric Tymoigne Previous posts studied the balance sheet of the fed, definitions and relation to the balance sheet of the fed, and monetary-policy implementation. In this post, I will answer some FAQs about monetary policy and central banking. Each of them can be read independently. Q1: Does the Fed target/control/set the quantity of reserves and the quantity of money? The Fed does not set the quantity of reserves and does not control the money supply (M1). It sets the cost of reserves;...

Read More »Money and Banking Blog – Part 4

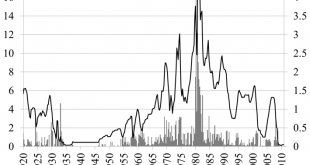

By Eric Tymoigne For convenience, I have put the balance sheet of the Fed below. A previous post examined the balance sheet and another one provided important information about the meaning of reserves and other basic concepts and their relation to the balance sheet of the Fed. Now let’s look at monetary-policy implementation. What does the Fed do in terms of monetary policy and why? While details in operating procedures have changed through time, the Federal Funds rate (FFR) has...

Read More »Money and Banking – Part 3

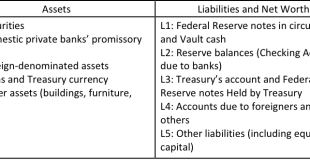

By Eric Tymoigne (A quick note: I noticed that the M&B posts get posted on other blogs. If you want me to respond to you, you should comment at NEP.) MONETARY BASE AND THE BALANCE SHEET OF THE FED. The previous post examined the balance sheet of the central bank: Now that we have an understanding of how the balance sheet of the Federal Reserve works, it is possible to go into the details of how the Fed operates in the economy in terms of monetary policy. To understand what the Fed...

Read More »Money and Banking – Part 2

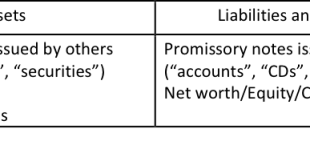

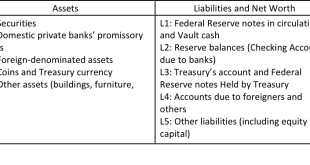

By Eric Tymoigne Central bank balance sheet and immediate implications The previous post reviewed basic balance-sheet mechanics. This post begins to apply them to the Federal Reserve System (Fed). Balance Sheet of the Federal Reserve System For analytical purpose, the balance sheet of the Fed can be presented as follows: Below is the actual balance sheet of the Federal Reserve System prior to the recent crisis (from Board of Governors’ series H4.1, Factors Affecting Reserve Balances). It...

Read More »Money and Banking – Part 1

By Eric Tymoigne I struggled a few years to get a Money and Banking (M&B) course together. It lacked coherency and students had difficulty linking the different parts of the class. A good part of the problem comes from the M&B textbooks that, besides having outdated presentations, are a disparate collection of chapters without a coherent core. So I gave up with textbooks and went my own way. The core of the financial system consists of financial documents and among them are balance...

Read More » Heterodox

Heterodox